This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

How should blockchains be valued?

In crypto’s very short history, there have been many attempts to definitively answer that question.

One time dusted with fame by monetarists, the equation MV=PQ tried to rein in private maverick currencies. Today, it is the unwanted generation of a textbook much past its bed. The markets having exploded into hundreds of chains each minting its own kind of “money” have ironically rendered this cute formula irrelevant.

Remember stock-to-flow ratio, the favorite theory of Bitcoiners? It was all about scarcity- the less there was, the price would automatically go up. Then showed up reality with its own interference. The enormous volatility of Bitcoin prices since 2021 keeps shattering this model one after the other, putting it on a shaky ground.

Remember 2020? The year that saw crypto access the stratosphere. People suddenly began scrutinizing the smart contract platforms, searching for the next big thing. The investors, in severe need of a guide, ended up clinging to TVL/Market Cap ratios an absurd attempt at applying the price-to-book concept of Wall Street. The problem was: TVL was about as reliable as a weather forecast given by a politician. Easily manipulated, it did not give any firm footing to a serious investor.

Forget the hard disk. Just picture your crypto vault as a digital orchard. Proof-Of-Stake chains promise a harvest: staking rewards. Hence arose the seductive idea: could one treat Layer 1 tokens as dividend stocks, applying discounted cash flow? A tempting thought, yes, but one that crashes hard against the simple fact that L1 token valuations are off-the-charts high. The DCF plainly cannot explain these stratospheric levels.

“Among today’s crypto investment pros, those valuation theories? Ancient history, largely.”

REV (real economic value)

Today, a growing class of investors are grappling onto REV (real economic value) to explain the value of blockchains.

What is REV?

REV is the total economic demand to transact on a given L1.

REV = Transaction fees + maximal-extractable-value (MEV) tips

Or Blockworks Research’s technical definition:

Also known as Network REV, Real Economic Value is the pulse of the economy of a blockchain. It is the bottom line for how much real value flows into the network through user activity. Forget abstract metrics – REV counts the hard cash users actually throw away: transaction fees that are incorporated in the code and all those little extra tips given for faster processing of their transactions. In essence, REV is showing the genuine appetite for using a blockchain, expressed in dollars and cents.

REV notably does not include “issuance,” the inflationary emissions with which every blockchain pays its validators.

(That metric is TEV i.e. “total economic value.”)

REV fundamentally disagrees with viewing blockchains through the outdated lens of conventional business, where rigid income statements dictate value.

