Bitcoin’s December fate is the crypto world’s burning question after a dismal November. The market bellwether plummeted over 17%, shattering its historical November bullish streak. Was that fleeting $80,000 surge a false dawn, or does December hold the key to unlocking Bitcoin’s true bottom? All eyes are on the charts now.

December: Bitcoin’s Make-or-Break Month?

Bitcoin’s December track record is a rollercoaster. Will this year be a gift or a lump of coal? Early indicators – spot flow jitters and subtle on-chain whispers – suggest a cautious approach. We’re diving deep into three crucial narratives: Bitcoin’s December destiny, the ETF effect, and what the chartsandthe blockchain are telling us about the month ahead. Buckle up.

Bitcoin’s December History and What ETF Flows Reveal

Bitcoin’s December Dilemma: Is a Holiday Rally in the Cards?

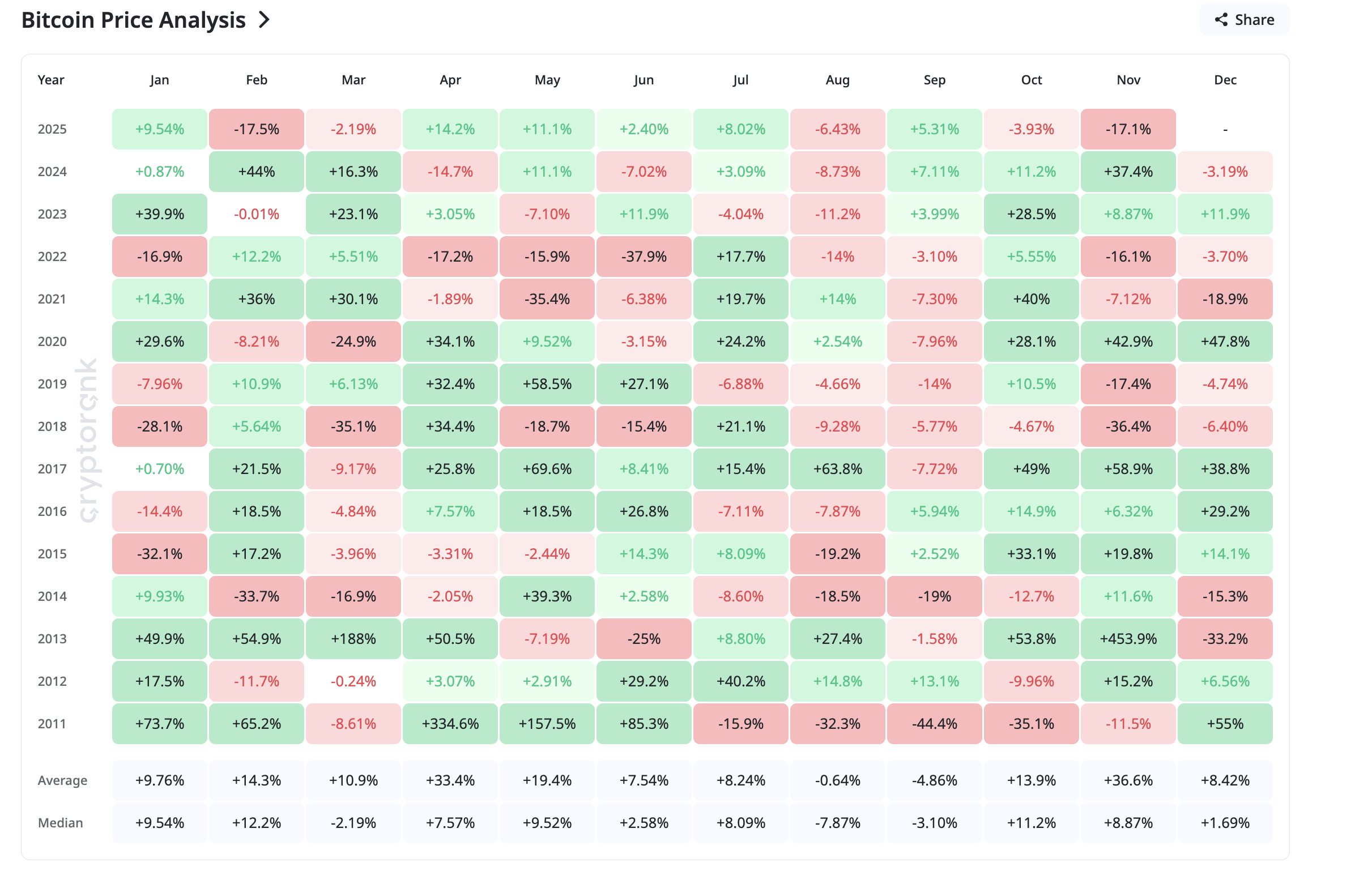

While the scent of pine needles and holiday cheer fills the air, Bitcoin investors often brace for a more sobering reality. Historically, December hasn’t exactly been a banner month for the crypto king. While the average return clocks in at a respectable 8.42%, the median return tells a different story: a meager 1.69%. Recent history adds fuel to the fire, with the last four Decembers painting a mixed bag – three ending in the red. So, will Bitcoin bring tidings of joy this holiday season, or will investors be left with a lump of coal in their digital wallets?

