- *XRP’s drop from recent highs of $2.65 on May 12 tests the 50-day EMA support as downside risks emerge.*

- *XRP faces declining network activity amid subdued daily active addresses.*

- *Large volume holders with between 100,000 and 1 million coins cut back on their holdings as the uptrend falters.*

- *Strong crypto market sentiment could keep XRP above its 50-day EMA support, boosting the chances of returning to $3.00.*

XRP stands at the edge. The once market darling, Ripple’s token languishes at $2.33, caught in a price purgatory for three days. The heavyweight of the crypto world struggles, having eyes on record highs for Bitcoin while offering a silent performance in contrast to that of widespread bullish fervor. Could this be just a wait before the next surge, or might this be the sign of greater troubles ahead for the currency?

XRP Ledger’s pulse is faint. Network activity flatlines, a stark contrast to the vibrant surge witnessed earlier this year.

XRP faces declining interest as network activity remains muted

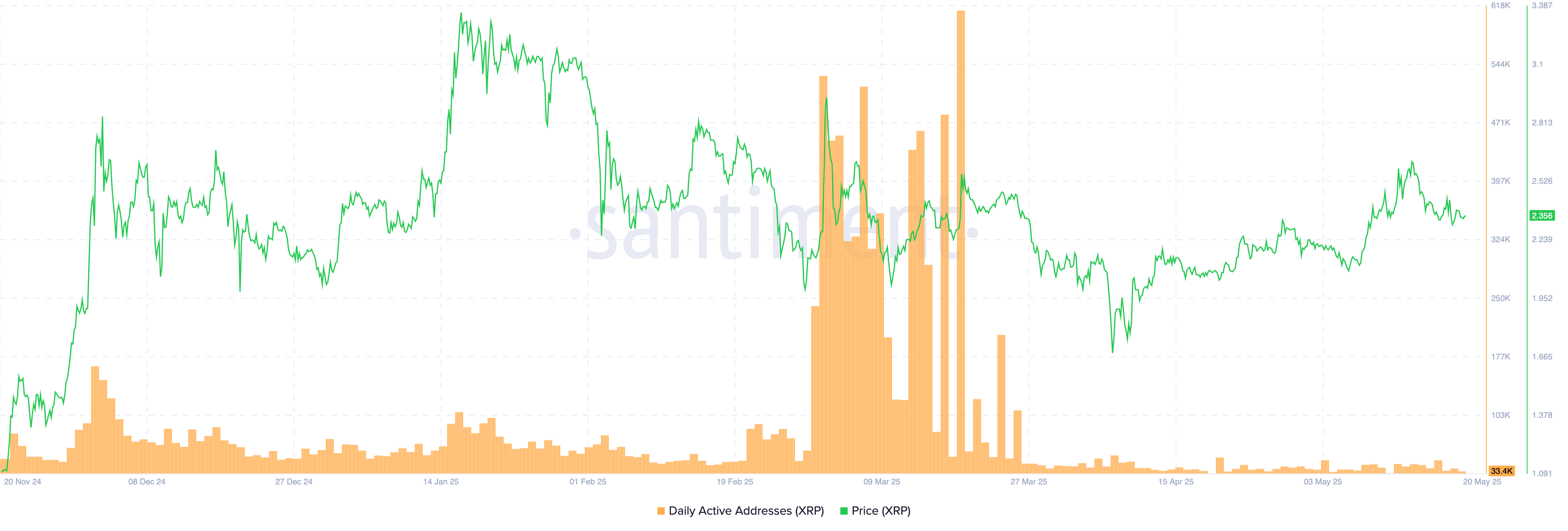

XRP holders prefer to count the seconds as the price wavers dangerously above $2.28, but meanwhile, all eyes were turned to the XRP Ledger-with nothing to celebrate. Data from Santiment paints a hazy picture: network activity is slowly decreasing, making some people wonder if this consolidation is merely a preparation for a more profound dive.

A ghost town? Not quite, but daily active addresses on the protocol have plummeted. From a bustling Q1 peak of 612,000 newly created addresses, the network now sees a mere 33,400 – a staggering 95% drop. What’s driving this dramatic decline?

An arguably bitter price action haunts the memories of the Q1 highs of $3.40 before falling steadily to $1.61 on April 7 in the wake of tariff-induced mayhem. When the price recovered to $2.65 on May 12, the rally practically fizzled and slowly dipped further to an unimpressive $2.33. And yes, the true underlying subject is engagement dropping to zero. Whatever lifeblood of any network-new addresses-is drying up.