REV today

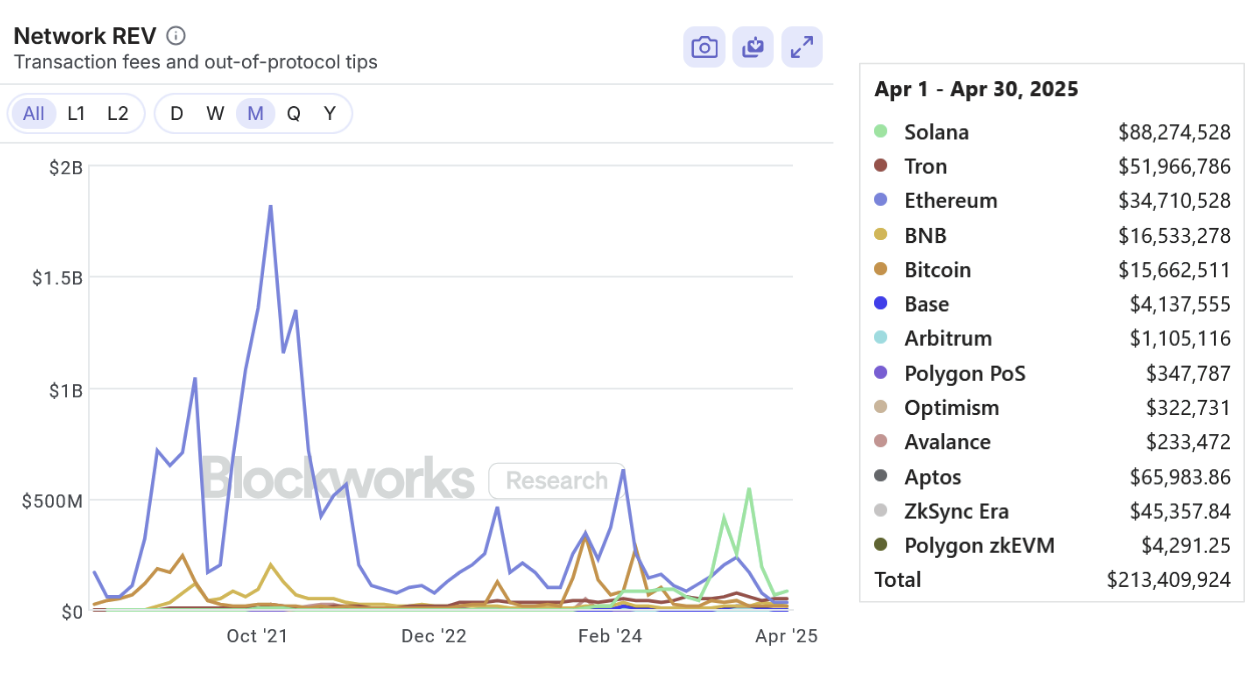

Ethereum once held the crown on REV (who remembers those outrageous $100 gas fees?). Now, Solana has taken center stage. Consider the chart as a reflection of the king’s fall and the rising of a new contender.

Forget flimsy comparisons. Instead investors can disregard all blockchain babble and use one basic price ratio to size up future earnings, thereby finally offering an apples-to-apples comparison across digital businesses.

