Chainlink’s big players, the whales, are swimming in a pool of 85 million LINK tokens, a consequence of retail investors staying ashore. But don’t think the current is still; while small fish are scarce, institutions are steadily scooping up LINK, draining exchanges by a consistent 100,000 LINK each week. The question is: Will the whales keep accumulating, or will a school of retail traders finally join the party?

Chainlink’s price: stuck in repeat. Despite bullish surges, LINK stubbornly clings to $12-$15. Will it break free? Analysts eye key resistance points, hunting for signs of an upward escape.

Chainlink Whale Accumulation Drives Exchange Outflows

A silent exodus is underway. Chainlink whales are emptying the exchanges, one massive transfer at a time. For months, a steady bleed of LINK – a staggering 100,000 tokens weekly – has drained from exchange wallets, hinting at a seismic shift in sentiment among the largest holders. Where are they going, and what do they know that the rest of us don’t?

A silent exodus is underway. On-chain whispers reveal a stark truth: institutional wallets are emptying exchanges, funneling crypto assets into the deep freeze of cold storage. Year-to-date, exchange reserves have plummeted a staggering 40%, signaling a strategic shift – institutions are HODLing for the long game, not trading the turbulence.

Whales are feasting on retail’s fear-fueled fire sale, turning panic into profit. Fleeting moments of buying frenzy from the little guys are mere blips on the radar as the big players relentlessly scoop up the supply.

In March 2025, Chainlink (LINK) witnessed a dramatic twist: a sudden influx of 5 million LINK tokens flooded exchanges. This surge coincided with a spike in retail trading, a frenzy that quickly flipped as negative flows took over. But the real story lies beneath the surface: Whale activity exploded in Q4 2024, hitting a staggering 3,000 withdrawal transactions per day, signaling a major shift in accumulation.

Chainlink analysis from CryptoQuant

Chainlink is seeing a surge in whale activity. Outflows are spiking, but don’t expect fireworks. This coordinated extraction suggests strategic accumulation, allowing deep-pocketed investors to quietly scoop up LINK without rocking the boat.

Non-volatilizing leverage levels across the market suppress volatility that would disrupt accumulation plans.

Institutional investors are doubling down, triggering a persistent exodus of crypto from exchanges. Withdrawals consistently outpace deposits, creating a potential supply shock as top trading platforms face mounting pressure.

Whales aren’t playing the daily game; they’re building empires. This isn’t about quick profits, but about a calculated, long-term accumulation strategy. We’ve seen this movie before – the slow, steady stacking of altcoins right before a moonshot.

Chainlink Retail Activity Remains Stagnant Despite Growth

Chainlink’s Main Street Appeal: Still Waiting for Lift-Off?

While whales swim in Chainlink’s waters, retail investors remain ashore. Daily active addresses are stuck in neutral, hovering between 28,000 and 32,000. Transaction volume paints a similar picture: a flatline at 9,000 per day, signaling stagnant growth. Is Chainlink losing its luster with everyday investors? The data suggests a wait-and-see approach, with Main Street holding its breath for a spark.

The retail cooling season is a reversal from rising oracle utility across a wider set of blockchain networks.

Chainlink’s DeFi dominance isn’t trickling down to the everyday user. Despite its surging adoption among decentralized finance protocols, retail interest flatlined after a brief Q4 2024 frenzy, suggesting a disconnect between institutional confidence and mainstream awareness.

Retail investors missed the chance to realize profits from increased network usage. Volume is still weak against increasing institutional demand.

Imbalance resulting from disparity between utility growth and retail participation is a cause of market imbalance.

LINK’s price is stuck in neutral, a trading range ($12.76-$14.00) reflecting a broader apathy from retail investors. The excitement’s gone; the market’s mundane.

