Bitcoin claws its way back, nudging toward $108,000 as a whisper of recovery breathes life into the crypto landscape.

But Bitcoin’s rally could soon hit turbulence. On-chain whispers hint at growing unease as miners and steadfast long-term holders begin to lighten their bags, potentially triggering a pullback from its recent highs.

Bitcoin Sell-Side Pressure Mounts

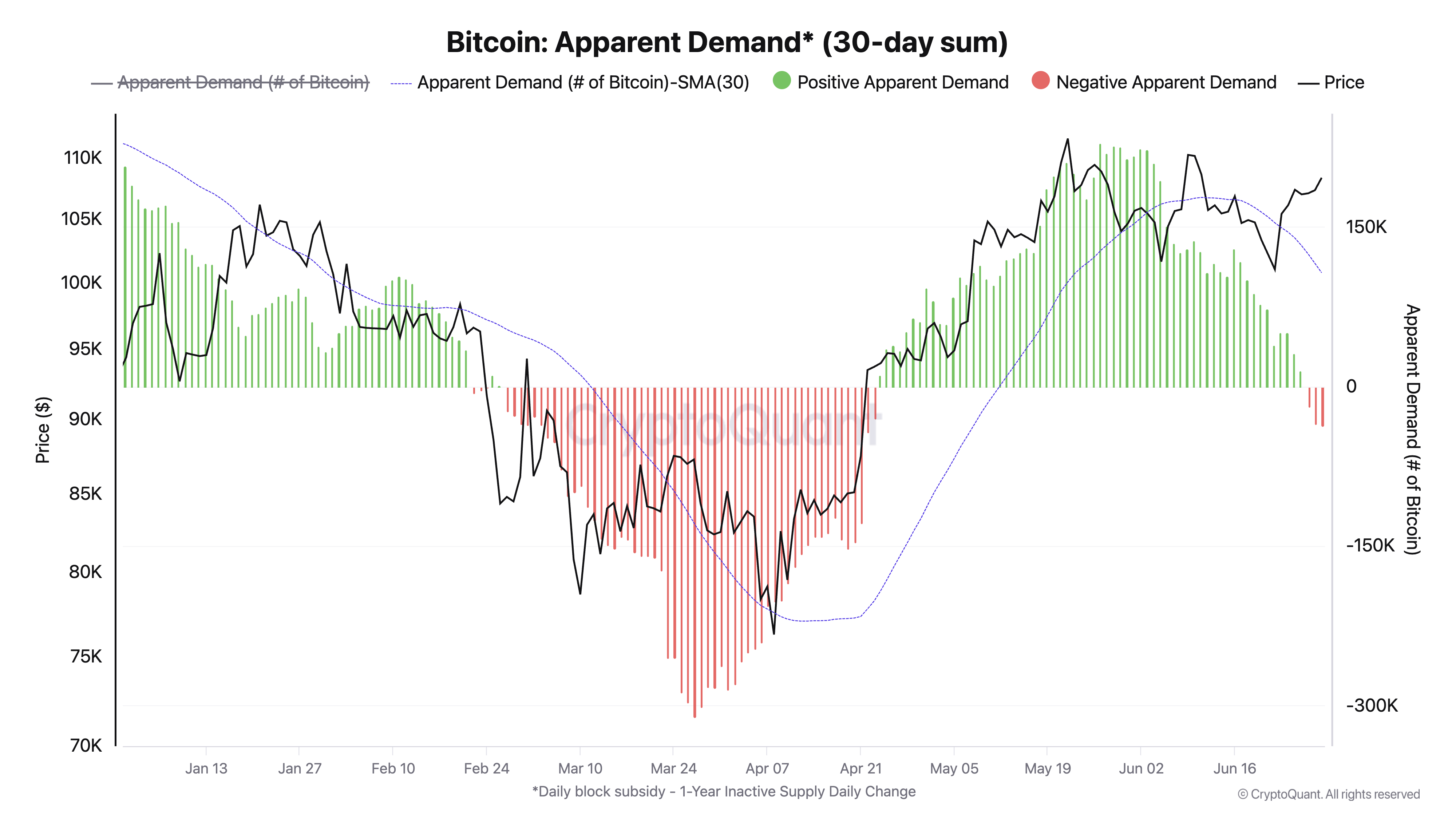

Uh oh, is Bitcoin losing its mojo? CryptoQuant data reveals a chilling trend: “Apparent Demand” has plunged into negative territory. Translation? The buying frenzy isn’t keeping up with the fresh supply of BTC hitting the market. Time to buckle up, crypto enthusiasts, the winds may be shifting.

Right now, Bitcoin’s pulse is registering a chill. Our “Apparent Demand” gauge, smoothed over the last month, reads a frosty -36.98. Think of it as a tug-of-war: on one side, fresh market hunger for Bitcoin; on the other, the combined weight of newly minted coins and the slumbering giants – long-term holders suddenly waking up and spending their stashes. A negative number? Demand’s lagging behind.

BTC Apparent Demand. Source: CryptoQuant

Bitcoin’s sinking sand: More coins are hitting exchanges than buyers can swallow. Blame lingering geopolitical jitters from the Israel-Iran-US triangle, a storm cloud that stubbornly shadows the market even as the sun peeks through.

Adding fuel to the bearish fire, the Bitcoin long/short ratio currently sits at a precarious 0.96. This suggests a growing chorus of traders are actively betting against Bitcoin’s future, a stark signal that downward pressure may intensify.

BTC Long/Short Ratio. Source: Coinglass

Imagine a tug-of-war in the market. The long/short ratio is the scorekeeper. Above 1? The “longs” – those betting on a price surge – are winning, suggesting bullish sentiment dominates the trading floor.

Think of it this way: When the ratio dips below one, it’s like a pack of wolves circling, signaling traders are bracing for a price plummet. This isn’t just bearish; it’s a chorus predicting further falls.

BTC bears are biting. Derivatives markets are echoing the on-chain cold shoulder towards Bitcoin, with short positions eclipsing longs. The market is bracing for a potential price dip, fueling the fear that’s currently gripping the crypto world.

Bitcoin Supply Surge Threatens Drop to $105,000

Bitcoin teeters on a knife’s edge, priced at $108,102. The bulls are facing a rising tide of sellers. If they can’t muster the strength to absorb the supply, brace for a potential fall below this critical level, with a retest of the $107,745 support zone looming.

Should this level fail to hold, BTC could fall below $105,000 to trade at $104,709.

BTC Price Analysis. Source: TradingView

But don’t count Bitcoin out just yet. A surge in buying pressure could spark a dramatic comeback. Imagine BTC shaking off the recent slump, blasting past the $109,304 barrier, and setting its sights once more on that elusive all-time high of $111,917.

Thanks for reading Why Bitcoin Price Might Drop Below $105000 in the Coming Days