As geopolitical tensions intensify and investor sentiment deteriorates, bearish pressure has continued spreading across Bitcoin’s spot and derivatives markets.

There is a whisper that Q2, during the sunsets of economic desolation, could soon unleash fury of global proportions as the humans dive for refuge, as the coin teeters on the brink.

Bitcoin Futures Turn Bearish

Bitcoin’s stalled ascent around $103,000 has futures traders sharpening their knives, betting big against the crypto king.

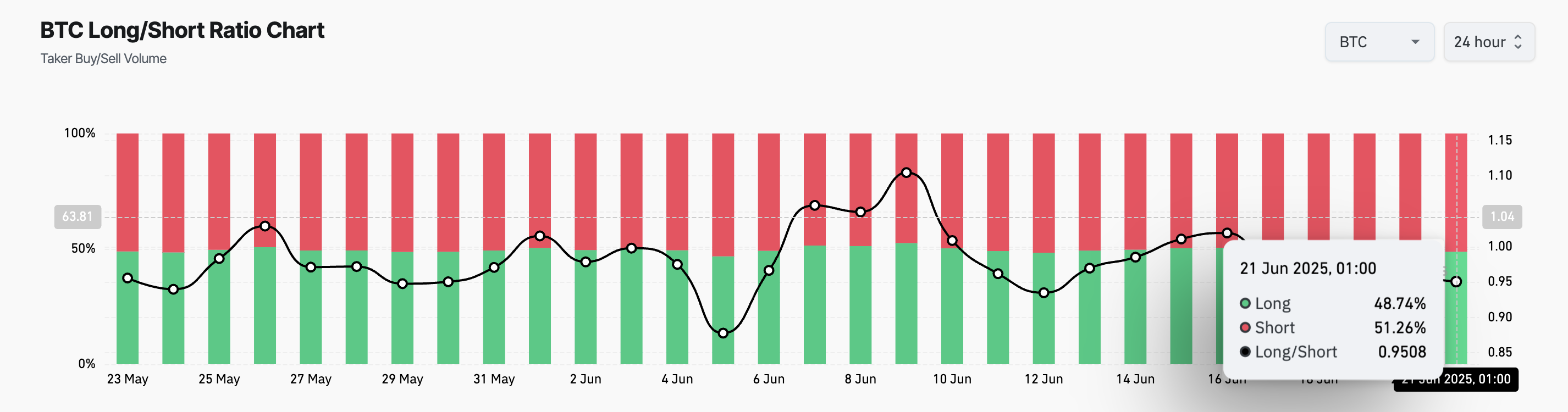

Bitcoin’s bullish winds might have turned into a bearish bite. Coinglass reveals a stark shift: since June 17th, the Long/Short ratio, one of the best reflects the market mood, has plunged. It suggests that there is a rising tide of traders who believe the recent surge of Bitcoin is being overly plied. Sitting now at a worrying 0.95, the ratio clearly indicates that more investors are staking against the crypto-king.

BTC Long/Short Ratio. Source: Coinglass

Decode Market Sentiment: The Long/Short Ratio.

If you picture a tug-of-war between market bulls and bears, then the long/short ratio will reveal who’s pulling harder. It is a classic application of the long-short ratio: if the long/short ratio is greater than one, it means bulls dominate and speculate on a price rally. Snapshot showing market optimism-the more traders are betting on the upside.

On the contrary, the downward BTC ratio below unity is like a red warning signal: rested on the assumption of a price drop. Think of it like the swells of the bear-choir that is being formed to anticipate short-term plummeting.

