* Ethereum price today: $1,770 *

Open interest in Ethereum saw an increase of 4%, but don’t get carried away. The Taker Buy Sell Ratio has nosedived, bringing a glimmering warning: The bears are tightening their grip on ETH.

- *However, spot investors maintained a bullish bias ahead of the Pectra upgrade, sparking 63,690 ETH in exchange net outflows.* ETH attempting to perch on the edge of a precipice. Failure to retake the symmetrical triangle and rejection from the 14-day EMA and 50-day SMA could see things collapsing down to $1,688. Is there any resistance left in the hands of the bulls? Or are we looking at the initiation of a sharp correction?

Ethereum Wobbles as Pectra Looms: Is a Sell-Off Coming?

Do 2 percent down on Tuesday, another wave of selling occurred, with the nervousness in the air before the Pectra upgrade hit within the next 24 hours. Spot traders are still hopeful, but an upward surge of short contracts by futures traders has raised concerns that they might be preparing for a “sell-the-news” event. Is this just a temporary rumble, or will it knock the floor down into a deep correction?

* Ethereum short traders mount pressure ahead of Pectra upgrade *

Ethereum’s open interest increased nearly 3% in the past 24 hours despite its price dropping by 2%, per Coinglass data.

If you imagine the tug-of-war with the rope being the price of a stock, the open interest becomes the crowd watching it, with each person representing an unsettled contract. The price is being pulled down; hence more and more people are rushing to join the down side (i.e., short positions). With this surge in new participants, and thus rising open interest, the momentum to the downside gets confirmed, suggesting a fairly strong bearish movement.

