Bitcoin flirting with $105,000 has made waves in the market. Gone are the whispers; this rally is a roar! A month-long surge has changed the discourse in crypto, given Wall Street’s new-found love for it and the massive waves of bullish sentiment flooding down.

However, conflicting market conditions may hold Bitcoin back from reaching a new all-time high.

Bitcoin Holders Heavily Accumulate

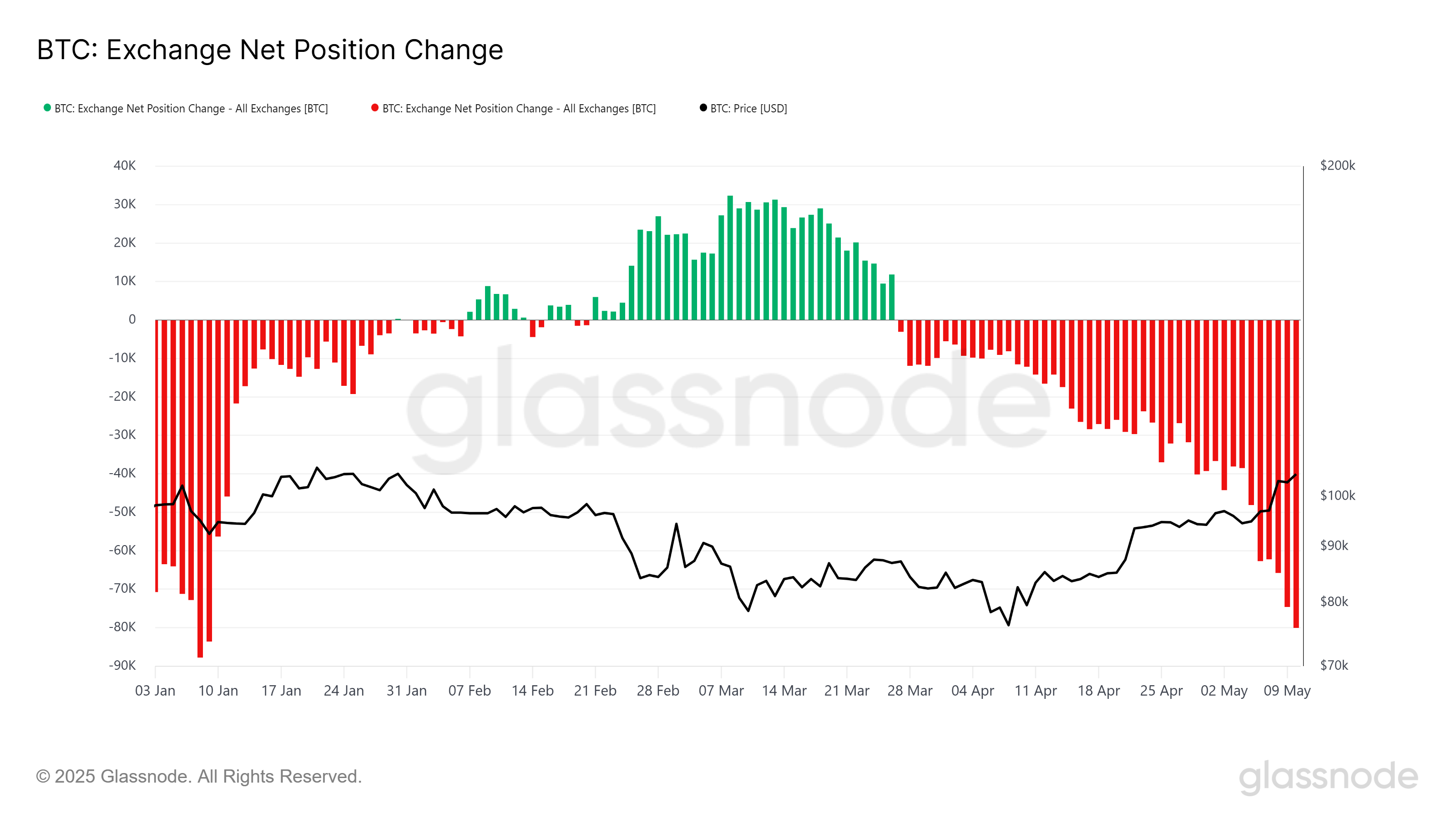

Bitcoin Bulls Stampede: $3.13 Billion Flood In, Draining Exchanges. Gone were the trickles in the previous week, which became an unprecedented waterfall of purchases as investors scooped up 30,072 Bitcoin, worth an astounding $3.13 billion. The plummeting net positions have left the exchanges high and dry for a four-month period of time, thus marking a clear shift in sentiment in the market.

The metric indicates that more coins are being withdrawn from exchanges than deposited, a classic sign of accumulation.

