Forget fleeting trends. A new breed of corporation is strategically embracing Bitcoin, not just as a speculative asset, but as a powerful tool for treasury optimization.

Imagine a balance sheet bolstered by potential capital appreciation, a portfolio fortified through diversification, and a shield raised against the corrosive effects of inflation. This is the promise of Bitcoin adoption when executed with precision and foresight. Forwardthinking companies are seizing this opportunity, positioning themselves for a future where digital assets play a central role in the global economy.

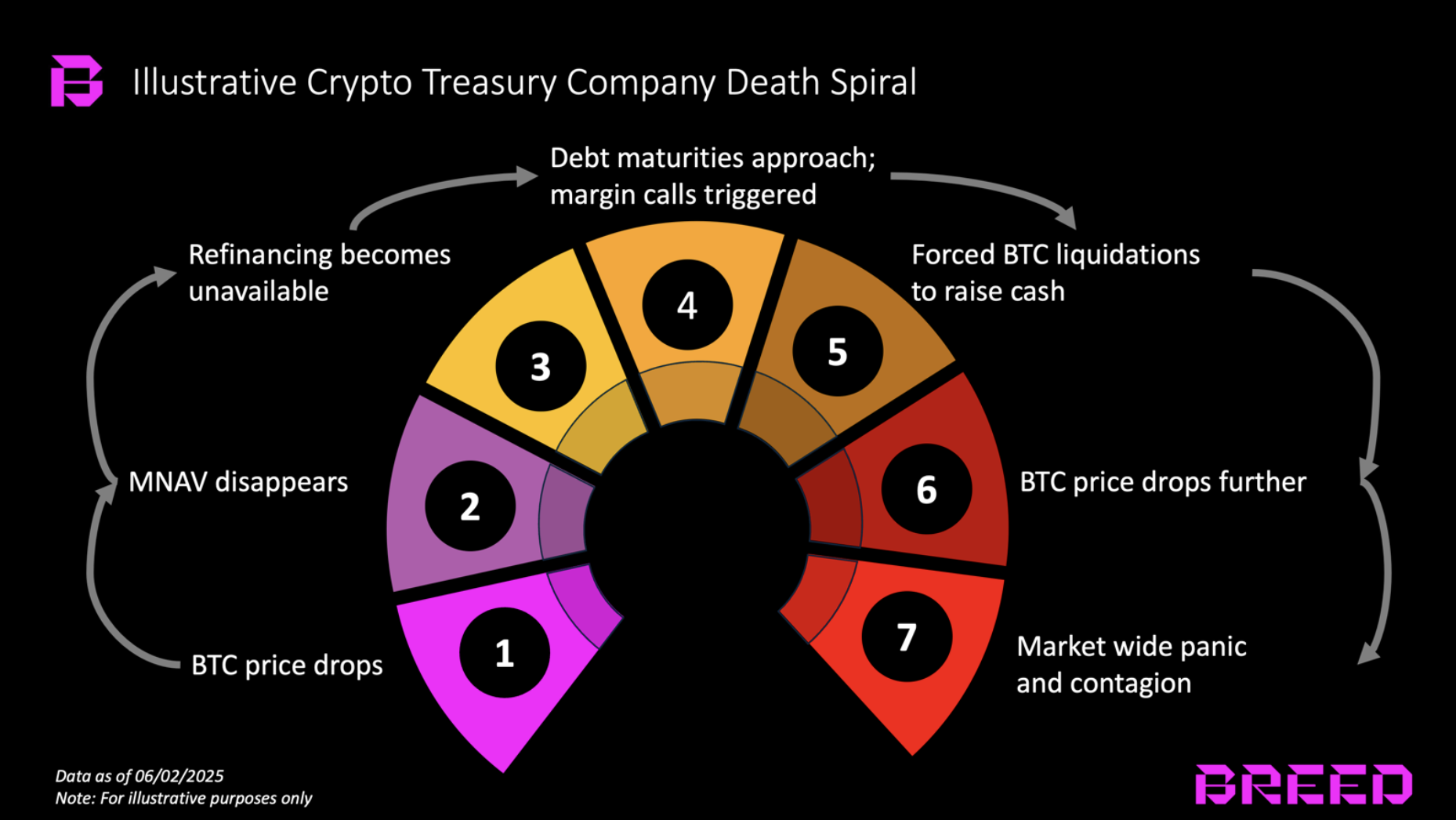

But beware: not all paths to Bitcoin riches are paved in gold. A company clinging to BTC as its only lifeline, without the financial muscle to weather prolonged crypto winters, risks a devastating avalanche. This could trigger a domino effect, sending shockwaves through the market and amplifying the very bear market they hoped to escape.

Varying Approaches to Corporate Bitcoin Holdings

Bitcoin’s quietly becoming Wall Street’s best-kept secret. Forget spare change – institutional Bitcoin treasuries have exploded, doubling since 2024. Public companies now control a king’s ransom, hoarding over 4% of the entire Bitcoin supply. Is this the dawn of Bitcoin as the new corporate reserve asset?

Interestingly, this increase in volume also represents a broadening range of reasons for doing so.

Top Public Bitcoin Treasury Companies. Source: Bitcoin Treasuries.

Forget stocks and bonds; some companies are going all-in on Bitcoin. Strategy, formerly MicroStrategy, is leading the charge, transforming itself into a Bitcoin treasury behemoth. Their gamble paid off massively. With a staggering 580,000+ BTC – a hefty 53% of their entire holdings – they’ve essentially hitched their wagon to the Bitcoin rocket.

Alternatively, companies such as GameStop and PublicSquare have opted for a strategy of visibility over hoarding, strategically adding Bitcoin to their portfolios without derailing their primary business objectives. This approach allows them to tap into the cryptocurrency buzz while staying true to their core mission.

