Ethereum’s price is coiled like a spring, trapped beneath the $2.5K ceiling. Volatility has vanished, leaving traders in a standstill. Is it poised for a breakout or breakdown? The answer hinges on an impending surge – a rush of buyers ready to catapult it skyward, or a wave of sellers poised to drag it down. The market awaits a spark to ignite the next price explosion.

Ethereum Price Analysis: Technicals

By Shayan

The Daily Chart

ETH is currently exhibiting muted trading activity and compressed volatility just below a critical resistance zone at $2,500.

Bouncing back fiercely from the $2.1K-$2.2K safety net, where the 0.5-0.618 Fibonacci levels stood guard, the price now battles a double threat: the stubborn 200-day moving average and the underside of a broken wedge, a ceiling it once soared above.

This confluence has stalled upward momentum, suggesting that market participants are in equilibrium, with neither buyers nor sellers in control.

ETH teeters on a knife’s edge. A surge of sellers could send it plummeting into a deep correction. But if the bulls seize control and shatter this resistance, prepare for liftoff. A short squeeze could ignite, rocketing the price toward a $2.7K target.

The 4-Hour Chart

ETH’s price action is currently stuck in neutral. Imagine a coiled spring, compressed within a tight range on the lower timeframes. Volatility has vanished, leaving traders guessing which way it will snap. Bulls are clinging to the $2.3K-$2.39K fair value gap as a lifeline, while bears are lurking at the broken wedge’s edge, ready to pounce.

This technical deadlock could soon be resolved, as a breakout from either side is likely to trigger a decisive move.

A chilling head and shoulders pattern is materializing at this critical juncture, flashing a bold warning of an impending bearish storm. If this ominous formation completes, brace for impact as the price could plummet toward the pivotal $2,000 support level.

Sentiment Analysis

By Shayan

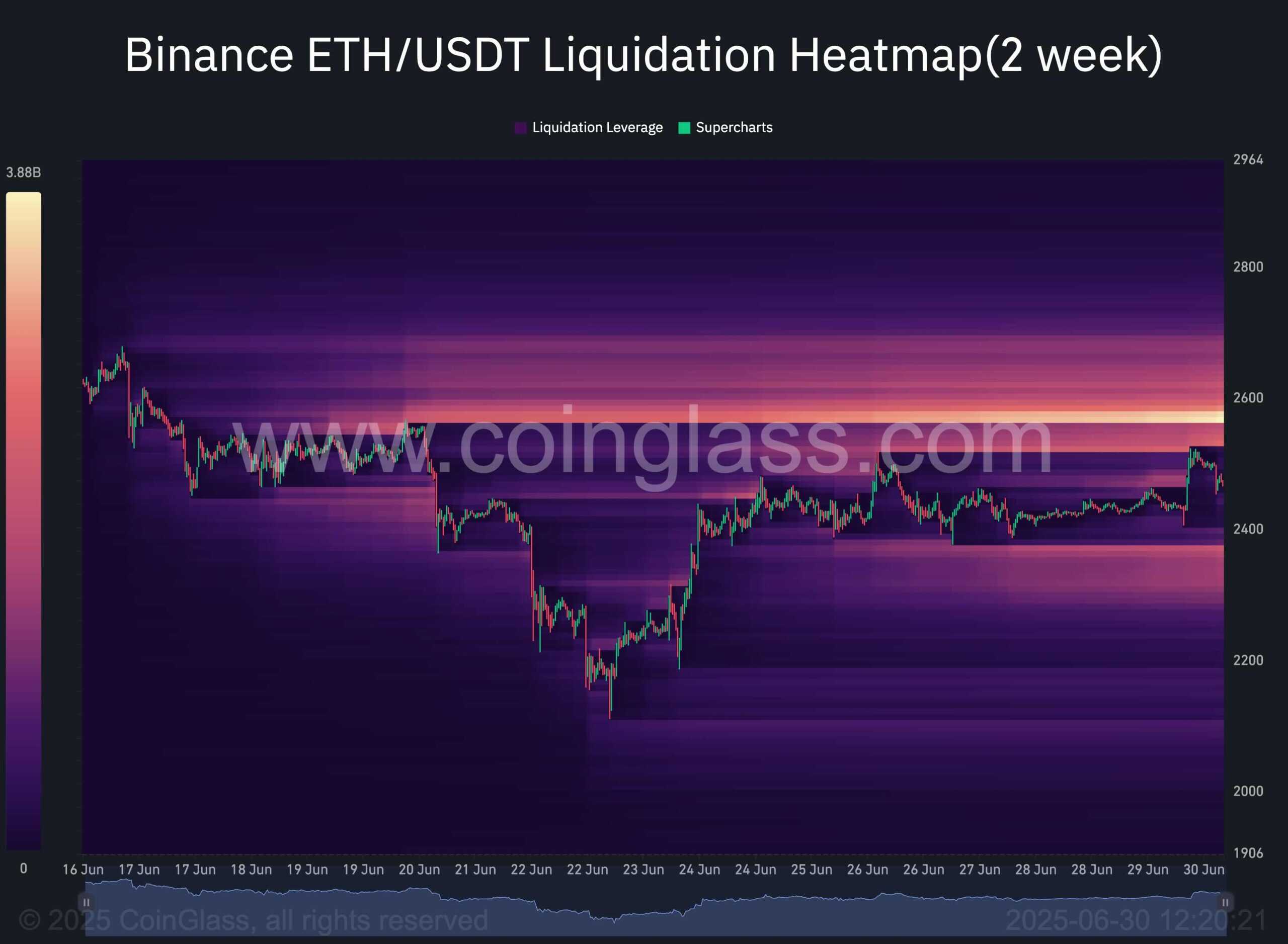

This chart illustrates the Binance Liquidation Heatmap, highlighting areas where significant liquidation events are likely to occur.

Liquidation levels? Think honey pots. Market whales, those apex predators of trading, are drawn to these zones of concentrated stop-losses like moths to a flame. They gorge themselves on the readily available liquidity, triggering a chain reaction that can send prices reeling in the opposite direction, leaving smaller players in their wake.

Ethereum’s price teeters on a knife’s edge. A massive pool of buy orders lurks just above $2,500 – the bait for a potential short squeeze that could send prices skyrocketing. But beware: relentless selling pressure shadows the current price, a constant reminder that bears are circling. $2,500 remains the critical battleground. Will bulls shatter the resistance and ignite a rally? Or will bears slam the door shut, sending Ethereum reeling? The next move will determine Ethereum’s fate.

Thanks for reading Ethereum at Crossroads: $22K or $27K Next This Week? (ETH Price Analysis)