Ethereum does not even care about the bears. After days and weeks of decline, the crypto flagship is finally catching its breath, redeeming its time after being in the shackles of a three-week leash. Even with whales selling enormous quantities, nearly sinking the ship, the price of Ethereum stubbornly holding its ground, hinting at the strength underneath.

This stability is raising expectations of an upcoming breakout, potentially setting the stage for a rise.

Ethereum Whales Move To Sell

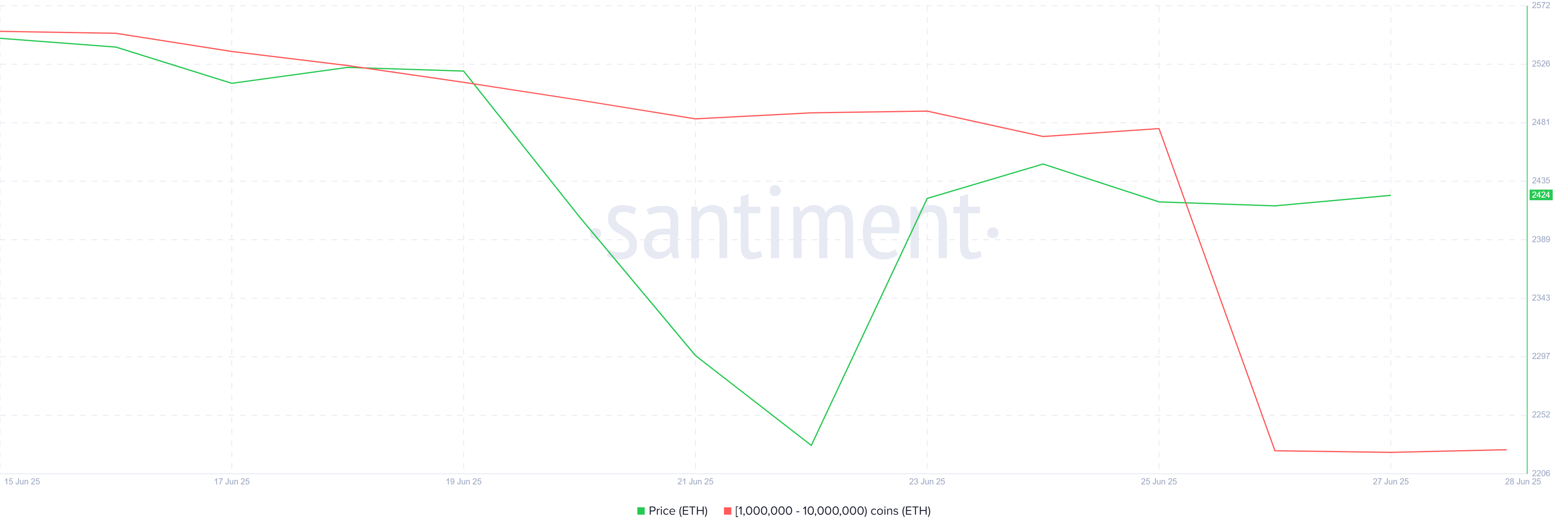

Whale addresses are exhibiting bearish sentiment at the moment, as several large holders have started to liquidate their positions.

Mountains of ETH are being moved by the whales! In the last two days, an eye-watering total of 1.06 million ETH was dumped, with these wallets holding an ETH balance between 1 million and 10 million. That would amount to a huge $2.57 billion being added to the waters of the ocean.

When whales are dumping Ethereum, the price usually tanks; this time, Ethereum is just shrugging its shoulders. This kind of defiance shows us that the market is far tougher than we’d initially thought.

