“A note from the author: The thoughts shared here are mine alone, a perspective painted with my own brush, and not necessarily the official stance of crypto.news.”

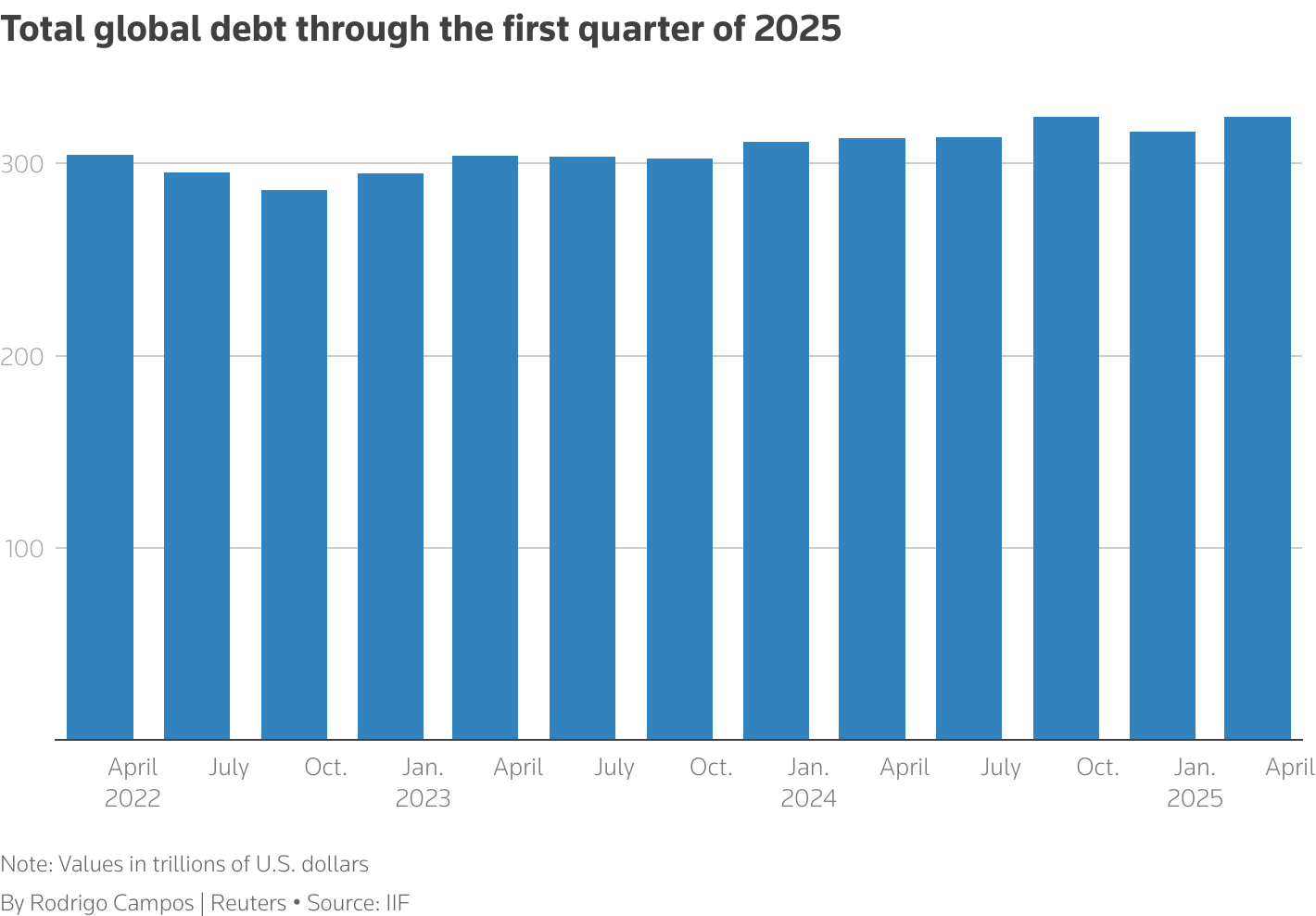

We’re drowning in debt. A staggering $324 trillion, according to the Institute of International Finance, swallowed the globe by early 2025. Is this the new normal? The real sting comes from the world’s economic powerhouses, like the United States, where growth is slowing as costs explode, threatening to pull us all under.

