Ethereum price pulled back in the past three days as traders adjust their positions for June, its historically worst month.

Ethereum’s Bull Run Hits a Speed Bump: ETH Plunges Below $2,500

Ethereum is stumbling right now. This is the third straight day recording a downward dive, touching the $2,500 lows. It was about a 10% slice from the recent highs. And while many are calling it a day on ETH, let’s remember this: it is still the king of altcoins. As the rest of the market bleeds, many altcoins are seeing double-digit losses, and Ethereum still manages to prove that it has the strength to outperform. Is this a buying opportunity, or is this just a foretaste of worse days to come?

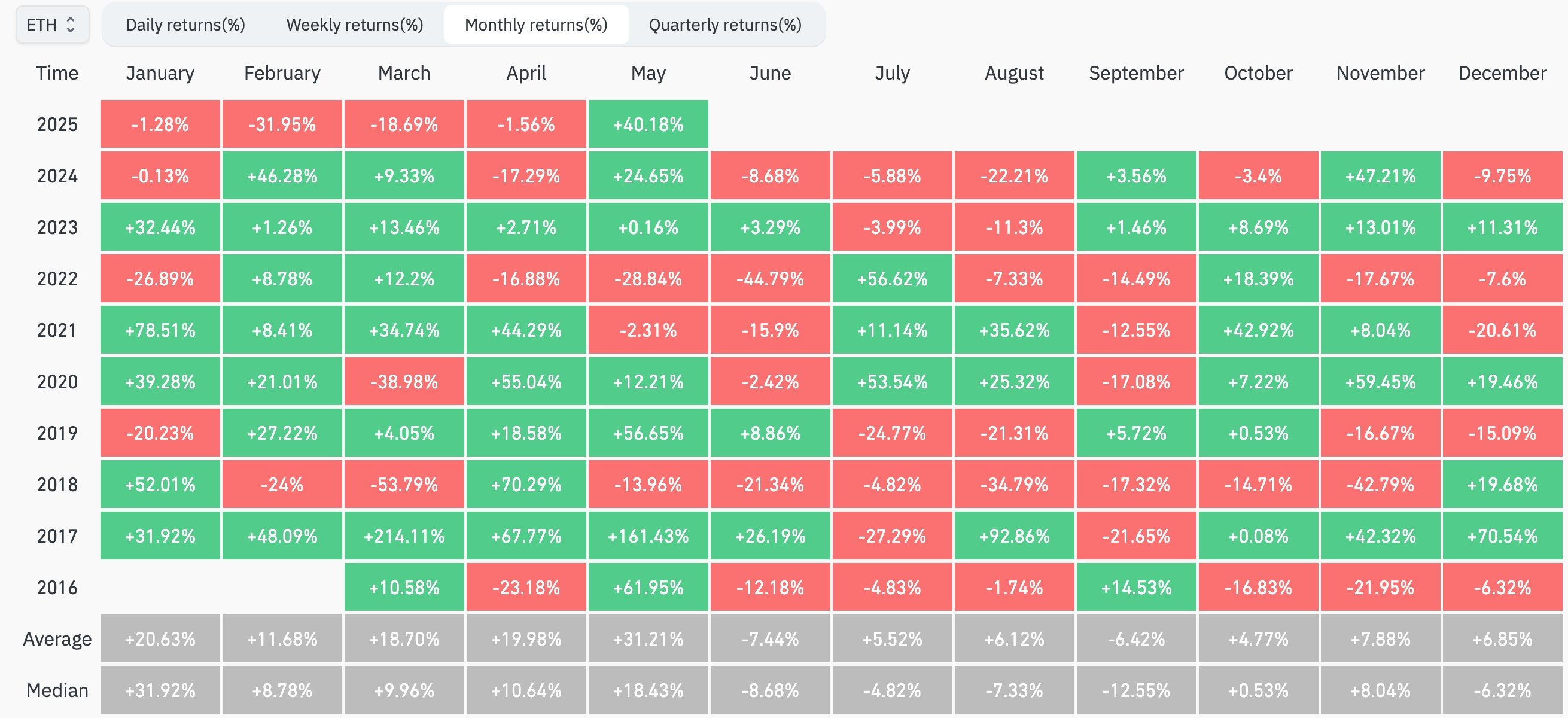

As the summer heats up, Ethereum tends to cool down. History might just prove that June months shall give chills to ETH investors. As per data disclosed by CoinGlass, the average dip since June 2016 has been 7.4 percent, while median returns fell by 8.68 percent. Is the “sell in May and go away” adage poised to haunt Ethereum once again?

ETH monthly returns | Source: CoinGlass

June is also Bitcoin’s (BTC) second-worst-performing month after September, with an average return of minus 0.35%.

