Ethereum’s Bull Run Breathes: Is the Party Over?

After weeks of a blistering ascent, Ethereum is showing signs of exhaustion as it grapples with resistance around the $3,820 mark. Currently hovering near $3,690 – a 1.9% dip today – ETH has stumbled, losing ground below key VWAP and trendline support. All eyes are now glued to the $3,650-$3,680 zone; a pivotal area that will likely dictate whether ETH regroups for another surge or succumbs to a deeper correction. Buckle up, traders – the next move is critical.

What’s Happening With Ethereum’s Price?

ETH price dynamics (Source: TradingView)

ETH’s bull run just hit a brick wall. After a meteoric climb from $2,800 to almost $3,820, the ascent ended with a sharp technical reversal. The 30-minute chart paints a clear picture: a rising wedge shattered, followed by a bearish kiss goodbye to the broken trendline. The $3,800 ceiling proved too strong, coinciding with a confluence of Fibonacci resistance and a stubborn supply zone, slamming the brakes on ETH’s upward trajectory.

ETH price dynamics (Source: TradingView)

Ethereum’s 1-day chart paints a picture of resilience, clinging to key EMA levels. But a storm cloud gathers: the daily candle slices through the upper Bollinger Band around $3,940 – a band stretched taut by the recent rally. This breach whispers of shrinking volatility for ETH. Keep a close watch: if the $3,650-$3,600 zone crumbles as support, expect the price to cool down.

Why Is The Ethereum Price Going Down Today?

ETH price dynamics (Source: TradingView)

Ethereum’s price is feeling the squeeze, and here’s the double whammy: stubborn ceilings and profit-hungry sharks. Zooming out to the weekly view, ETH bumped its head on a historical hurdle around $3,624 – that’s the 0.786 Fibonacci retracement level marking the fall from the November ’24 peak to April ’25’s low point. This zone has been a brick wall before, and history seems to be repeating. Add to that, leveraged traders are cashing in their chips, amplifying the downward pressure.

ETH price dynamics (Source: TradingView)

Ethereum’s flirting with danger! A dip below $3,750 signals a potential trend shift, confirmed by Smart Money Concept indicators. Bullish hopes were dashed as ETH bounced off the $3,820-$3,940 supply wall – a resistance zone glaringly obvious on daily charts and LuxAlgo alike. Buckle up: Gravity’s pulling us down towards critical demand zones between $3,600 and $3,500.