Summary

- Global debt is fueling fears of a looming financial crisis and pushing investors to seek safer, alternative assets. Worried about inflation eating away at your savings? As trust in traditional institutions crumbles and the dollar dips, a new financial shield is rising: cryptocurrency.

Bitcoin: Digital gold, or fool’s errand? Its allure lies in limited supply and freedom from central control, promising a haven in turbulent times. Yet, this shimmering promise is clouded by wild price swings, regulatory storms brewing on the horizon, and ever-present security threats. A revolutionary vision, perhaps, but hardly a guaranteed path to riches.

“Economic storms brewing? Don’t get caught in the crypto-only downpour. Diversify your portfolio; think of crypto as a strategic piece, not the entire shield, in a volatile world.”

Source: Reuters, IIF

With global debt teetering on a knife’s edge, individuals are scrambling for financial life rafts. As traditional investments tremble, a digital haven emerges: cryptocurrency, a potential shield against the coming storm.

You might also like:

Crypto acts like land, not tech, and that’s why it’s weird | Opinion

Global debt crisis looming ahead

The unthinkable is now on the table: a U.S. debt restructuring. Once relegated to the realm of financial fantasy, this scenario is gaining traction, sending tremors through global markets. A recent UBS survey reveals a startling consensus among nearly half of central bank managers – they believe a U.S. debt shakeup is a real possibility. Adding fuel to the fire, the freshly inked federal budget package is projected to inflate the national debt by a staggering $3.3 trillion over the next ten years, potentially accelerating the looming crisis. Is the world’s financial superpower teetering on the edge of a debt abyss?

