Ethereum Price Holds Its Breath Below $2,600: Is a Breakout Brewing?

After last week’s exhilarating surge, Ethereum’s price is now perched precariously just south of $2,600, like a coiled spring ready to unleash. A tense calm has descended as a tight trading range forms, with buyers digging in their heels, desperately defending key moving averages. All eyes are on the volume – will it whisper promises of a breakout above local resistance, or will the bears crash the party? The next move could define Ethereum’s trajectory for the days to come.

What’s Happening With Ethereum’s Price?

ETHUSD price dynamics (Source: TradingView)

Ethereum’s price is currently locked in a tight battle, hovering between $2,560 and $2,590 on the 30-minute and 4-hour charts following a powerful surge on July 6th. Think of it as a tug-of-war, with neither bulls nor bears gaining significant ground. The price is dancing along the Bollinger Bands’ midline, hinting at equilibrium, while crucial support levels like the VWAP and Parabolic SAR, sitting pretty at $2,572 and $2,565, are acting as a safety net. This suggests buyers are still in the game, even if they’re currently taking a breather before the next potential rally.

ETHUSD price dynamics (Source: TradingView)

ETH’s bulls are flexing! Bollinger Bands on the 4-hour chart have widened, giving ETH room to run. Resistance? Not today. Look at the chart: ETH’s dancingabovea bullish stack of EMAs, a fortress of support between $2,541 and $2,497. This isn’t just support; it’s a launchpad. Get ready for liftoff.

Why Ethereum Price Going Up Today?

ETHUSD price dynamics (Source: TradingView)

Ethereum’s price is currently enjoying a gentle nudge upward, fueled by a potent cocktail of positive momentum and clever derivatives plays. Zooming in on the 30-minute chart, the RSI reading of 56.2 tells a story: bulls are present, but not raging. Think controlled optimism. Meanwhile, the MACD is teasing a neutral crossover, hinting at a period of price wrestling rather than a full-blown bearish assault. The market is taking a breather, gathering strength for its next move.

ETHUSD price dynamics (Source: TradingView)

Ethereum’s price action is teasing bulls. Having bounced confidently off the $2,540 mark – a key zone defined by recent structure breaks and internal shifts – ETH is now eyeing a decisive move beyond the $2,600 resistance, where equal highs have formed a tempting target. The stage is set: a successful close above $2,590 could uncork a significant upward surge.