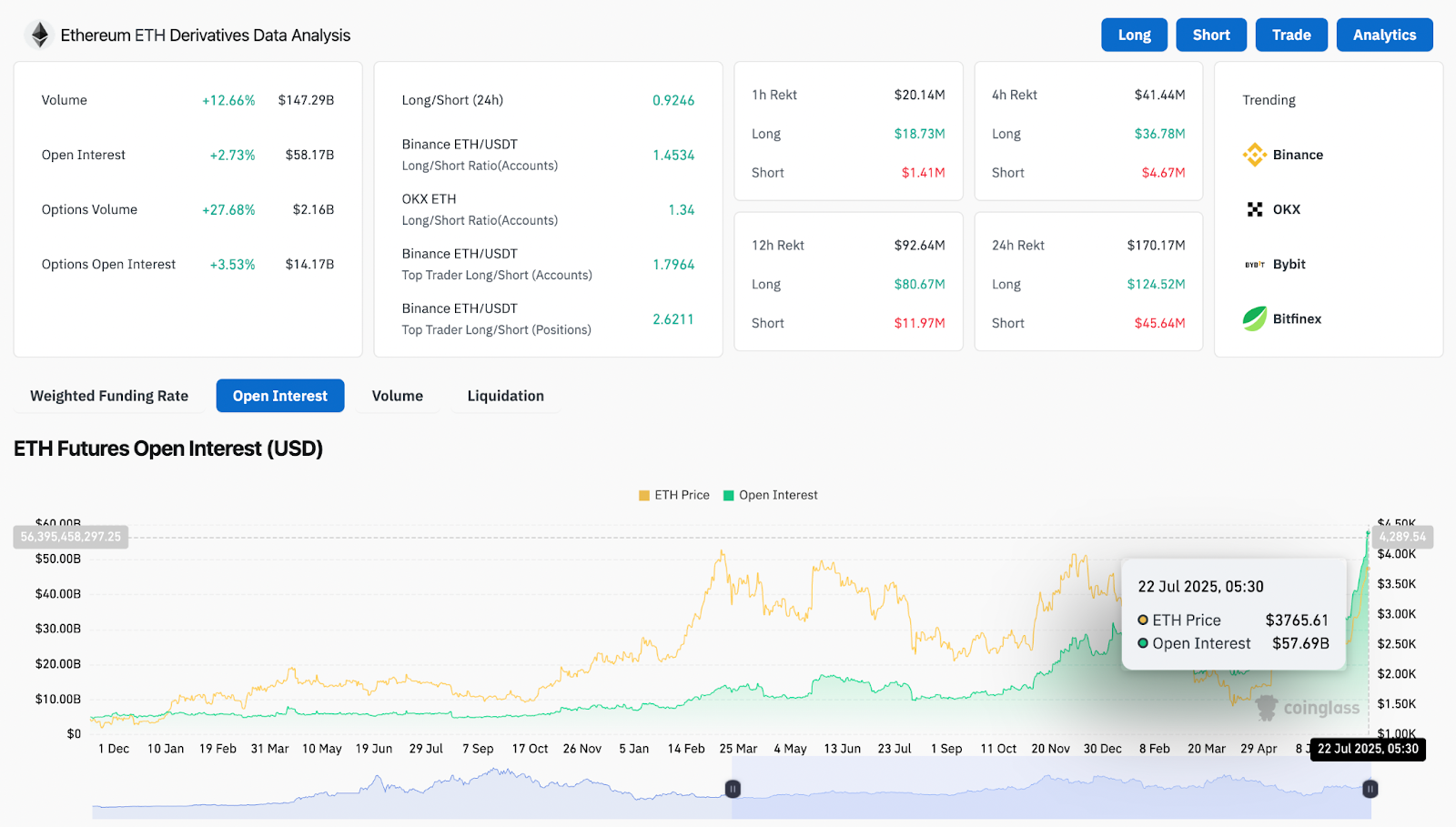

ETH Derivative Analysis (Source: Coinglass)

Ethereum’s price teeters on a knife’s edge, and on-chain whispers hint at a possible downturn. Coinglass data paints a picture: While 24-hour volume surges 12.6% to $147.29 billion, open interest crawls a mere 2.73% higher. This isn’t a surge of new believers; it’s the frantic shuffling of those already in the game, a dance of liquidations and profit-taking. Further fueling the unease, Binance’s top traders are leaning precariously long, their long-to-short ratio a hefty 2.62. Should Ethereum stumble below $3,650, these overextended bulls could face a painful reckoning.

EMA Structure, SAR, and VWAP Levels Confirm Breakdown Potential

ETH’s one-day chart paints a story of ambition meeting gravity. Soaring past the 200 EMA ($2,582) and 100 EMA ($2,625), Ethereum now finds itself drawn back to Earth, specifically, the mid-Bollinger Band around $3,065. Will this level act as a launchpad for another rally, or will it crumble, signaling a deeper descent? Keep a close watch – support levels will be the key to ETH’s next act.

ETH price dynamics (Source: TradingView)

Zooming in on the 30-minute and 4-hour charts reveals a brewing storm. The 4-hour Supertrend holds its ground, refusing to signal outright bearishness, but the Parabolic SAR has already succumbed, flashing red. Each attempt to climb past VWAP is met with fierce rejection, and the price now claws desperately at the lower Bollinger Band. This persistent pressure amplifies the danger: a break here could unleash a rapid descent towards $3,600, or even lower.

If the bears claw past the $3,590 safety net, and then shred through $3,520, brace for impact. These zones once launched rallies, but now stand as the last line of defense. Should sellers breach these fortifications, look out below! The $3,380-$3,400 range, a mid-July oasis of liquidity, becomes the next likely battleground.

ETH Price Prediction: Short-Term Outlook (24H)

Ethereum’s bull run is taking a breather, but don’t panic yet. The price is currently dancing on a knife’s edge. Watch out! A dip below $3,650 could trigger a cascade towards $3,590, even $3,520. If the bears really take charge, brace for a plunge to $3,380 and potentially a revisit to the $3,200 launchpad where this whole rally began. Is this a momentary pullback or the start of something bigger? Keep a close eye on that $3,650 level!

Bulls need to dust off their trampoline and launch above the $3,719 VWAP, then stick the landing between $3,750 and $3,780 to even sniff a retest of $3,820. But it’s not just about muscle; this rally needs rocket fuel – fresh trading volume and a serious attitude adjustment in the derivatives arena.

ETH’s dance on the edge: Parabolic SAR flashes red, VWAP looms large, and bulls are losing their grip. Unless buyers mount a heroic defense of current support, brace for deeper dips.

Ethereum Price Forecast Table: July 23, 2025

| Indicator/Zone | Level / Signal |

| Ethereum price today | $3,690 |

| Resistance 1 | $3,750 |

| Resistance 2 | $3,820 to $3,940 (supply zone top) |

| Support 1 | $3,650 |

| Support 2 | $3,520 |

| VWAP (30-min) | $3,719 (price below, bearish rejection) |

| Parabolic SAR (30-min) | Dots above price (bearish) |

| EMA 20/50/100/200 (1D) | All stacked below (bullish long-term) |

| Bollinger Bands (1D) | Retracing from upper band ($3,940) |

| Fib Resistance (Weekly) | 0.786 at $3,624 (tested, reversed) |

| Open Interest (Coinglass) | $58.17B (+2.73%), high long exposure |

| Binance Top Trader Ratio | 2.6211 (long-heavy, vulnerable) |

Consider this your treasure map to crypto knowledge – packed with insights and education. However, remember, we’re just pointing the way. Coin Edition isn’t a financial advisor, and this isn’t financial advice. Think of us as your friendly guide, not your copilot. Chart your course wisely, because any buried treasure (or sudden squalls) are ultimately your responsibility. Trade safe, and always do your own digging before setting sail!

Thanks for reading Ethereum (ETH) Price Prediction for July 23