Jan. Tuesday, Crypto markets were soaring in the direction of crypto trading and traded sharply higher. as soft U and 13 as . s S The data from inflation helped stabilize risk sentiment — with analyst warning that ‘older fragility in market positioning was still very fragile’.

Bitcoin (BTC) – about $95,600, up around 5% on the day as of press time. Total crypto market capitalization rose to around $3. 5% over the last 24 hours, 35 trillion (35 trillion) of s.

BTC 7-day price chart. Source: CoinGecko

Most of the 10 best crypto assets remain green, with Ethereum (ETH) up nearly 8% to around $3,330. Big-cap gains were made by Dogecoin (DOGE), a 10% increase of about $0, up to around $10 per cent for the gain. Paraphrasing 15.

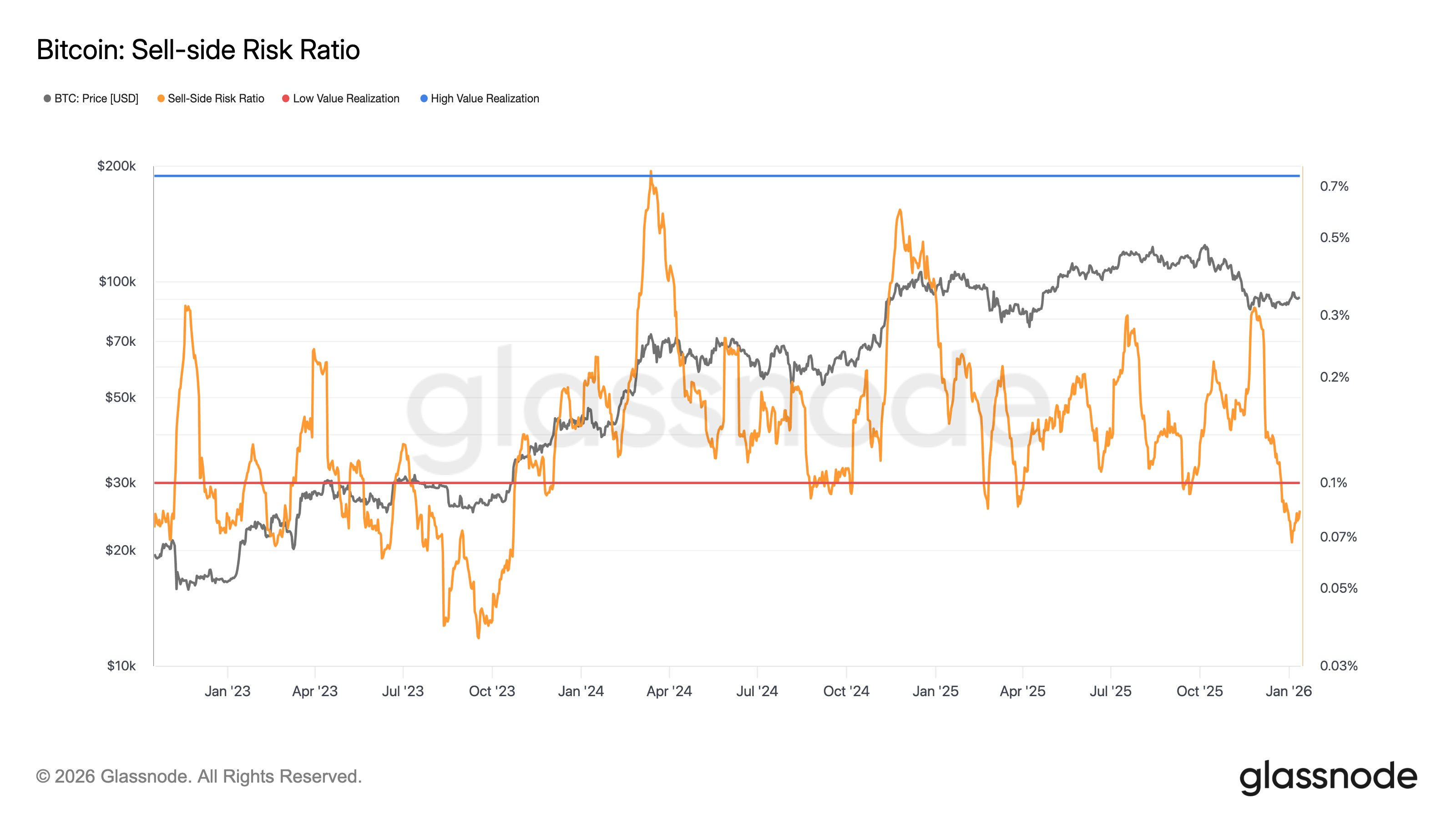

Compressed Sell-Side

In a recent X post today, glassnode analyst Chris Beamish noted that Bitcoin’s sell-side risk ratio has “compressed back to lows not seen since Oct ’23” and the price of bitcoin. Paraphrasingr ’It is.

BTC sell-side risk ratio. Source: glassnode

He added ‘It is now at ‘relatively low multiples’ that we realise profits and losses, which means subdued belief behind distribution at current price levels. , ” and.

Despite the longer term “extreme fear” streak of last month’s long ‘fearful and very cautious’ investor caution was maintained as of Tuesday morning when the Crypto Fear & Greed Index continued to remain in the “fake” zone for a third consecutive day.

Big Movers and Liquidations

Story (IP) jumped nearly half on the day, leading gains by far from story’s gain to look at the top-100 assets by market cap. After that, Monero (XMR) continued its multi-day rally, up 15% today as privacy-focused tokens remained in the mix to attract retail interest.

The losses were confined to the short-lived loss of on the downside. Zcash (ZEC) and Midnight (NIGHT) both slipped about 3-4. In the top-100 assets, they are ranked lowest performers amongst ‘s 2% who perform poorly.

Approximately $159 million in crypto liquidations were sold to the market over the past 24 hours, according to data from Coinglass. About $94 per cent of short liquidations were involving . More than $63 million, 9m. 8 million in long liquidations of 8m? $44 per cent were spent on Bitcoin’s . It is 1 million of the total, followed by Ethereum at $24 for every one. 9 million, 9million.

ETFs and Macro Conditions

Jan, Jan. on Monday, . spot Bitcoin ETFs recorded net inflows of $116 total for 12 spot. bringing cumulative inflows to $56, 7 million and pushing ‘s seven million. SoSoValue said ‘It is 52 billion for s to be true. During the same period spot Ethereum ETFs also had relatively weak net inflows, but were still green (a net $5 million) and pushing cumulative flows to $12. 44 billion a , or 44billion in the world.

U.Pasphraser on the macro front, i.e. S. After a new inflation data showed price pressures eased, risk sentiment was high. excluding food and energy, core consumer prices (avoiding the term “food and power”) rose just 0 in December. Two per cent of a month over month and two per percent of s. According to data from the Bureau of Labor Statistics, 6% year over year.

Headline CPI jumped 0 -. Annual inflation is 2.3% on the month, 3% for s. According to the Dow Jones consensus estimate, 7% of CNBC pointed out that “the Dow News Network (DJP)” had been steady from November.

U. S S. But Tuesday’s investors digest today’s inflation report, published hours ago and early Q4 2025 earnings were little different as equities changed. The S&P 500 jumped 0. The Dow Jones Industrial Average dropped 35 points, 1%, and a Dow JJI fell 35.

Thanks for reading Bitcoin Climbs Back Over $95K as Traders Digest New Inflation Data