The big names of Wall Street are now entering the crypto arena with Ethereum at the center of attention. BlackRock’s recent activities in the Ethereum ecosystem are not just a whisper; they are a roar indicating a late-stage bull run. Is ETH about to explode? Looks like the smart money wants it to.

On June 5, BlackRock purchased $34.7 million worth of Ethereum (ETH), marking a significant shift in institutional investment patterns.

Ethereum flirts with $2,600: Is this the dawn of a bull run?

Ethereum’s price treads water, but could BlackRock’s next move unleash a tidal wave of institutional ETH adoption?

BlackRock’s $34.7M Ethereum Purchase Sparks Institutional Confidence

An infusion of $34.7 million into Ethereum has just been made by BlackRock. The iShares Ethereum Trust is an exciting story, marking an institutional embrace of the second-largest player in the crypto arena. Is this the catalyst for the next bull run?

Unleashed upon June 5th, the mighty deposit into the vault consisted of 27,846 ETH, treasures of staggered value of $73.21 million. This brave act pushed the firm’s total ether holdings to a meteoric altitude of 1.49 million ETH, transformed now to a flashing figure of $3.93 billion.

BlackRock’s Ethereum streak hits a high note: Day 12 of inflows signals unwavering confidence in the digital realm’s rising star.

A rally of $34.7 million to purchase Ethereum by BlackRock is not just another headline; rather, it could be viewed as an earth-shattering event within institutional circles. Institutional giants are awakening to the potential of Ethereum, and BlackRock’s bold move reflects a belief-against Ethereum being just a cryptocurrency, it is a future-proof asset. It is not ETH they’re just purchasing; they’re truly investing in the long-term vision of Ethereum.

Ethereum was hovering at $2,572. Its tottered future was tied to professional crypto investments pushing market destiny to new limits.

Source: X

Along with BlackRock, other prominent institutions like Fidelity are also increasing their exposure to Ethereum through exchange-traded funds (ETFs).

Ethereum’s rising tide: institutional money floods in, hinting at a seismic shift to a bullish future.

Ethereum’s Strong Market Performance Amid Growing Institutional Support

The price of Ethereum soared in recent weeks while leaving the May $1,900 levels behind. ETH now trades at a sizzling hot price of $2,572, making it bullish for the smart contract giant.

While this price point represents a solid upward trend, analysts are closely watching how Ethereum reacts to key technical levels.

Ethereal markets are abuzz with pent-up energy from the inflows of institutional money. All eyes are upon ETH, sitting between the tectonic resistance levels and ready to explode into a win that will relegate every other cryptocurrency off the leaderboard. Will that barrier yield to the breakout and rally? As such, the market is holding its breath.

Some analysts, such as Lark Davis, have pointed out that Ethereum has been outperforming Bitcoin (BTC) in Q2 2025.

The scale of the Ethereum ecosystem really remains enormous. With the Pectra upgrade just around the corner, scaling issues and inflation are brought under much greater control, giving the whole system a huge shot-in-the-arm. ETH is shaking off this digital sort of reputation and is catching some attention from Wall Street, where the big boys would rather start thinking of it as a serious asset.

Excited rumors still flutter on the market floor, but uncertainty shades the scene. Uncorking the champagne seems a little premature from here. Polymarket’s crystal ball shows a quite shy forecast of only 27% chances of Ethereum breaking its all-time high by 2025. Is the rocket running out of fuel, or is it merely an instance of turbulence before the next lift?

Therefore, the bright future shines over Ethereum: Institutional giants are now circling. The initiation of BlackRock’s iShares Ethereum Trust, among others, opens the floodgates for serious investment.

If prices cling to this critical support, buckle up – we might be headed for a rally.

