- Ethereum price rebounds after retesting its daily support at $3,730, keeping intact the chances to reach $4,000.

- On-chain data shows that ETH whale wallets continue to accumulate ETH tokens, while exchange reserves hit a 9-year low.

- Ether Machine announced on Ethereum’s 10th birthday that its subsidiary has purchased nearly 15,000 ETH.

Ethereum just celebrated a decade in the game, and the party’s just getting started. Fresh off a bounce from a critical support zone, ETH is flexing its muscles, smashing past $3,800 as bullish winds gather force.

Whale wallets are feasting on ETH this July, stockpiling tokens as exchange reserves plummet to levels unseen in nine years. This dwindling supply, coupled with a surge in institutional and corporate crypto appetites, is fueling speculation of a potential price surge. Could ETH be gearing up to blast past $4,000? The data suggests a bullish storm is brewing.

The Ether Machine adds 15,000 ETH

Ethereum’s 10th birthday just got a whole lot richer. The Ether Machine, a leader in ether generation, revealed Wednesday that its subsidiary, The Ether Reserve LLC, went on a monumental shopping spree. Snapping up almost 15,000 ETH at an average of $3,809.9 – a $56 million investment – The Ether Reserve is making a bold statement about its confidence in Ethereum’s future. Was this a calculated gamble, or a sign of things to come? Only time will tell.

The Ether Machine deepens its bet on Ethereum, scooping up more ETH to reach a staggering 334,757 ETH. With a war chest still boasting $407 million, the firm signals its bullish intentions, hinting at further acquisitions in the future.

“Ten years of Ethereum? At The Ether Machine, we’re not just raising a glass; we’re doubling down. Consider it our birthday gift to the future of ether,” declared Andrew Keys, Chairman and Co-Founder, in a statement brimming with celebratory enthusiasm.

“This is just the overture. Our mission: amass, multiply, and champion ETH for the long haul. We see it not merely as a digital currency, but as the very spine of a revolutionary online marketplace.”

