Ethereum is holding strong near $3,428, rising more than 7% day-on-day and breaking past a key resistance level.

Ethereum Poised for Liftoff? On-chain whispers and futures market fervor hint this rally’s just warming up. Dive into exchange reserves, funding rates, and price action, and a tantalizing picture emerges: Ethereum may be primed to surge a breathtaking 32%, targeting $4,541.

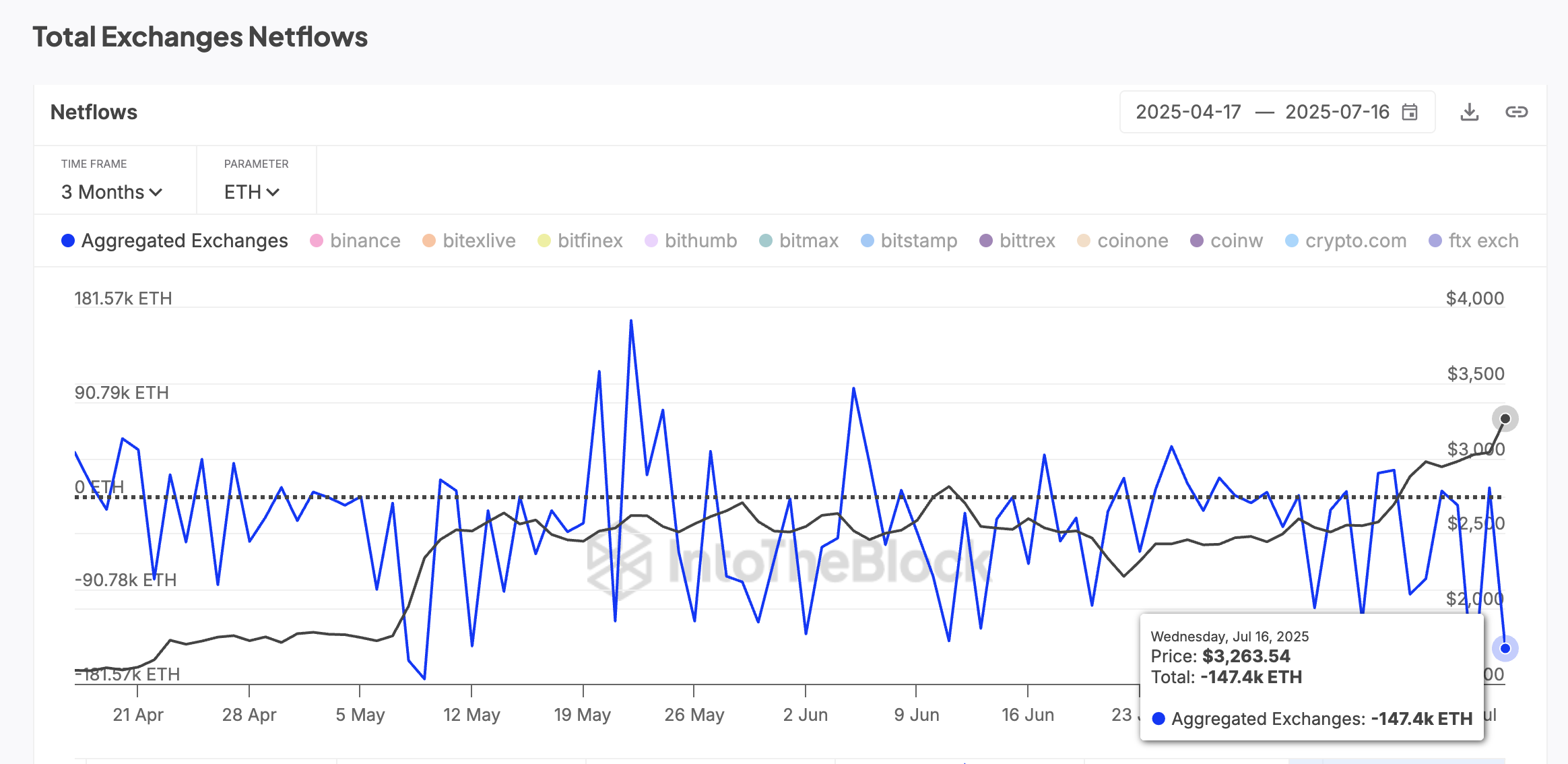

Exchange Reserves and Netflows Show Similar Setup to Last Major Rally

Ethereum’s exchange reserves are flashing a bullish signal. Sitting at 19.7 million ETH on July 16th, they mirror the setup from October 9, 2024 – the eve of a 75% price explosion over the following two months. Back then, similar ETH stockpiles on exchanges, combined with steady withdrawals, ignited a massive rally. Is history about to repeat itself?

History may not repeat, but it often rhymes. The uncanny echo of exchange reserve levels between July and October hints at more than coincidence. In both acts of this market drama, prices were on the rise, suggesting a powerful, underlying connection that demands closer inspection.

Ethereum price and exchange reserves: CryptoQuant

Zooming out, the Ethereum exodus continues. July 16th saw a staggering 147,400 ETH vanish from exchange balances, sucked into the gravity of personal wallets. Is this a digital land grab, fueled by unwavering conviction? The migration suggests a powerful HODL mentality is gripping the Ethereum faithful, as they fortify their positions offline.

ETH price and netflows: IntoTheBlock

Ethereum’s price is holding steady, shrugging off profit-taking like a seasoned boxer. Demand remains robust, a powerful undercurrent buoying its value. The kicker? Exchanges are running lean on ETH, putting a serious lid on potential sell-offs and hinting at further upside.