The Bitcoin FOMO is now hitting the fever pitch. No toe-dipping; holding giants are full-scale into accumulation as Bitcoin teeters on the verge of making all-time highs. Long-term investors are aggressively stacking sats, believing that it will be a seismic breakout, never wanting to be left behind.

Bitcoin Exchange Net Position Change. Source: Glassnode

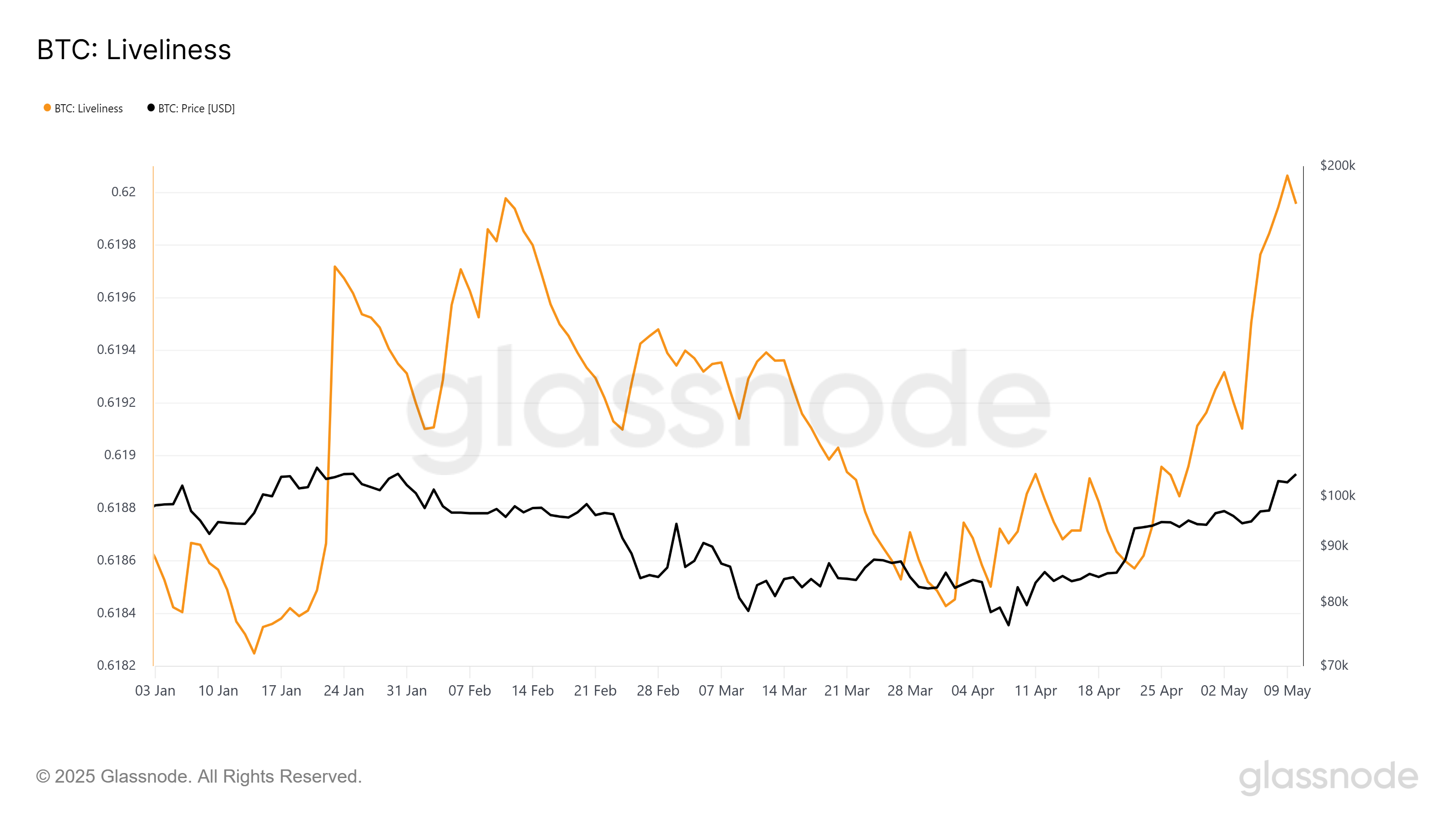

Rising, yet storm clouds form toward the horizon. An unusual spike in Liveliness, a core on-chain indicator, casts a shadow over the situation. The indicator, hitting a multi-week high last observed in May, conjured this whispering realization: even the hardest-core long-term holders were subtly starting to break and cash out some of their positions.

When dormant coins go alive, so does the pulse of the market. A hike in Liveliness tempted the early crypto pioneers to cash out, thus starting the tides of sell pressure. Keep your eyes wide open: veteran activities can create ripples in the entire ecosystem.

If Bitcoin LTHs continue to offload their holdings, it could undermine the bullish sentiment driven by fresh accumulation.

