Ethereum remains range-bound between the 100-day and 200-day moving averages, signalling a consolidation phase.

The market’s coiled spring is about to unleash. Will it be a bullish surge that paints the coming days green, or a bearish plunge into the red? A definitive break above or below the current stalemate will dictate the next major market narrative, and the whispers suggest the bulls are ready to charge.

ETH Price Analysis: Technicals

By Shayan

The Daily Chart

ETH is currently consolidating between the 100-day and 200-day moving averages, entering a decisive phase in its price action.

Ethereum’s price vaulted past the $2.5K mark, shattering the 200-day moving average that had stubbornly capped its rise for weeks. Now, the real test begins. This isn’t just a dip; it’s a proving ground. If bulls can muster the strength to defend this newly conquered territory, expect ETH to rocket towards the $2.8K resistance, fueled by renewed momentum. A failure to hold, however, could spell trouble.

Ethereum’s trapped. It’s ping-ponging between $2,500 and $2,800. Escape velocity from this zone is the key. Will bulls conquer, cementing a new uptrend? All eyes are glued to the charts, waiting for the breakout.

The 4-Hour Chart

ETH’s spirited climb recently slammed into a brick wall: a bearish order block lurking between $2625 and $2670. Sellers swarmed, turning the tide and shoving the price back towards the familiar embrace of the $2.5K support – a zone etched in ETH’s historical battles.

Ethereum’s fate hangs in the balance as bulls and bears clash at this critical juncture. A successful defense by buyers here could reignite Ethereum’s engines, fueling another assault on the overhead resistance.

However, failure to hold $2.5K could trigger extended consolidation or even a retracement toward lower supports.

Onchain Analysis

By Shayan

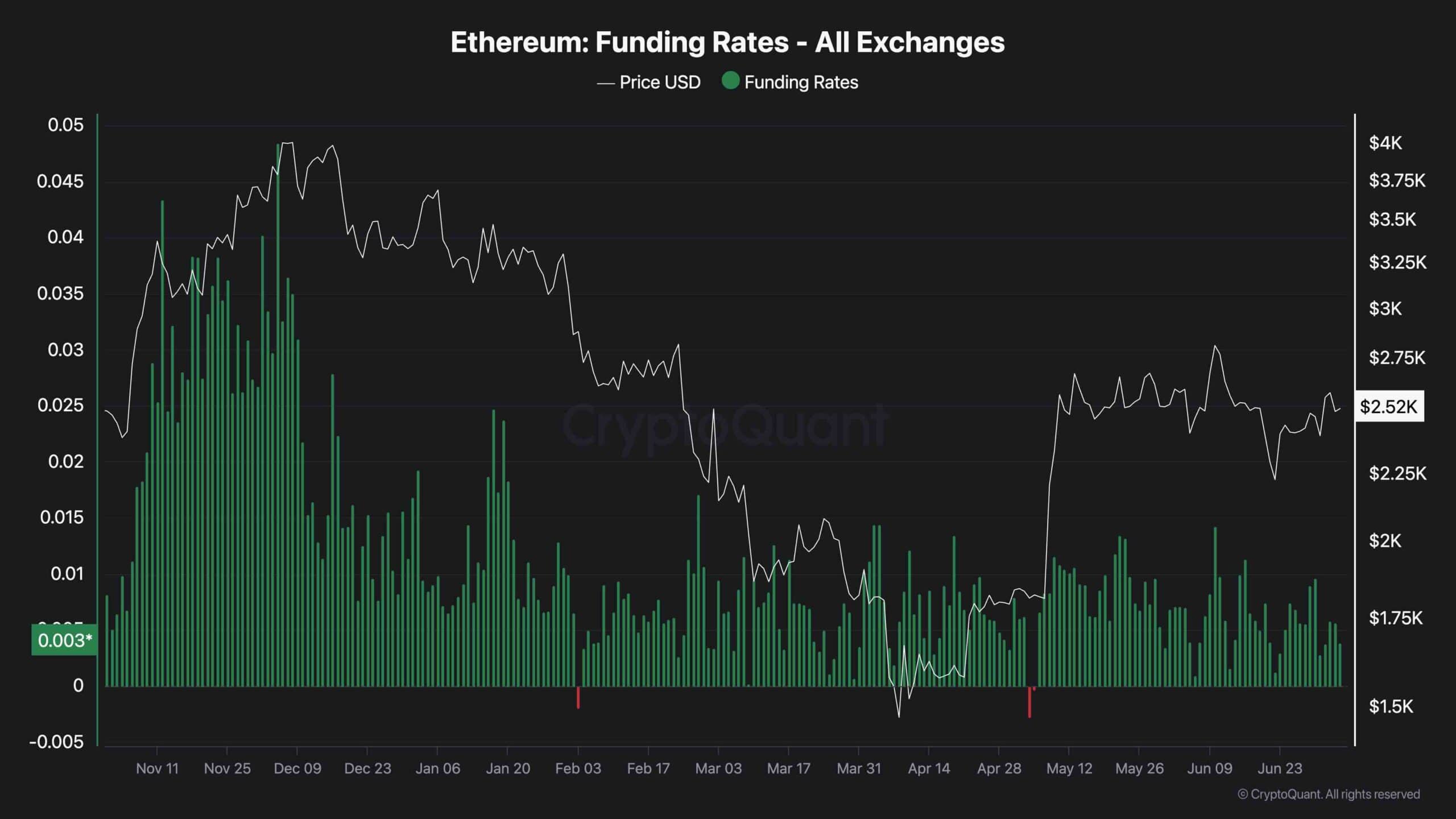

Ethereum futures market: funding rates act as a barometer of bullish fervor. Rising rates signal strong confidence, with traders loading up on ETH in both spot and perpetual markets, fueling the uptrend.

ETH’s funding rates are cooling off as its price dances between the 100-day and 200-day moving averages. Is the bull run taking a breather? Declining rates hint at fading bullish enthusiasm and weary buyers, potentially paving the way for a prolonged period of sideways shuffling.

Ethereum’s stuck in neutral. Cracking $2.6K and then $2.8K needs a derivatives market adrenaline shot – positive funding rates are the key. Until then, expect more sideways shuffling.

Thanks for reading Ethereum Gains 4% This Week What are the Next Targets? ETH Price Analysis