Bitcoin bulls are putting their muscles to use, with price stuck at an obstinate $100K and achieving a 7% gain in the last seven days. The whale report tells a different story, though. Are these whales building a position, or simply shadowing? Mixed signals from the past month answer the $100,000 question with another question.

Bitcoin is balanced on the edge of a knife. Ichimoku Cloud and EMA give thin protection, while the market’s pulse weakens, conviction absent. A battle is set between major support and resistance. Will Bitcoin smash the ceiling going beyond all new highs? Or would gravity pull it down, taking with it the dreams of six figures? That next candle will hold the answer.

BTC Whales Inch Up, but Confidence Still Mixed

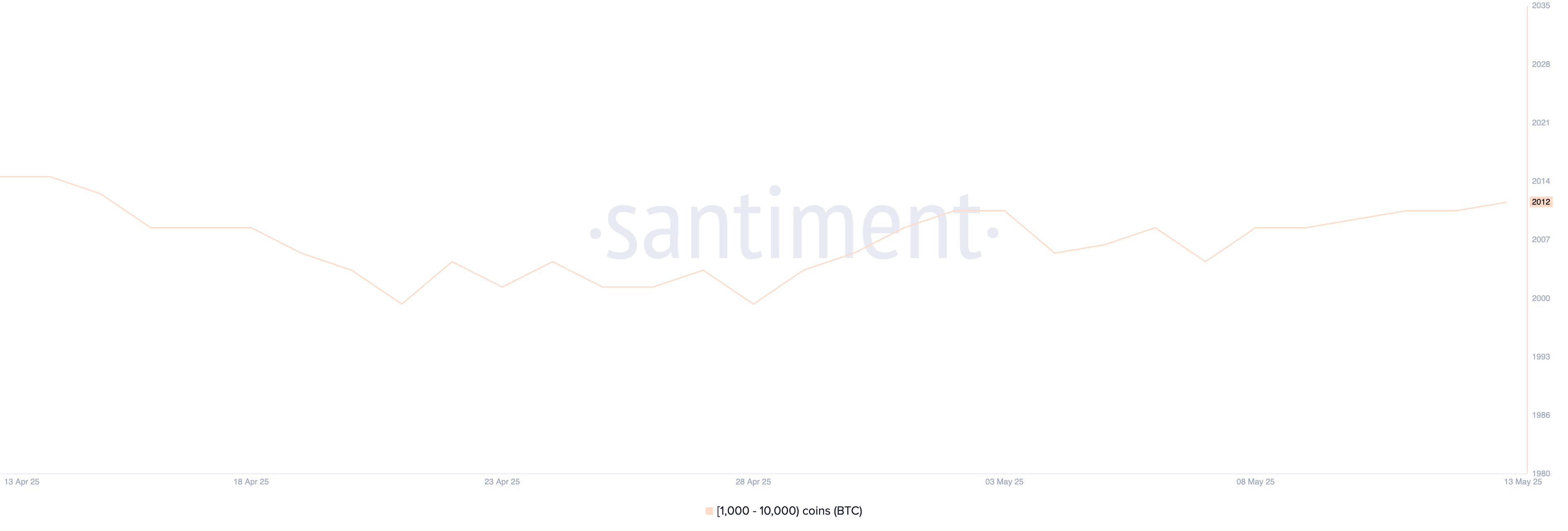

These are the whales of Bitcoin, such deep-pocket holders between 1,000 and 10,000 BTC. These ranks have grown just slightly, with the total now at 2,012 as compared to just 2,009 on May 9th. Are these whales accumulating Bitcoin, or are they repositioning large swaths of Bitcoin along the way? This slight leftward movement in these giant bulls speaks volumes about what undercurrents are shaping the future of Bitcoin.

Sure! A tiny blip is not enough to distract. All eyes are on whales for a good reason. These huge market players have enormous power. They can create tidal waves with their enormous trades in a flash, compelling market sentiment and direction to move.

Bitcoin whales are either loading up for a bull run or bailing out for calmer seas. Growing whale wallets suggest surging confidence in Bitcoin’s staying power, hinting at a bullish horizon. Conversely, shrinking whale populations can forebode choppy waters as major players either cash out or brace for a downturn.

Bitcoin Whales. Source: Santiment.

You might just be able to spot the first glimmers of hope where whale populations are making a crawling recovery, as they have made a number of unpredictable moves in the last month.

Bitcoin ETFs are bleeding red as whales engage in tug-of-war: With an exit of $96 million, the largest one-day outflow since mid-April reveals investor apprehension. The macroeconomic headwinds and choppy price waters have precipitated a tug-of-war battle for whales, with hoarding and dumping Bitcoin in turns. Such is the state that all the twelve Bitcoin ETFs are underwater, leaving investors pondering the next move in this high-stakes crypto chess game.

Bitcoin’s recent pulse? A faint flutter, not a surge. While optimists speak of records being broken, whales remain on their heels; they stick to dipping in toes rather than taking the plunge. It is an indication of the market being hesitant to really take off; not yet ready to remain in the stratosphere.

