Chainlink price may be on the verge of a breakout to $20 as exchange outflows rise and ecosystem growth continues.

Wednesday saw an eruption of substantive volatility in trading for LINK, which stood at the $16 mark after an unbelievable run of 60% off a yearly low. The price action described the LINK bull storyline with a few more punches; one strong year had already been enough bruising.

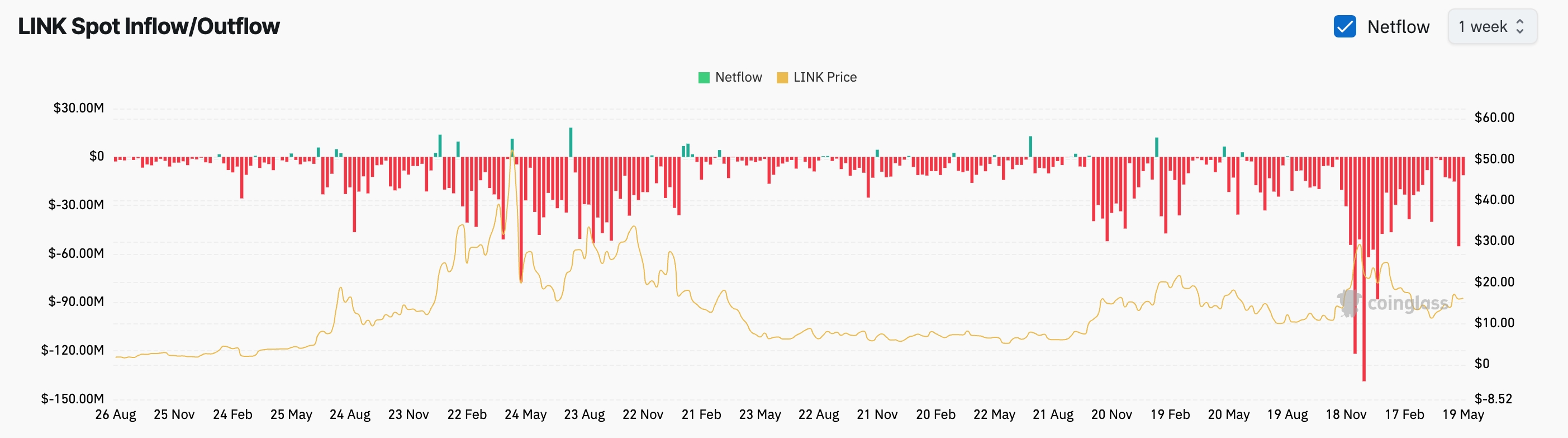

Chainlink (LINK) is currently showing a compelling accumulation story that hints at a potential comeback. Data from CoinGlass hints at undiminishing investor confidence as the exchange balances keep on dripping out LINK. It has been steadily leaving these exchanges for more than nine months. Just this week, $11.27 million LINK was taken away, an amount added to last week’s whopping $55.2 million outflow. Is this the calm before a storm-the much-anticipated price surge? Investors certainly seem to believe so as they have already been voting with their wallets in anticipation of a possible Chainlink revival.

A steep decline in an exchange’s balance is usually a sign that savvy investors are moving away from exchanges to store their crypto in personal wallets. Conversely, rising exchange holdings usually warn the threat of a potential sell-off, as holders begin preparing to cash out.

Chainlink exchanges outflows | Source: CoinGlass

As DeFi gets wider, and tokenized real-world assets come into a sharper focus, the spotlight falls on Chainlink as a promotor. Proof? Chainlink very recently facilitated a landmark transaction between titan financial institution JPMorgan and Ondo Finance (ONDO), signaling that a new instance interlinked finance has arrived.

You might also like:

KAITO price gears up for another potential 100%+ leg up as it tests post-ATH resistance

Activated on Chainlink, Solana now facilitates over $18 billion of assets-a perturbing concours in the DeFi arena. It’s here that Solv Protocol is surfing on the crest of the wave: a Bitcoin staking platform hitting $2.5 billion assets. Chainlink-powered assets weigh in at $1.16 billion. This is not a slow drip; this is an interoperability backlash.

The RWA revolution has barely scratched the surface, yet is forecasted to grow explosively, a scenario that would immediately shoot Chainlink into the stratosphere. VanEck’s audacious stance paints a picture of tokenized securities soaring from today’s $50 billion market valuation to an ominous $30 trillion by 2030, suggesting the huge opportunity awaiting anyone that can get in on it.

Imagine a world where your crypto interacts with the traditional financial system with no friction. That future is edging closer with Chainlink joining hands with SWIFT, the financial giant that transacts in trillions every year. This is not just a partnership; it is a bridge that is about to be created between the revolutionary world of blockchain and the established world of traditional finance. Enhancing speed and efficiency may thus be increased, and with that might be increased with the value of LINK.

Chainlink price technical analysis

LINK price chart | Source: crypto.news

In LINK’s chart, it reads “buy!” Twice it fell down to $10.20, hitting rock bottom while drawing up a classic double bottom pattern-a sure foot to stand on to launching a flying rocket into the skies. LINK has been drawing an ascending channel, steadily making its way up for three weeks. To choke on the fuel, the 50-WEMA is supporting the price. HELLO LIFTOFF!

Eyes are fixed on the charts, watching the price ascend toward $20 – an enticing 27% from here. Bulls are fine as long as they remain within the channel, but caution is advised. Should the price slip below the channel’s floor, it will check the upward rally.

You might also like:

VanEck’s new fund targets real-world utility in Avalanche ecosystem

Thanks for reading Chainlink price targets $20 as exchange outflows surge