Ethereum Whale Holdings. Source: Santiment

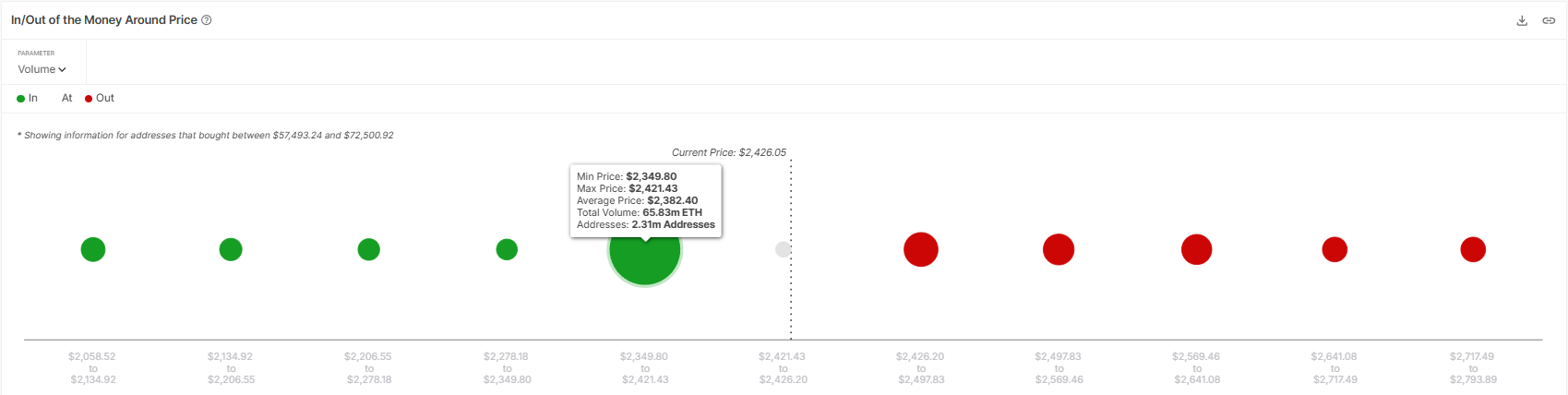

Ethereum is building macro momentum. Just from an IOMAP look, the scene looks interesting as there is an enormous demand wall set up. Imagine what a colossus 65.83 million ETH would mean-worth over $159 billion-$159 billion to be more exact, holding the price. This isn’t support; it’s a forcefield.

These holdings were bought between the $2,349 and $2,421 range, establishing a strong support area.

ETH’s price hangs from a significant ledge. A larger-than-life wall of investors had thrown in their money at this very level, making for a fearsome barrier. We can expect fierce fighting to get through. The bulls are probably digging in their heels, and therefore letting the price crash below this point may prove rather difficult.

The Ethereum bulls’ fortifications are digging deep into the demand zone, making it impassable. The excitement and lust for free fall have vanished, turning this region into a price bungee cord-the last grasp for ETH as it almost hits rock bottom. Another theater of despair sees bears frolicking, except that a wall of the resolute buyer stands firm to keep Ethereum afloat.

“Therefore, expect a firm floor around $2,344. A plunge beneath that could signal a steeper, more menacing slide.”