Bitcoin Holds Above Cloud, But Momentum Slows

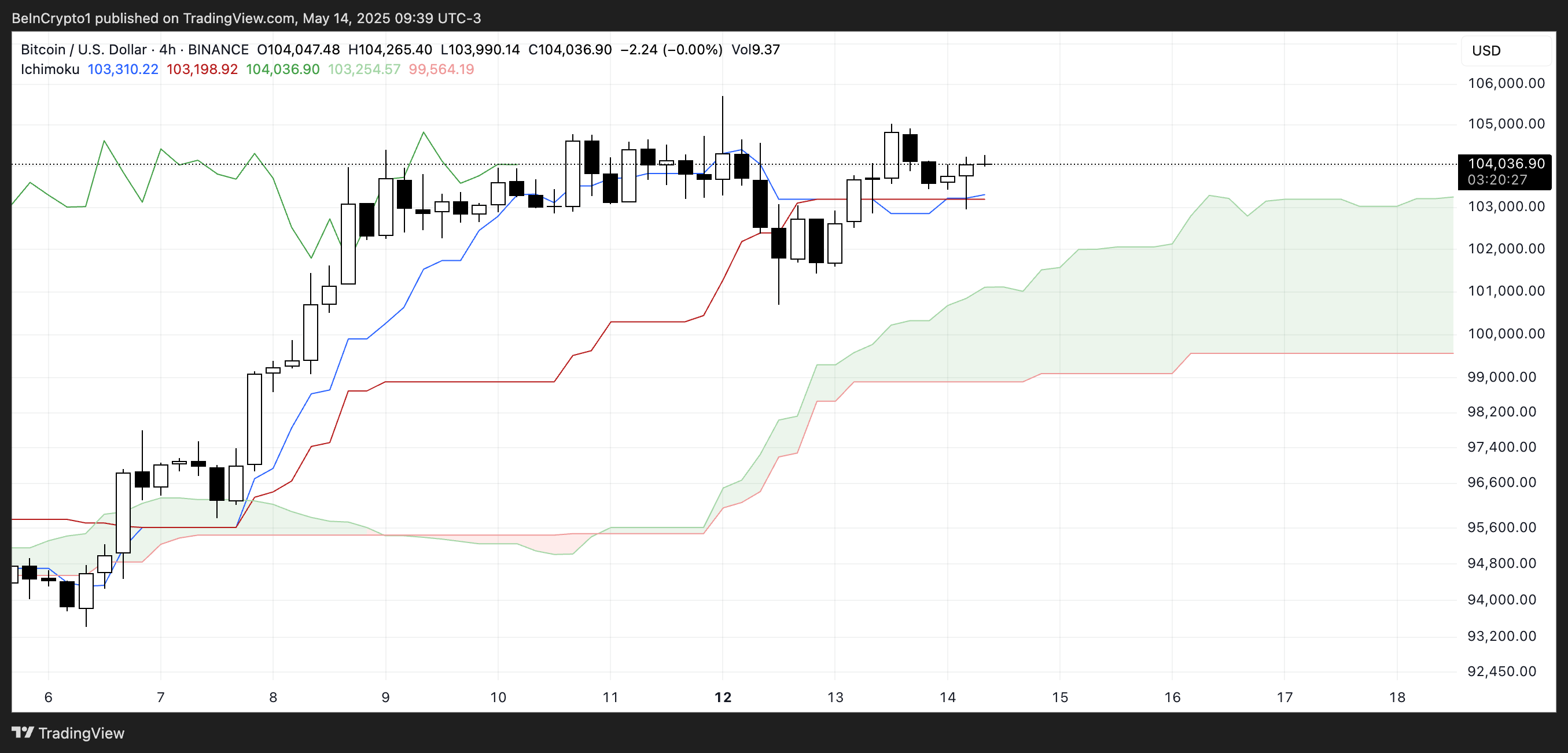

Bitcoin Ichimoku cloud points towards storm brewing – hopefully bullish. The price is just above red Kijun-sen and blue Tenkan-sen lines, holding on to short-term support like a climber on the cliff. Is this just a brief respite before the price dives down further, or is it just a calm before the storm of rapid upward movement? Only time and the cloud can tell us that.

Sightseeing the coming event through the Ichimoku Cloud (Kumo), we encounter a bullish sunrise. The green Senkou Span A, like a lush veil, floats above the crimson Senkou Span B. This is a strong forward-looking signal for prices to climb, i.e., earnings ahead.

BTC Ichimoku Cloud. Source: TradingView.

The Chikou Span (lagging green line) remains above the price from 26 periods ago, signaling cautious bullish sentiment.

A higher level of unease begins to engulf the market as it floats calmly over the bullish Ichimoku cloud. It finds itself drifting sideways in unpredictability. The Tenkan-sen and Kijun-sen, once very far away from each other, are beginning to get closer, indicating a possible momentum change or just a short breather before the next big move.

“The bulls need adrenaline! Gentle crossovers no more; we are talking about a breach-the blue line soaring far into the red-with conviction. Imagine a thunderhead of bullish momentum, thick and fast, boiling over ahead, clearing the path for a sustained rally.”

Key Levels to Watch: Bitcoin’s Next Move After Holding $100,000

Bitcoin Defies Gravity: Six Days Above $100K!

Bitcoin has been defying gravity by stubbornly staying above the number $100k for six full days! Technical: bullish. EMA lines are giving a siren call of an uptrend, with short-term averages high above the long-term ones. Translation: This bull run has really got some life in it.

If BTC can break above the immediate resistance at $105,705, it could trigger another leg up toward $107,038.

BTC Price Analysis. Source: TradingView.

If the bulls keep pushing through that momentum, a surge towards $109,312 would be expected. Successfully breaching this level could ignite a breathtaking rally up to $110,000 and, hence, make market history.

However, if the current trend loses steam, Bitcoin may face a pullback toward its first key support at $101,296.

This critical support level may prove to be this much significant. The loss of this foothold could swiftly dunk a descent, while altimeters topple below the psychological $100,000 mark onto the platform of corrective actions at $97,766. Brace for impact; that breach, if sustained, may give way for shocks all the way down to $93,422.

Thanks for reading Bitcoin Whales are Increasing But Their Activity Remains Unstable