BONK, the Solana-based meme coin, is riding high today, spiking a dizzying 22% in the last 24 hours! Forget the Monday blues, this dog-themed token is leading the pack as the broader crypto market stages a comeback. Is this just a playful pup, or does BONK have some serious bite?

BONK’s price is surging, fueled by a fresh wave of investor enthusiasm as rumors swirl about a leveraged ETF potentially hitching its wagon to the meme coin.

Traders Bet Big on BONK as Potential ETF Launch Nears

Hold on to your hats, crypto enthusiasts! Tuttle Capital is gearing up to launch a suite of leveraged ETFs, and a 2x Long BONK ETF is leading the charge. According to a recent SEC filing, this could be hitting the market as early as July 16th. Buckle up, because this might just be the wild ride your portfolio has been waiting for.

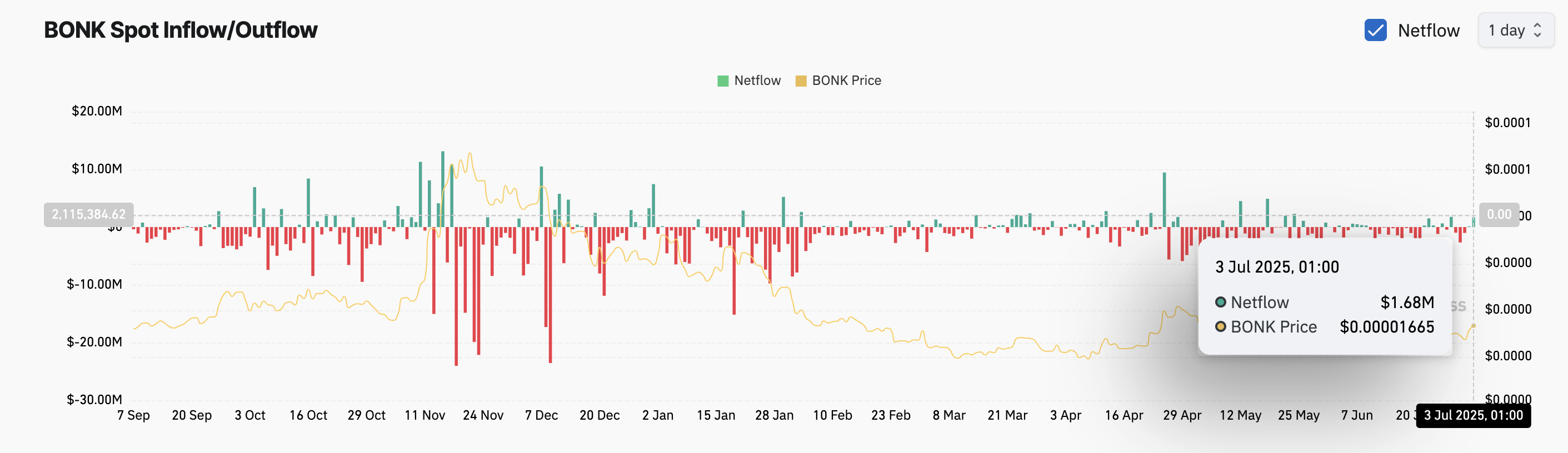

BONK is back, baby! An ETF whisper has traders swarming, wallets wide open, betting big on institutional FOMO. Forget faint interest – we’re talking a tidal wave. Spot net inflows? Up over 100% in a day, surging to a cool $1.68 million. This isn’t just a ripple; it’s a BONK-fueled tsunami.

BONK Spot Inflow/Outflow. Source: Coinglass

Spot net inflow: the heartbeat of an asset. It pulses stronger with each direct purchase, revealing swelling investor interest and a hunger for what’s on offer. A rising tide of spot net inflows doesn’t just hint at a bull market; it screams it.

BONK is experiencing a surge of investor interest, indicated by its swelling net inflows. This influx of capital could be the rocket fuel needed to propel its price even higher.

