* Ethereum price today: $2,510 *

- *Key Ethereum on-chain data has remained muted in the past week.*

- *Middle East geopolitical tensions have caused market participants to become less active.*

- *ETH extended its consolidation after finding support at $2,450.*

Ethereum (ETH) held steady around $2,500 in the early Asian session on Thursday following mixed activity across its on-chain data.

* Ethereum on-chain data stays muted following Middle East war tension *

Ethereum’s on-chain life had now entered another calm stage, one of calm-as-contrary-to-previous-agitation. After plunging from perceived peaks of $2,700, price has remained static for six days inside an invisible space of stillness.

Ethereum ETFs: From Red Hot to Lukewarm? After an ebbying debut marked by over $170 million influx, US spot Ethereum ETFs seem to be experiencing a chill. New data, however, suggests a stark slowdown as just $32 million came trickling in over the past two days. Is this a pause, or has the honeymoon for the Ethereum ETF come to an end?

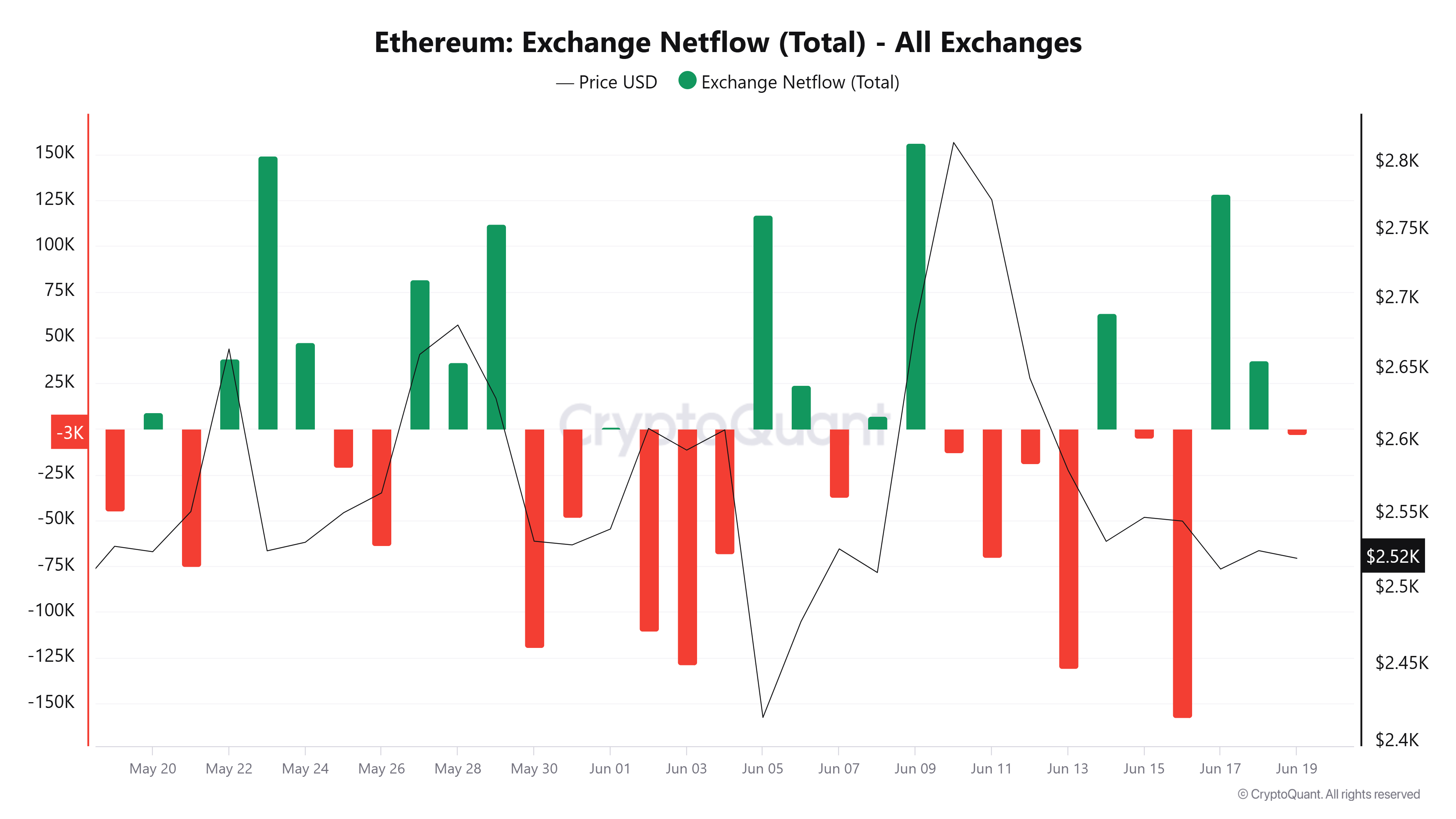

This market is signaling to its investors in confusing ways. Exchange flows have been a choppy sea of inflows and outflows for a market seeking some direction. Ethereum futures follow this indecisiveness: open interest has been flat for nearly a week, showing that traders are afraid of placing large bets.

ETH Exchange Netflows. Source: CryptoQuant

A fragile calm settles upon the market after the US Federal Reserve Midweek Pause, keeping the rates at 4.25 and 4.50%. But, under calm, storm clouds gather: the still-threatening US tariffs and the foreboding drumbeats of resurgence in the Middle East are threatening to break this peace.

Forget oil spills, a real liquidity crisis might be brewing in Middle East. The hype is on a high-stakes power shuffle with the US, Russia, and China jostling to obtain advantages by proxy. QCP analysts warned the investors on Wednesday: brace for this geopolitical chess game to perhaps rewrite the rule book of the region.

“Tehran finds itself cornered. The unthinkable-horrendous disruption or even a full-fledged blockade of the Strait of Hormuz-has pulled out of fantasy thin air onto a very real threat. This critical artery pumping gases and oils across the globe is now vulnerable. Should the flow falter, an inflationary jolt will ripple through the world economy.”

