With the U.S. CPI data release looming, crypto’s biggest players are making their moves. Bitcoin’s holding steady near its peak, but the smart money seems to be hunting for opportunity elsewhere. Keep an eye on midcap altcoins; whale activity suggests they could be primed for a breakout.

Whispers of a crypto rally? 1INCH, LINK, and CRV are stirring. On-chain data reveals a week-long buying spree, with wallets swelling and exchanges seeing subtle exits. Dive into the details and uncover the forces behind this crypto undercurrent. What secrets do these token flows hold for the market’s next chapter?

1inch (1INCH)

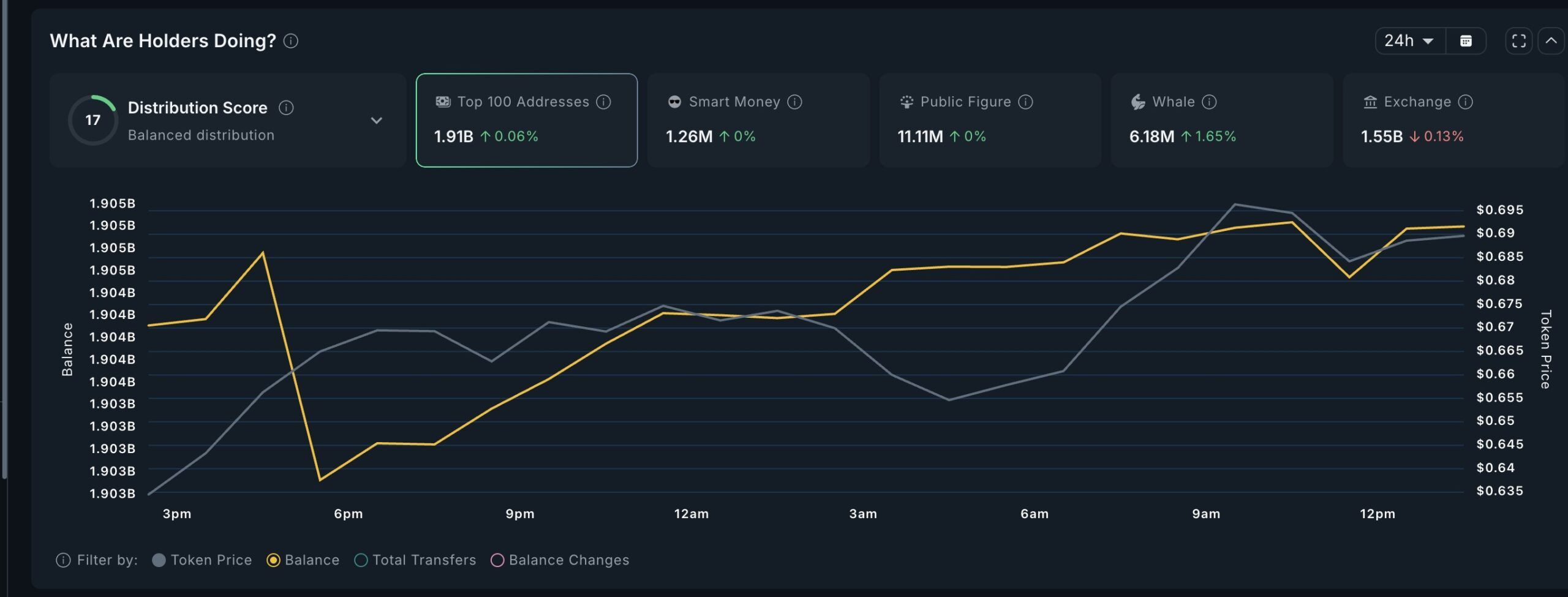

In a feeding frenzy, deeppocketed 1inch investors have increased their holdings by 5.65% in the last day, now commanding a colossal 9.56 million tokens. While the top 100 addresses still control a staggering 1.26 billion 1INCH, a slight decrease in their overall share suggests a strategic reshuffling – tokens finding new hands rather than fleeing the ecosystem. Could this redistribution fuel the next price surge?

1INCH whale activity: Nansen

July 14th saw a surge of buying pressure ignite around noon, as the token price danced between $0.32 and $0.33. While “smart money” stood pat and exchange wallets remained still, whale-sized wallets quietly began accumulating, hinting at a strategic long-term play. The balance chart tells a story of calculated demand, building steadily beneath the surface.

1INCH price defies gravity, plunging 8% despite whales loading up! Is this a strategic power play? Smart money appears to be anticipating a future on-chain volume surge, filling their bags before the masses catch on. Forget fleeting pumps, these whales are playing the long game.

Is 1inch about to surf a crypto whale wave? Smart money seems to be positioning itself, anticipating a surge in DEX trading. The trigger? A potential CPI dip igniting a risk-on frenzy, and sending on-chain volumes soaring. 1inch could be the prime beneficiary, poised to ride the wave of renewed bullish momentum.