Ethereum IOMAP. Source: Santiment

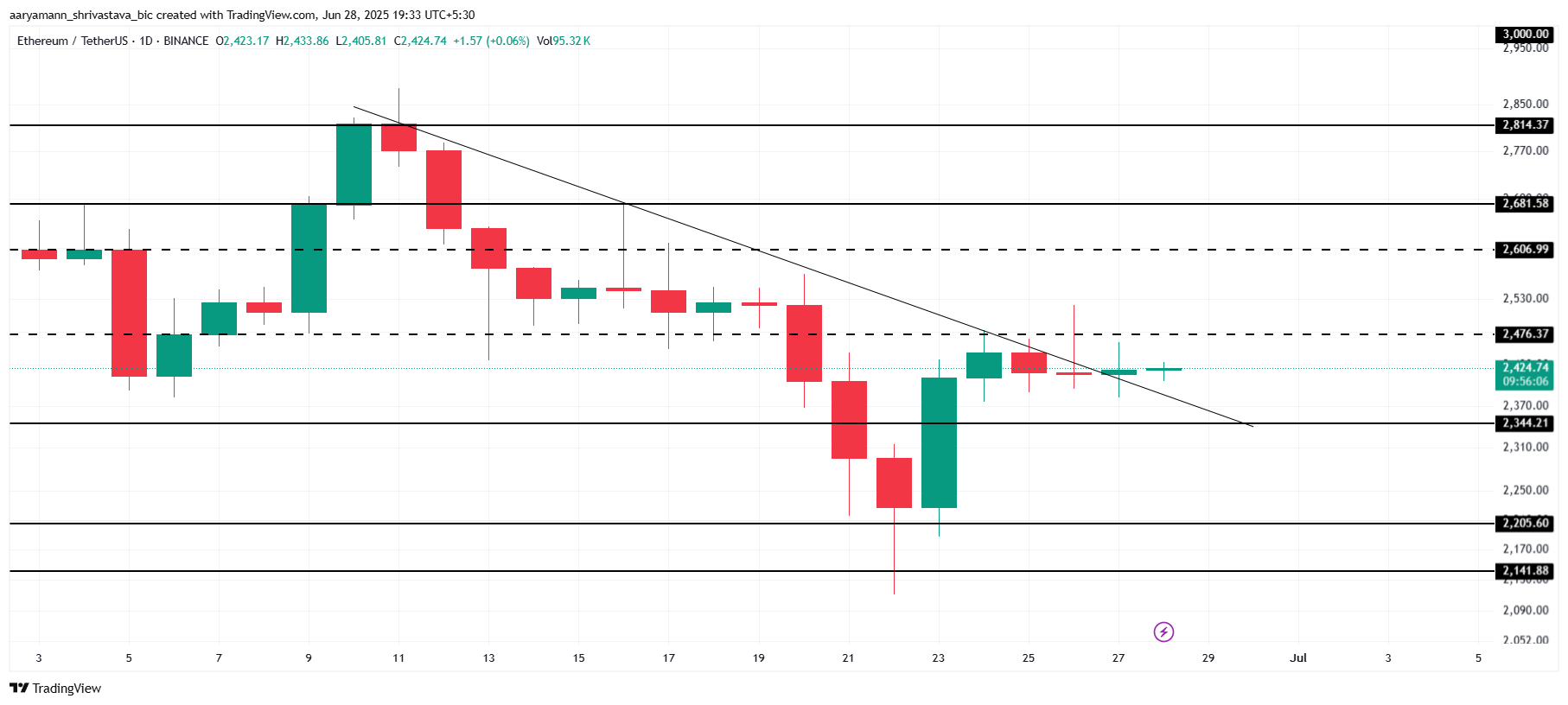

ETH Price Is Consolidating

Ethereum’s price is currently trading at $2,424, just under the critical resistance of $2,476.

The bears shrugged at ETH! After weeks of moving doggedly sideways, ETH finally snapped a three-week raining spell. This coiled spring of consolidation points to one hell of a strong kick ahead.

ETH price is treading the thin line. Will it remain bound by $2,344 and $2,476 in a calm consolidation? Or are the forces gathering their energies to shatter the resistance at $2,476 and propel it into the unknown? A dramatic breakout or a frustrating glitch is in the offing.

A plunge or take-off? That is the question! Plunging or taking off above $2476 could be $2606’s calling. This $2476 region is not considered resistance; rather, it is the launch floor from where breakouts happen, FOMO gets created, and an avalanche of buyers juleps.

ETH Price Analysis. Source: TradingView

Alternatively, if another storm like that brutal downturn of last week takes hold of the market, Ethereum might break past the $2,344 support and downslide towards the somewhat chilling $2,205 abyss.

A drop below this support would invalidate the current bullish thesis, potentially signaling a further decline.

Thanks for reading Ethereum Bears Sold $25 Billion: Will It Impact ETH Price?