XRP is sheltering through the crypto storm, protectively staying stable as the markets train the turbulence. With the current price at $2.27 and a slight increase of 0.85% in 24 hours, XRP shows some resilience. The month March started very powerful, with strong buying of XRP, only to meet with some resistance from important moving averages and getting corrected back down. Is this a temporary hiccup or a consolidation for the next sharp run-up?

XRP Derivatives Market Shows Strong Bullish Signals

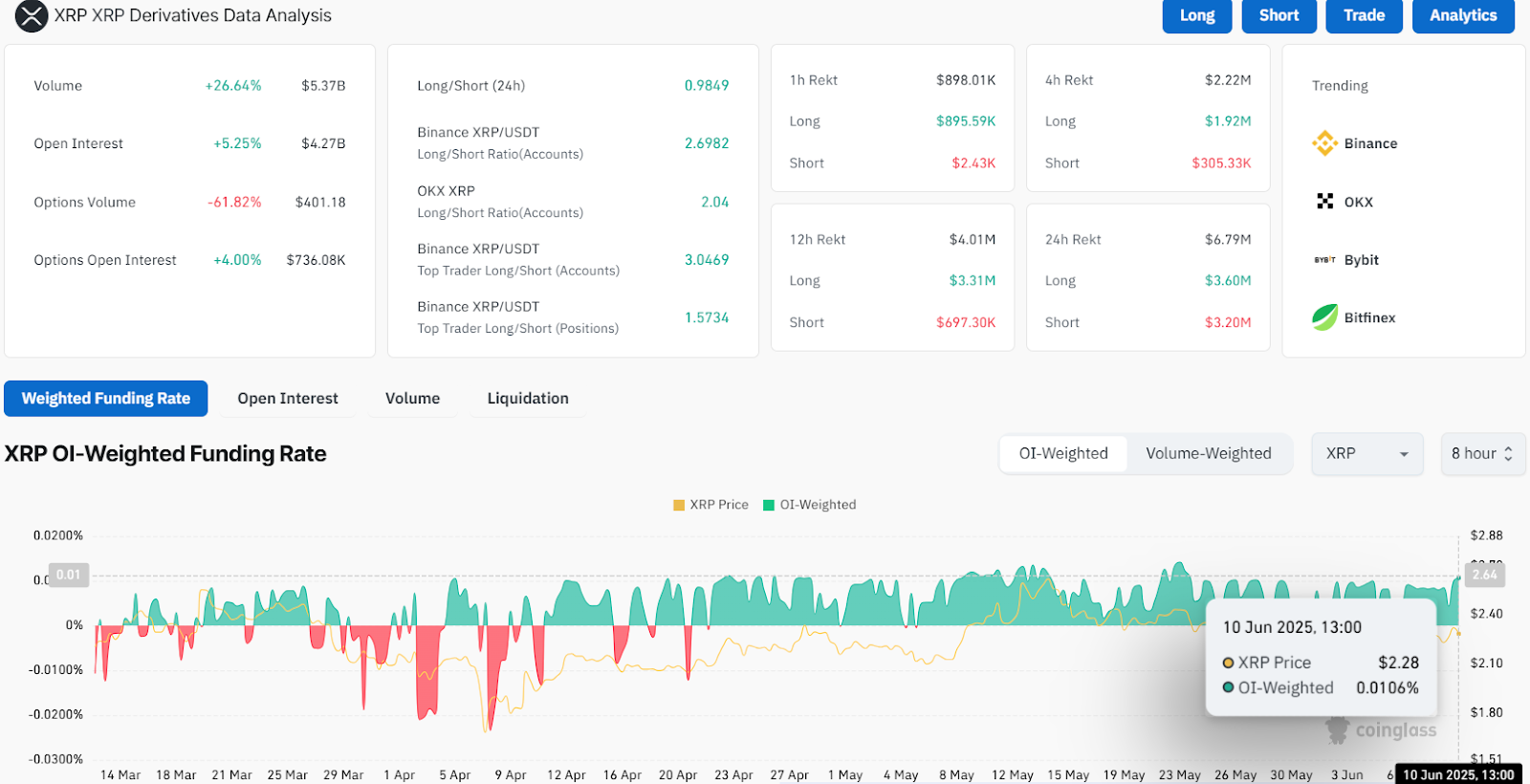

While the XRP derivatives market is buzzing, it has potential for a bull run. According to recent data from CoinGlass, the activity has surged, with daily trading volumes hitting $5.27 billion, recording a 26.64% increase. Open interest, however, has been the more gradual variable to increase, reaching $4.27 billion with a 5.25% upswing. These numbers suggest that cryptocurrencies are gaining rising interest the world over, with major long-term investments entering into XRP.

Source: CoinGlass

XRP Bulls Stampede: Exchange Data Screams Confidence

The market is roaring. A tidal wave of long positions on Binance, OKX, and other leading exchanges reveals a powerful conviction gripping both retail and institutional investors. But the real kicker? The OI-weighted funding rate, sitting pretty in positive territory at 0.0106. This isn’t just hopeful speculation; it’s seasoned XRP holders putting their money where their mouth is, willingly paying a premium to maintain their positions. This bullish fervor signals a deep-seated belief in XRP’s long-term potential, turning the crypto landscape a vibrant shade of green.

XRP Holds Key Support Levels and Eyes $2.60 Resistance

Short-lived price increase in XRP saw it shattering through the 50 and 100-day EMAs lying at $2.26 and $2.28. Bitcoins selling resistance set in near the 200-day EMA as the bulls failed to maintain the break upward beyond $2.40. A pullback is now in effect, although analysts still remain positive since they view the price retreat as a much-needed pause before the next leap. Is the next big move for XRP currently being compressed?

Bulls are clinging to the lifeline of the 100-day EMA, while the 50-day EMA waits beneath, ready to catch it should it stumble. These are no mere lines; they are the defining battlegrounds from which the next chapter of XRP is to be written. Holding these lines would offer the potential for XRP to gather enough bullish power to test the 200-day EMA and old resistance near $2.60. Losing these levels would allow bears to take over and chop XRP down from above. Stakes could not be higher.

Source: TradingView

XRP is dancing on a razor’s edge. It loiters around $2.26 and $2.28 with tantalizing prospects of an upward rush. Conquer this zone and the sun will shine from thereon. If, by chance, it slips below $2.26, the bears will drag the price back to the 200-day EMA at $2.08. It is a bullish case but only if XRP clings to this precarious perch above $2.26.

The price of XRP is coiling like a spring due to an impending explosive move. This lull is nothing to worry about; it is the market taking a calm breath before the next surge. Prepare yourself for a major change.

Related: Cardano’s ADA Price Jumps 5% as Hoskinson Announces XRP and Bitcoin Integrations

XRP’s bull run is making the climb on back of institutional backing and increase in trading while positive futures keep the price well supported. Watch the $2.26-$2.28 area intensely as that’s the deciding factor. If it can stabilize there, then it may very well step up with XRP going higher.

Thanks for reading XRP Resilience: Will It Maintain Bullish Momentum After Recent Pullback?