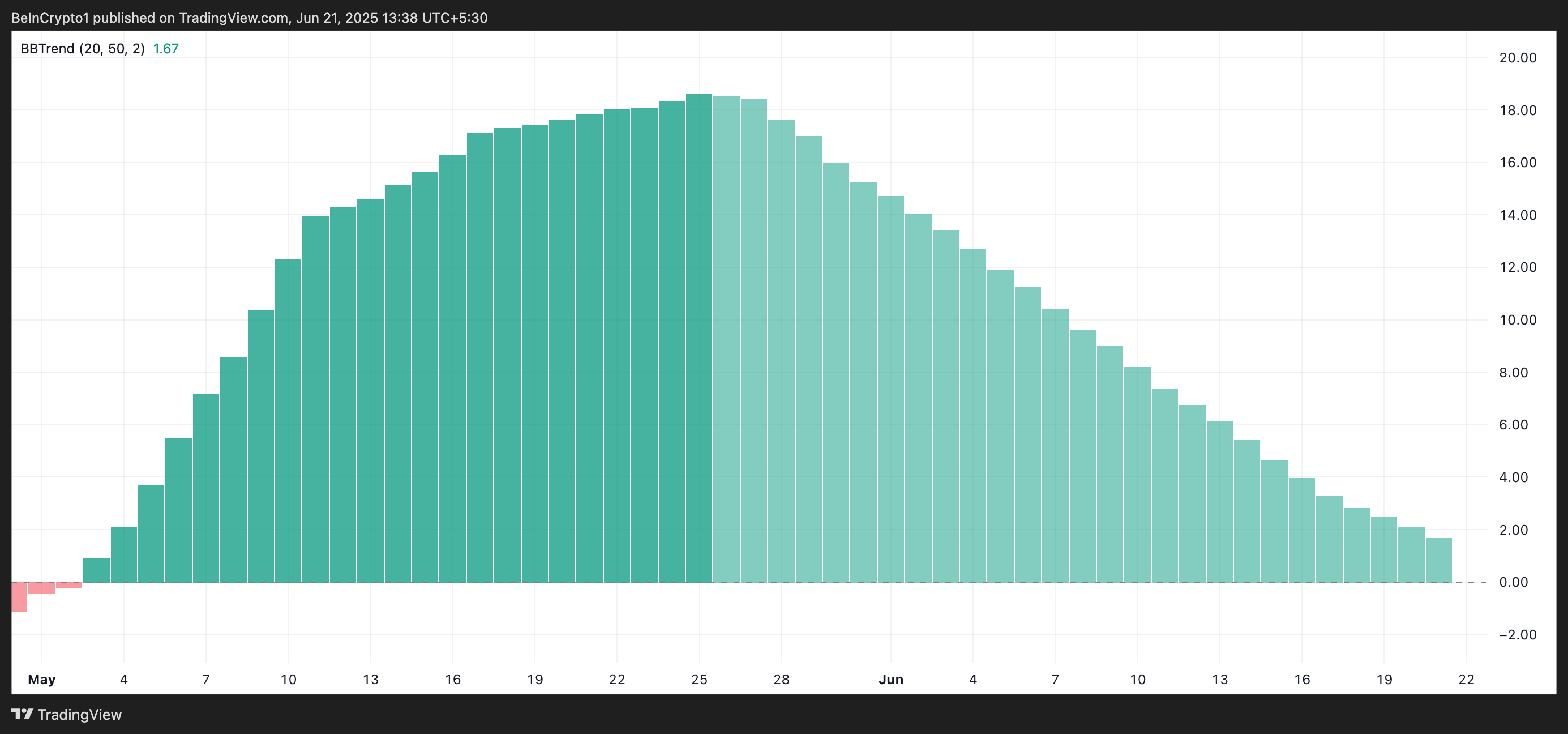

To add more fuel to the fire, the BBTrend indicator for BTC provides a gloomy picture on the daily scale. The mighty green histogram bars, once a soaring representation of buying momentum, have now shrunk into glimmering shadows telling the story of evaporating powers of the bulls and buyer’s sheer lack of enthusiasm. The bulls are slipping away.

BTC BBTrend. Source: TradingView

The financial heartbeat is pulsing green with rising optimism or flashing red in caution. That is the BBTrend. It is not just a chart line; it is an elaborate visual story told by colorful histogram bars about latent power and the possible direction of the price. When the bars turn green, bulls take over to prove upward momentum. However, when the bars blaze red in fury, bears reign in control, warning of a drop. Decipher BBTrend, and you grasp how to sail the ever-shifting currents of the market.

Is the BBTrend finally wearing off? The shrinking green bars seem to paint the picture of a peak setting in, hinting at a stall or even a downward slide for the asset. Watchout-the climb might be over!

A consistently negative BBTrend suggests that selling pressure is dominating, increasing the likelihood of an extended price correction for BTC.

BTC Slips to Two-Week Low: Will Support at $102,000 Hold?

Bitcoin dropped yesterday, falling to a two-week-low of $102,345 to stage a slight recovery to close at $103,297. But don’t get your party hats on yet; the bears are still prowling. If anything, despite the late-day rally, BTC is still nursing 2% wounds from the last 24 hours, suggesting the bulls might have their work cut out for them.

Bitcoin is teetering on a knife’s edge now. The price is in danger of plummeting toward $101,520 with demand as dry as the Sahara.`If there will be no buyers there, get ready for a free fall to $97,658-It’s all or nothing for the bulls now.

Bitcoin Price Analysis. Source: TradingView

However, bitcoin comes with a significant downside out of the box. It’s true: it’s good, sure, and steady about it; however, not significantly higher than $103,952.475. Push past this point and $106,295 might come under attack-teasingly offer.

Thanks for reading Will Bitcoin (BTC) Break Below $100000 as Q2 Nears its End?