As broader crypto market weakness continues to weigh altcoins, **Stellar’s price has been under pressure. In its steady decline, XLM has confirmed that it is following a bearish chart pattern and maintaining short-term downside risks. *****

While traders may look to capitalize on this momentum, on-chain behavior suggests XLM holders are positioning differently.

Stellar Holders Could Rescue XLM

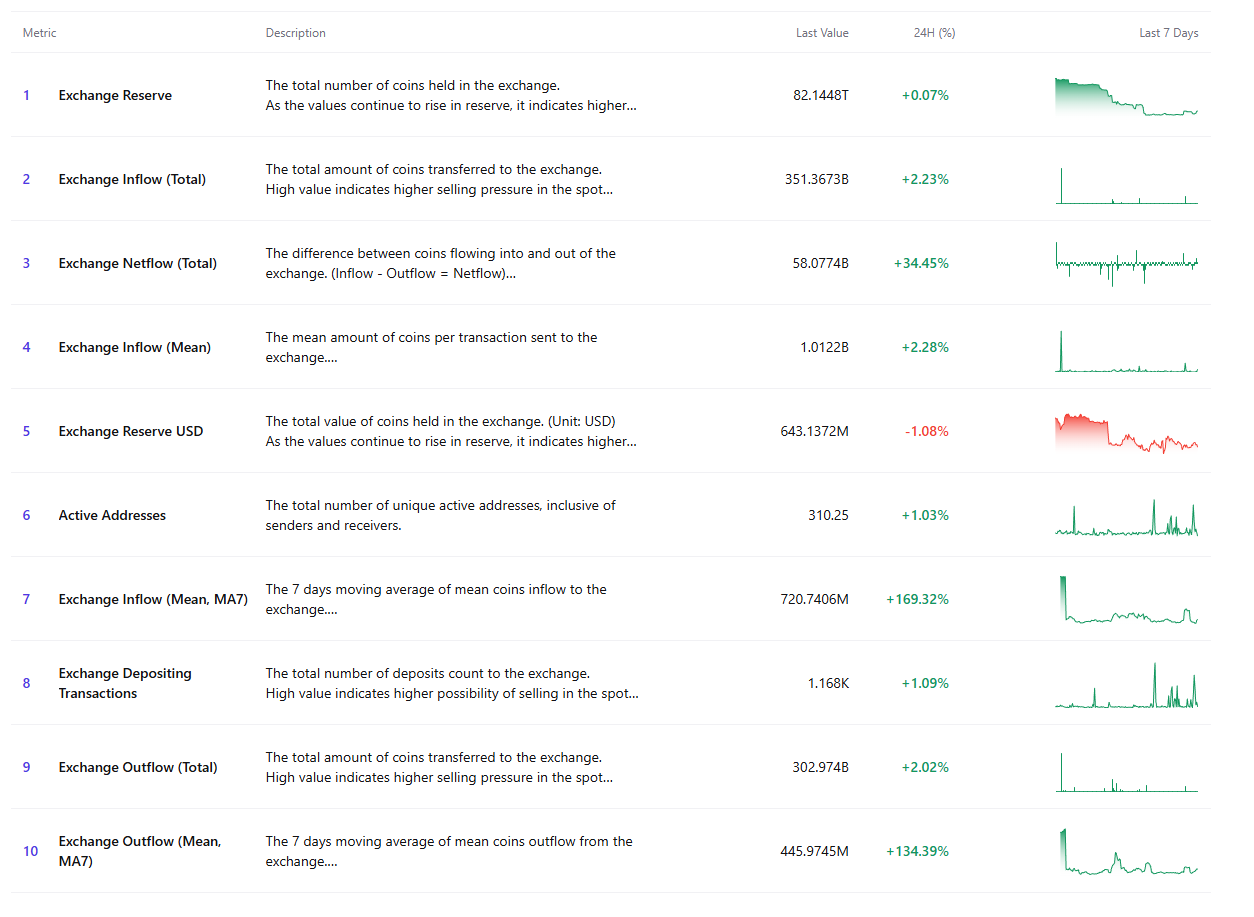

Derivatives data show a clear divergence in market positioning position. The liquidation map shows exposure skewed around 68% towards short traders, which is strongly bearish in its belief that the trader was not involved. Often, such dominance often increases thesensitivity to volatility; for example, when momentum shifts and is in turmoil, trading with large trade signals increased price reactions.