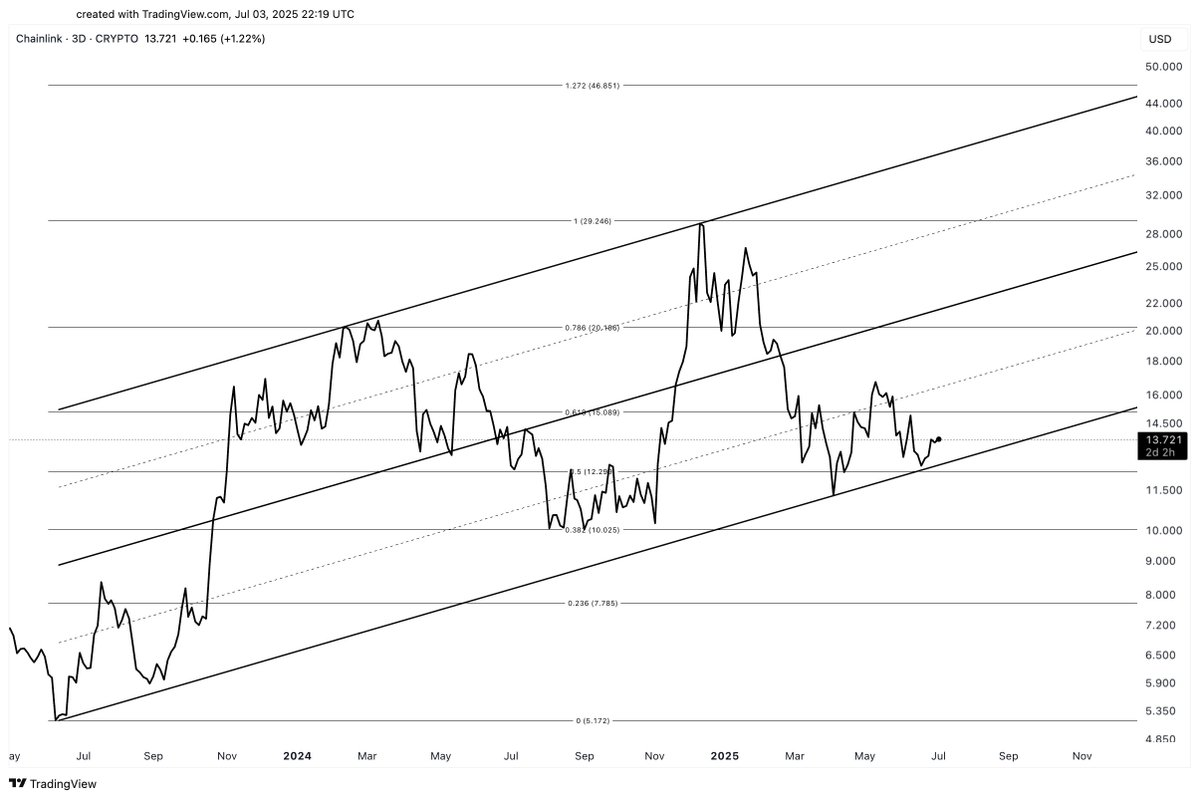

Currently caged between $13.28 and $14.00, the market whispers of a slumbering giant. But don’t forget the titan’s peak: a dizzying $52.70 reached in May 2021. That’s a staggering 74.7% ascent from today’s foothills – a stark reminder of the heights this contender once commanded. Will it rise again?

Retail absence limits upside momentum at the $15 resistance. Without retail spark, Chainlink price cannot overcome technical levels.

The flat user base halts the momentum necessary for long-term price appreciation over levels currently traded.

Technical Resistance and LINK Price Breakout Scenarios

Whales are loading up on Chainlink, but the price is stuck in neutral. LINK is trapped between $12 and $15, hinting at a pressure cooker building up for a massive breakout – or breakdown – down the line. Is this the calm before the storm?

LINK’s daily chart is currently teasing traders, trapped beneath a descending trendline of lower highs. Will it break free? Technical analysts are watching key resistance levels, waiting for a breakout signal that could ignite a rally. But so far, LINK’s closing patterns have been less than inspiring, leaving bulls on edge.

“Smash through this ceiling, and we’re looking at a potential surge toward $16. Keep the momentum going, and $18 and even $20 become the new targets.”

LINK price analysis from Ali

This week’s market dance leaves technical indicators waltzing near familiar ground, hinting at a potential return to the average. Bulls are digging in their heels, establishing a floor above $12, but bears are eyeing a crucial $10.92 mark – a break below that daily threshold could signal a shift in momentum.

Local resistance is near diagonal trendlines that have been capping recent price increases.

Several LINK price levels are in the wings waiting for successful resistance breaks higher from present levels.

Eyes on $17.40: Conquer this, and $21.99 beckons. A sustained surge past that could unleash a rally aimed at $26.61.

LINK analysis from analyst Crypto Feras

Chainlink price action is largely subject to re-entry by the retail market or ongoing whale accumulation.

Breakout situations demand active addresses above the current levels and rising transaction volumes.

Conversely, lowering withdrawal transactions below prevailing levels along with surge exchange netflows could erode accumulation trends.

This could threaten a LINK price decline towards $10 support levels in the event of declining whale interest.

Thanks for reading Chainlink Whales Stack 85M LINK Amid Retail Cooling Will Price Catch Up?