23 days and 23 more to build that $100,000 fortress for Bitcoin. A consecutive period in the span of months above the six-figure mark indeed stamps some history while at the same time witnessing tremendous raw power surging to annual peaks, thereby writing the 2025 canvas with record strokes. However, beneath it all, small cracks begin to show. While price and hashrate shout bullish momentum, subtle on-chain murmurs and the off-chain murmurs of divergence call for attention.

New Highs for Bitcoin, But Core Metrics Slip Back

Bitcoin’s meteoric rise continues! 2025 is already proving to be a landmark year for the digital kingpin to have been shattering any selldowns it once used to abide by. May 22nd saw a highly feverish rise, gladly topping at $112,000 on Bitstamp. Across the crypto-verse, weighted average prices are now near a hefty number of $111,900. According to Glassnode, this is officially a “third” all-time high within this cycle, another signal that this bull run has longevity.

While the Bitcoin engine roared, forget about moonshots; the hashrate shot past the stratosphere. The network crossed the insane figure of 929 exahash per second (EH/s) amid celebrations on May 8th, 2025, thus unlocking a level traditionally thought of as a concept in speculative fiction.

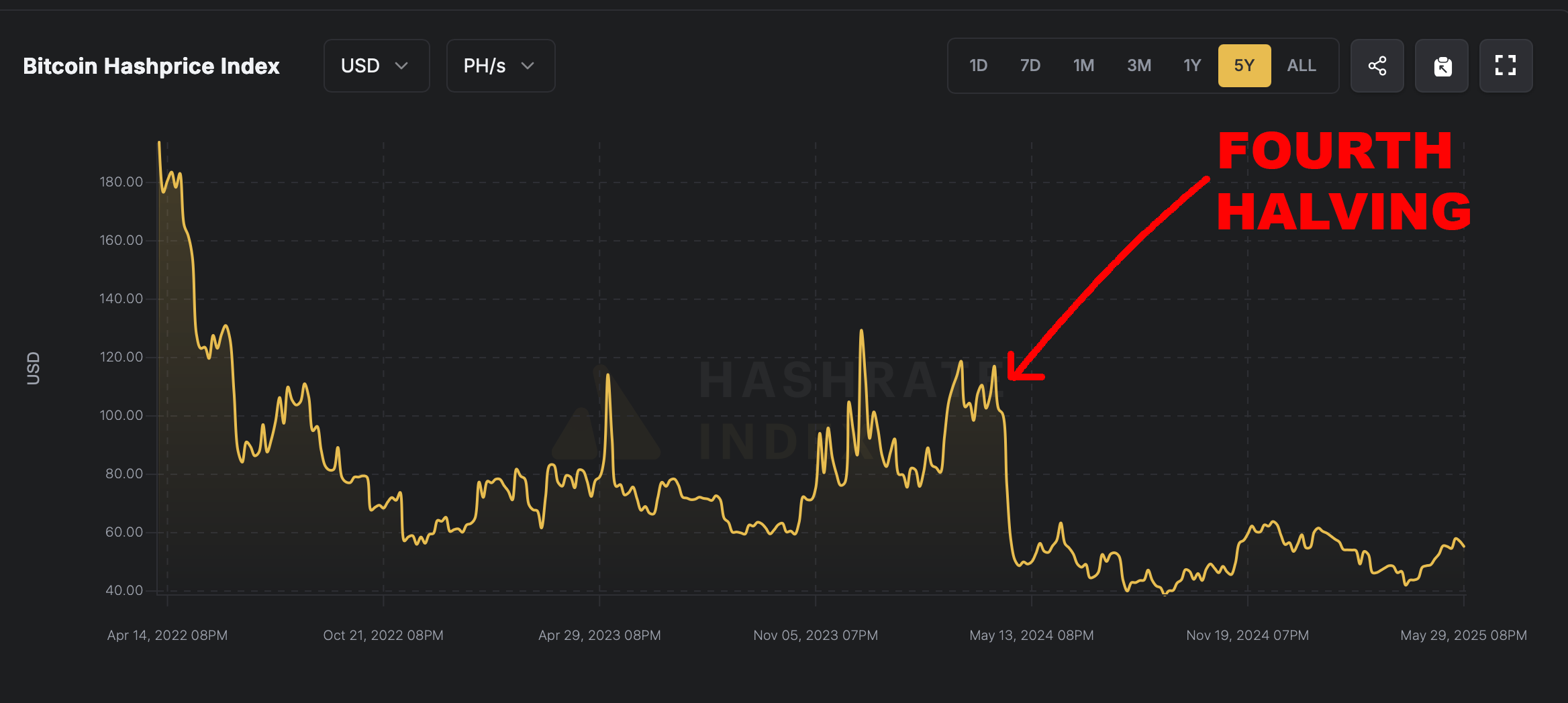

