Plunging below $2,500, bears clutch onto their prey, beginning to drown the gains for the bulls. Bulls are desperately hemorrhaging as their Longs are vaporizing due to the sell-side pressure. The Relative Strength Index (RSI) is behind warning signs that further weakness might be on the horizon. Could $2,000 be the next stop for the battered ETH?

Ethereum goes down below $2,500, while Bitcoin is hanging right off a $105,000 precipice. Will this be the freefall onset for ETH? The 200-day EMA is now the last-thick line; will it hold, or are we headed for the $2,019 reckoning? The bears have managed to find some worthy prey to eat; and well, perhaps it’s time for their feast on Ethereum.

There are many useful comparisons between this and other coins and assets that would ultimately depend on perception. For instance, if Bitcoin is the investment and Ethereum is something slightly riskier with more upside, then Ethereum is likely to correspond almost in the opposite way to something else in price.’ That is unclear, however. Even though at times the correlation does exist, there are expected to be some periods where it won’t.

Ethereum Price Analysis

Price action in Ethereum is pretty nail-biting now. With that 7% drop on Thursday, the daily chart still mesmerizes into a sideways grind. That short-lived rally gave hope for the buyers, but now Ethereum is clinging on to the $2,400 level-a crucial Fibonacci retracement-that perhaps marks a last line of defense. Will this last, or is more down waiting?

Ethereum Price Chart

Ethereum clawed back above $2,461 with a hint of conquest over the 200-day EMA. But overshadowed by Sunday’s damning Doji candle came nearly 1% intraday retracement-a temporary reprieve against a slide towards the 38.2% Fibonacci level? The market waits in suspense.

Bears are stirring. The relative strength index shows a break in the recent stalemate, its line inching downward, the preview of the pondered plunge. Look out for the bearish divergence- a red light flashing with increasing selling pressure and a sign that the floor might go off from beneath.

Ethereum is teetering. Fibonacci levels suggest that a daily close below the 38.2% retracement might cause ETH to tumble toward $2,000, a psychological battleground lying just beneath the 23.6% Fibonacci line. Will it hold, or will ETH go further down?

But watch out! On slanting downwards, safety nets could materialize around $2,357 sell order and $2,319 buy order – 50 days and 100 days EMAs stand ready. Upside? Further surge can see a ceiling around $2,699, with the bulls’ strength further tested by the 50% Fibonacci level.

Beware: On a downside, safety nets may be found around $2,357 and $2,319 – the 50-day and the 100-day EMAs readied for defense. On the upside, any further surge might hit the ceiling at around $2,699, where the 50% Fibonacci level will remain to test the bulls’ strength.

Long Liquidations Hit $26 Million

This moment just became a burn for the bulls. Yesterday’s intraday dip triggered a massacre for leveraged long holders, with liquidations amounting to an astronomical $26.89 million. Meanwhile, bear traders are rejoicing, with the much smaller amount of $9.16 million being wiped out on the short side. Could this be a temporary pause or is a much deeper correction getting underway? The underlying derivatives market sure signals a momentum change.