November added more caution. Instead of repeating its strong seasonal pattern, Bitcoin finished the month more than 17% lower.

BTC Price History: CryptoRank

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

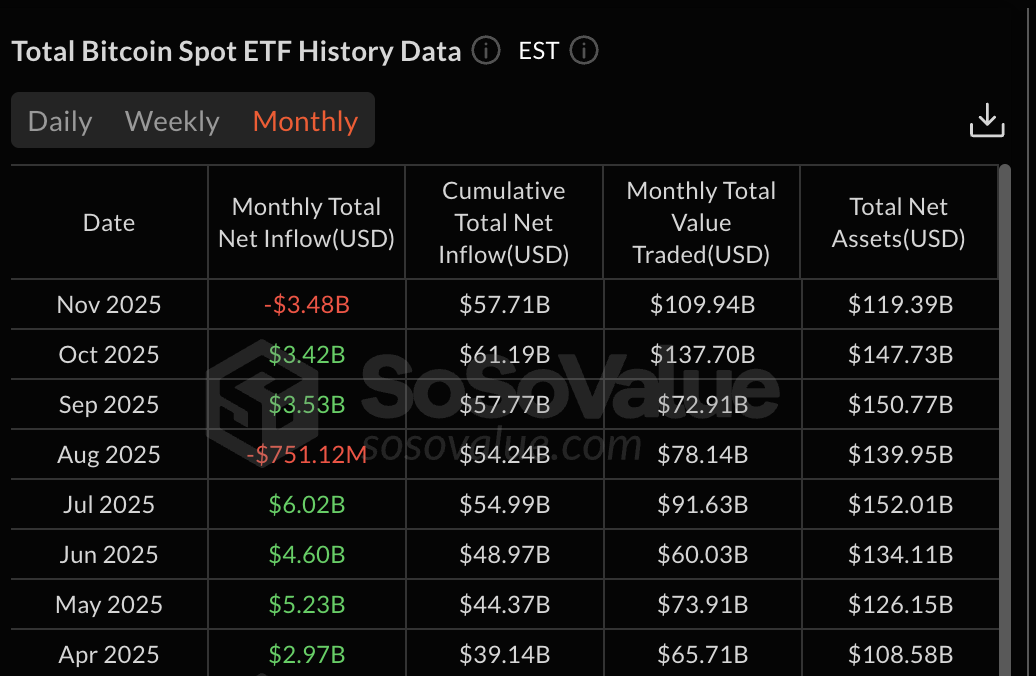

ETF investors slammed the brakes in November, pulling $3.48 billion from US spot ETFs and snapping a hot streak of inflows. The last time we saw this kind of cold shoulder? Back between April and July, when investors were eagerly piling in.

Since then, flows have been inconsistent, and November confirmed that institutions remained defensive.

ETF Flows Need To Make A Green Sreak: SoSo Value

“A surge in ETF interest, not just a trickle, is the vital spark needed to reignite the crypto market,” claims MEXC’s top analyst, Shawn Young, hinting at a potentially sluggish recovery until consistent investment pours in.

Bitcoin’s next moonshot? Watch for these telltale signs: a return to risk-on trading, a flood of liquidity, and deeper market waters. The real kicker? Keep an eye on those Bitcoin spot ETFs. If we start seeing consistent days of $200-300 million pouring in, that’s the signal institutional whales are back in the game, and the next price surge is blasting off.