Picture this: almost a zettahash! Difficulty for mining has been at its highest level for quite some time, and after halving event revenues have become tighter than a drum (miners currently earn 22% less per petahash than before the April 2024 event); this never-the-less hesitates not to express that the network has become stronger in security and process-thwacking power. This figure, therefore, is not just for the numbers but represents the resilience of Bitcoin and the unwavering commitment of its miners.

Bitcoin’s hashprice or the estimated value of 1 petahash per second every day according to hashrateindex.com.

Halving the reward is doubling the challenge indeed. The old-timers used to gulp $75 per petahash per second (PH/s) per day by way of rewards before the big split. Now? Bitcoin has to make it all the way to $139,300 to just touch the old profit margin again. Forget about the 2024 fee phenomena-transaction fees are 1% of daily revenues. Now that fees are out of the picture, it’s Bitcoin’s price that’s grabbed the spotlight in mining profitability.

On- and Off-Chain Engagement Shrinks

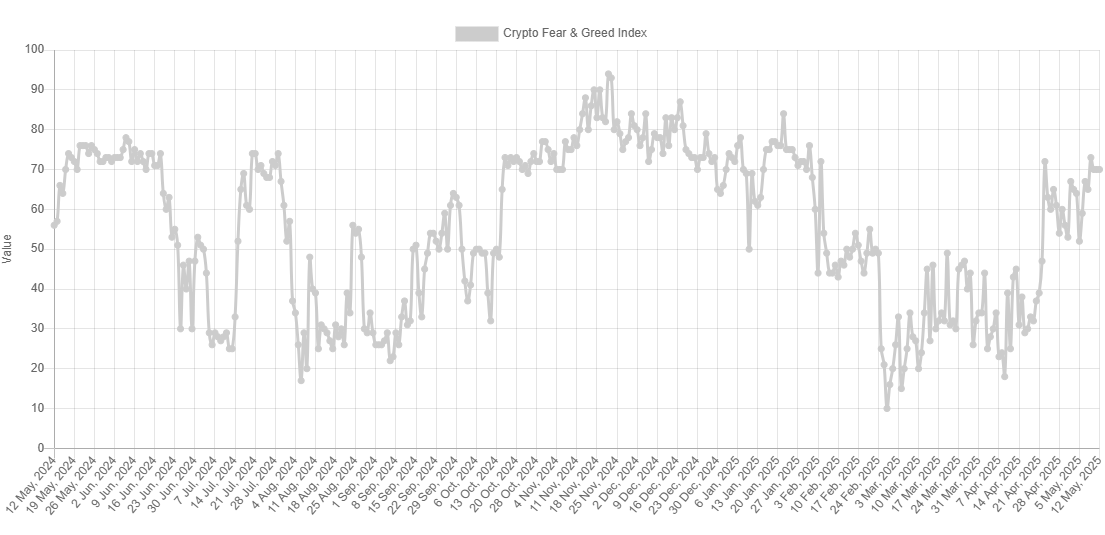

The dreary on-chain action had observers believing that winter had descended upon the cryptocurrency space. Utilization of block space has been shrinking, and daily throughput of transactions has dropped precipitously this year. Recall the mempool once clogged with over 700,000 pending transactions? It is now almost hauntingly empty. Fees maintenance is putting miners in an austere environment and drying up fast. Take, for instance, a glance at blocks 899008 to 899056, many half full, some a quarter full. What a sharp view of the deceleration!

Bitcoin transactions per day chart since February 2023 via Blockchair.