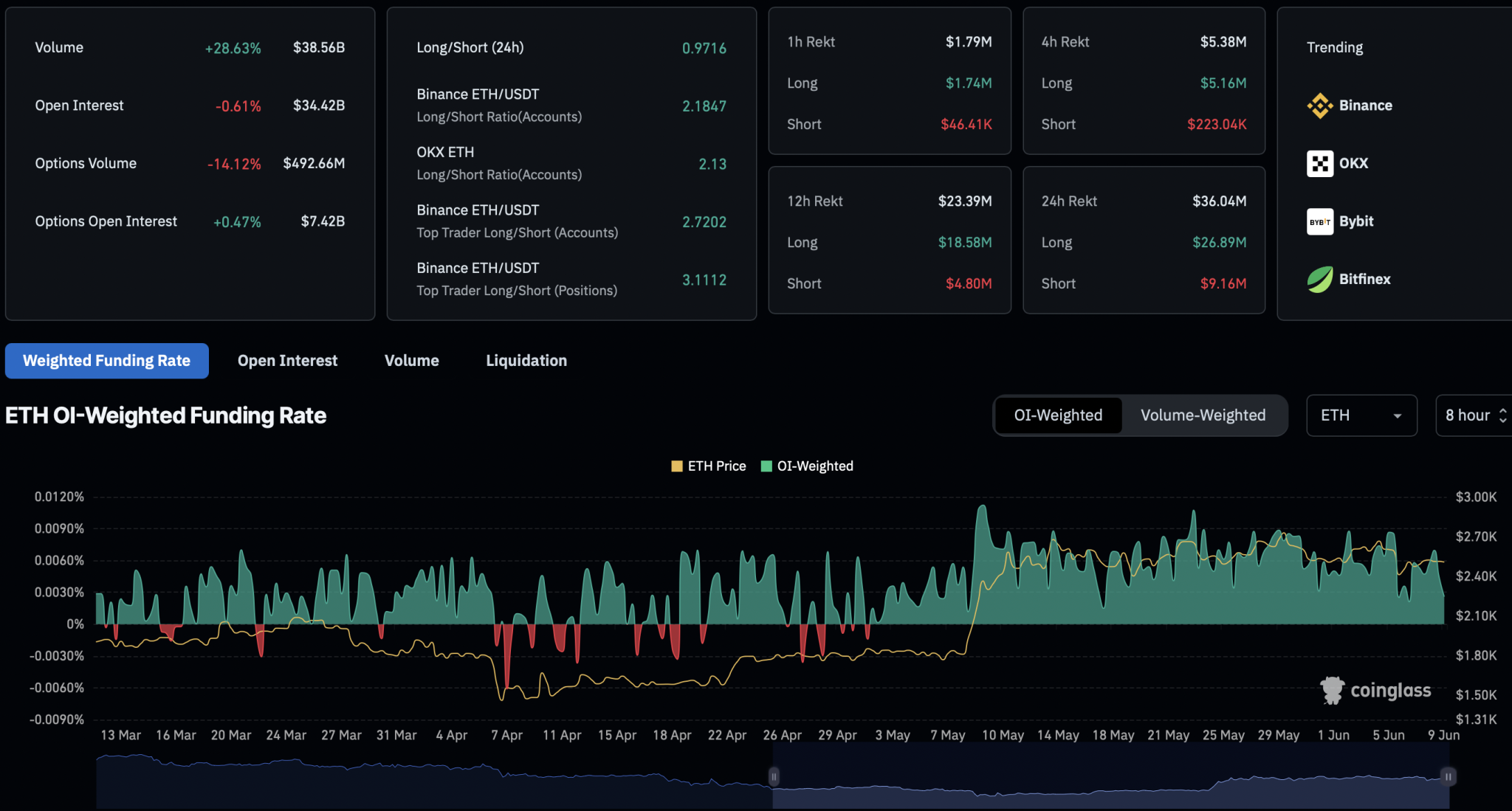

ETH Derivatives

Bulls got wrecked. The long-to-short ratio now stands dangerously at just 0.97, with shorts gaining a tug on the expression. What does the market do? A collective shrug. Open interest gave a sneer-dipped 0.61%, and woke up at a soggy $34.42 billion. The traders are on the sidelines, soaking in the bloodbath.

Ethereum derivatives have been flashing red. From a massively bullish frenzy, the activity has now substantially waned-from a fire-hot 0.0070%, the OI-weighted funding rate has descended to a chilly 0.0026%. CoinGlass steps in to confirm-it is a bear-way.

Institutions Expand Ethereum Holdings

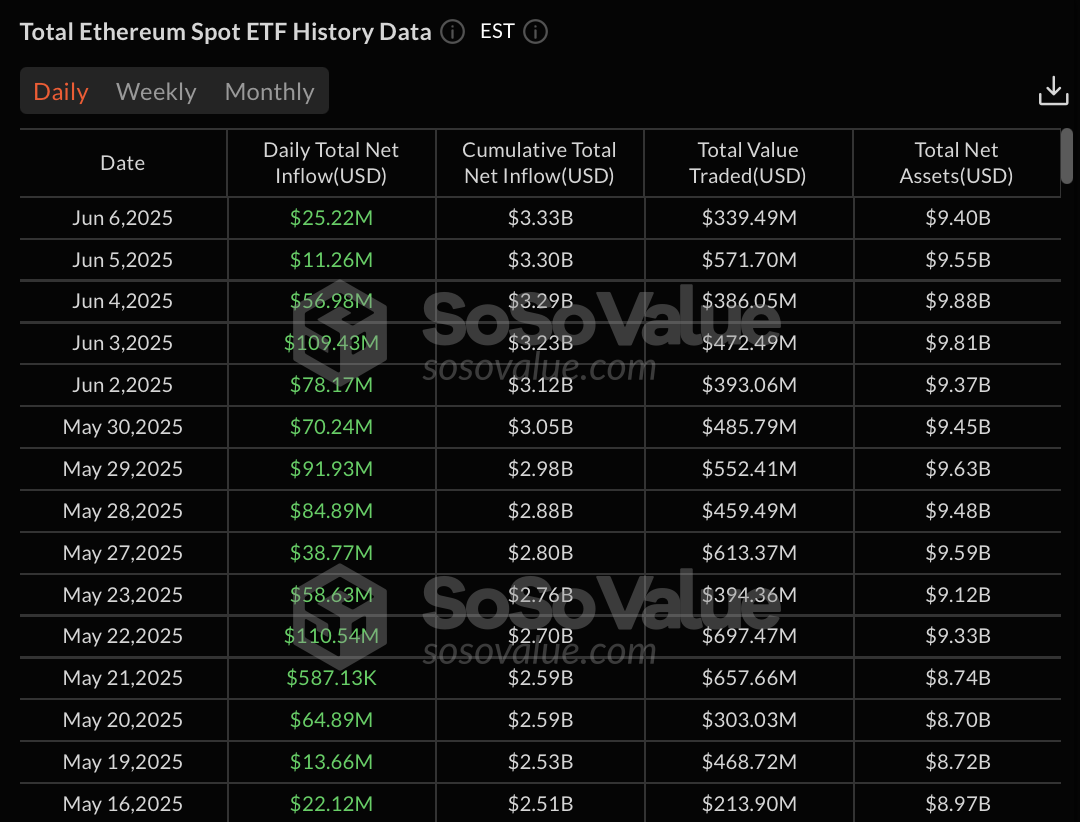

Retailers are indecisive, but there’s no doubt about Wall Street’s conviction in Ethereum. A whisper on the street about an interesting phenomenon suggests that institutional investors might be quietly withdrawing money from Bitcoin ETFs and putting it into the fresh but promising Ethereum ecosystem.

Ethereum ETFs continue their winning run! For 15 consecutive days, investors have pumped in over $837 million in spot Ethereum ETF flows in the U.S., showing great confidence in the crypto’s future. Another surge was witnessed on 6 June, with a net inflow of $25.22 million. BlackRock led the charge with $15.86 million, closely followed by Grayscale’s $9.37 million, firmly cementing the investment stature of Ethereum.

ETH ETFs Flow

Thanks for reading Will Ethereum Recover or Crash to $2K? Indicators to Watch