Initiatives like this carry far less risk than companies whose core business solely holds Bitcoin.

The growing rush of companies hoarding Bitcoin as a treasury reserve isn’t just a passing fad it’s a high-stakes gamble that could redefine their fortunes and the very destiny of Bitcoin itself.

How Do Bitcoin-Focused Companies Attract Investors?

Becoming a Bitcoin treasury titan isn’t about reckless buying sprees. If your company’s heartbeat is solely Bitcoin accumulation, its worth will live and die by the Bitcoin price alone.

To lure investors away from Bitcoin and into their stock, these companies face a formidable challenge: they must not just match, but demonstrably beat Bitcoin’s performance, justifying a premium reflected in a coveted Multiple on Net Asset Value (MNAV).

The challenge? Persuade investors their company is more than just a vault overflowing with Bitcoin; it’s a treasure chest brimming with potential.

Instead of simply buying Bitcoin, imagine investing in a company whose leadership relentlessly pursues strategies to amplify the Bitcoin value behind every single share. That’s the allure of MicroStrategy: not just Bitcoin exposure, but active, aggressive Bitcoin accumulationper share, driven by a visionary management team.

If investors believe MicroStrategy can consistently grow its Bitcoin per share, they will pay a premium for that dual ability.

But here’s the kicker: investor belief is only half the battle. Strategy must then walk the walk, attracting capital to fuel its Bitcoin buying spree.

The MNAV Premium: How It’s Built, How It Breaks

To unlock maximum value for shareholders, a company must aggressively grow its Bitcoin reserves. One strategy? Leverage the power of convertible debt: borrow cheaply now, supercharge your Bitcoin holdings, and watch the premium explode.

Here’s how they’re playing the Bitcoin game: when their stock price soars beyond its actual Bitcoin holdings, they unleash an ATM equity offering, selling new shares. Think of it as printing money to buy more Bitcoin at a discount! This clever maneuver allows them to snatch up more Bitcoin for every dollar raised, ultimately boosting the Bitcoin holdings per share for existing investors.