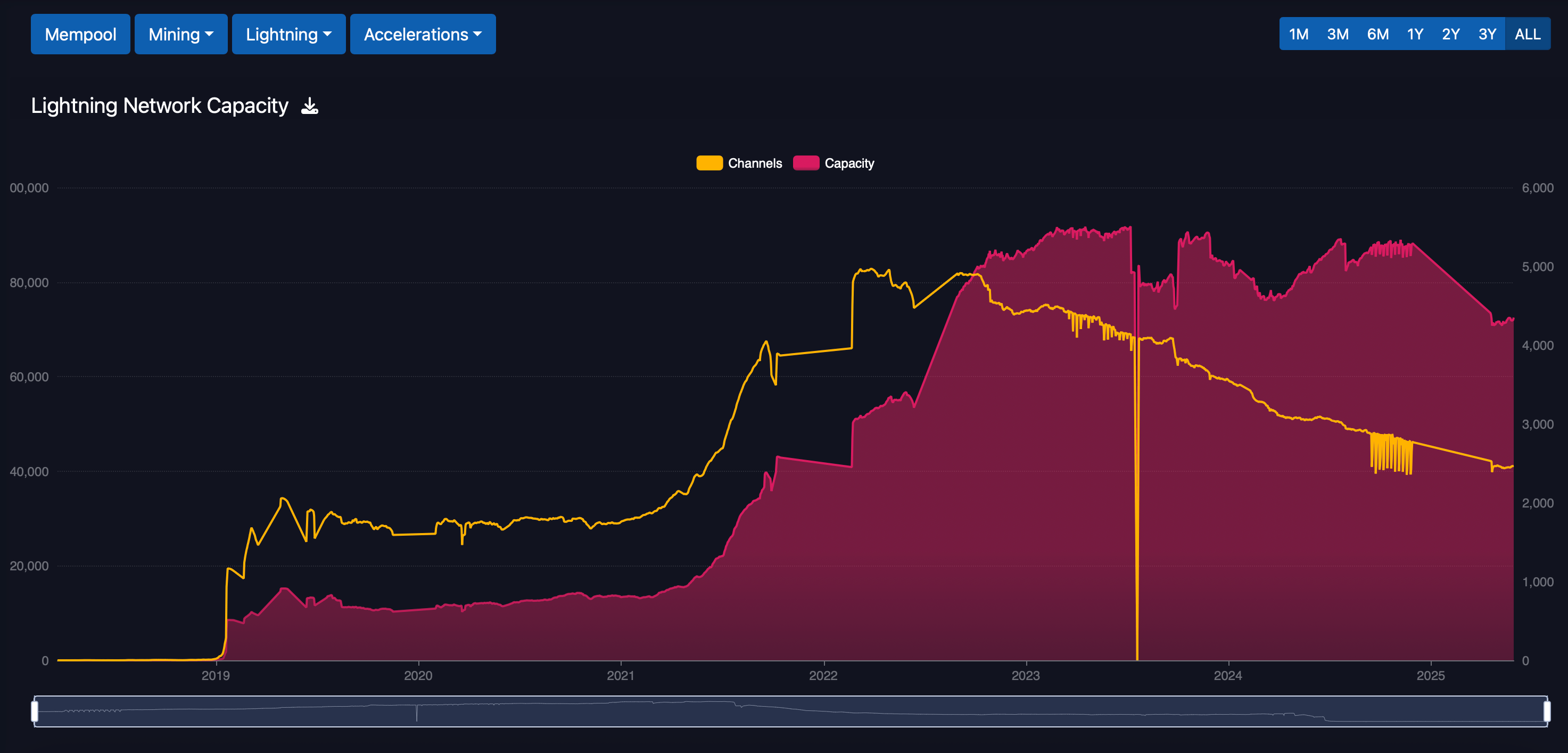

There existed the ephemeral day between 2025, swinging between the lows of 290,000 and highs of 630,000, finding a delicate balance of about 460,000 transfers. But, grim clouds are gathering below. Once an off-chain innovator unto itself, the Lightning Network now seems to be in a dimming glow. From a figure of over 80,000 channels lighting up in September 2022, barely 40,000 stand today, a heart-chilling 50% cut. The very lifeblood of the network is bleeding away too-the total BTC locked within these channels, which largely shows the drying up of the off-chain realm in another way.

Lightning capacity and channels via mempool.space.

Lightning Network’s spark seemingly tends toward dimming. Approaching its zenith in November 2024 when it went past 5,000 BTC, capacity fell aggressively to a little above 4,300 BTC: a level not seen since 2022. The growth engine of the network stalled back in October 2022, unable to continually break past the 5,000 BTC ceiling. With massive structural changes occurring throughout the Bitcoin ecosystem both on and off-chain, has the period of unrelenting growth ended? Are we perhaps topping out low and efficient operations versus big ones? This may well be the backbone onto which Lightning’s future hangs.

Will this pause fuel the phoenix-like rise of a new age, or will it remain as a forecaster of the prolonged winter in the financial landscape of the network? The economic evolution of the network answers these questions based on how things change.

Thanks for reading While Bitcoin’s Hashrate and Price Hit New Peaks On- and Off-Chain Metrics Shrivel