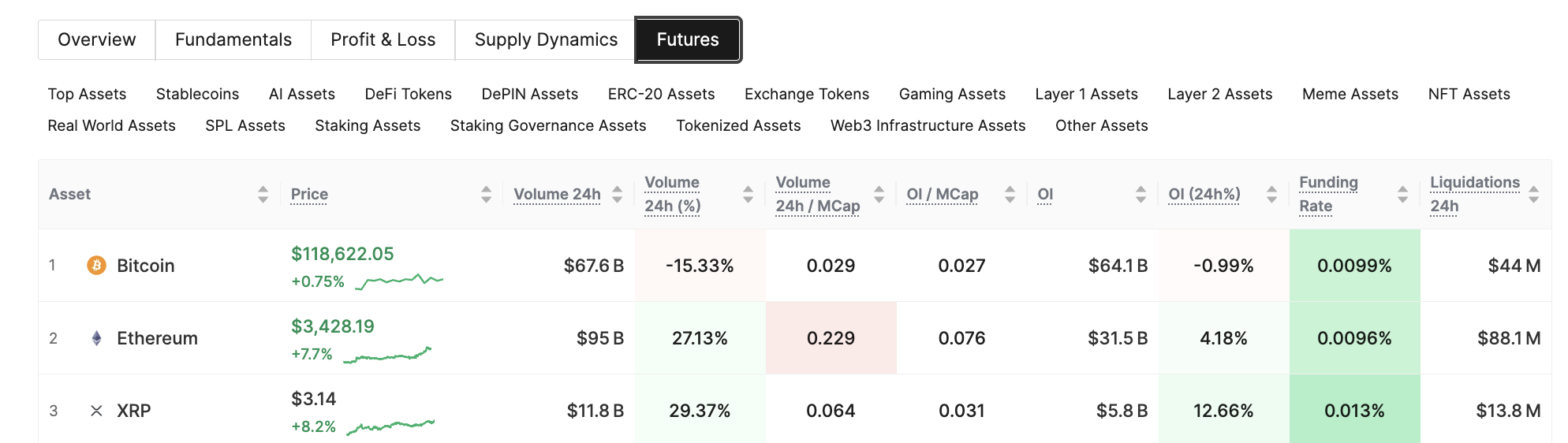

Futures Market Rises, But Sentiment Remains Balanced

Ethereum’s pulse is quickening. Spot markets are flexing, fueled by relentless outflows and dwindling supply. But look closer – the derivatives market is whispering a similar story, a tale of measured optimism. Over the last day, Ethereum futures exploded, trading volume rocketing by 27.13%. Open interest followed suit, jumping 4.18%, a clear signal that traders aren’t just watching the rally, they’re diving in headfirst. New positions are blooming, and the future of Ethereum is looking bright.

ETH Futures data: Glassnode

Now, hold on, because this is where the plot thickens! Despite the spotlight shining brighter than ever, the funding rate stubbornly clings to 0.0096%. Translation? The market isn’t exactly drunk on bullishness. Think of the funding rate as the market’s heartbeat, a pulse that measures sentiment. Right now, it’s whispering, not shouting, with those holding long positions making tiny payments to those betting against them.

“A hovering neutrality? That’s the market whispering, ‘Truce.’ Neither bulls nor bears hold sway, creating fertile ground for rallies to blossom, free from the threat of a sudden squeeze.”

ETH Price Clears Key Resistance; $4,541 Target in Sight

Ethereum’s price is feeling the squeeze. Dwindling exchange reserves, relentless outflows, and stagnant funding are finally taking their toll. But here’s the kicker: ETH just smashed through the $3,298 ceiling, a barrier perfectly aligned with the 0.786 Fibonacci extension. This isn’t just a breakout; it’s a roar from the spot market, a clear signal that on-chain activity is fueling the price surge. Buckle up, things are getting interesting.

Ethereum price analysis: TradingView

Ethereum’s spring awakening, from an April low of $1,388 to a near $2,870 peak, took a breather, dipping to $2,130. Now, Fibonacci whispers hint at the next act in ETH’s bullish drama. Will this projection setup unlock the code to Ethereum’s next price surge?

Ethereum Poised for a Repeat Performance?

Deja vu in the Ethereum markets? Current conditions eerily echo October 2024. Back then, ETH danced at similar reserve levels before exploding in a 75%+ rally. Could history be about to rhyme?

If so, brace yourselves. Ethereum’s next pit stop: $4,541.88, pinpointed by the 1.618 Fibonacci level. That’s a potential 32% surge from today’s prices. But the real fireworks could ignite beyond that.

Conquer $4,541.88, and a full-blown sprint toward a 75% gain – and a shiny new all-time high – becomes a distinct possibility. Is ETH primed to rewrite history? Keep watching.

Ethereum price rise from October 2024 to December 2024: TradingView

The ETH bulls are in control, but their grip hinges on a critical threshold: $3,047. This price point isn’t just a number; it’s the bedrock upon which their optimistic outlook is built, a level fiercely defended over the last seven days.

“The $2,870 line in the sand. Breach it, and the bullish dream crumbles. But a break coupled with surging inflows or a reversal in exchange reserves? That’s a cold shower for bulls, signaling renewed selling pressure that could slam the brakes on any upward surge.”

Thanks for reading Ethereum (ETH) Exchange Reserves Mirror Levels From Previous Rally: $4500 Next?