From XRP Unleashed: 20 Percent May Surge Made Because of Whale Moves! What is driving the market madness? On-chain data reveals a volcanic change in XRP whale behavior hinting at a game-changing strategy.

XRP’s tides may be turning. After the long period of whale-powered selloffs, the pressure seems to be going away. Is this the sign the market has been waiting for? A possible rally of XRP glints in the horizon as these whales’ major hold starts slipping away.

XRP Whales Halt Sell-Offs, Signaling a New Phase in Price Movement

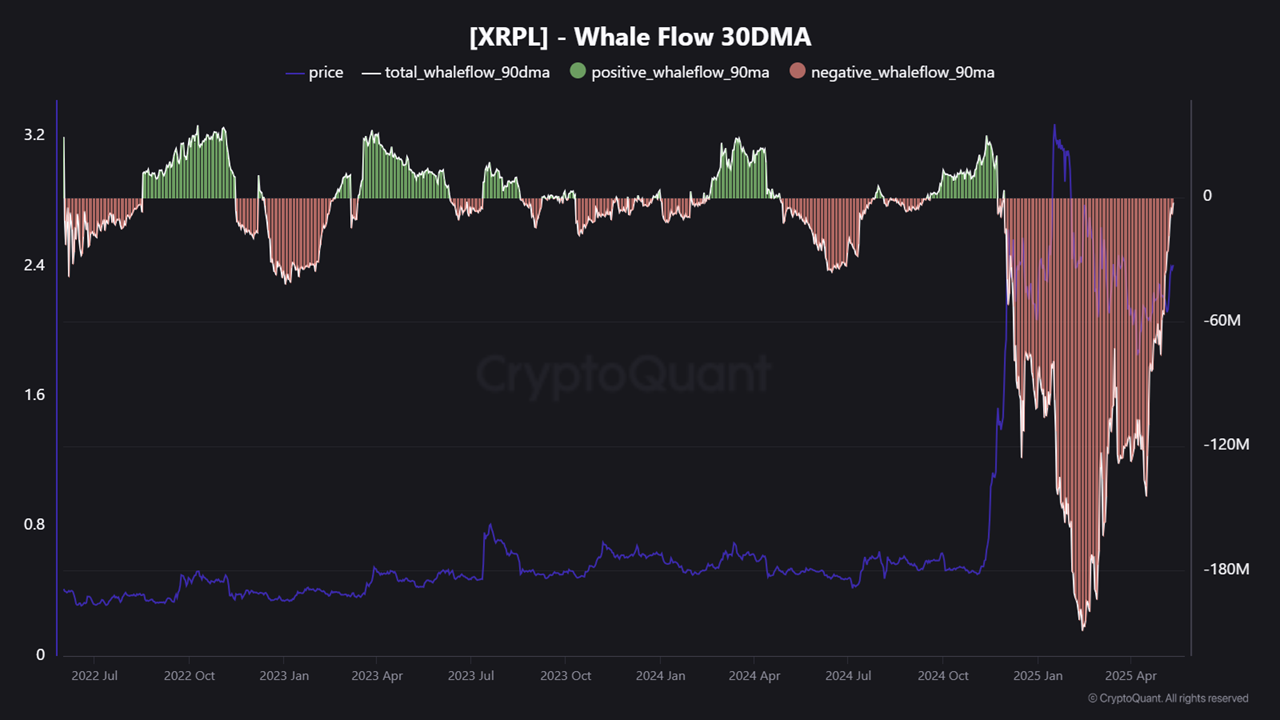

According to CryptoQuant, XRP whales aggressively sold off their holdings in early 2025, pushing net flows deep into negative territory.

The rise of XRP to $3.38 was a siren call for heavyweight investors. They smelled the gas of peak liquidity and exited the market on one of the ripest bullish runs. This intentional sell-off gained momentum and halted the price rally of XRP, producing a horrifying 50% descent to $1.60 in April. Bled dry and flushed out, the bulls were routed.

However, recent data suggests a shift in momentum.

XRP Whale Flow 30DMA. Source: CryptoQuant.

Has the crypto winter thawed? The on-chain data provided by Kripto Mevsimi indicates the possibility of the great sell-off coming to an end. The 30-day Whale Flow moving average evidences a reduction in downwards pressure, while the net flow bars imply a shift to holding rather than dumping by whale wallets.

Although this isn’t a full reversal yet, Mevsimi remains optimistic.

This implies that whale behavior can give signals to market bottoms. Mevsimi mentions that reversals in whale flows often presage durable recoveries and hence potentially give an early premonition of a base being laid in the market. He recommends looking very closely at any flow inflection, especially in concert with strong price action.

Forget the blockchain breadcrumbs; go now and see that the market is roaring with the mentioned XRPs being on fire! CoinMarketCap data echoes: a surge in daily spot trading volumes that suddenly zoomed above $10 billion. This is more than just mere interest. This is actual rush!

Notably, community sentiment on CoinMarketCap is high. Around 88% of investors expressed a positive outlook on XRP.

Additionally, Santiment data reveals an 11% increase in XRP-holding wallets in 2025 alone proof of growing community interest.

Total Amount of Non-Emply XRP Wallets. Source: Santiment.

Missouri just fired a shot heard ’round the crypto world! Santiment credits the state’s bold step of abolishing capital gains tax on cryptocurrencies like Bitcoin and XRP through House Bill 594 for catalyzing renewed interest in the market.

