Hedera (HBAR) has snatched back some ground in a very volatile session and mustered a rally of more than 4%. Don’t pop the corks yet, though: for HBAR, the bears seem to be still in control as it is almost 7% down for the week and still sits below $0.19. This recent spike; that could well be a dead cat bounce. The BBTrend indicator is glowing red while strengthening the bears’ case; also, the EMA lines keep echoing that downtrend. Is this rally just a sucker’s bet or maybe she goes somewhere? Time will definitely reveal that, if HBAR can ever find its way out of the bear’s clutches.

And hold on! The RSI pulse is quickening; this means the buyers might be in play. Is this the sentiment shift we wanted to see? HBAR is now on a ragged edge, waltzing through the duality of important resistance and support. This moment holds the key to whether it will soar and claim new heights or get lost into the abyss.

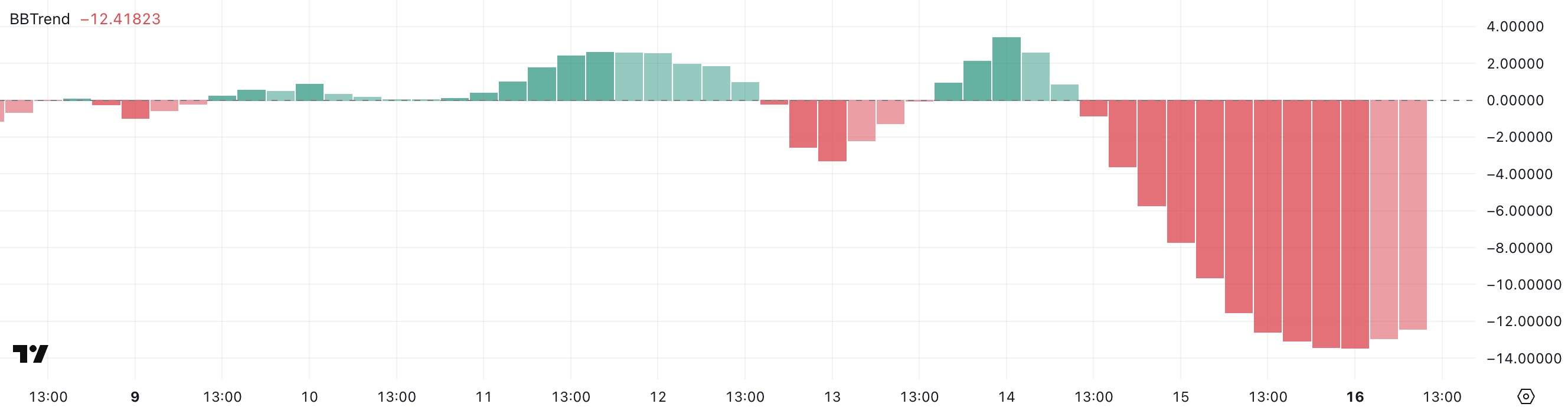

Hedera Slides as BBTrend Turns Deeply Negative

The bullish wind for Hedera has turned into a cold headwind. The BBTrend indicator, which had been at a gentle +0.83, has now plunged 12.41 in two days, thus indicating the expeditious deceleration of upward momentum. Can this be treated as a pause before more, or is it the beginning of a deeper correction of HBAR?

Earlier today, the indicator hit a low of -13.43 before slightly recovering, underscoring a potential intensification in bearish pressure.

This rapid shift suggests that HBAR is entering a stronger downtrend phase, with sellers increasingly dominating recent price action.

HBAR BBTrend. Source: TradingView.

PCR toBearTrend: Use Bollinger Bands to decode the momentum of the market. Not only does this indicator show price direction, but it also reveals the hidden power behind every surge and dip, with the expanding width and tilting slope of the Bands demonstrating the strength of the true trend.

HBAR’s BBTrend is ominous. Now that it has fallen abruptly to -12.41, we are dealing with high involved volatility. The bearish momentum is gathering, much as clouds gather for a storm.

Should this downward spiral continue, brace yourselves: prices could plummet even further, or we could be stuck in a holding pattern close to rock bottom for a very long time.