XRP Active Addresses metric | Source: Santiment

New addresses, the lifeblood of the XRP Ledger, are the ones drying up and thus signifying a loss of user interest. This degradation in influx, therefore, amounts to an outright choke on the demand for XRP with no hope of an appreciable price increase.

Meanwhile, cryptocurrency whales are churning the waters while unloading huge amounts from their holdings, this being clearly evident in the Supply Distribution data charted below.

A subtle shift is occurring in the so-called middle-class whales of crypto – those holding anywhere from 100,000 to 1 million coins. They have quietly been cutting their holdings since the start of Q4, which indicates that they are deliberately rebalancing. This band of holders had an 11% command of the total supply on November 1st; now, a further dip from 10.76% on March 1st, they command just 10.32%. Are they taking an exit on profits, or are larger waves occurring just beneath the surface?

“Riding the mercurial XRP rocket in the last quarter, a shrewd group of investors started to liquidate their holdings as prices were moving upwards. The trend was more intense during the first quarter and looks like a well-timed profit-taking strategy, visible in the chart below.”

XRP/USD Supply Distribution chart | Source | Santiment

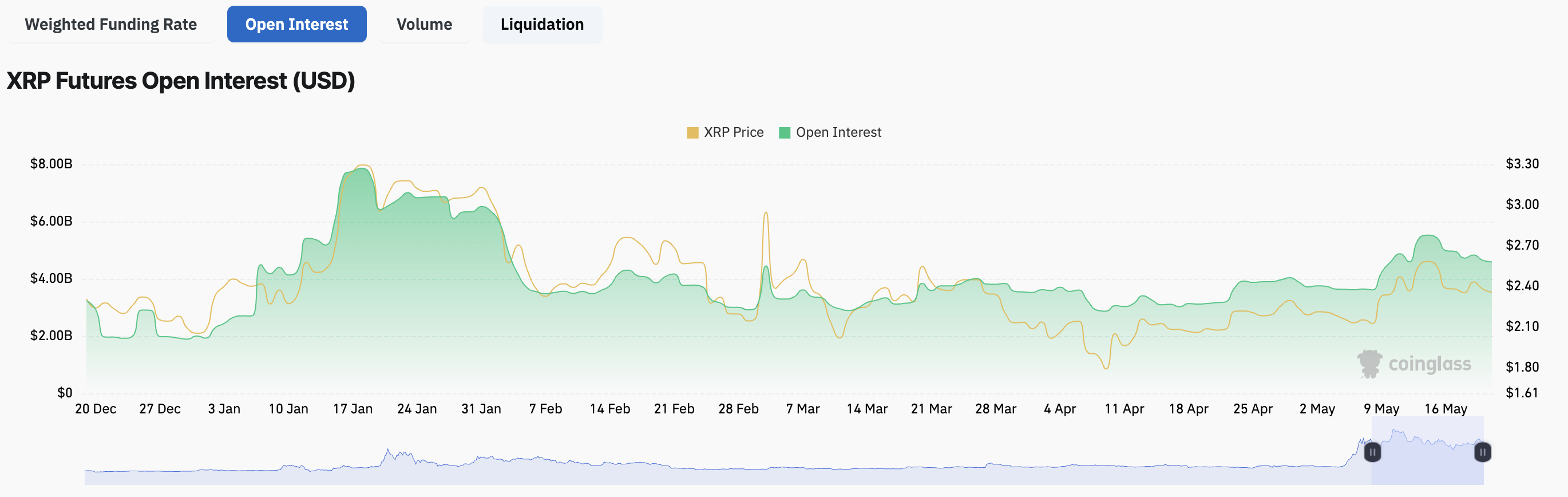

XRP’s bullish run confronts a make or break situation. Should the present profit-taking episodes escalate, it is highly likely that the move to the $3.00 zone will come to a halt. Further pressure was exerted by open interest in XRP futures contracts, which fell sharply from its $5.52 billion high set on May 14th to $4.59 billion. Is this a short-term retracement or the onset of a deep correction?

Open interest is the market heartbeat. It tries to reveal the pulse of derivatives trading by counting every single futures and option contract still in force-a good indication of commitment and conviction on the part of the trader.

