The crypto trader Coinvo asserted recently on X, “ETH is insanely undervalued.” Could there be something in his theory? Delving into the blockchain tells a compelling story. Despite the general price action of ETH lately, accumulation addresses keep stacking sats. Are these smart money investors witnessing something that all of us are missing? On-chain data certainly says “yes.”

Ethereum May Be Due A Rally Soon

An 8% rebound looks promising, but a devastating year still looms large. Hovering somewhere around the $1,700 mark, ETH is still nursing massive wounds; to be precise, these include a 43% loss. Widen the lens, and the picture seems even bleaker: 63.6% down from the all-time high. In contrast, Bitcoin almost seems invincible at about 13.7% down from its all-time high. Is Ethereum about to start its resurgence, or will it continue to remain behind the crypto king?

The shine of Ethereum is starting to fade. While Bitcoin still enjoys the glam of being the first cryptocurrency and the Wall Street crowd, Ethereum languishes facing hungry competitors. Solana, SUI, Polkadot-they are no longer just names but contenders nibbling at Ethereum’s heels in pursuit of smart contract supremacy and thus shadows an alleged erstwhile unshakable dominance. Is the time coming to end the reign of Ethereum?

Forget doom and gloom. The whispers for an Ethereum comeback get louder by the day. Coinvo is at the forefront of the bullish fight. They say ETH is not down; it is a great bargain, and it needs to explode.

Ethereum Hints at Bottom: Is a Bull Run Brewing?