Chainlink (LINK)

LINK whales are growing fatter: since July 10th, they’ve gobbled up 6.19% more tokens, now hoarding a colossal 2.84 million. The feeding frenzy peaked between July 11th and 12th, a dramatic surge in their wallets that foreshadowed LINK’s price surge to nearly $16. Were they the puppet masters pulling the strings?

Crypto whales buying LINK: Nansen

Chainlink Whales are Getting Hungry: Top 100 wallets gobble up LINK!

The top 100 Chainlink addresses are flexing their financial muscles, now hoarding a staggering 654.73 million LINK! This bullish trend, up from earlier in the week, signals growing confidence in the decentralized oracle network.

Adding fuel to the fire, exchange balances have plummeted by 1.51%. This suggests a strategic shift as investors move their LINK holdings into the secure depths of self-custody and cold wallets, tightening the circulating supply.

The market has responded with enthusiasm! Over the past week, LINK’s price exploded, soaring nearly 18%. Is this the start of a massive price surge, fueled by the insatiable appetite of crypto whales? All signs point to “yes.”

This hints at renewed optimism.

Curve DAO (CRV)

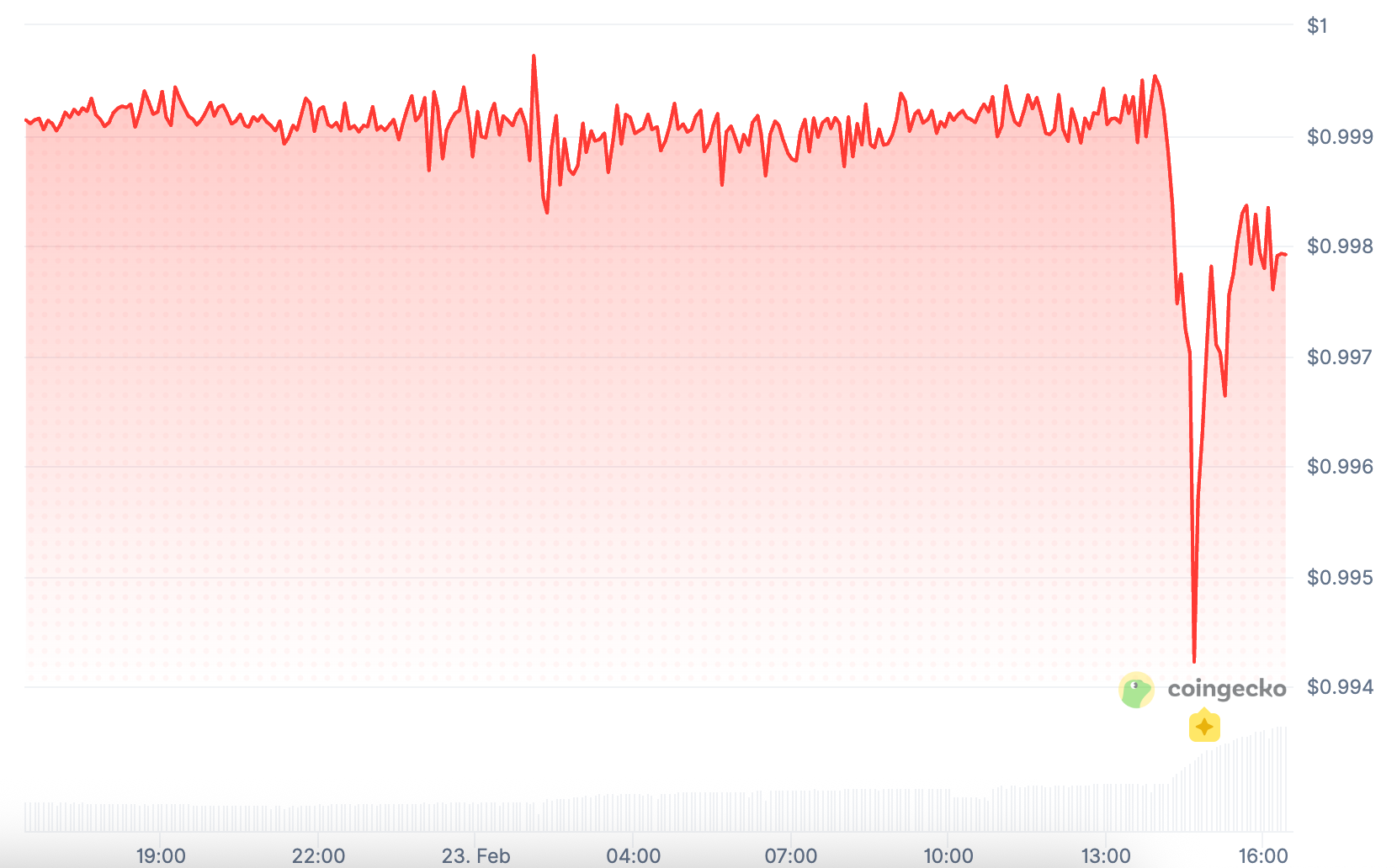

Crypto Whales are Making Waves with CRV Accumulation. A close watch on CRV’s largest wallets reveals a 1.65% increase in holdings, now totaling 6.18 million tokens. While seemingly modest, this accumulation trend paints a compelling picture: a consistent upward trajectory displayed as a steady climb on the balance sheet throughout the night of July 14. Could this quiet accumulation signal a coming surge for CRV?