Hunter Rogers, Co-Founder of TeraHash, added that the setup for December still looks muted even after November’s flush-out:

“Forget the December drama. Don’t expect a rocket launch or a face-plant. Think gentle climb, like a seasoned mountaineer. If the ETF frenzy chills and market jitters stay grounded, Bitcoin might just deliver a pleasant little gift before the New Year. But let’s be real, we’re still patching things up here, not throwing a party.”

Together, the seasonal pattern and ETF flows show that December may stay cautious unless ETF demand turns sharply higher.

On-Chain Metrics Still Show Weak Conviction

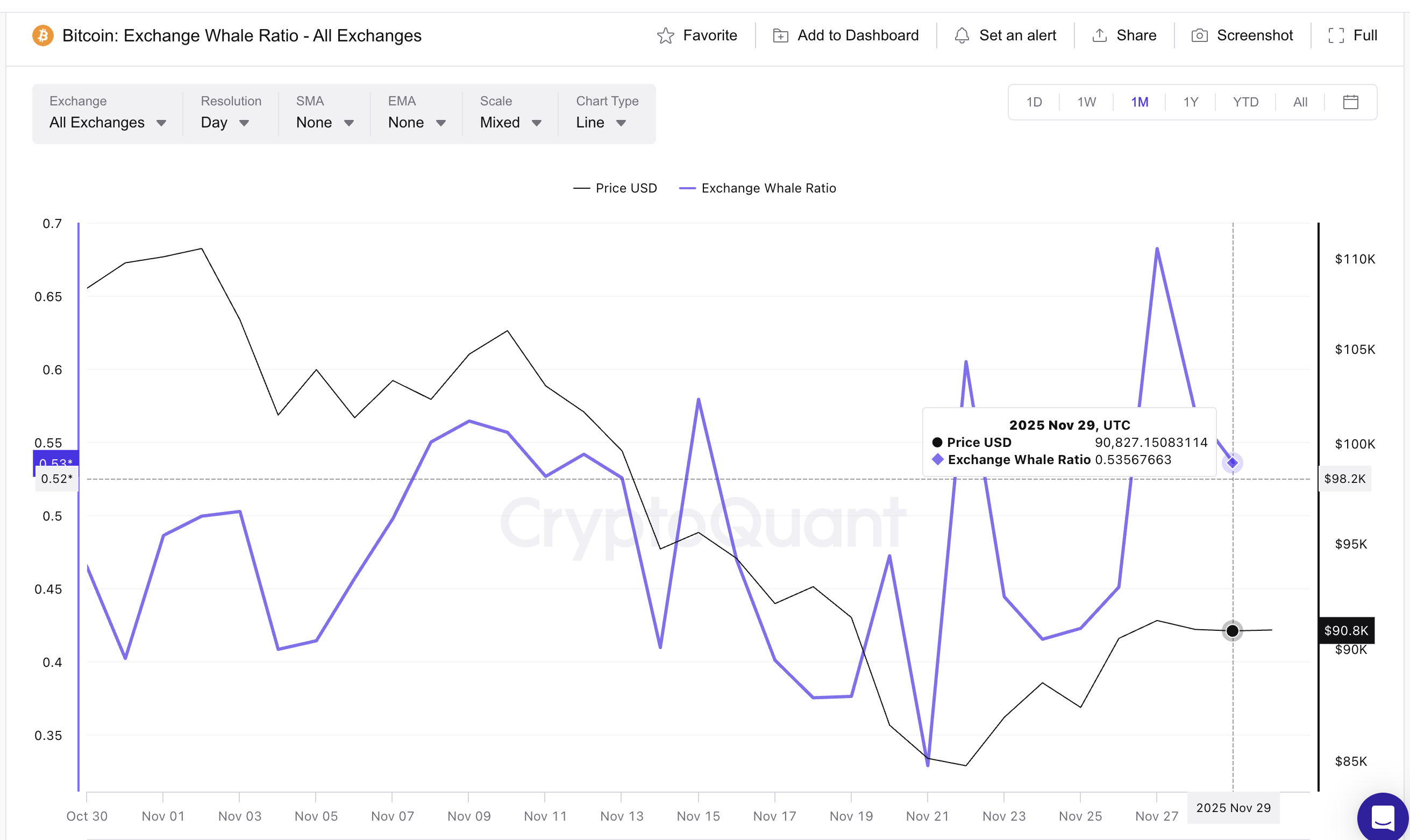

Is Bitcoin’s bottom really in? On-chain data whispers a hesitant “maybe.” But two red flags refuse to disappear: whale wallets are still funneling crypto onto exchanges, hinting at potential sell-offs, and long-term holders, the bedrock of Bitcoin, are stubbornly shedding their holdings. A true December bottom usually looks like theoppositeof this.