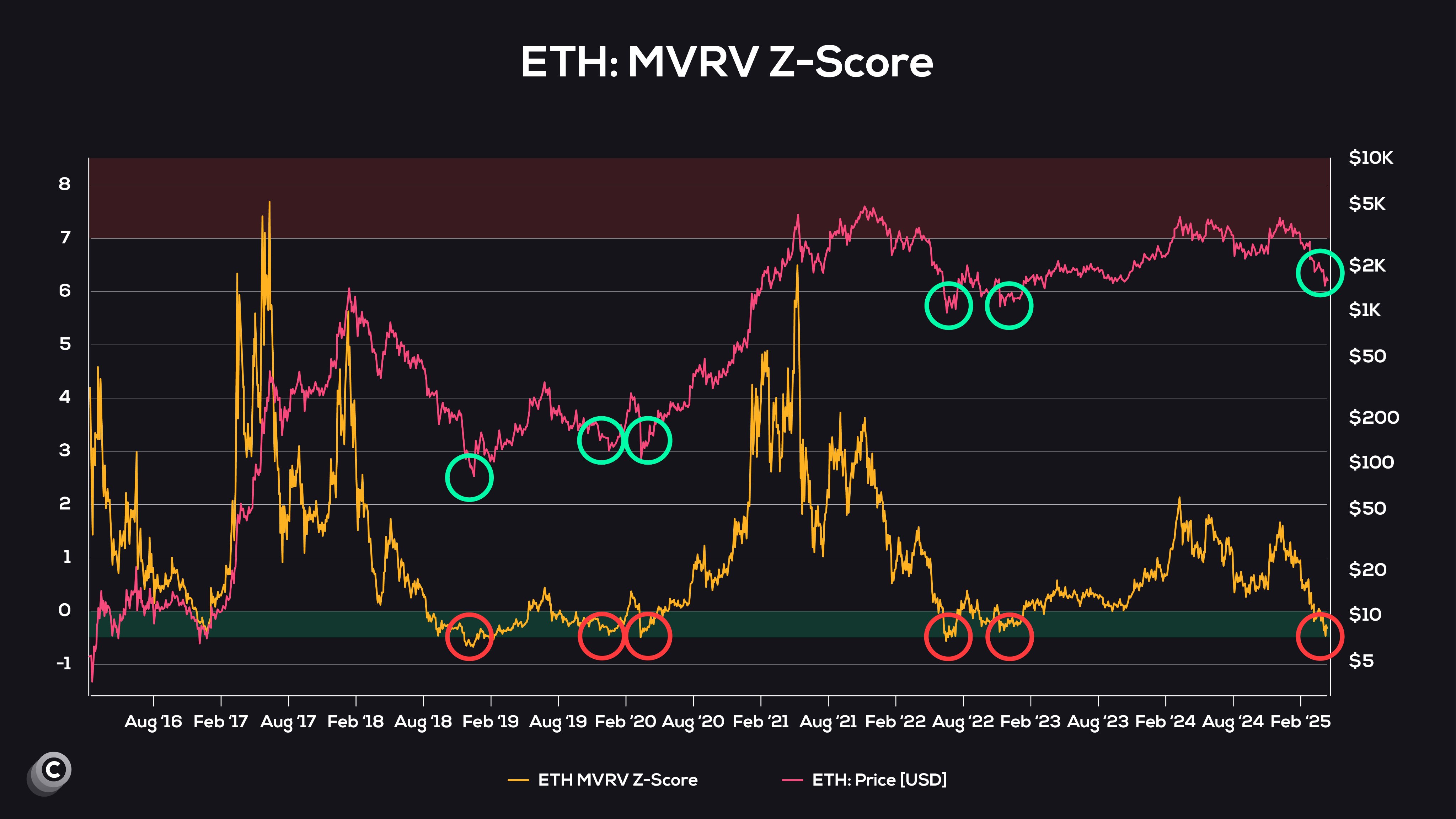

A savvy trader spotted this key signal: Ethereum’s Market Price to Realized Price Value (MVRV) Z-score has entered the green zone. Far from being fancy jargon, when the MVRV Z-score ranges from 0 down to -1, it’s days of market bottoms. Could this be the lull before the bullish storm? Eyes open.

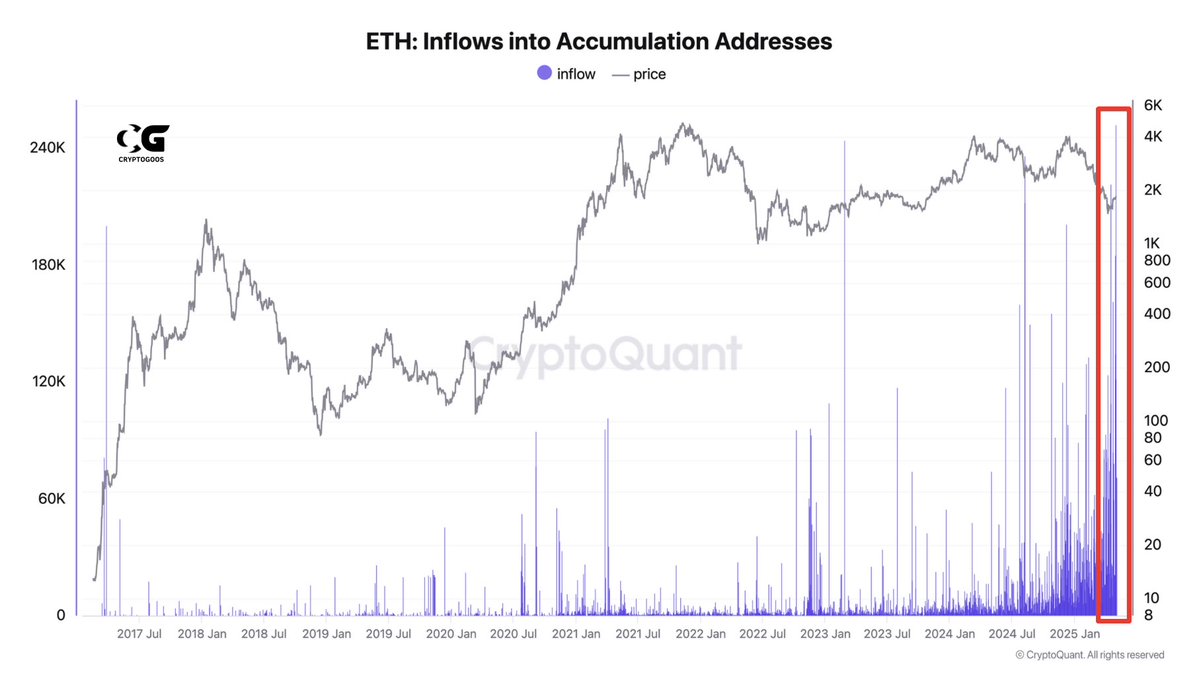

There is some movement within the silent hoarding arena of Ethereum. Analyst CryptoGoos gave X an explosive chart, showing that the accumulation addresses are overflowing and have reached an all-time high in 2025. Is this the calm before the storm in crypto?

