Virtuals Protocol token: Poised for a Parabolic Leap? Whales Cash Out as Price Eyes New Heights.

This being that is called Virtual Protocol (VIRTUAL) just smashed along a major ceiling! Recovering above the $2.1270 level, VIRTUAL set a high never seen since, alas, January, dropping into oblivion (and uncertainty) of its investors. Hold onto your pearls! This crypto rocket is creeping away with over a 430% appreciation!

Ava AI and its cluster of AI agents have been birds of prey in crypto. The Ava AI token went 30% in rally mode on the back of spectacular performances by flagship projects like aixbt, VaderAI, Ribbita, and Game, each rallying over 15%. With Monday dedicated to AI, Ava AI has been at the forefront.

This Wednesday, the spotlight is all on NVIDIA for earnings releases-The rocket fuel for Virtuals Protocol and also the entire galaxy of AI tokens. The numbers will unveil the actual direction in which the AI revolution is proceeding.

Being ready for takeoff is the Q1 for NVIDIA. A projected 65% spike in revenue, clouding in an impressive $43.17 billion, is in the forecast. Earnings per share are set to make their leap as well-from $0.61 to $0.73-giving the signal for a powerful ascent. But having a hang on the momentum, that might not be easy. Rumors are flying stating that Q2 shall see revenue reach a mind-boggling $45 billion, therefore consolidating NVIDIA’s dominance.

You might also like:

Bitcoin eyes $120k as bullish trend holds above key support

A strong earnings report by NVIDIA will likely push AI tokens like VIRTUAL and Artificial Superintelligence Alliance (FET) higher.

Even so, some would ask whether this rally has been stalled at some point by the Virtuals Protocol. The revenue generated so far this month of $496K, as said by DeFi Llama, dramatically rose from $200K last month. Yet, the lingering memory of January, with its massive $3.9 million, hangs over as an awkward reminder of peaks yet to be reached.

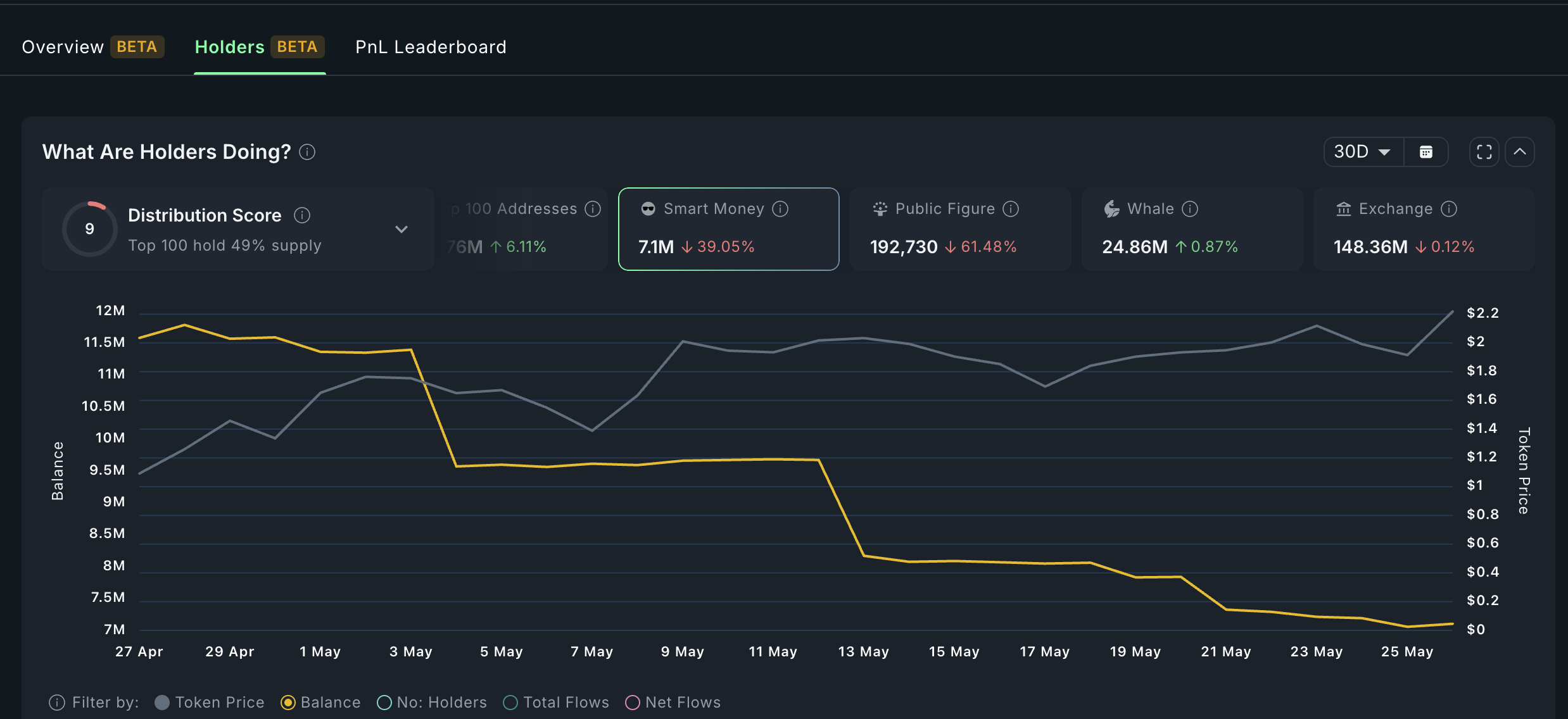

The landscape for VIRTUAL tokens is undergoing shifts. Earlier this month, smart money wallets used to store up to 11.9 million tokens; lately, they seem rather lean, holding 7.1 million tokens. Whale accounts are also following this pattern, their huge holdings getting reduced from almost 30 million on May 11 to 24.4 million at the present. Could these be early exits as a red flag, or just portfolio rebalancing?

Smart money investors have dumped VIRTUAL | Source: Nansen

Virtuals Protocol price technical analysis

VIRTUAL Protocol price chart | Source: crypto.news

The Virtuals Protocol made an impressive recovery from a bottom of $0.4165 in April towards an apex of $2.1271. On the daily chart, a bullish scenario is depicted, with the price cutting through paramount Fibonacci retracement levels of 61.8%, an indication that all momentum is in its favor.

VIRTUAL, previously trading at \$2.1271, has unexpectedly shot beyond the ascending triangle. Momentum is gaining as it stole a march on the 50-day EMA, with the Relative Strength Index soaring. There is a barrage of bullish signals.

The token’s ascent does appear far from over. Bulls are locked on $5.1335, the January high that now stands as the next major target. Breaching this summit would start an unbelievable 135% surge from current levels and trigger a new bullish wave.

You might also like:

Alchemy Pay integrates PayID, enabling crypto payments to Aussie bank accounts

Thanks for reading Virtuals Protocol token targets 135% rally despite smart money exit