Ethereum’s surge positions it as a top global asset, outpacing giants like Coca-Cola and Alibaba.

Key Takeaways

- Ethereum’s price surged nearly 50% to over $2,700 after the Pectra upgrade.

- Abraxas Capital acquired 211,030 ETH valued at approximately $477 million post-upgrade.

An almost 50% price surge from the $2,700 region was witnessed in Ethereum on whispers of the Pectra upgrade one heck of a recovery that mostly wipes off the so-called “Eric Trump bump.” Data from TradingView now tells us that it is just 6% shy of the level it held when the former President’s son actually spoke out in favor of the digital asset.

On the 3rd of February, the president’s offspring dropped a digital bombshell with his tweet amply endorsing Ethereum: “In my opinion, it’s a great time to add $ETH.” However, he eventually walked the talk back and went into editing mode, removing the mic-drop last line.

The tariff bombshell given by Trump triggered a massive market carnage, and Ether was caught in the crossfire. Over two days of brutal depreciation, specifically the 2nd and the 3rd of February, it made a downward move over 15%, scraping the cool bottom price of $2,300.

The brief rays of sun cannot penetrate the gloomy sky. In the beginning of April 2019, Trump’s tariff bombshell set off a market maelstrom, trading anxieties and inflation fears. The storm surge dragged Ether below $1,400 on April 7, chillingly back down to levels unseen since November before.

While the activation on May 7 was Market’s ignition, there is more at work in kindling the flames. The thaw in US-China relations is fueling bullish whispers, while the bigger and institutional whales are quietly loading up, meaning real legs down this rally.

Ethereum formerly upgraded on its futures. It would be an incredible sky of EIPs that Pectra is raising that could do wonders for the network, making stake easy, wallets smart, and Layer 2s scalable like never before! Pectra is not merely enhancing the surface of Ethereum; it is constructing the foundational platform for its explosive growth.

Ethereum Unleashed: Upgrade Ignites 40% Price Surge!

The platform has leapfrogged, becoming a truly user-friendly staking experience. What used to be clunky interfaces are today elegantly programmable staking strategies. What has the market said? It said, “Go, Ethereum!” Up over 40% in a mere five days after the upgrade.

A whale has today just surfaced in the crypto ocean: A UK-based investment firm, Abraxas Capital, swooped in and bought a staggering 211,030 ETH-worth almost half a billion dollars-in just six days. Arkham Intelligence sets the timeline for the feeding frenzy, giving many an idea of what this institutional giant might do with their new Ethereum booty.

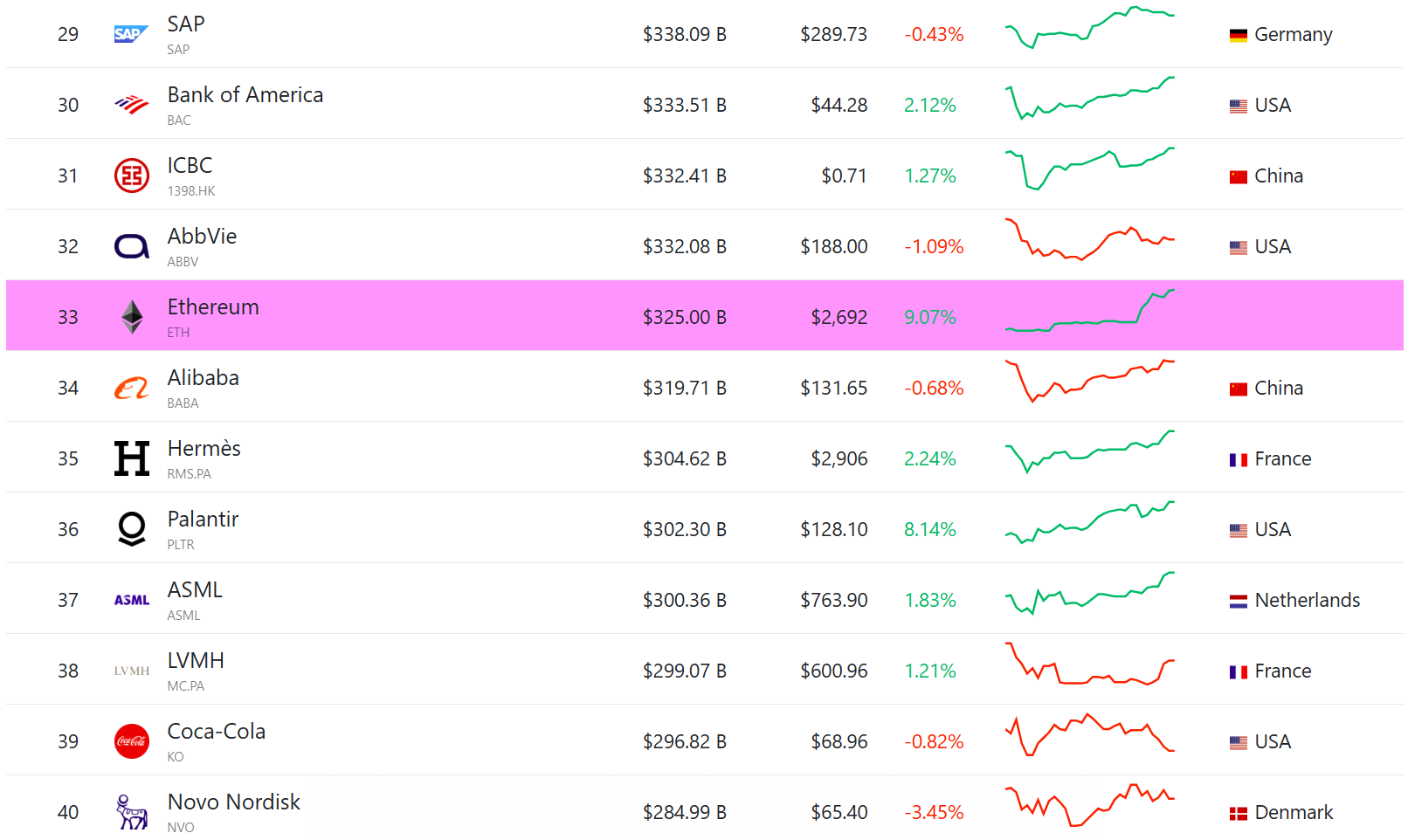

Ethereum surpasses Alibaba and Coca-Cola in market cap

Ethereum’s parabolic upward price surge after Pectra elevated it above such giants as Alibaba and Coca-Cola to become the 33rd largest asset across the world. An unprecedented 40% skyrocket within just five days further establishes bullish confidence in the market.

Ethereum’s market cap now stands at roughly $325 billion, surpassing Coca-Cola’s valuation of around $297 billion and Alibaba’s $320 billion.

For a fleeting moment on Monday, the crypto world held its breath as Ethereum, the second-largest digital asset, gained a staggering market cap of $308 billion, thereby shutting Alibaba out. But the win was short-lived. Like a phoenix, Alibaba’s stock then surged by nearly 6%, thus pushing its market cap beyond $317 billion, thereby announcing its return into glory as per Market Watch data, and leaving Ethereum behind.

Thanks for reading Ethereum price almost doubles post-Pectra upgrade nears Eric Trump promo high