So much for predictable patterns! ETH just changed the seasonalities, dropping 18% this March- a curious end to a four-year winning streak. And February? Don’t ask. Its jaw-dropping 31% dip ended its brilliant positive-price rise over the last six years. It is time to rethink those textbook strategies.

You might also like:

Ripple effect: XRP plunge puts whale on brink of $8m liquidation

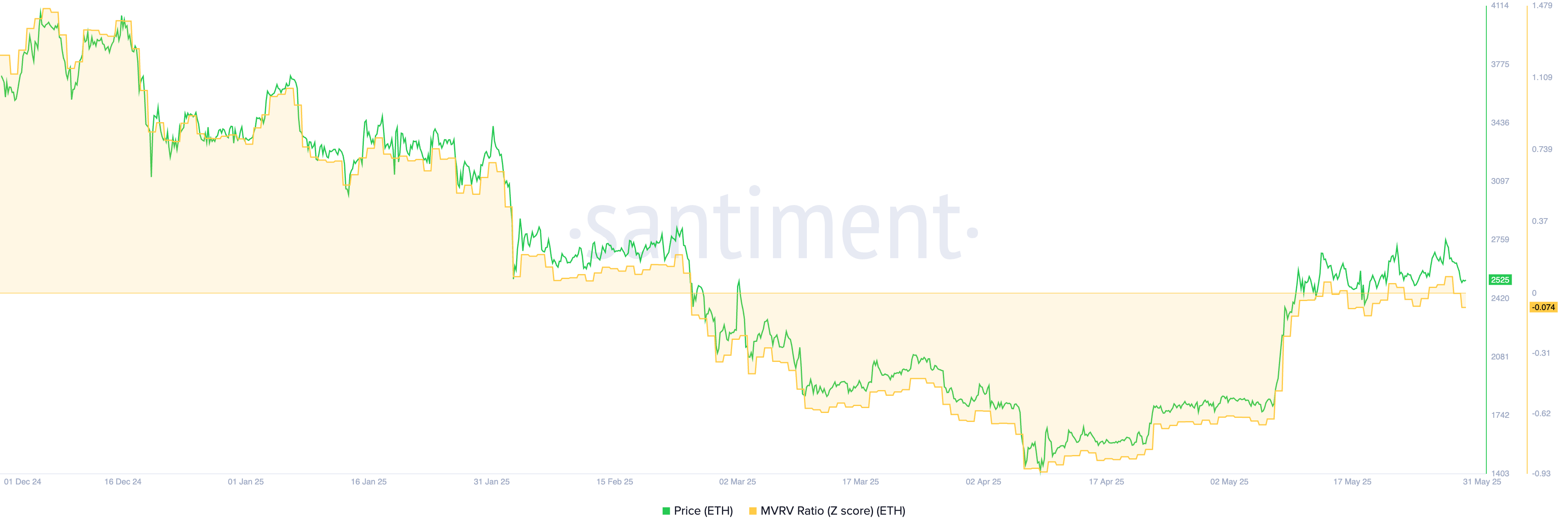

June dawns with Ethereum whispering opportunities. Enter MVRV Ratio. Today it is deeply undervalued at -0.074. It is like an “Ethereal Price Tag” flashing on a clearance sale, with price far below its realized value. Do you want to have a cheap buy?

The Ethereum’s leviathans move stirring. Whale wallets load on cheap ETH, so collectively, their holdings have increased from a low of 103.45 million to a hefty amount of 103.5 million. This feeding frenzy is a great wave of confidence on the buyers’ side, suggesting that the big boys feel this dip is only a passing opportunity. It hardly gets more bullish than this signal.

Ethereum whales and MVRV score | Source: Santiment

Sustaining their ravenous hunger for ETH, a tsunami of capital has been flooding into spot Ethereum ETFs, acting out its tenth-straight day of inflows. Such a bullish rally gave the total inflows a crossing beyond $3 billion, evidencing a major institutional sentiment change.

Ethereum price technical analysis

On April 9th, at $1,385, Ethereum genuinely plummeted to a new low, only to stage an incredible comeback that has seen it rally all the way back to $2,530. It got its footing and jumped over the 50-day MA, while a bullish flag has been slowly unfolding on the daily chart that spells potential way up.

This pattern comprises of a vertical line and a consolidation.

ETH price chart | Source: crypto.news

The brewing breakout from Ethereum. Keep a close eye on the cup and handle formation in the charts, as this is a standard signal of bullish continuation. The cup has generated a 50% drop, which might throw Ethereum towards a tempting target of $4,185. Be alert!

Read more:

Shiba Inu price crashes as whales sell, burn rate slows

Thanks for reading Ethereum price declines with June’s poor track record looming