Pi’s price weathered November’s crypto storms better than the big names, but a closer look at the charts reveals a tug-of-war between resilience and potential trouble. After a turbulent summer, Pi Coin found an unusual period of calm last month. Now, the question remains: can it break free and finally paint the charts green for only the third time this year?

Will December defy gravity, soaring past November’s heights, or will the relentless undertow of the market drag it back into the abyss?

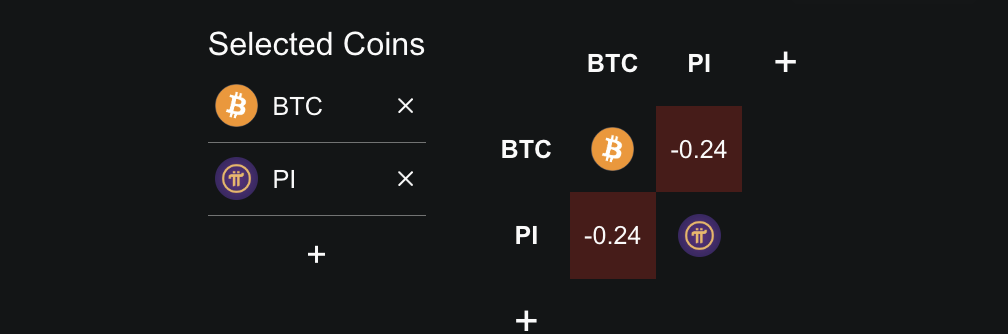

History And Its Negative Correlation With Bitcoin

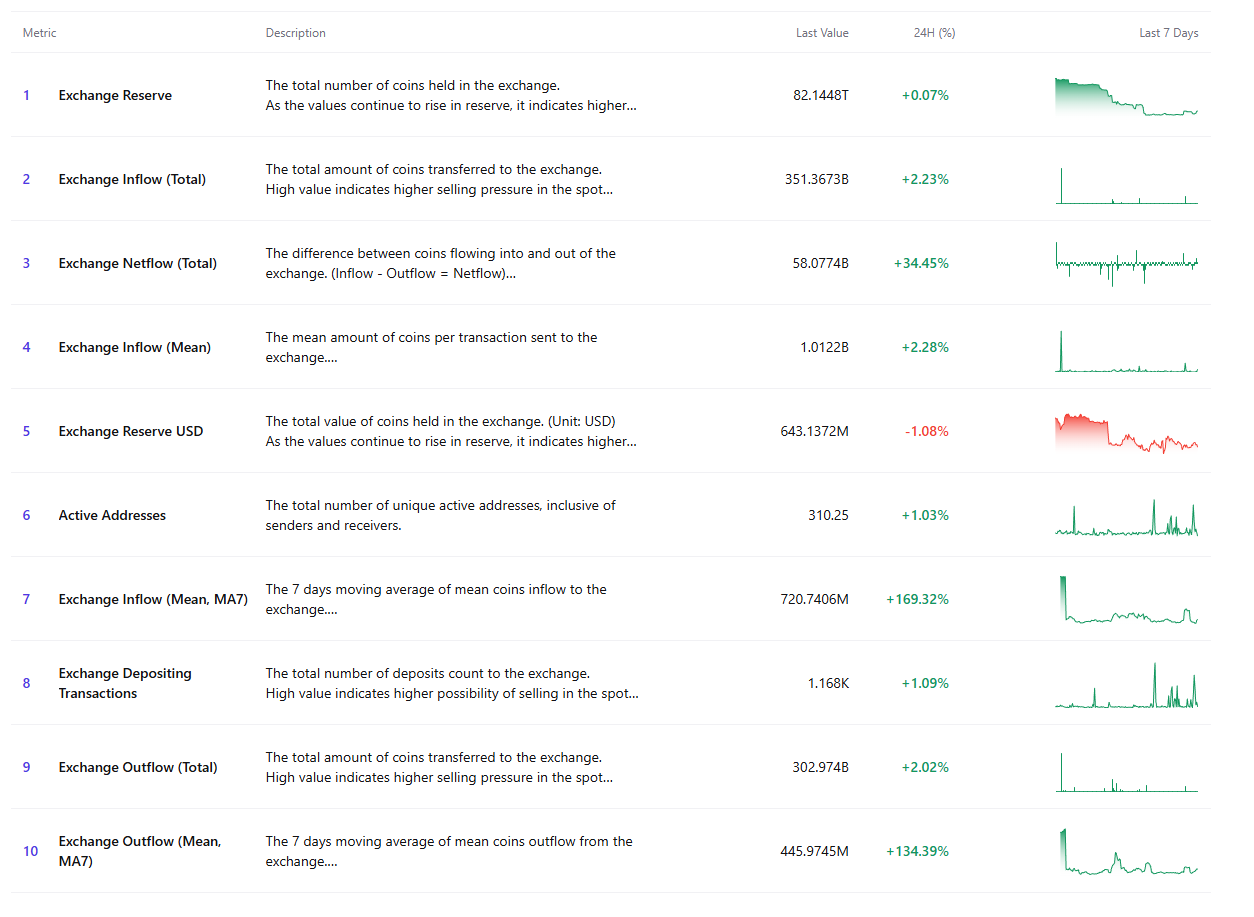

Pi Coin’s tale is brief, yet its price chart paints a stark picture. 2025 has largely bled red, with only February and May offering fleeting glimpses of green. Now, November fights to break free from the bearish grip, hoping to add another chapter of growth to Pi’s unfolding story.