Ethereum’s Price Action and Potential Breakout Scenarios

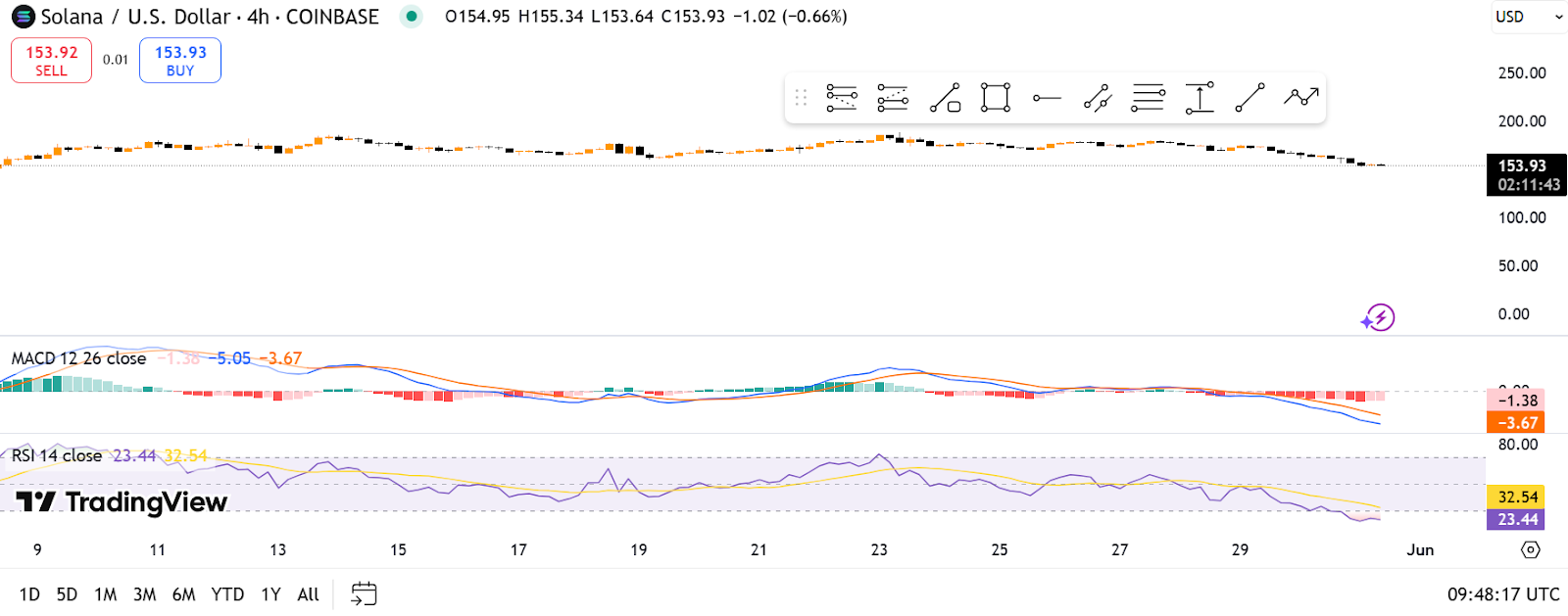

The price hovers around $2,455. ETH halts can calmed down a hair at the very end; 0.03% was recorded over the past four hours on TradingView. Is this the calm before the storm or buoyancy in the ascension?

Recent movements in the price were from $2,455 to $2,468, showing Ethereum is consolidating within a small price range.

The market’s rally hits a wall, leaving investors in limbo. Uncertainty reigns, hinting at a potential period of range-bound stability.

A gust of chilly winds cautions about impending doom; the MACD whispers of the dawn of the bearish. The line in the sand has been crossed with the MACD line now languishing below its signal, grim days ahead for the bulls.

The histogram presents red lines, which confirms that there is downward pressure in the markets.

“The chart’s shallow valleys whisper of exhaustion. Is this bear truly ferocious, or merely bluffing before a stunning market reversal?”

Source: TradingView

The Stochastic Oscillator hissed, “Buy! Buy!” The blue line hovered at a paltry 24.01, while the orange line somehow felt lower at 18.83. Sellers have been at a spatter for the prices now-so-much-a-terolith, a signal too loud to be ignored.

So, although this could suggest a bearish reversal may be in the offing, there is no clear crossover yet.

The coin’s price is currently uncertain as it is at a vital juncture touching a point of no return for a brief rally or extended sideways moment prior to a massive explosion.

Thanks for reading Could BlackRock’s $347M Ethereum Buy Signal a Bullish Shift for ETH Price?