A gripping fear envelops the market. Investors have rushed for the cover, abandoning all things risky. This has manifested in heavy buying of put options on Deribit, the biggest player in crypto options trading. Smart investors are placing their bets on a crash near the $2,450-$2,500 levels. In the name of Amberdata, volatility is screaming: Brace for impact. This range of prices is now under the spotlight.

Just consider put options as your insurance against a crash in the stock market. Purchasing a put gives you therightand not theobligationto sell a particular asset at a pre-stipulated price (known as the strike price) before a defined date. Your expectations are that prices will be falling. If the market dives and the price of the asset goesbelowyour put’s strike price, thenboom, you’re “in the money,” making profits that will increase as the market descends.

“It is like battling persistent inflation; world markets now find themselves in a geopolitically dangerous place, a place variously explained as eclipsing the embers of yesterday’s trade wars. The “Tariff War” has died a quiet death while the spotlight brightens on the exacerbating tensions in the Middle East,” the analyst warned.

* Ethereum Price Forecast: ETH extends consolidation amid weak volumes *

Ethereum markets witnessed a wild 24-hour shootout, with Coinglass reporting futures liquidations amounting to $64.61 million. Bulls got their hands scorched, especially for $35.61 million, whereas the bears, free from any sympathy whatsoever, were slipping for a $29 million loss in the carnage.

There is no movie star in the night market. $2,450 is a fine line in the sand according to the Fibonacci Retracement. Now, bulls have to break free above the 50-day EMA. Upon breaking it, the $2,850 resistance is their next aim. And that is asking for more strength-the surge in bullish volume amid events worthy of an E-category!

ETH/USDT 8-hour chart

Traders might have to watch out for a break below the 38.2% Fibonacci retracement and channel bottom, causing a swift sell-off, dragging ETH within the danger zone of $2,260-$2,110.

Bearish claws are clawing deeper. Both the RSI and Stochastic Oscillators lie below the center line, indicating sellers on the market and the swift extinguishment of any bullish spark. The gradual sideways drift reconfirms the presence of extended downward pressure.

Thanks for reading Ethereum Price Forecast: ETH stays muted as uncertainty from Middle East crisis weighs on market sentiment