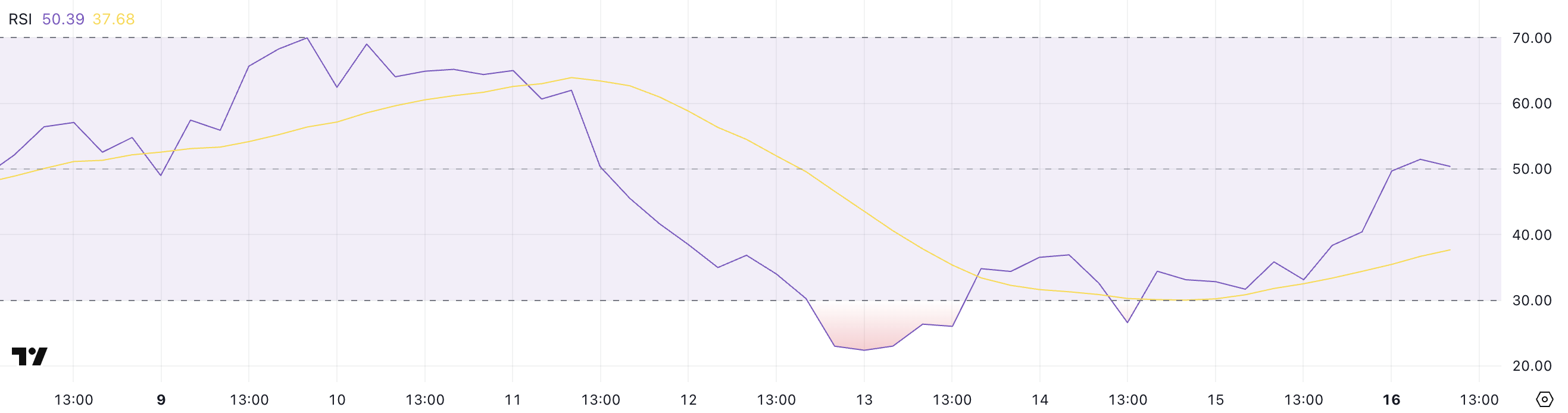

HBAR Momentum Recovers as RSI Rebounds from Oversold Zone

The pulse is quickening for Hedera! After flirting with oversold levels, its RSI has soared from the languid value of 26.6 to a vibrant 50.39 within a mere 48 hours. Is this the beginning of a grand rally?

This sharp rise suggests that buying interest has picked up, potentially marking the end of an oversold phase.

Up until now the market has been on an almost helpless decline that threatened to put dusk on what has been bullish territory for months-the delicate climb back to neutral territory could thus mean a turnaround, or at the very least, a let-up in the ongoing selling pressure.”

HBAR RSI. Source: TradingView.

RSI can be thought of as a speedometer that measures price momentum between zero and 100. Below 30 would mean that the engine is pretty much stalled-considered an oversold buying opportunity. Above 70 is a redline, giving the impression that the asset might be overheated and due for a pullback.

With HBAR’s RSI now hovering around 50, the token is neither overbought nor oversold, signaling balance between buyers and sellers.

This juncture is an important one. A breakout above this level could lead to a re-emergence of bullish momentum, had we not stumbled; alternatively, such a stumble could cause all recent gains to evaporate.

Hedera Faces Make-or-Break Moment Between $0.160 and $0.155

Bearish pressure is weighing on Hedera’s price as it struggles to shake off a persistent downtrend, with short-term momentum indicators weighed down by longer-term trends, boding ill for long-position bears.

This configuration typically signals downward pressure, but price action is now approaching a key resistance level at $0.160.

HBAR Price Analysis. Source: TradingView.

“If the ceiling is shattered, $0.175 is just the next stop on the bullish trip. Buckle those seat belts, because $0.183 and $0.193 could be shining far away if bulls keep charging ahead.”

The bond between the bulls and the price action will be shaken if that happens. Matters would take a bad turn, at least temporarily, should the major support of $0.155 be tested again. Should this support be breached suddenly, fierce selling will pour in, forcing the bears to wrest control of the market at $0.150.

Thanks for reading Why Bears Still Control Hedera (HBAR) Price Direction Despite Recovery