ETH sent to accumulation addresses shows the long-term investor putting their money behind the coin rather than abandoning it in times of price volatility. It is a holding-to-the-very-end kind of mentality-Holding is the supreme confidence in the long-term prospects of Ethereum and maybe foreshadowing the surge underneath-the-radar in bullish interest.

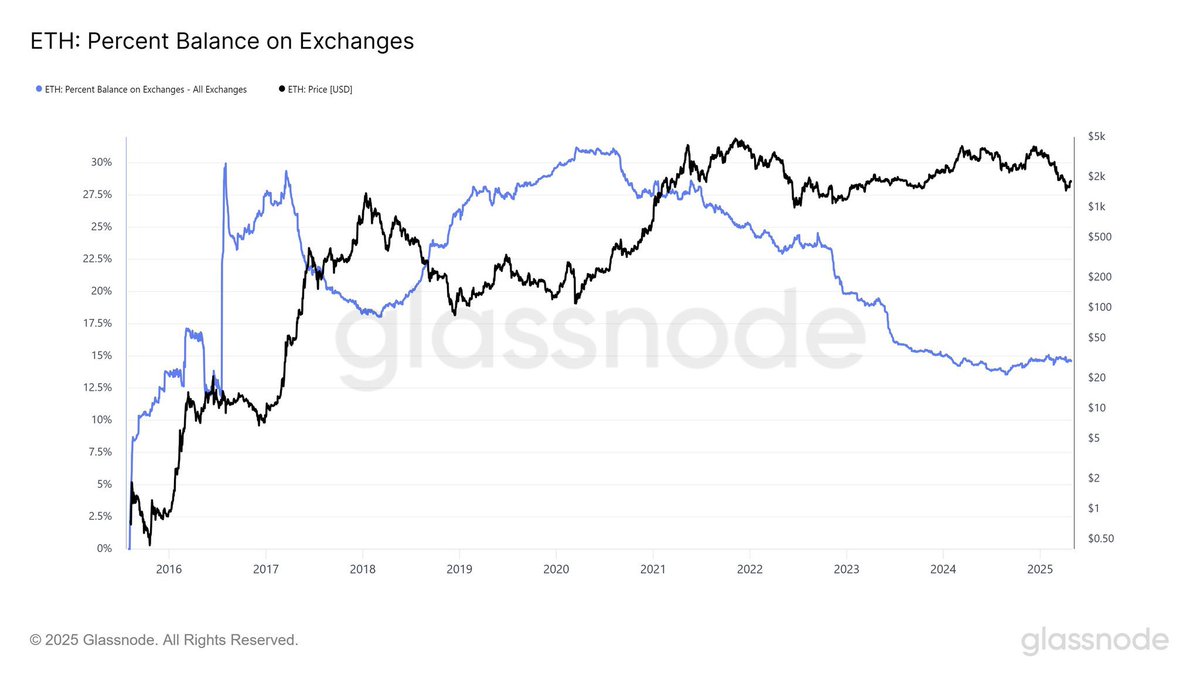

Ethereum’s exchange reserves have fallen to levels not seen in years, CryptoGoos chirped separately. The diminishing supply on the exchanges signals a lack of sellers; thus, they tighten the grip of ETH. Such scarcity murmurings are what might rocket ETH and bring about a short-term price gain.

ETH Holders Not ‘Bullish Enough’

An Ethereum to Bitcoin rally? Crypto Rover, one of the foremost market analysts, finds uncanny similarities in ETH’s moves right now with what BTC did during its spectacular run of 2021. In case history does indeed rhyme, be prepared: Ethereum could be headed to all-time highs much sooner than you imagine.

At $1,754, Ethereum wobbles precariously with a 2.1% dip in the last day as the shade of Trump’s trade tariff threats looms large. Could a global economic chill send ETH down further? Investors are holding their breath.

Featured image created with Unsplash, charts from X and TradingView.com

Thanks for reading Ethereum ‘Insanely Undervalued’ As Accumulation Addresses Keep Stacking – Is A Rally Imminent?