While bitcoin

BTC

$116,674.05

While Bitcoin merely dipped its toe, the altcoin market took a nosedive this week, leaving investors wondering if altcoin season has already met its icy end.

XRP

XRP

$3.0693

DOGE

$0.2266

Dogecoin and Solana (SOL) took a beating Friday, leading the top 10 crypto losers with a 5% dive in 24 hours, according to CoinDesk. Zooming out to Wednesday’s peak, XRP and DOGE have been hammered, collapsing nearly 20%, while SOL’s lost 12% of its swagger. The CoinDesk 80 Index, tracking mid-cap mavericks beyond the top 20, bled a painful 10% from its weekly high.

Bitcoin dipped slightly, hovering around $116,000, a minor pullback from its $120,000 peak earlier in the week. Ethereum’s ether (ETH) followed suit, trading 4% below its weekly high, buoyed by persistent buying pressure from crypto treasury players.

When altcoin season?

The recent market plunge followed weeks of capital flooding into smaller tokens, igniting whispers of a full-fledged altcoin season. This “alt season,” when the crypto underdogs leave Bitcoin in the dust for a sustained rally, may be over.

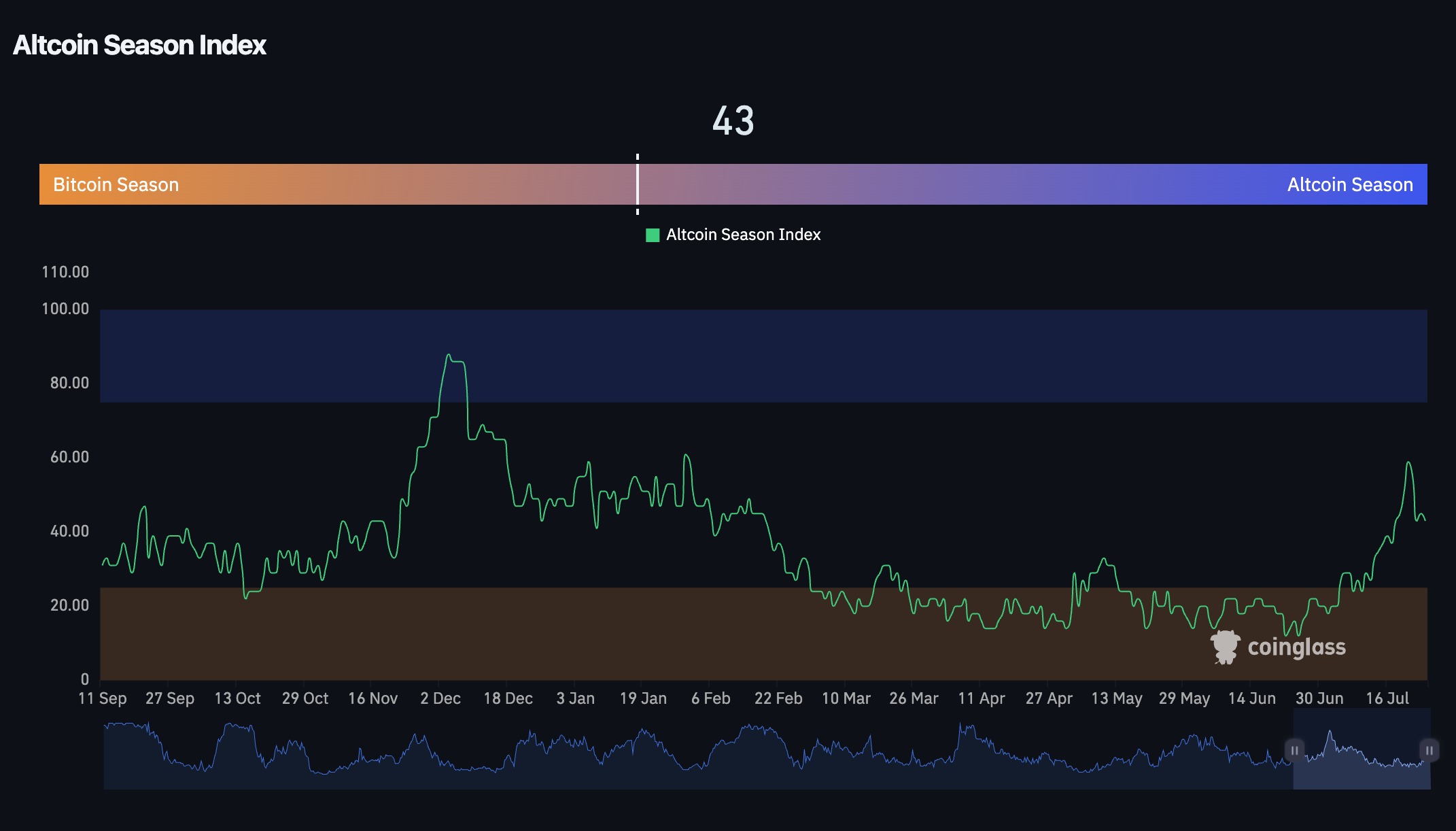

The altcoin party might be winding down. CoinGlass’ Altcoin Season Index, a barometer of altcoin exuberance compared to Bitcoin, has dipped to 41. That’s a noticeable chill from Monday’s scorching 59 – a high not seen since January’s Trump-fueled market mania. Are altcoins losing steam, or is this just a breather before the next rally?

Altcoin season index (CoinGlass)

Coinbase’s head of research, David Duong, noted in a recent report a breathtaking rally in the altcoin market (excluding stablecoins). Since April, these digital assets have virtually doubled in value, showcasing a resurgence that’s leaving many investors breathless.

For this week’s pullback, traders taking on excessive leverage on altcoin bets were to blame, the report pointed out.

Altcoin fever is reaching a boiling point. Open-interest dominance, measuring the dollar value swarming around altcoin derivatives versus Bitcoin, has spiked to a concerning 1.6. Historically, this altitude foreshadows market avalanches. Think of it as a pressure cooker; the altcoin market is loaded with leverage. Analyst Duong warns that a drop in this ratio is crucial – a sign of deleveraging and a healthy reset. Without it, prepare for more violent shakeouts as the excessive speculation unwinds.

Is Altcoin Season Finally Here? Bitcoin’s Grip on the Crypto Market Weakens.

A key indicator suggests altcoins could be primed for a major surge. Bitcoin Dominance, reflecting BTC’s control over the total crypto market, has just plunged below its 200-day moving average – a level of support it hasn’t breached since a fleeting dip in January 2025. This break hints at a potential shift in momentum, potentially paving the way for altcoins to shine. Smart investors are watching closely.

Bitcoin dominance (Coinbase)

“If the 200-day moving average cracks, brace for altcoin ignition. Historically, this threshold has been the launchpad for explosive alt season rallies, reminiscent of 2021’s altcoin bonanza,” Duong noted.

Instead of diving headfirst into altcoins, traders could strategically wait for a series of confirmed dips below this key level before committing capital – a more cautious and potentially rewarding approach.

Thanks for reading XRP DOGE SOL Lead Crypto Selloff But Altcoin Season Still in Play if This Happens