XRP teeters on a knife edge as bulls work desperately to keep support at $2.13. The week’s high near $2.20 was just a mirage, vanishing from view. The question remains as to why the sudden dampening of prices of XRP. Exhaustion, this is it. Much like a runner stumbling before the finish line, the repeated attacks of XRP on trendline resistance have drained away its momentum, while the options market has weighed in with a note of caution to fan the bearish flames.

While medium-term structure remains bullish, today’s price action reflects a tug-of-war between speculative interest and broader consolidation.

What’s Happening With XRP’s Price?

XRP price forecast (Source: TradingView)

XRP Price Check: June 22, 2025 – Will the Rally Reignite?

After an early-week brief upsurge, the XRP is dealing with gravitational pull around $2.13. With the big picture still hinting at a potential bullish breakout, there appears to be a tug from the other side when viewed up close. The momentum is waning, and the constant walls of resistance are hurting XRP. So is it just another pause before another go at it, or is the rally about to run out of steam?

XRP price forecast (Source: TradingView)

XRP’s rally hits the wall. A strong resistance zone clustered around the $2.18-$2.22 area is killing upward momentum. Here lies the 50-day EMA and a prior support-turned-resistance; over the past three sessions, it has rejected several advances in price. The bulls are finding it hard to scratch free from its claws.

Mixed Momentum Across Timeframes as XRP Struggles Below Key Resistance

XRP price forecast (Source: TradingView)

Viewing the XRP price on the 4-hour chart reveals it coiled in a spring. Bulls batter their heads against the stiff $2.18 ceiling, while bears find support from the 200 EMA at $2.05. This place of conflict is further reinforced by the 100 EMA and upper Bollinger Band, acting as a very strong supply wall. Which side will fall first?

XRP price forecast (Source: TradingView)

On the four-hour chart, something seems to be murmuring secrets. The RSI, stuck on 48, throws in the towel and refuses to make a particular decision; the MACD drifts flat, a shadow of the bullish energies it had once boasted. The interesting part remains: The Bollinger Bands are contracting, just like a spring being tightly compressed and poised to pop out. Hold on! A storm of volatility is brewing, and XRP’s price is soon bound to explode in whichever direction.

The supertrend, after a fleeting bullish tease, has retreated to neutral territory, suggesting the bulls are still hesitant to charge.

Options Data and EMA Structure Reinforce Caution

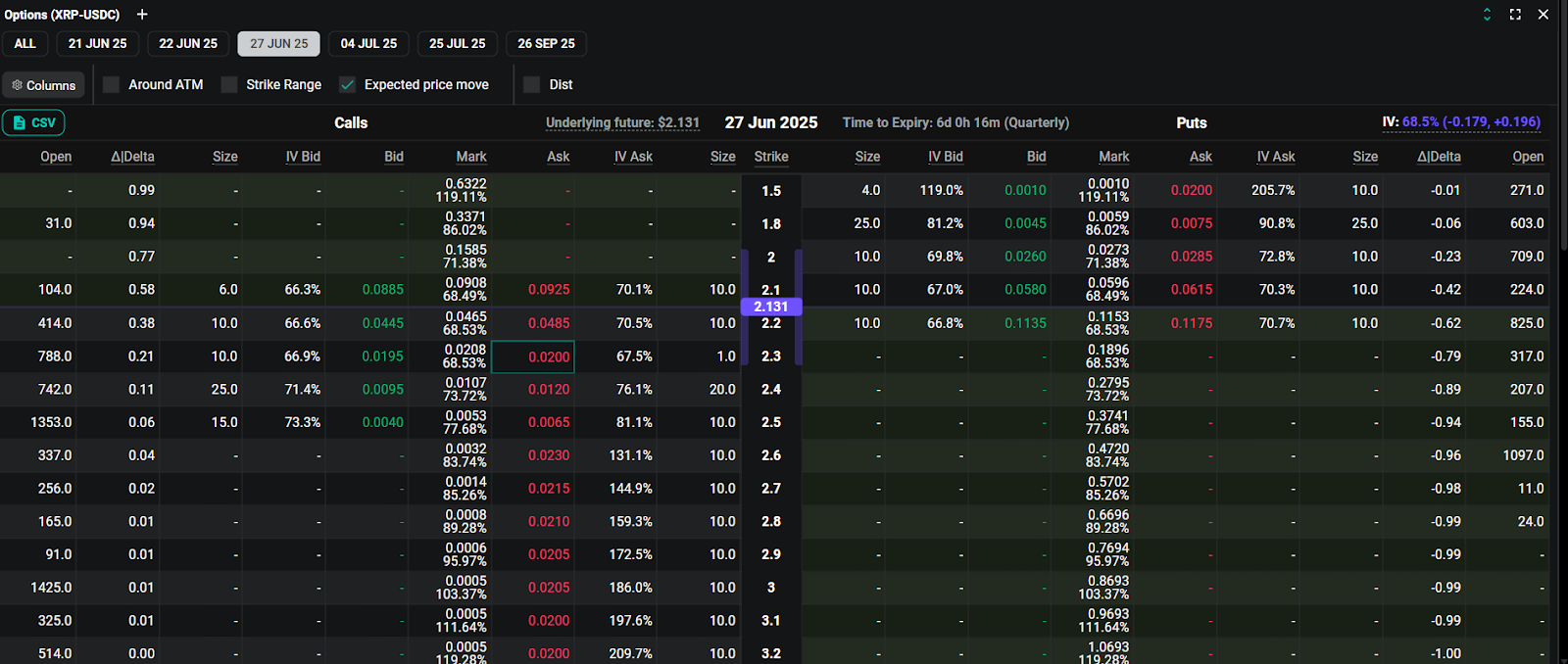

XRP option chain data (Source: Deribit)

Are you warmed up to the XRP options expiry set for June 27th and crypto swinging around $2.13? The $2.10 and $2.20 strike prices are in the limelight, for the largest open interest concentrations can be found there. But all hell can break loose at the $2.20 call strikes. The implied volatility is soaring to an almost fabulous ~68.5%, and the gargantuan volume of contracts suggests these players are either setting up for a breakout or for an absolute shellacking at this key resistance level. Will it breach $2.20, or are the bears going to hold that ground? Time is running out!