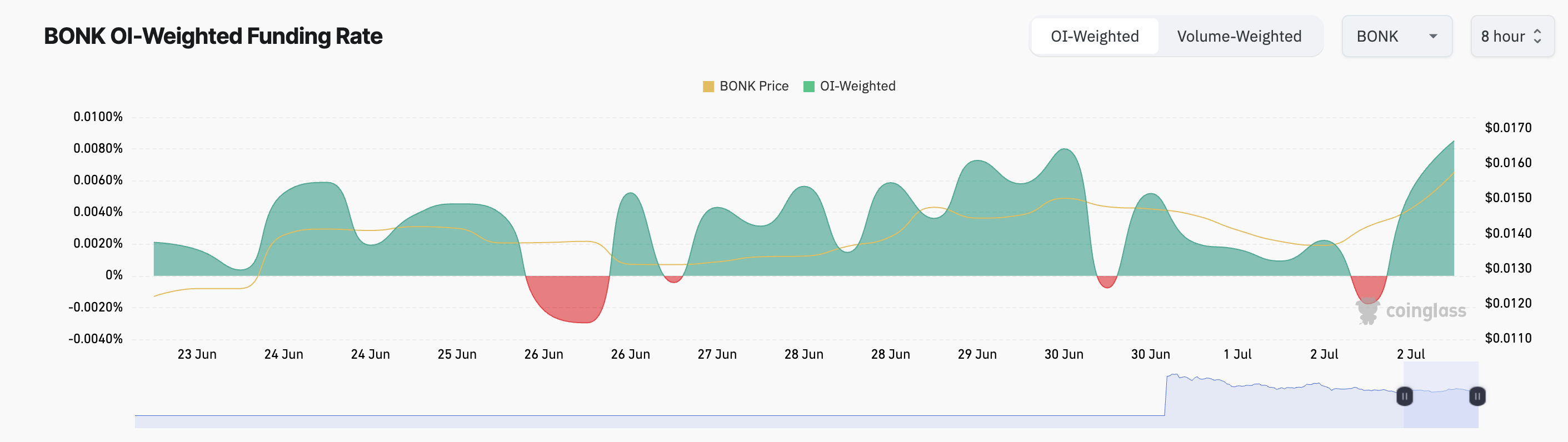

The meme coin’s funding rate isn’t just positive, it’s practically screaming “BONK to the moon!” At 0.0085%, futures traders are betting big on price gains, piling into long positions like there’s no tomorrow. Shorts? They’re nowhere to be seen.

BONK Funding Rate. Source: Coinglass

Ever wondered how perpetual futures contracts stay tethered to the real-world price of an asset? Enter the funding rate – a subtle but powerful mechanism that acts like a balancing act between traders. Think of it as a periodic “tip” paid between those betting on price increases (long positions) and those betting on price decreases (short positions). When demand for long positions surges, the funding rate turns positive, meaning longs essentially pay shorts. This encourages equilibrium and prevents the futures price from wildly diverging from the underlying spot price.

This means that more traders are betting on BONK’s price extending its gains in the short term.

BONK Breaks Above 20-Day EMA, Signals Fresh Bullish Momentum

BONK is breaking free! After a surge in price, BONK has blasted past its 20-day EMA, turning the once-resistance level into a launchpad at $0.000014. This EMA is now acting as a safety net, ready to catch BONK if it dips.

Imagine the 20-day EMA as a heat-seeking missile, locked onto an asset’s price. It tracks the average price over the last 20 trading days, but with a twist: recent prices pack a bigger punch. Now, picture the asset’s price soaringabovethat line. Boom! That’s a signal – short-term bullish momentum is in play, and the rocket might just keep climbing.

If the bulls retain control, they could drive BONK’s price toward $0.000018.

BONK Price Analysis. Source: TradingView

Conversely, if demand plunges, the altcoin’s price could break below $0.000016, falling to $0.000012.

Thanks for reading BONK Rises 22% as ETF Excitement Sparks Fresh Rally