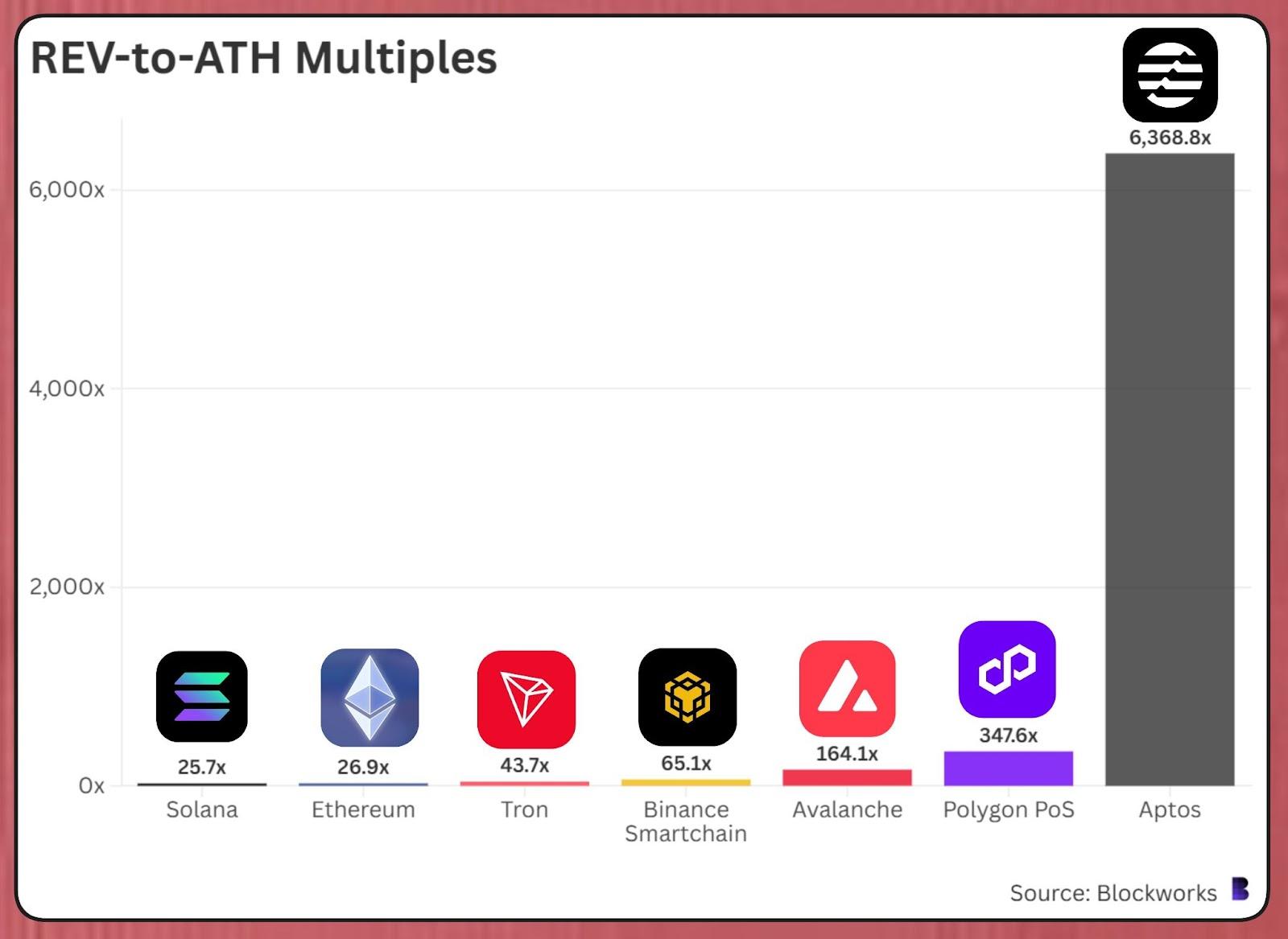

Here’s what it looks like in practice when applied to the all-time-highs fully diluted valuations of the major L1 tokens:

Source: 0xBreadGuy

The diagram throws REV into Ethereum-Solana valuation. Their multipliers of REV-to-ATH stand close to 26, a number that looks quite reasonable when put together with the actual cash that users spend on-chain. So, REV? It whispering what the chains could actually be worth.

However, newer chains like Aptos with a 6,368.8x multiple, likely driven by speculative momentum, still seemingly defies fundamental valuation.

I asked Blockworks Research’s Dan Smith about this.

“Aptos, less than two years old, is part of the too crowded field that all blockchains face today. Even if we give them an unbelievably slim shot of success, say 1 percent chance to dominate their small niche, even then their valuation looks stretched. It is like saying a pre-revenue startup is worthless; it is discounting potential. The real wager is betting on Aptos’ revenue-generating future– rather a big-risk consideration.”

REV criticisms

REV is not without its critics.

Instead of sharing the MEV revenues across the blockchains, might some get left behind and see others gorge on MEV? The critique here is whether in fact every chain gets offered the same footing into this lucrative opportunity or not.

0xngmi belabors the point: MEV is not a singular entity. Blockchains construct and fall apart architectural ploys and set a different order of transactions that make various types of sorts of MEV in very different ways or free MEV in very different ways.

Loading Tweet..

Arbitrum transaction ordering used to be simple, like a bakery line: first come, first serve. But about a month ago, the narrative changed with Timeboost, a market mechanism that changed the whole situation. Before Timeboost, Arbitrum was actually selling itself at a discount, its potential revenue untapped. Think of it like finding out your favorite coffee shop was selling lattes for a dollar-great for customers, but so much revenue now lost to Arbitrum with the introduction of Timeboost.

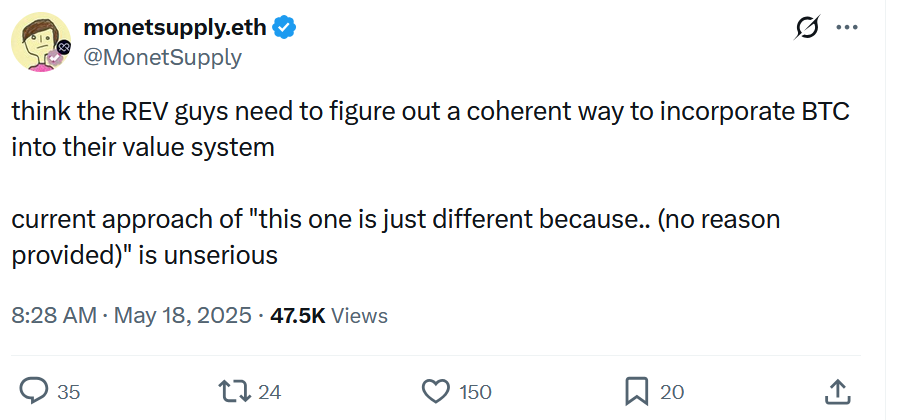

Secondly, REV fails to explain bitcoin’s $2.1 trillion valuation, as Block Analitica’s monetsupply points out.