Several large clusters of long liquidation leverage sit between $0 and below current levels, under which the level of is highly concentrated. $0 & 20 and $ 185 If a move into this zone would cause forced liquidations, selling pressure and speeding down if s moved in. This arrangement also describes how bears are seeing further downside, as liquidity pockets remain vulnerable under key supports and liquidity is still at risk.

XLM

Liquidation Map. Source: Coinglass

XLM Liquidation Map”>

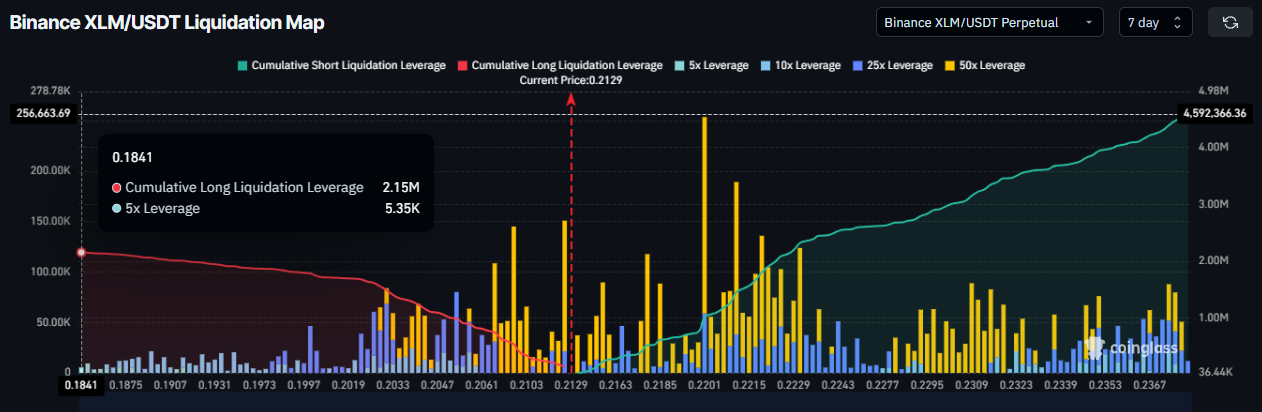

Although macro indicators are positioned in bearish positions, they can give early signs of divergence. For four consecutive days, the Chaikin Money Flow has set lows for higher-lows as the XLM price printed lower low. A similar bullish divergence identifies capital inflows are growing under the surface of , which suggests that capital flows are increasing.

The CMF tracks the buying and selling pressure through price and volume of s. A rise in CMF during a price drop usually indicates accumulation, rather than distribution. For Stellar, this pattern means investors are gradually constructing positions for the company; thus setting conditions for a potential short-term reverse once selling pressure fades.