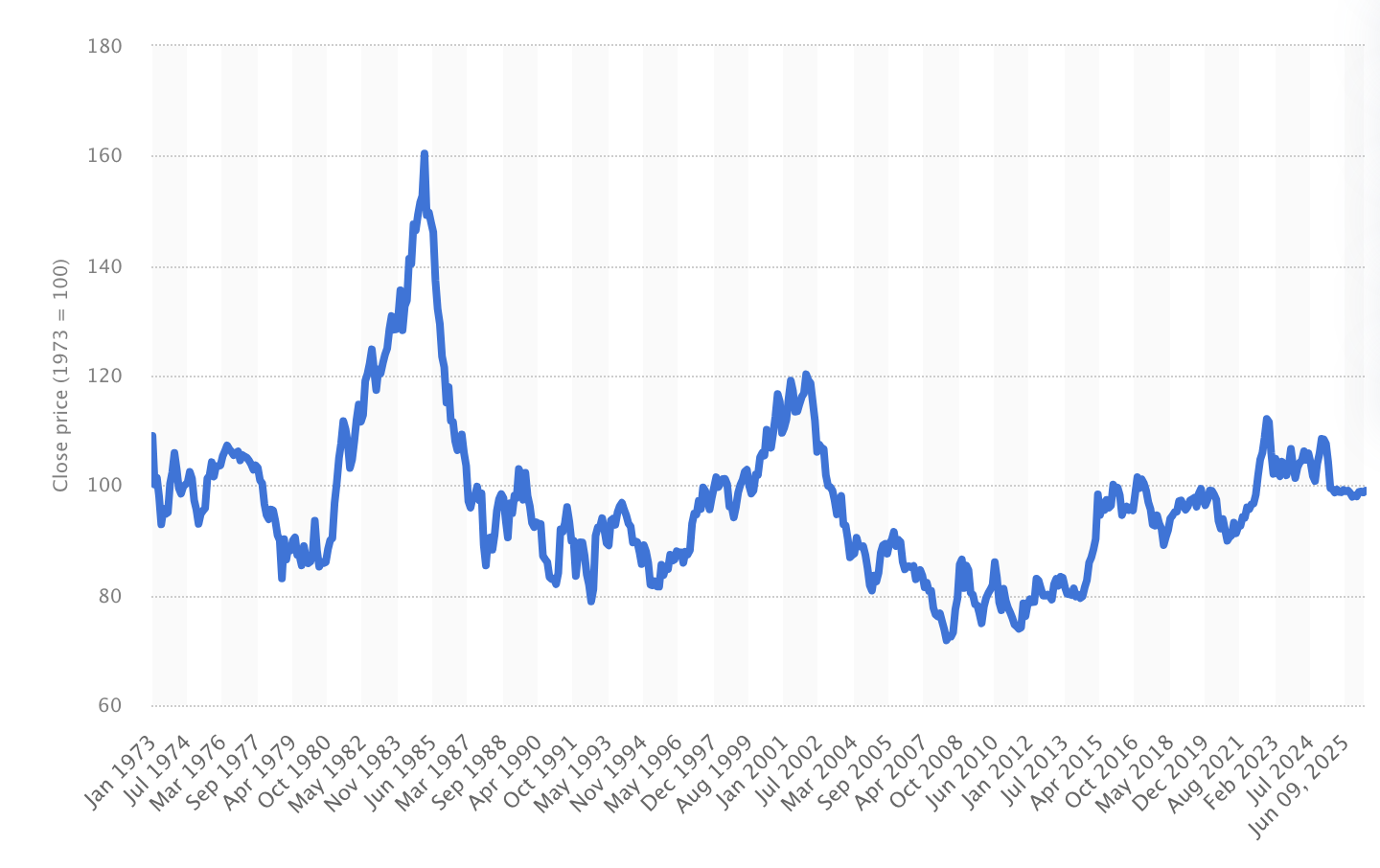

Former Coinbase CTO Balaji Srinivasan paints a grim picture: America’s debt, he warns, is a runaway train with no brakes. The dollar, already showing signs of strain, is undergoing what some call a “historic stress test.” Agustín Carstens, General Manager of the Bank for International Settlements, echoes this sentiment, declaring the global economy has plunged into “a new era of heightened uncertainty and unpredictability.” Are we on the precipice of an economic earthquake?

U.S. Dollar Index chart development | Source: Statista

Globally, inflation’s relentless grip tightens on developed and emerging economies alike. Whispers of a day of reckoning grow louder, fueled by unprecedented monetary expansion and soaring national debts. Could this reliance on borrowed prosperity trigger a worldwide debt avalanche?

Crypto as a protection from financial crisis

Forget fleeting trends; the multichain revolution is rewriting the rules of global finance. As blockchain technology explodes, whispers of cryptocurrency as a mere fad have morphed into roars of strategic hedging against a looming debt storm. Crypto isn’t just surviving; it’s evolving into a bulwark, a decentralized defense in an increasingly centralized world. The future isn’t single-chain; it’s a tapestry woven from countless, interconnected blockchains, each fortifying the new financial frontier.

Coinbase CEO Brian Armstrong isn’t mincing words: the global economy is teetering on the brink of a debt crisis, with the U.S. leading the charge. But amidst the doom and gloom, Armstrong sees a beacon of hope – cryptocurrency. In a recent post on X, he declared, “The world needs crypto, now more than ever,” framing digital assets as a vital lifeline against soaring debt, runaway inflation, and the erosion of financial freedom.

The world needs crypto, now more than ever.

– Debt is growing exponentially – Inflation is crippling entire nations – Economic freedom is declining It’s time to increase economic freedom globally, with crypto. Here’s how we’re making it happen at Coinbase🧵↓ pic.twitter.com/POh8hsaz0a Brian Armstrong (@brian_armstrong) June 20, 2025

Forget gold, prepare for crypto. Analytics Insight reports that in 2025, cryptocurrency is emerging as a shield against economic storms. Why? Sovereign debt’s staggering $35 trillion peak makes decentralized digital assets an increasingly tempting safe harbor.

The investment landscape is shifting. Forget just stocks and bonds – crypto is crashing the party. Bitcoin, the OG digital gold, is still king, but Ethereum’s innovative engine and rising stars like Solana and Chainlink are turning heads and opening wallets, from Main Street to Wall Street. The future of finance? It’s decentralized and it’s happening now.