Price History: CryptoRank

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

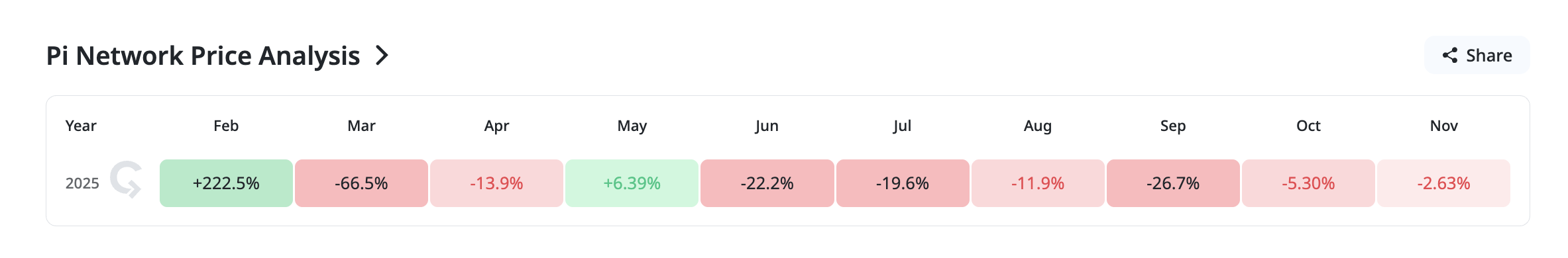

Bitcoin dips got you down? Pi Network might be your silver lining. Bucking the crypto trend, Pi exhibits a fascinating inverse relationship with Bitcoin, currently hovering around a compelling -0.24. Think of it this way: as the Bitcoin tide recedes, Pi often stands strong, or even swells. With Bitcoin’s waning influence since October, Pi has discovered a steadfast foundation, offering a potential counterweight in a volatile market.

Over the last month, Pi is down only about 2.6%, while Bitcoin has dropped much more sharply. Almost 19%.

Pi Coin- BTC Correlation: DeFillama

Pi has maintained its poise, climbing approximately 2.7% this week, a beacon of stability in a turbulent crypto sea. However, storm clouds may be gathering. Three-day chart signals hint at headwinds that could make December a tougher climb than November’s relative ease.

Hidden Bearish Divergence Appears As Big Money Weakens

Pi Coin is coiling like a spring! Its price action is trapped within a falling wedge – typically a launchpad for bullish breakouts. Pi is currently flirting with the wedge’s upper boundary, poised for a potential surge. However, storm clouds are gathering. Two key indicators are whispering tales of impending weakness, suggesting this breakout attempt might be a false dawn.

Pi Coin’s three-day chart is flashing a warning: a hidden bearish RSI divergence. While the price formed a lower high between October 25th and November 24th, the Relative Strength Index (RSI) painted ahigherhigh. This momentum mismatch hints at a lurking downtrend, suggesting the apparent price stability is merely a deceptive calm before the storm. Don’t be fooled; bearish forces are likely still in control.

Pi Coin Faces Divergence Risk: TradingView

But lurking beneath the surface, a more ominous indicator whispers of caution: the Chaikin Money Flow (CMF). This metric, designed to detect the footprints of institutional investors, remains stubbornly negative on the three-day chart. Even more concerning, it’s now edging perilously close to its ascending trendline, threatening a break that could signal a significant outflow of capital.

The last time CMF revisited this trendline in early October, Pi dropped more than 42%.

Big Money Keeps Flowing Out: TradingView

Can PI’s November surge last through December? The answer hinges on two key factors: Money must flow back into the market, and the Chaikin Money Flow (CMF) needs to avoid a meltdown. If either falters, November’s gains could vanish like a snowflake in July.

Pi Coin Price Levels To Watch In December

PI’s price action is coiling, ready to spring! To ignite a true rally, watch for a decisive break above $0.28 – where the wedge formation’s upper edge awaits a challenge. Piercing that ceiling could unleash significant upward momentum.

Break above $0.28, and the bulls could stampede towards $0.36, with an audacious run to $0.46 if the market truly ignites. However, the signal flags are flying caution, hinting that this rally needs more fuel – specifically, a surge in capital flow – to truly take flight.

However, keep a close eye on $0.21 and $0.20 – breaches here could trigger a slide toward $0.18. Should Bitcoin stage a surprise rally, PI’s inverse relationship might cause it to lag, potentially dragging the price down to the wedge’s lower boundary.

Pi Coin Price Analysis: TradingView

December’s fate hangs by a thread: $0.20. Defend this line, and the long-term vision remains intact. But a slip past this critical level unleashes the bears, dragging the price down to $0.18, with a chilling possibility of a further descent to $0.15. The battle for $0.20 will define December’s destiny.

Can Pi Network defy the odds? Momentum hinges on a critical juncture: a stable Chaikin Money Flow and a breakout from its descending wedge. If Pi can conquer the $0.28 resistance, a surprising year-end rally could materialize. The clock is ticking.

There is hope still if Bitcoin weakens and the negative correlation makes Pi Coin more desirable to big money.

The post What To Expect From Pi Coin Price in December 2025 appeared first on BeInCrypto.

Thanks for reading What To Expect From Pi Coin Price in December 2025