Whale activity just spiked! The Exchange Whale Ratio, a key indicator of crypto market influence, has more than doubled this month. A surge from 0.32 to a whopping 0.68 on November 27th reveals that a small group of the top 10 largest wallets now controls a significantly larger share of exchange inflows. Are the big players calling the shots, and what does this mean for the rest of us?

While the ratio has dipped to 0.53, don’t breathe a sigh of relief just yet. History whispers a warning: this level has typically been whale territory, signaling sell-offs, not a feeding frenzy. Lasting market bottoms rarely materialize when this key indicator lingers in the upper echelons for weeks on end.

Whales Keep Moving BTC To Exchanges: CryptoQuant

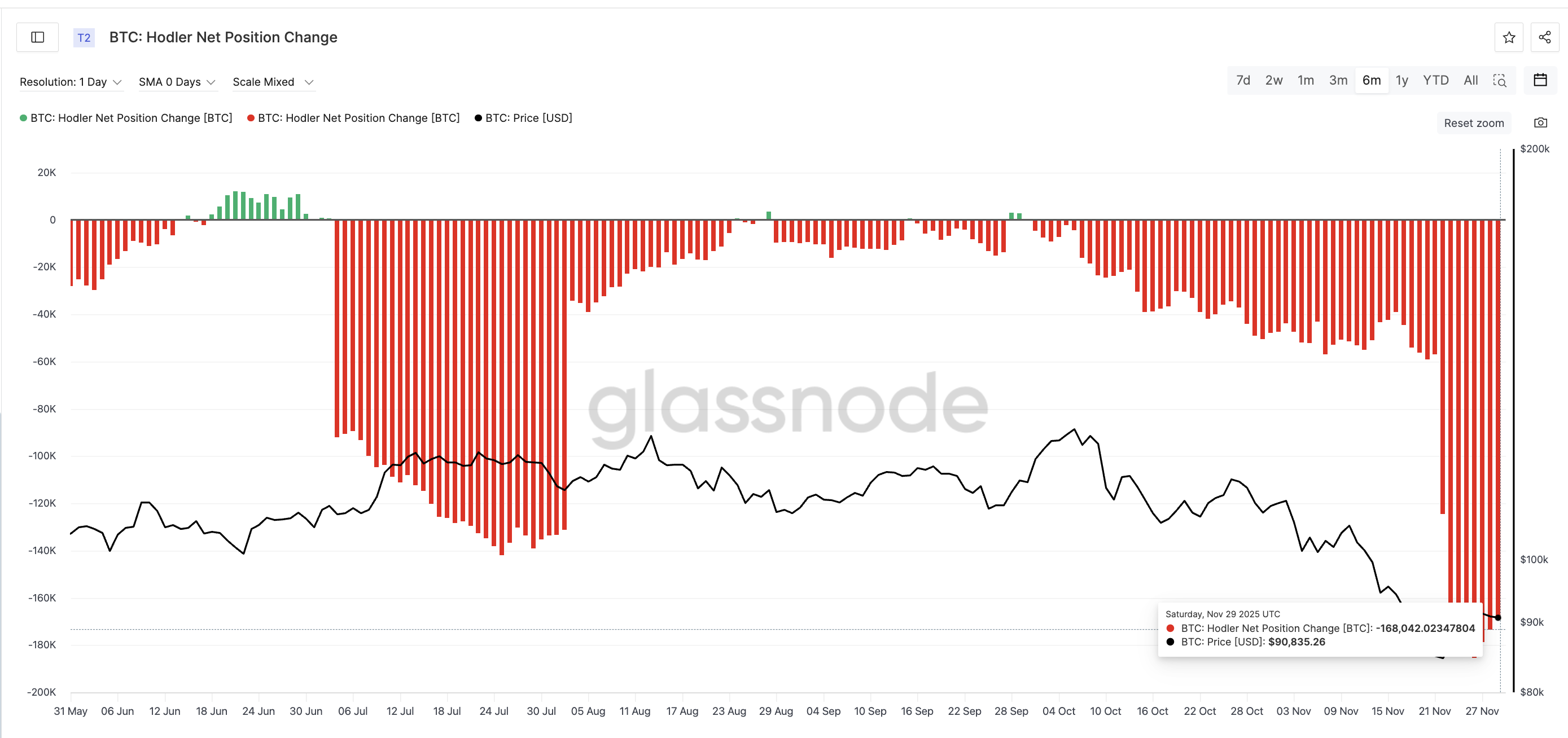

Hodlers are capitulating, with their net position change firmly entrenched in the red for over half a year. Will history repeat itself? The last significant Bitcoin surge ignited only after this metric flipped green in late September. Could a return to positive hodler sentiment be the key to unlocking the next bull run? For now, the green light remains elusive.

Long-Term Investors Still Selling: Glassnode

Until long-term holders stop sending coins back into circulation, sustained upside becomes harder to support.

Shawn believes that a true shift begins only when long-term sellers step aside:

The rally ignites when OG sellers relinquish control, whales dive back into the feeding frenzy, and market liquidity surges across top-tier exchanges.

Hunter Rogers echoed this view, linking any trend reversal to cleaner supply behavior from miners and long-term wallets:

“When long-term holders quietly move back into accumulation, it means supply pressure is fading,” he mentioned

Bitcoin’s December forecast remains cloudy. Whale wallets are still fueling exchanges, and long-term holders are shedding their stashes. These combined movements hint at a potentially rough ride ahead, suggesting Bitcoin might test lower depths before staging any significant comeback.

Bitcoin Price In December: Key Risks And Confirmations

Bitcoin teeters on a knife’s edge. A whisper of a price shift now could dictate December’s narrative. Forget bullish dreams – the underlying current remains stubbornly bearish. The charts aren’t lying, echoing the somber whispers from ETF activity and the cryptic language of on-chain data.