Amidst the crypto world’s whirlwind and high-stakes gambles, a virtuoso virtual assistant emerges as the unsung hero. Imagine reclaiming your day – conquered schedules, crystal-clear communications, incisive research, and effortlessly managed admin. As economic tides turn turbulent, these digital dynamos empower leaders to laser-focus on the crypto core, transforming chaos into clarity and uncertainty into opportunity.

Why crypto could help and when it might fail

Whispers of a looming global debt crisis have intensified since 2025, fueling speculation about cryptocurrency as a safe haven. While digital currencies offer a degree of protection against worldwide fiscal turmoil, they are not a magic bullet. Whether navigating personal or corporate debt, crypto is just one piece of a much larger puzzle, not the solution itself.

Before diving into crypto, carefully weigh the potential rewards against the risks. In a turbulent economy, knowledge is the ultimate key to unlocking widespread crypto acceptance.

Crypto as a promising hedge against a potential crisis:

Bitcoin: Digital Gold in a Limited Vault. With a hard cap of just 21 million coins, BTC’s scarcity mirrors that of gold, offering a powerful shield against inflation’s eroding effects. Secure your share of this finite digital treasure.

Imagine a world where your money isn’t tied to governments or banks. That’s crypto’s promise: a financial haven when faith in institutions falters. Untethered and free, it thrives beyond the reach of any single power.

Unleash global trading power! Crypto markets never sleep, offering round-the-clock access beyond banking hours and geographical limits. Trade anytime, anywhere.

Is crypto a financial safe harbor? Its capped supply and decentralized structure offer an enticing alternative to ever-inflating fiat currencies. But before you jump ship amid stormy financial seas, remember: crypto might be a future life raft, not necessarily the immediate rescue boat you need right now.

Feeling financially swamped in the Golden State? Before diving headfirst into the crypto craze, explore California’s debt relief programs. They can be a lifeline, offering debt management and consolidation – a solid launching pad for your financial future, far from the wild west of digital currency.

The possible risks of relying on crypto alone:

Cryptocurrency: a frontier riddled with digital dangers. Your crypto wallet? A tempting target for cyber thieves. Security isn’t optional; it’s the bedrock of safe transactions. Neglecting it invites disaster.

Can crypto become a safe harbor for your wealth? Its fate hinges on two powerful tides: widespread acceptance and lasting value. Public fascination and ever-changing market currents will either lift it to prominence or leave it adrift. Tread carefully, though. Volatility’s waves, regulatory storms, and security breaches still pose a threat to even the most seasoned crypto navigators.

Is crypto a safe harbor in stormy economic seas, or just a passing squall? Analysts are diving into website traffic across crypto exchanges, financial news hubs, and investment platforms to find out. Surges in clicks and views could signal growing confidence in crypto as a legitimate alternative to traditional assets. But a sudden spike followed by a drop might just mean it’s another flash in the pan. The digital breadcrumbs left by online users offer vital clues to deciphering crypto’s true role in an uncertain world.

Final words

Global debt. A ticking time bomb? Many fear a worldwide financial meltdown, scrambling for safety. Could cryptocurrency be the shield we desperately need? The truth? It’s a gamble, not a guarantee.

Tired of financial storms capsizing your portfolio? Cryptocurrency offers a potential haven. Its limited quantity, untethered nature, and worldwide accessibility present an intriguing shelter when traditional markets crumble. However, tread carefully. The crypto landscape is a volatile frontier, riddled with security breaches and shadowed by ever-shifting regulatory sands. Diversify wisely; don’t put all your treasure in one digital chest.

Worried about the global debt tsunami? Crypto offers a lifeboat, but don’t abandon ship for it entirely. A diversified financial portfolio remains your strongest anchor in these turbulent economic waters.

Read more:

The new ‘decentralization theater’: Crypto projects are still controlled by the few | Opinion

Alex Yarov

Born in Ukraine, Alex Yarov isn’t just a writer; he’s a digital storyteller, charting a course through the ever-shifting currents of the online world. For five years, he’s been deciphering the complexities of the digital landscape, transforming its jargon and trends into clear, insightful narratives. Yarov doesn’t just report on innovation; he explores its impact, revealing how it’s reshaping our connections and redefining the future of business.

Thanks for reading Crypto might protect you from a global debt crisis | Opinion