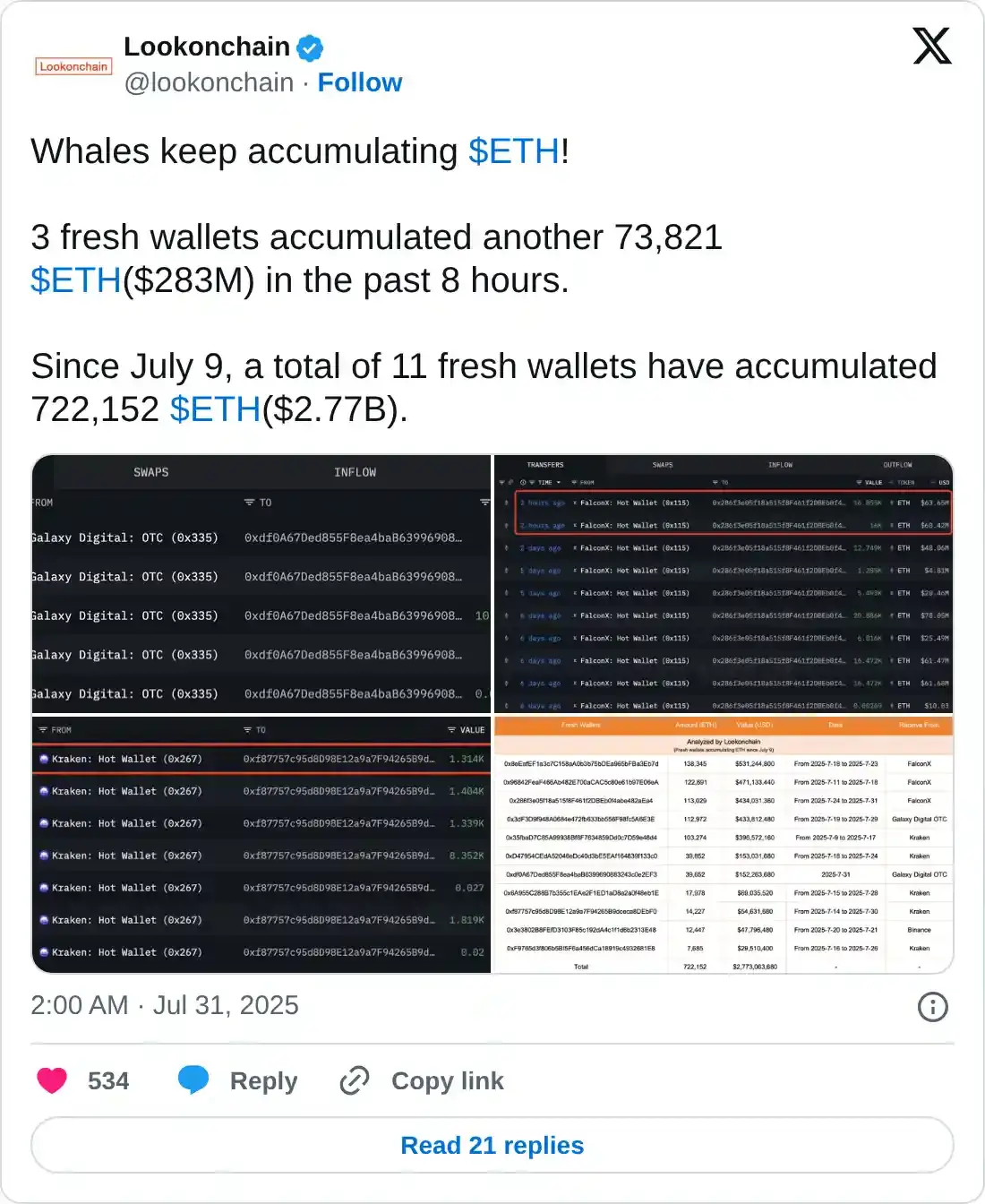

Whales are accumulating ETH tokens

Ethereum Whales are on a Buying Spree! Fresh data reveals a frenzy of accumulation, with three newly-minted wallets scooping up a staggering 73,821 ETH (worth $283 million!) in just the last 8 hours. The feeding frenzy extends back to July 9th, where a total of 11 new wallets have devoured a monstrous 722,152 ETH, valued at a jaw-dropping $2.77 billion. Is this the calm before a massive ETH surge? Keep your eyes peeled!

