Tensions simmered, missiles cooled. The specter of all-out war between Iran and Israel receded as the United States stepped onto the global stage. This diplomatic intervention rippled through financial markets, sending safe-haven assets like gold and silver tumbling from their perch as investors exhaled a collective sigh of relief.

Gold’s glow has faded: sellers seize control. But don’t jump just yet! A strategic pullback is anticipated this week, offering a prime opportunity to short the precious metal at key resistance levels. Sharpen your focus as we dissect crucial pivot points for both bulls and bears in this forecast, covering June 30th to July 4th, 2025, and arming you to profit from gold’s next move.

Table of Contents

- Key economic events of this week

- Gold HTF Overview

- Gold Forecast for June 30th to July 4th, 2025

- Trading Strategies & Investment Recommendation

Key economic events of this week

Some significant U.S. economic reports are scheduled for release this week that are expected to impact XAUUSD.

Tue, Jul 1 – Fed Chair Powell Speaks, ISM Manufacturing PMI, JOLTS Job Openings

-

Powell’s speech might increase volatility because hawkishness could hurt gold while dovishness could weaken the USD and increase gold. “Gold catches a faint updraft as manufacturing stutters: The ISM Manufacturing PMI, though edging past dire predictions, remains in contraction, offering a sliver of support to the precious metal.”

-

Gold upside may be constrained by labor market resiliency, as evidenced by stronger-than-expected JOLTS job postings.

Wed, Jul 2 – ADP Non-Farm Employment Change

ADP’s jobs report just dropped a bombshell (105K new jobs, triple expectations!). This unexpectedly robust labor market data throws fuel on the fire for further Fed rate hikes. Buckle up, because a resurgent dollar could be bad news for gold, potentially sending its price tumbling.

Thu, Jul 3 – Average Hourly Earnings, Non-Farm Employment Change, Unemployment Rate, ISM Services PMI

Gold glitters as the latest jobs report disappoints – a paltry 120K jobs added against 139K expectations, coupled with sluggish wage growth (0.3% vs. 0.4%). The scent of cooling labor markets and easing inflation is in the air, fueling gold’s allure as a safe haven.

- Further evidence for this story comes from a higher unemployment rate (4.3% vs. 4.2%). “Is gold poised for a golden run? Mounting economic anxieties are fueling speculation, and a soft reading on the ISM Services PMI could be the catalyst that sends gold prices soaring.”

Read more: XAUUSD weekly forecast: $3600 next target for gold?

Gold HTF Overview

June bows out, and with it, the fate of gold hangs in the balance. Will the month’s final curtain call set the stage for a July gold rush or a disheartening descent? The bulls flexed in May, reaching a high in 2025, but a looming $3122 low now whispers of potential downside. A crimson close to June could unleash a torrent, dragging gold down to that $3122 mark. But if the bulls can muster a defiant rally, watch for a retest of $3441. The next few hours will tell the tale.

XAUUSD 1m chart – Source: Tradingview

Gold Forecast for June 30th to July 4th, 2025

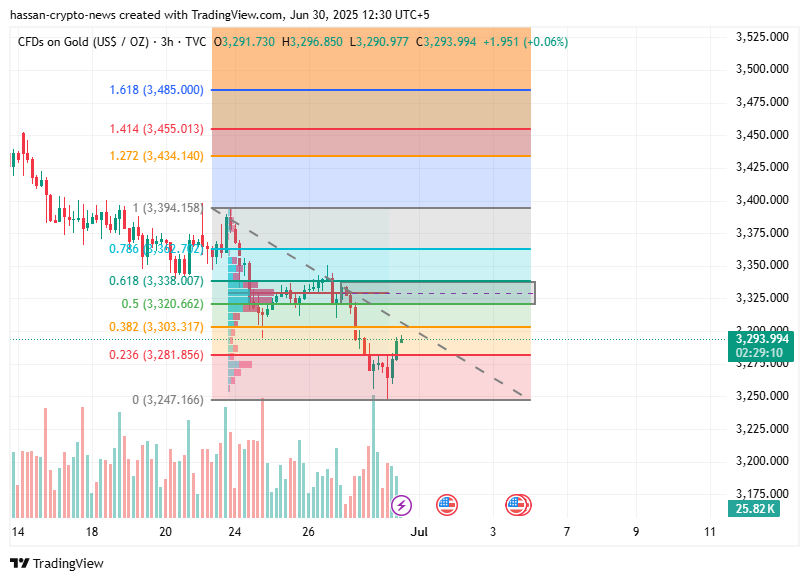

Gold’s about to hit a ceiling. Watch the $3320-3337 zone. That’s where price action meets a perfect storm: the Point of Control, a stubborn breaker block, and the golden ratio itself on the 3-hour chart. Short it there, or miss the ride.

XAUUSD 3h chart – Source: Tradingview

Gold’s 30-minute chart flashes a sell signal. A critical support level, once a bedrock for prices, has shattered and transformed into a formidable resistance ceiling between $3301 and $3313. Look for opportunities to capitalize on this bearish shift.

XAUUSD 30m chart – Source: Tradingview

Gold bulls, brace yourselves! A surge of buying pressure is anticipated between $3232 and $3202. This zone represents a potent 4-hour order block, fortified by a Fair Value Gap (FVG) – a perfect storm for a potential price reversal. Keep a close watch; the golden opportunity may be just around the corner.

XAUUSD 4h chart – Source: Tradingview

Read more: Goldman Sachs scraps recession forecast as Trump pauses tariffs

Trading Strategies & Investment Recommendation

Gold’s compass spins! Short-term charts hint at a downward drift, yet the long-term horizon still glitters with bullish potential. Trade carefully; this week, gold offers a double-edged sword.

Resistance Levels

- $3301-3313 – support turned resistance

- $3320-3337 – POC, breaker block, and golden fib level

Support Levels

- $3232-$3202 – 4h order block and FVG

Before you dive in, remember this: I’m not a financial advisor. This article is pure knowledge – meant to illuminate, not dictate your investment decisions. Consider it a classroom, not a crystal ball.

Thanks for reading XAUUSD weekly gold forecast: Has the trend of gold shifted to sell?