One seismic change might be in store for crypto investors! Although one can scarcely imagine any broker’s informed that profits from Bitcoin, XRP, or other lofty digital assets be subjected to usual capital gains tax, this legislation intends to throw onshore capital gains so that a resident can deductallcapital gains on earnings from the sales of cryptocurrencies. For marine-style crypto marketers in the US, news like this might just bestow a financial revolution. Here is the highlight from XRP mining: a promise of freefalls from capital gains tax on profits from crypto trading.

Analysts Highlight Liquidity as a Key Factor Behind XRP’s Price Movement

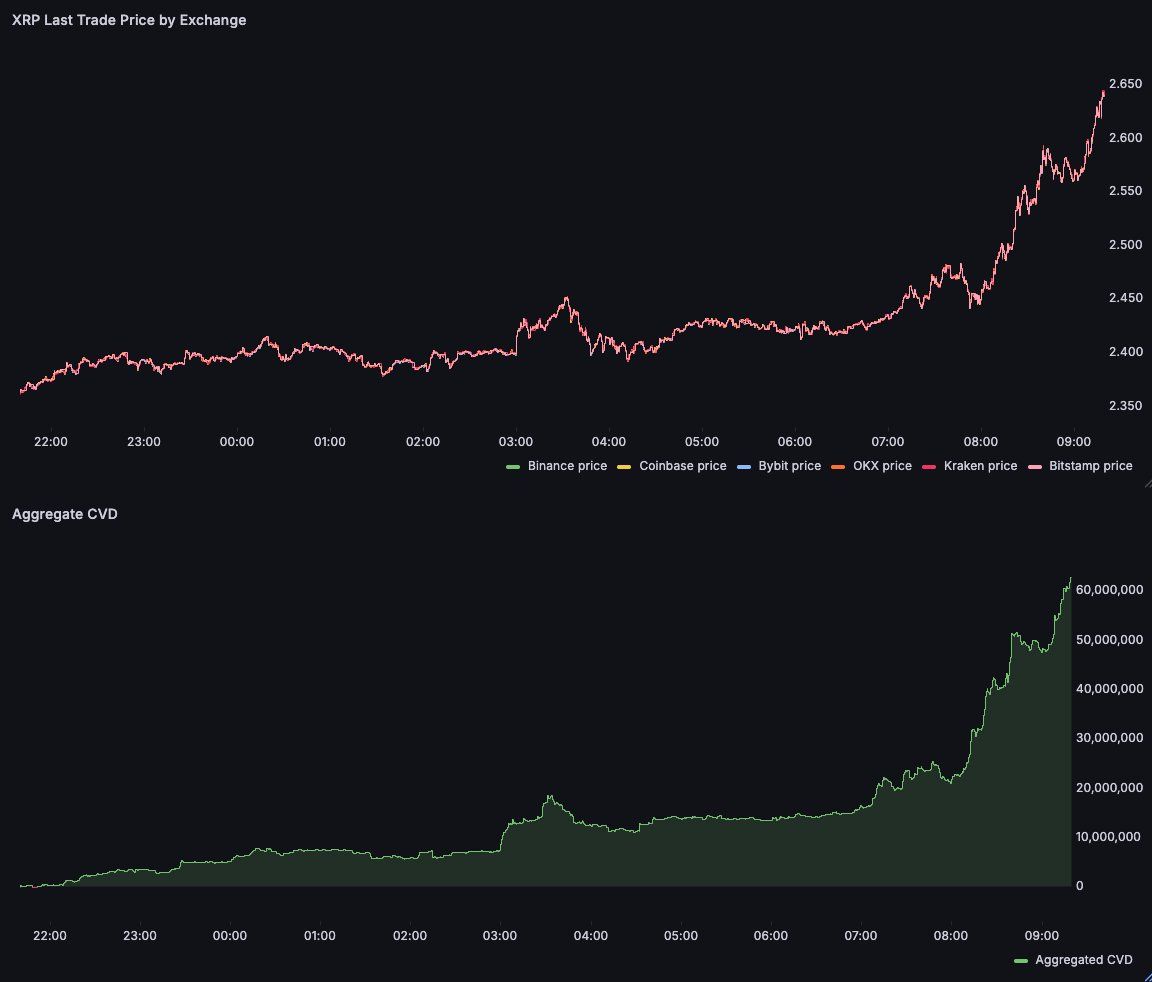

Ditch that market cap mirage. Analyst Dom just dropped a truth bomb on X: liquidity, the lifeblood of XRP, dictates its true breakout potential. Is XRP slated to pump, or will it face the shallow liquidity that might choke the movement? Dom is not buying the hype without the flow.

$61 million. That alone may do the job. Even a minuscule $61-million net inflow, claims new research, can trigger an epic $16.6-billion swell in XRP’s market cap. The whole thing just goes on to prove how much XRP gets affected, or maybe stands to gain, from liquidity shifts.

XRP Aggregate Cumulative Volume Delta. Source: Dom on X

“…marketcap is irrelevant all that matters is liquidity,” Dom said.

With trading volume surging and whale selling pressure easing, XRP appears well-positioned to attract fresh capital.

Beware, though; if Dom is right, XRP’s market cap may bleed value faster than a puddle through a punctured tire, collapsing with the mere trickle of funds flowing outward.

Thanks for reading XRP Whale Sell-Offs Slow Down—Here’s What It Means for Price