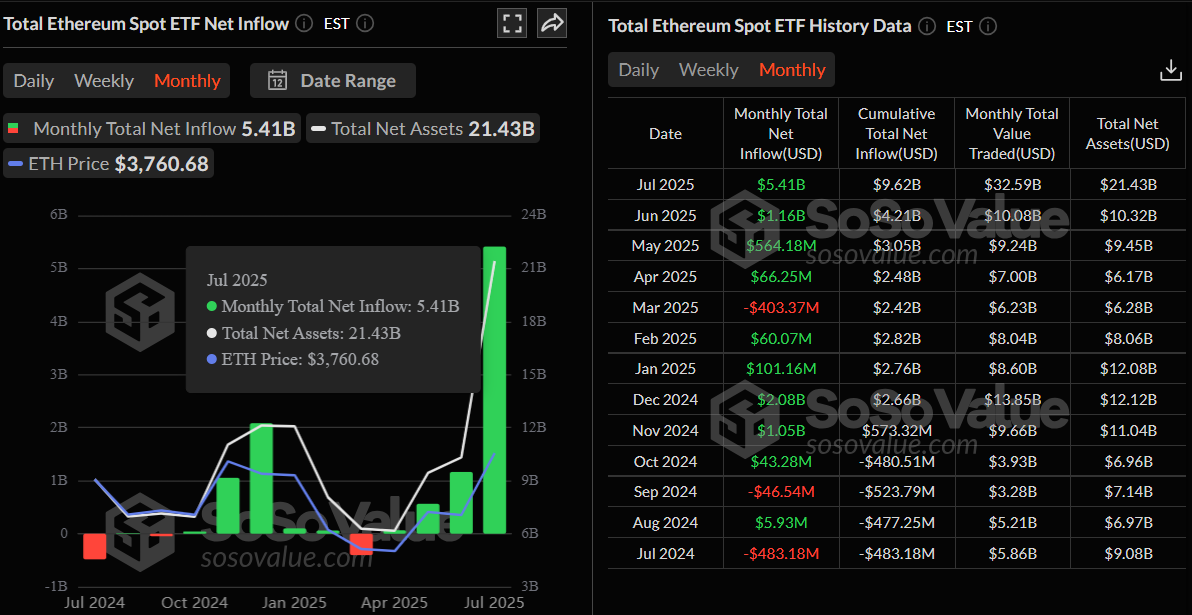

While not as explosive as earlier in July, institutional appetite for Ethereum ETFs continues to simmer. Wednesday saw a respectable $5.79 million trickle into US spot Ethereum ETFs, according to SoSoValue data, extending the winning streak that began July 3rd. Zooming out, July inflows have already hit a staggering $5.14 billion, a new high-water mark since these ETFs first launched.

Total Ethereum spot ETF net inflow daily chart. Source: SoSoValue

Total Ethereum spot ETF net inflow monthly chart. Source: SoSoValue

Ethereum exchange reserve drops to a 9-year low

Ethereum’s Exchange Exodus: A Bullish Signal?

CryptoQuant data reveals a dramatic drain from ETH exchange reserves, plummeting to a 2016 low of 18.7 million ETH as of Thursday. This exodus, accelerating since early July 2024, points to a significant shift in investor sentiment. Fewer ETH on exchanges translates to lighter selling pressure and a shrinking supply, potentially fueling the next surge. Are we witnessing the calm before the storm?

A drop in reserve also signals an increasing scarcity of coins, an occurrence typically associated with bullish market movements.