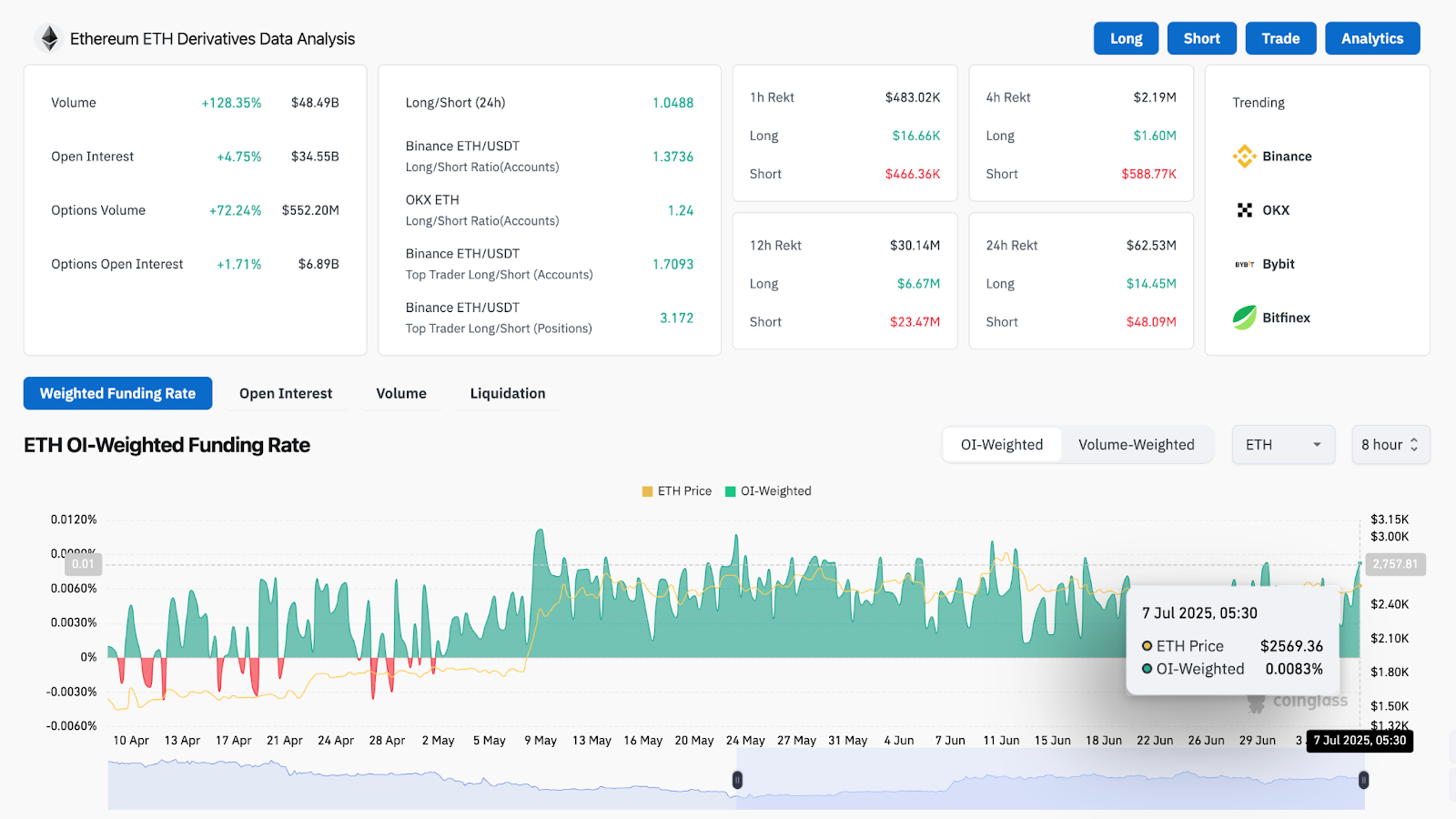

ETH Derivative Analysis (Source: Coinglass)

Ethereum derivatives are exploding! Coinglass reports a staggering 128% surge in ETH trading volume, hitting a massive $48.49B. Open interest is climbing steadily, up nearly 5%, while options traders are piling in, fueling a 72% volume jump. But here’s the kicker: Binance’s top traders are overwhelmingly bullish, with long positions outweighing shorts by a whopping 3.17 to 1. Are they right? Is ETH gearing up for another leg higher? This lopsided ratio suggests a strong consensus – but remember, markets rarely move predictably.

ETH Price Indicators Signal Compression Breakout Potential

ETHUSD price dynamics (Source: TradingView)

Ethereum is building a fortress above a critical line in the sand. ETH is consolidating above the Bull Market Support Band ($2,194–$2,407), a territory it victoriously reclaimed in June. Historically, this zone has been a reliable compass for the overall trend. The fact that the price is now comfortably perched above it adds significant fuel to the existing bullish fire.

ETHUSD price dynamics (Source: TradingView)

ETH dances near $2,582, testing the waters of a rising channel’s support. Fibonacci whispers suggest a pivotal moment: hold this ground, and the path clears for a surge towards $2,697, potentially even a leap to $2,908. The bulls are poised; the question is, will the support hold firm?

ETHUSD price dynamics (Source: TradingView)

Ethereum’s monthly chart paints a high-stakes drama around $2,550, where trendlines clash in a make-or-break moment. Conquer this summit with a decisive monthly close, and ETH blasts off into uncharted territory. First stop: $3,284. Then, eyes locked on the $4,089 oasis of liquidity, promising a lucrative journey for the bold.

ETH Price Prediction: Short-Term Outlook (24H)

Ethereum’s price is coiling like a spring, trapped between $2,565 and $2,595. Intraday bursts are testing the ceiling, hinting at an impending breakout. Clear $2,600 with conviction – fueled by significant volume – and brace for a surge towards $2,697 (R3) and then $2,745, a zone teeming with sidelined sellers eager to unload.

However, should the $2,560 level falter, brace for a potential dip towards the $2,540-$2,514 EMA zone. A breach there could trigger a more significant retreat, targeting the $2,475-$2,500 support pocket – a confluence of past VWAP battlegrounds and mid-Bollinger cushion.

ETH’s price is a coiled spring, ready to launch. Bullish signs are flashing: derivatives are leaning long, and the broader economic picture is improving. Keep a close eye on volume. If ETH explodes past $2,600 with force, expect a powerful surge.

Ethereum Price Forecast Table: July 8, 2025

| Indicator/Zone | Level / Signal |

| Ethereum price today | $2,577 |

| Resistance 1 | $2,600 |

| Resistance 2 | $2,697 (Fibonacci R3) |

| Support 1 | $2,565 (VWAP/SAR support) |

| Support 2 | $2,514 (EMA cluster zone) |

| RSI (30-min) | 56.2 (mild bullish) |

| MACD (30-min) | Neutral crossover |

| Bollinger Bands (4H) | Expanding, mid-band support |

| EMAs (20/50/100/200, 4H) | Bullishly aligned below price |

| SMC Structure | CHoCH/BOS held above $2,540 |

| Derivatives Volume | +128%, Long-dominant bias |

| Bull Market Support Band (1D) | Held above $2,407 |

Investing involves risk. This article is for educational purposes only and shouldn’t be considered financial advice. Coin Edition isn’t liable for any investment decisions made based on this content. Do your own research before diving in!

Thanks for reading Ethereum (ETH) Price Prediction for July 8