XRP futures open interest | Source| CoinGlass

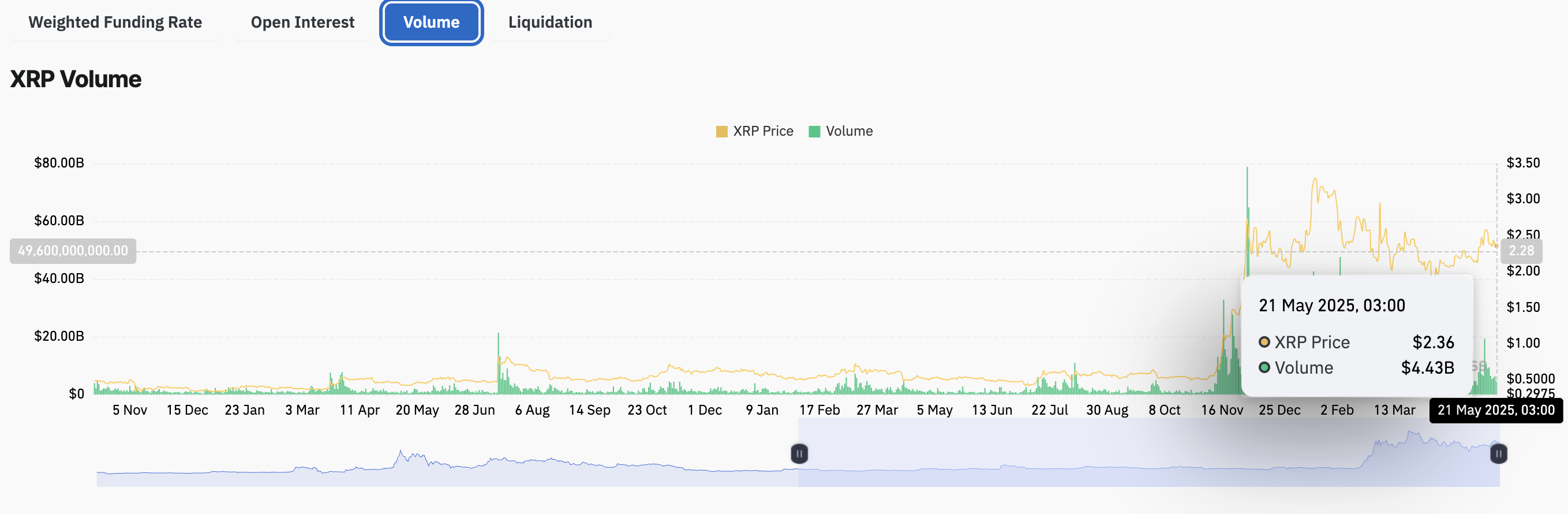

XRP’s market is waning at the moment. A volume drop to $4.43 billion is not merely the dropping of numbers; it’s a red warning. Less open interest, waning volume, and a stumbling price are talking-equal-bid farewell from the traders and a rising gust of bearish wind. And there seems to be something like blocking out from the view, i.e., a lack of market participation.

XRP futures trading volume | Source: CoinGlass

Looking ahead: Could XRP break the uptrend and accelerate losses?

XRP is hanging on a precarious edge! Hovering just above the $2.28, it is clinging to the 50-day EMA like a life raft. The bulls now need to draw power from the momentum that began in the deep April 7 crash at $1.61 to keep the price moving upward. The fight for XRP’s future is on.

XRP’s rally struck a blockade at $2.65, and the bears are now clawing back. The MACD bellows a glaring red warning: the blue line has shot down below the red, confirming a sell signal. Pull back! If the bulls don’t kick into counterattack somehow, those ever-widening red bars on the histogram might very well send a descending cascade of sell orders that will just push the price of XRP even further down.

I note you say something about the need to keep word count and HTML elements. Well, let’s try one:

XRP’s rally slapped into a wall at $2.65; now, the bears are clawing back. The MACD flashes a glaring red warning: the blue line plunges below the red to confirm a sell signal. Pull back! If the bulls do not contrive a counterattack, each ever-widening red bar on the histogram may well provoke a descending cascade of sell orders, forcing XRP deeper still.

The Relative Strength Index (RSI) is presently frolicking in some danger at 52, indicating that a bear attack is afoot. A slide below the very important midline at 50 may see a whirlpool of selling pressure drowning the token in crimson prices. Bear with me; the bears are just waiting to get on with it.

XRP/USDT daily chart

Support levels key to watch! The $2.28 level, where the 50-day EMA flirts with the ascending trendline, serves as the first line of defense. Should the bears show initiative, however, pay much attention to the 200-day EMA at $2.05. A drop below it could send ripple effects down to April’s low of $1.61 a crucial floor.

Thanks for reading XRP rally to $3 at risk as network activity and whale holdings drop