Ethereum Exchange Reserve– All Exchanges chart. Source: CryptoQuant

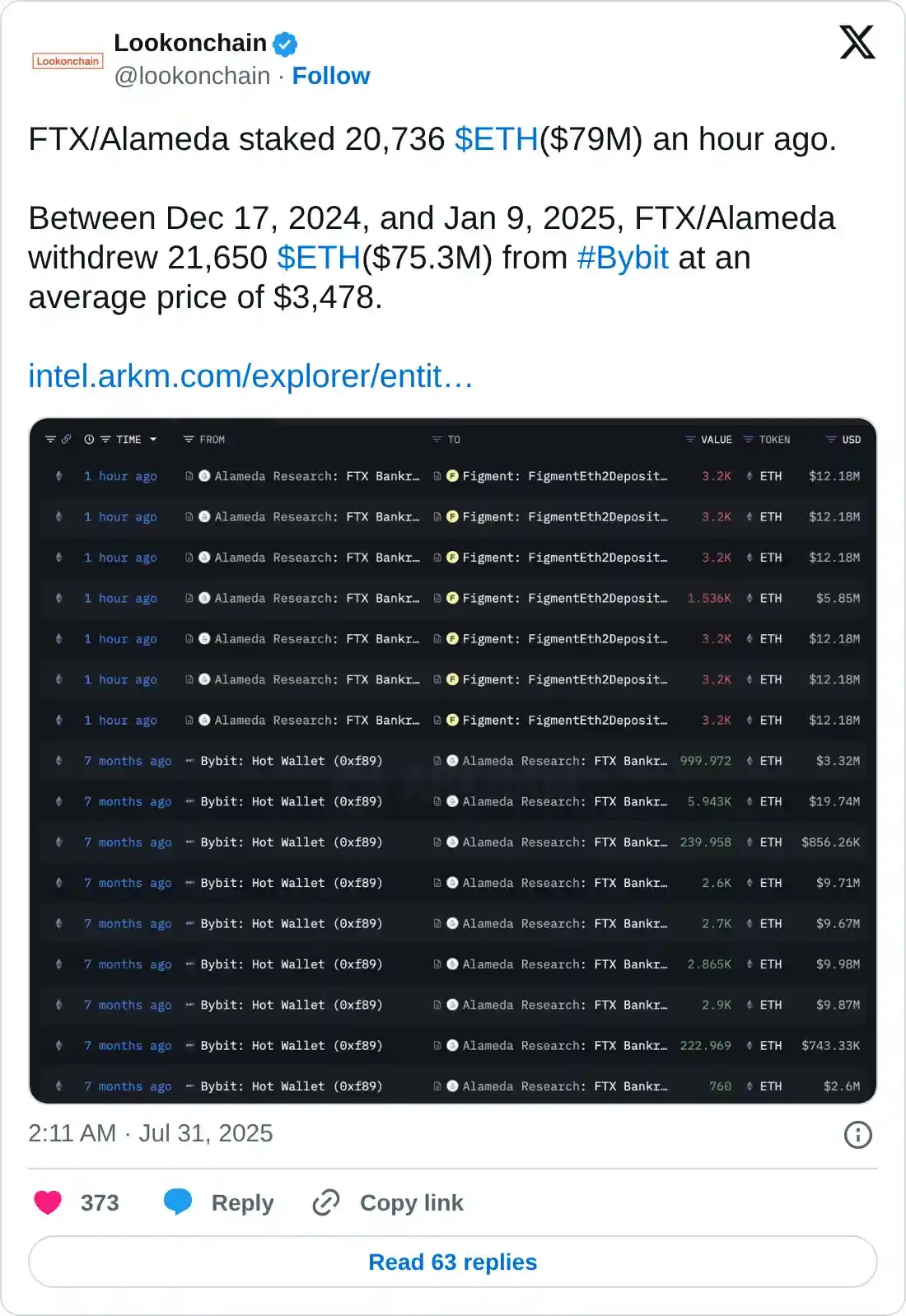

While reserves dwindle, crypto sleuths at Lookonchain spotted FTX/Alameda making a bold move on Thursday, staking a hefty 20,736 ETH, valued at a cool $79 million. But the plot thickens! Digging deeper into their blockchain activity reveals a calculated maneuver between mid-December and early January: FTX/Alameda quietly siphoned off 21,650 ETH from Bybit, effectively tightening supply and subtly easing the downward pressure on the coin’s price. Is this a strategic play, or a desperate gamble?

Ethereum Price Forecast: ETH bulls aiming for levels above $4,000

Ethereum’s ascent stalled just shy of the $4,000 peak on Monday, triggering a ripple effect that pulled the price back to $3,730. Bulls regrouped on Tuesday, using this level as a springboard. Wednesday saw a resurgence, and as Thursday unfolds, ETH is battling its way back, clawing above the $3,800 mark.

Ethereum teeters on a knife’s edge at $3,730. A successful defense here could unleash a bullish surge, propelling ETH toward the coveted $4,000 mark. Shatter that psychological barrier, and the bulls might set their sights on a more ambitious target: revisiting the $4,488 peak from December 2021.

The RSI screams “overbought” at 77 on the daily chart, flashing a warning sign above the critical 70 mark. Adding fuel to the fire, Wednesday’s MACD flashed a bearish crossover, hinting at a potential shift in momentum. Is this the calm before a downward storm? Traders, batten down the hatches and watch closely.

ETH/USDT daily chart

ETH’s holding its breath above $3,730. Lose that daily life raft, and we could see a swift descent to $3,500.

Thanks for reading Ethereum Price Forecast: ETH ticks up as whales buy exchange reserves hit 9-year low