Bitcoin’s bear flag finally snapped, plunging below its lower boundary after weeks of tense consolidation. While the technical target points to a potential freefall towards $66,800, don’t expect a straight line down. Market liquidity could throw a wrench in the bears’ plans, creating unexpected bounces and volatility along the way.

December’s critical threshold? $80,400. Breach it, and brace for turbulence; defend it, and hope flickers. This former launchpad, already showing cracks, holds the key to the month’s crypto fate.

Plunging below $80,400? Buckle up. Shawn Young predicts this could trigger a liquidity grab – a sharp, sudden dip designed to shake out weak hands – before any real rebound. Think of it as a pre-recovery earthquake.

Here is what he said in an exclusive bit, giving the market some hope as well:

“Bitcoin’s market setup suggests a wick-style liquidity sweep rather than a prolonged breakdown,” he believes

But here’s the kicker: this bearish house of cards collapses only if Bitcoin storms back to $97,100, seizing the high ground of the broader pole-and-flag formation. Conquer that level, and the bear flag vanishes in a puff of smoke, paving the way for a bullish charge toward the $101,600 resistance wall.

Hunter underscored a critical caveat: surging past trendlines is a hollow victory without the backing of amplified trading volume. In essence, price must dance to the rhythm of strong participation.

“The real test begins now. If Bitcoin digs in its heels above this zone, volume swelling with conviction, we could be witnessing the forging of a bedrock floor for the market.”

December’s make-or-break moment? Between $93,900 and $97,100. That’s the price range where charts must sing a bullish tune, ETFs need to throw their weight behind the bulls, and on-chain data has to ditch its defensive stance and start playing offense.

Bitcoin Price Analysis: TradingView

Until the green light flashes, the bears hold the reins. Watch for a potential Bitcoin price plunge if ETF bleeding intensifies, or if whale migrations to exchanges become a flood.

Bitcoin’s December dance begins, trapped between titans. $80,400: the last stand for bulls, a concrete floor against the bear’s relentless paw. Above, $97,137 looms, a seemingly impenetrable ceiling. Break through, and the slumbering giant awakens, momentum surging, ready to redefine its peak. Fail, and risk a deeper winter. The coming weeks will determine Bitcoin’s fate.

The post What To Expect From Bitcoin Price In December 2025 appeared first on BeInCrypto.

Thanks for reading What To Expect From Bitcoin Price In December 2025