Bitcoin Liveliness. Source: Glassnode

BTC Price Aims For New ATH

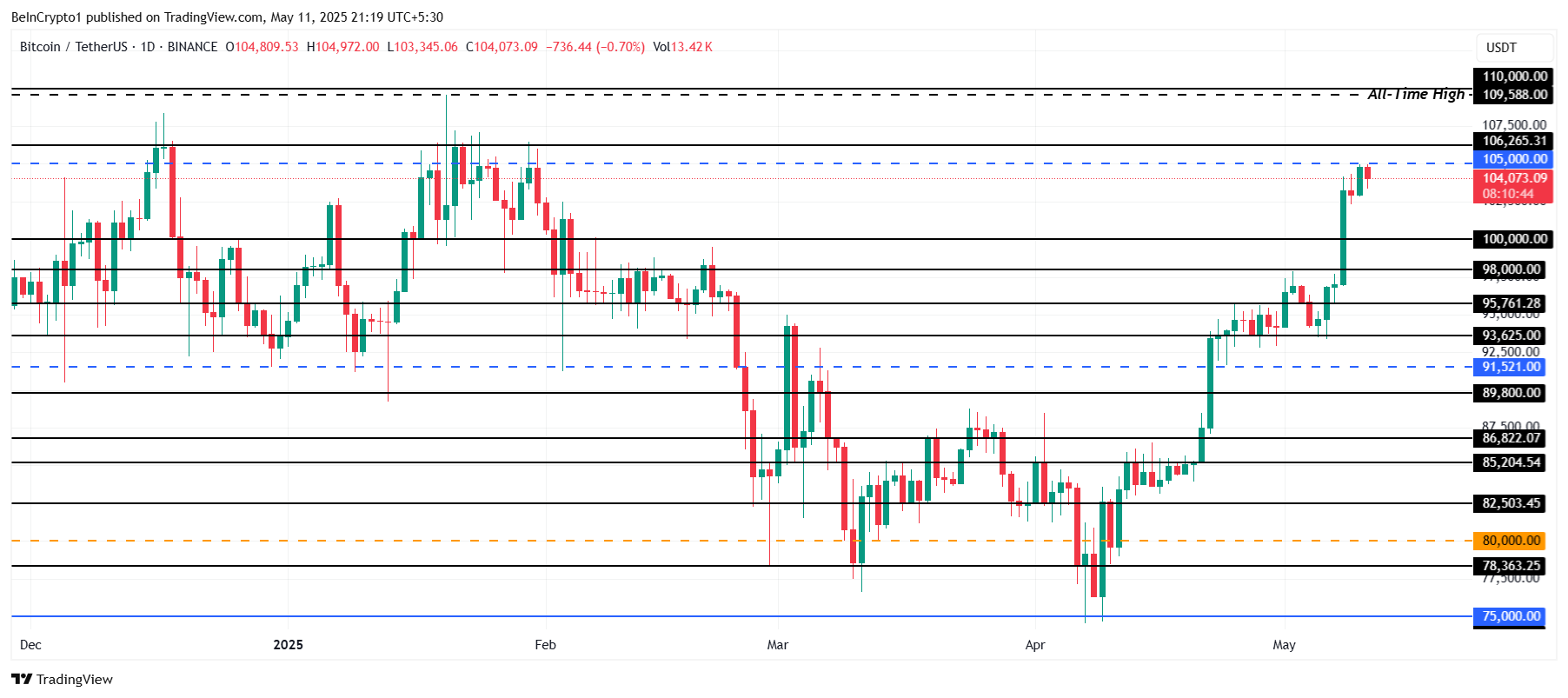

The breath of Bitcoin fogs up the $105,000 mirror, presently priced at $104,231. Will it shatter through? Not just yet. Just overhead, the real gatekeeper in business is the obstinate $106,265. That price has been kryptonite for Bitcoin ever since December 2024, a proverbial ceiling it just cannot seem to pass.

This run for bulls stands in the way of a $106,265 gauntlet, a critical level despite soaring to an all-time peak of almost $110,000. Overcoming this price point requires wresting control from long-term holders cashing in and overseeing divided investor opining in choppy waters. Will Bitcoin overpower resistance until this point, or will this resistance prove too big an obstacle?

Should Bitcoin fail to overcome this resistance, a price correction back to $100,000 remains a strong possibility.

Bitcoin Price Analysis. Source: TradingView

Beyond the ceiling of $106,265, if Bitcoin could shatter it and move it into solid ground, then watch out! This would hence fasten on a renewed bullish run, lifting Bitcoin to $109,588 towards granite and higher, which shall become a glorious new all-time high.

Surpassing this level would invalidate the bearish outlook and could set the stage for a run to $110,000.

Thanks for reading Why Bitcoin’s $105000 Rally Might Fall Short of a New All-Time High