Crypto whales and CRV accumulation: Nansen

Whales are stirring in the crypto sea. The top 100 wallets are bulking up, adding a sliver (0.06%) to their holdings. Is this the start of a re-accumulation phase? The market seems to think so, at least for Curve DAO Token (CRV). CRV is surging towards $0.69, riding a nearly 7% wave of gains. Coincidence? The whales might disagree.

Curve: Where whales go to weather the CPI storm. Forget choppy waters – this stablecoin swap platform offers the deep liquidity and low fees that institutions crave, especially when inflation anxiety peaks ahead of announcements like tomorrow’s U.S. CPI data.

Honorary Mention: SPX6900 (SPX)

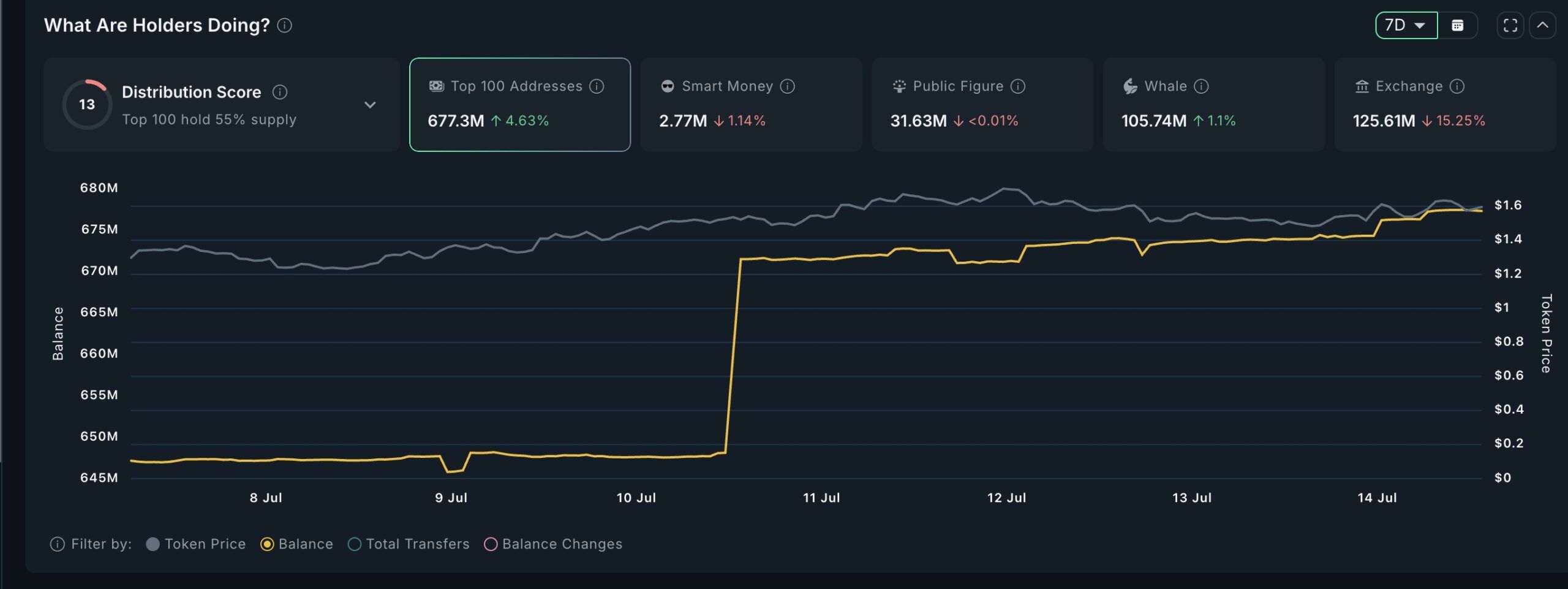

Forget Bitcoin. Forget Ethereum. Keep your eye on SPX6900, the undisputed champion of meme coin indices. Whales are loading up: holdings jumped 1.1% this week. But the real kicker? The top 100 wallets are gorging themselves, adding a staggering 4.63% to their already bulging portfolios. This isn’t just a ripple; it’s a rising tide. While the numbers might seem modest next to the titans, the message is clear: the meme coin rotation is ON.

The token price moved closer to $1.60, and the inflow pattern from July 10–13 shows coordinated entry points.

SPX whale activity: Nansen

Beneath the surface of CPI anxieties, the SPX is whispering a bullish secret. Are some traders still chasing the meme coin dragon, hoping for inflation data to fuel another frenzy? A risk-on revival might be closer than we think.

Thanks for reading What Crypto Whales Are Buying Ahead of US CPI Reveal