XRP price forecast (Source: TradingView)

Warning signals are rising on 4-hour and daily representations. Price remains trapped below a web of EMAs (20, 50, 100), struggling to break out. The 200 EMA is standing strong as support at around $2.05, yet it is not enough. So, the bulls really need to break through the stronghold between $2.18 and $2.22 to represent a change in momentum. Until then, sellers will have a field day in any upward attempt.

On-Chain Flow Shows Bullish Intent But No Follow-Through

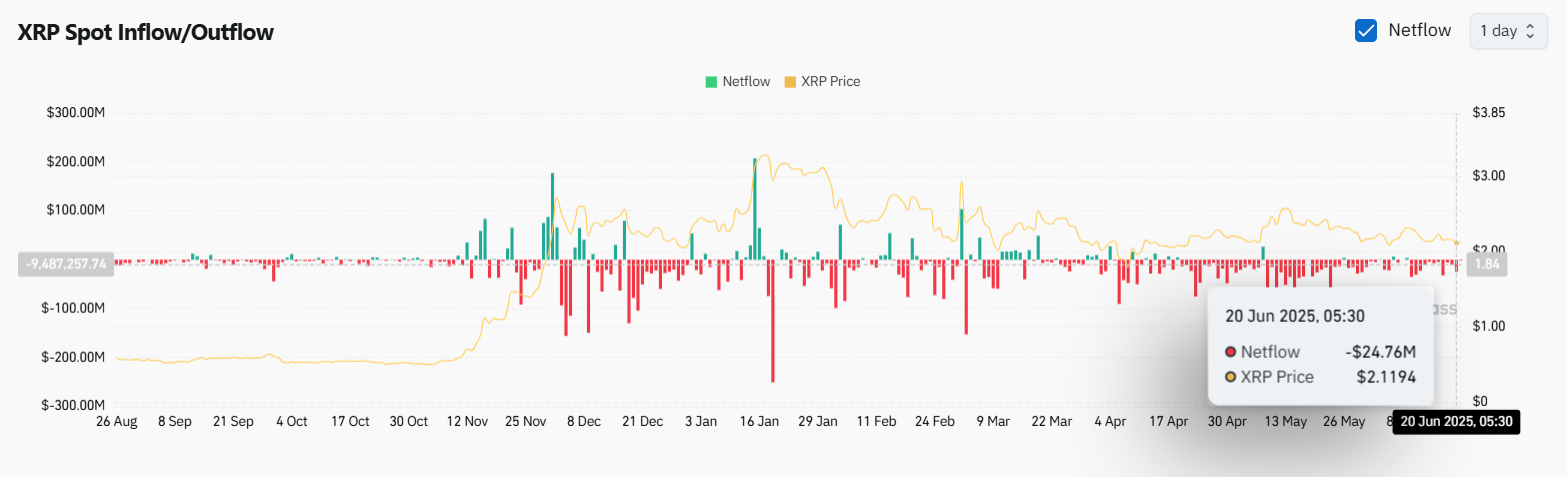

XRP spot inflow/outflow (Source: Coinglass)

XRP is all about the whispered notion of silent accumulation, that is, a secret stash growing big while prices remain stoic. June 20, 2025 saw an exit of $24.76 million from centralized exchanges. Could this be the calm before the bullish storm? History says yes: usually, this exodus to cold storage heralds a pump, echoing the determination of the holders. Are they accumulating it for the long term, wagering on some secret value of XRP? The data is tantalizing, but the entire market is holding its breath, waiting for price to reflect the on-chain signals.

XRP bleeds the tokens away, and yet the price hardly reacts a chilling sign that momentum is waning. The mass exodus has so far failed to deliver the breakout that traders were hoping for. Instead, the XRP price remains stubbornly pinned below the $2.18 level, suggesting a market strangled by a hidden oversupply and an undertone of sellers unwilling to take a deposit.

XRP price forecast (Source: TradingView)

XRP price remains stuck in neutral. Unless we see a triumphant surge past resistance or bullish trader interest, expect its prices to bounce lazily between $2.05 and $2.22. Don’t just assume that it is going up yet; wait for the breakouts to be confirmed. Celebrating too early is bound to disappoint.

XRP Price Forecast Table

| Level | Type | Zone |

| $2.18 | Key Resistance | EMA Cluster + Supply |

| $2.05 | Immediate Support | 200 EMA + Demand Zone |

| $2.25 | Bullish Target | Previous Swing High |

| $1.98 | Bearish Target | Weekly Pivot Support |

| 68.5% | IV (June 27) | Reduced Volatility |

Thanks for reading XRP Price Prediction For June 22 2025: XRP Holds $213 As Bulls Struggle Below $220 Resistance