Source: X

The mind-boggling estimation is: If Bitcoin actually manages to hit the projected revenue targets for early 2025, the REV multiple will be above 10,000! That means it would be really, really far from the valuations of SOL and ETH, which are at a mere 26. Hype indeed!

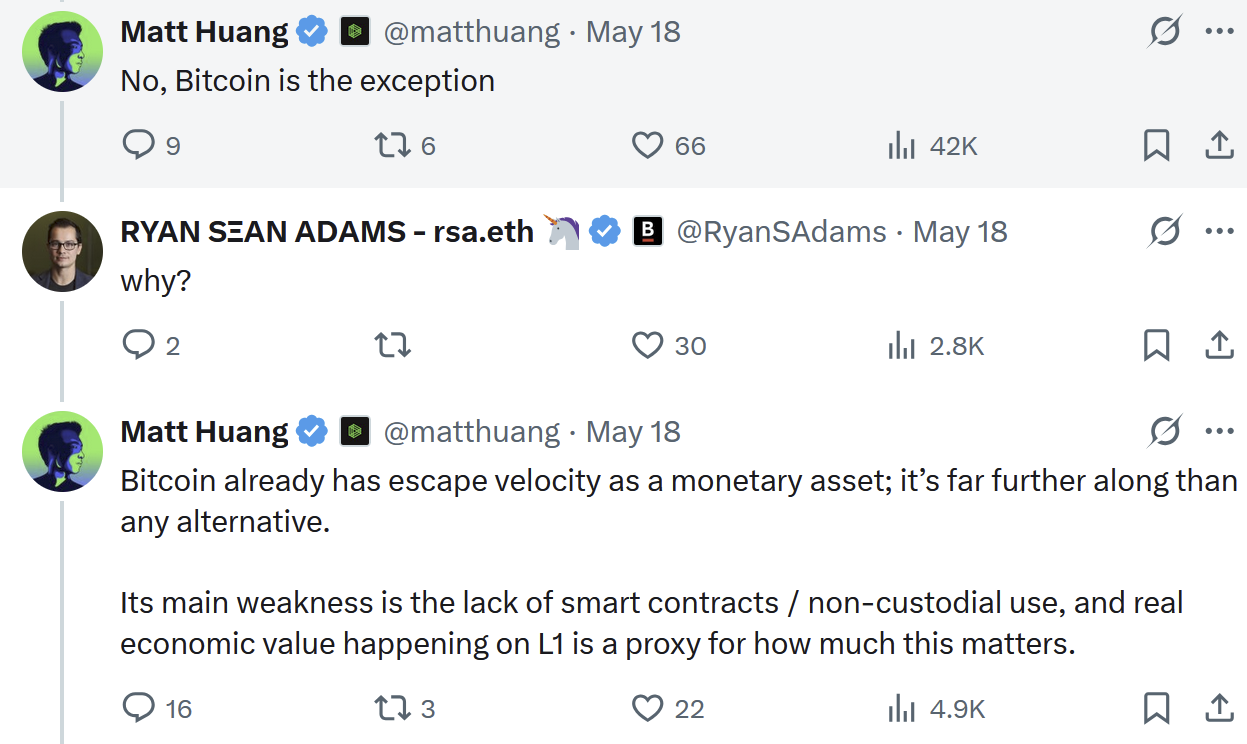

Matt Huang, from Paradigm, posits that Bitcoin is the exception. It never intended to become a smart contract mother; instead, it has definitely cemented its position as digital gold-a store of value in a fast-evolving financial world.

Source: X

REV: Is this truly the golden metric of the blockchain, or have we prematurely crowned it? Critics may not necessarily be dismissing the utility but questioning whether blockchains have been too obsessively valued through REV-colored glasses.

Thanks for reading Valuing blockchains: The great REV debate