The virtuous cycle spins: a stock premium unlocks cheap capital, fueling Bitcoin acquisitions that amplify the bullish narrative – justifying a sky-high valuation that eclipses mere Bitcoin holdings.

However, this path is fraught with peril. For many organizations, the “crypto-as-treasury” model is a financial tightrope walk, inherently unsustainable. Even MicroStrategy, a vocal evangelist, felt the gut-wrenching squeeze when Bitcoin’s value plummeted.

Despite skepticism, a quiet revolution is underway: over 60 companies embraced the Bitcoin standard for their treasuries in the first half of 2025 alone. As this movement gains momentum, a tidal wave of newcomers will inevitably grapple with the uncharted risks and rewards of this bold financial strategy.

Aggressive BTC Accumulation Risks for Small Players

Strategy giants boast a trinity of advantages: immense scale, rock-solid reputations, and iconic leaders – think Michael Saylor. Without this powerful combination, most companies struggle to cultivate the unwavering investor faith required to command premium valuations.

Smaller businesses often lack the financial muscle and sterling credit history of their larger counterparts. Consequently, they’re frequently saddled with higher interest rates and tighter loan restrictions. This double whammy makes borrowing pricier and turns debt management into a high-wire act.

Bitcoin-backed loans in a bear market? A recipe for disaster. As Bitcoin tanks, margin calls detonate, instantly vaporizing your collateral. And when debt comes due, forget refinancing. In this crypto winter, borrowing becomes a costly, desperate scramble for companies already buried alive.

But here’s the real kicker: these companies, having bet the farm on Bitcoin, now teeter on a knife’s edge. Strip away the crypto veneer, and you find businesses nakedly reliant on two things: a ceaseless influx of capital and Bitcoin’s relentless climb. Without a Plan B, they’re just Bitcoin-fueled rockets, spectacular until the engine sputters.

When several companies take such a move simultaneously, the consequences for the greater market can go south dramatically.

Does Corporate Bitcoin Adoption Risk a “Death Spiral”?

Imagine a swarm of minnows suddenly deciding to hoard gold coins. Sounds harmless, right? Now picture the gold market tanking. These tiny firms, their coffers overflowing with Bitcoin, face a brutal choice: liquidate or drown. A Bitcoin crash could trigger a domino effect, turning these small accumulators into forced sellers, amplifying the downward spiral.

Imagine a dam bursting. That’s distressed selling – a flood of assets hitting the market all at once, accelerating the price plunge. Remember the crypto winter of 2022? We’re talking about a potential “reflexive death spiral,” where panic selling fuels further drops, creating a vicious cycle that’s hard to escape.

The different stages of a Bitcoin death spiral. Source: Breed VC.

One company’s fire sale could ignite a Bitcoin bonfire, setting off a chain reaction of liquidations for its peers. This domino effect risks a rapid and devastating plunge in the market.

But beware: highly visible flameouts could torch investor confidence across the crypto landscape. This fear-driven “risk-off” stampede might trigger a domino effect, sending ripples of panic through correlated markets and sparking a frenzied flight to safer havens.

This action would inevitably trigger regulatory alarm bells and send potential Bitcoin investors running for the hills.

Beyond Strategy: The Risks of Going “All-In” on Bitcoin

MicroStrategy isn’t just holding Bitcoin; they’re staking a claim as pioneers. While others watch from the sidelines, Saylor’s empire wields a rare trifecta: deep pockets, market-shaping influence, and an undeniable competitive edge, putting them in a league of their own as a Bitcoin treasury heavyweight.

This playbook’s risks are a high-stakes gamble capable of destabilizing the entire market if copied en masse. As Bitcoin attracts public companies, the crucial decision boils down to a calculated dip or a potentially ruinous plunge.

Choosing the sidelines? Tread carefully. While Bitcoin dances near its peak, remember: winter’s chill can return without warning.

Thanks for reading Will Bitcoin Treasury Companies Kickstart the Next Crypto Bear Market?