XLM

CMF. Source: TradingView

XLM CMF”>

XLM Price Needs To Secure Support

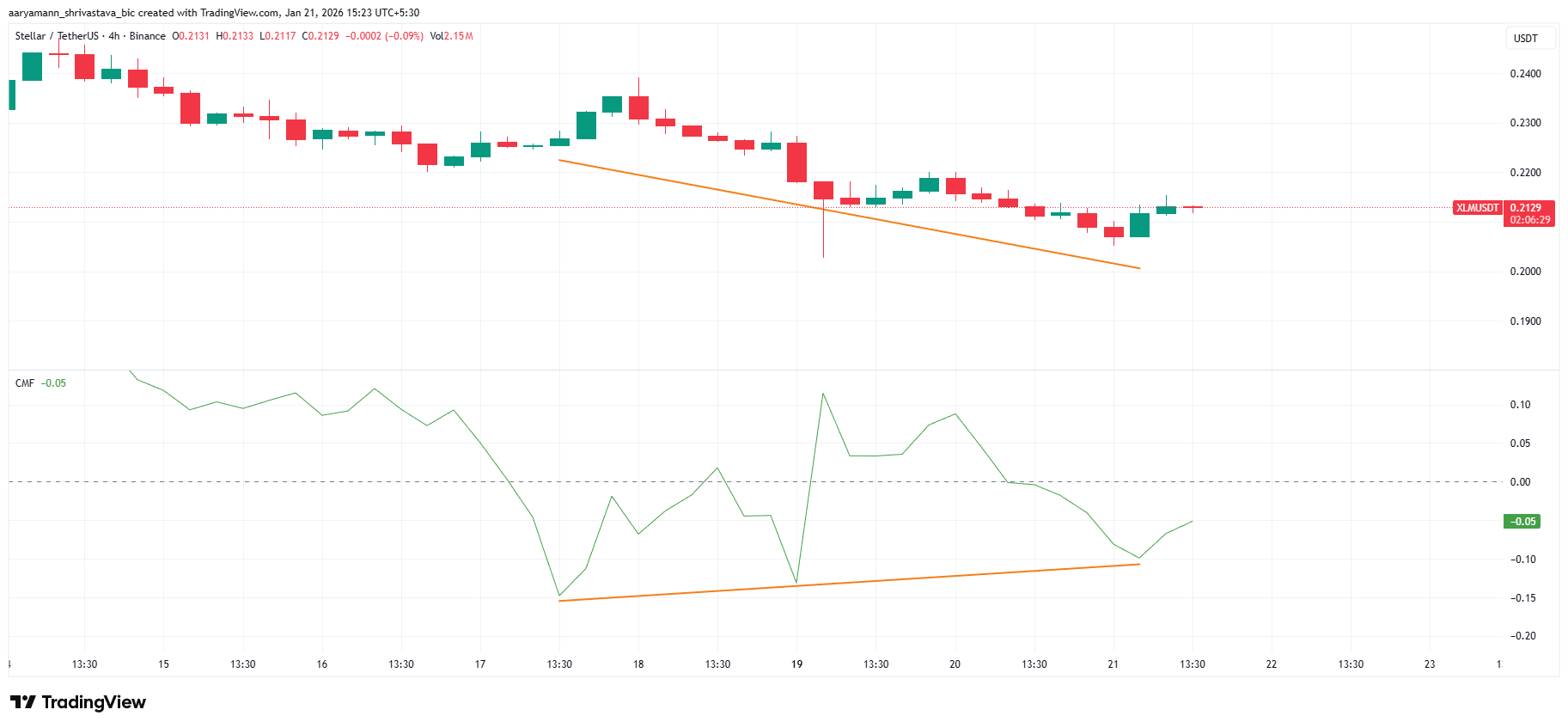

XLM also operates around $0 trades near $0- 212 when writing, just above the $0 at the time of writing. support level of 210, which is at. The altcoin descended from a pattern of descending triangles earlier this week, which usually favors bearish continuation formation known as the “downhill” type of formation that typically occurs in favour of an older form called alcoine. In the near term, downside risk is elevated by that breakdown and a decrease in risks associated with that break-up.

A potential 14% drop toward $0 could be a result of the descending triangle’s projected decline towards $0-. 188, taking XLM about 11% from the target. Yet, the price may be a little higher than that level before it can go to that point of . It is likely that support will emerge around $0 with support. 210 or at worst, near $0. 201 This uncertainty is a sign of ‘neutral-to-bearish perspective’.

XLM

Price Analysis. Source: TradingView

XLM Price Analysis. “>

The key level defenses are the most important factors in a shift in momentum for to change. What if $0 is paraphrasing? 210 is support, Stellar could be stable again. XLM will also be driven toward the $0 by a sustained bounce from . Resistance zone 230 resistance area for . The reclaiming that level would disprove the bearish pattern and signal a short-term reverse in response to increasing demand.

Thanks for reading 68% of XLM Traders Are Short—Could Accumulation Still Trigger a Reversal?