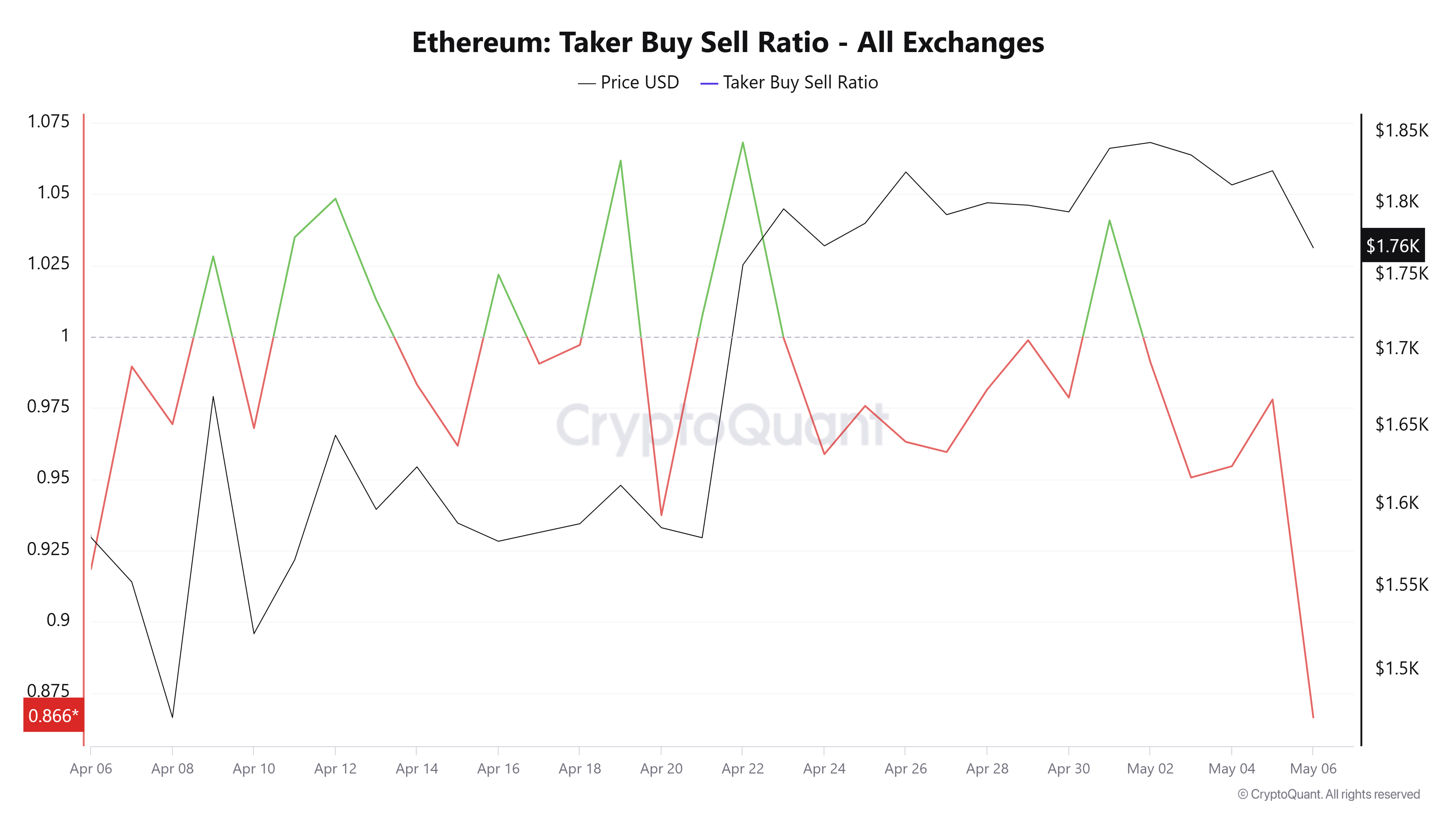

ETH’s Taker Buy Sell Ratio just hit a chilling low of 0.866, something that has not been witnessed outside of February 2. Imagine this ratio being an old market mood ring, measuring the appetite of traders in the perpetuals market. Now, it’s shouting “bearish.” Below 1? It means the sellers have it on their side, and the buyers are fast losing heart.

ETH Taker Buy Sell Ratio. Source: CryptoQuant

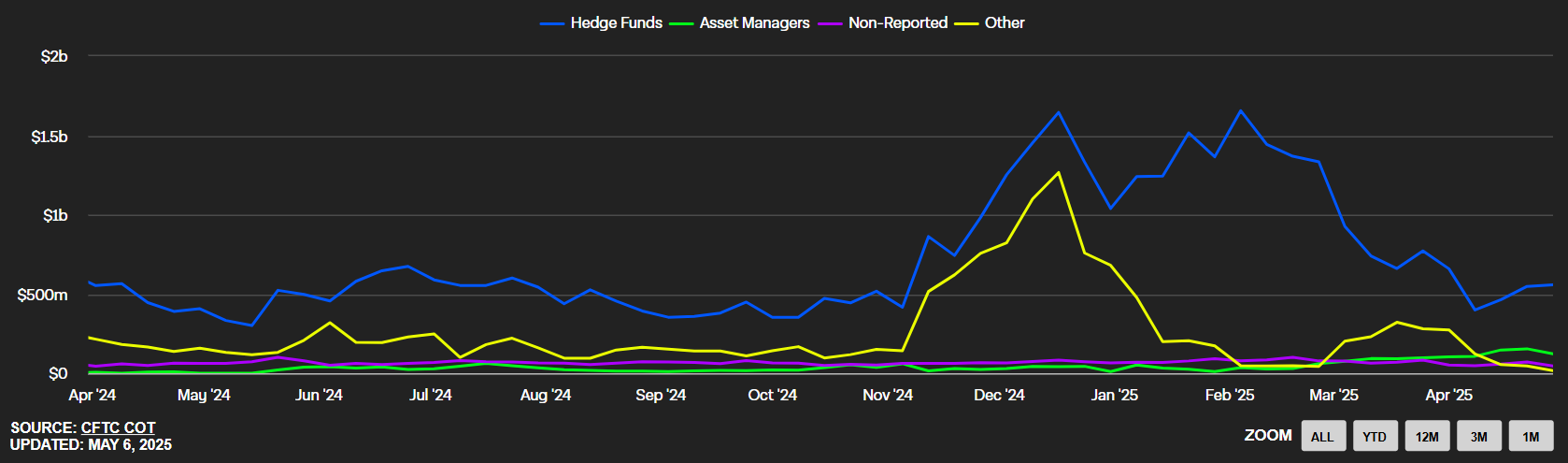

The open interest painted a mixed picture for ETH. Exchanges largely experienced a surge, while among the major ones, CME experienced a 5% dip, signaling a mass exodus from the exchange. Asset managers and retailers led the retreat, unwinding long positions, which indicates a suspicion of institutional sentiment going cold.

Since mid April, a very shadow has been cast over the Ethereum landscape with hedge funds hazily building short positions on the CME. This counter-current is established even as Ether spot ETFs from the US continue to garner investment, indicating a resurgence of that lucrative yet risky ETH basis trade among sophistigated operators. Is this a straight-up short bet on future gains or just clever arbitrage?

ETH CME Futures (Shorts). Source: The Block

After a price decrease, the bulls held in their heels, effectuating the great withdrawal from the exchanges. CryptoQuant declares an enormous 63,690 ETH having been whisked away in the last 24 hours- an unruly signal in the leftover bad news for the price.

Pectra upgrade is set to launch within a day and has been pushing bulls to a frenzy in the spot market. It is not just another update, but a seismic shift in the Layer 1 environment. Imagine double the blobspace per block, thus doubling data ingress. Astonishing staking opportunities are now within reach for whales, who can lock in 2048 ETH. Brace yourself for a smart wallet experience where transactions can be sponsored, gas can be paid to any ERC-20 token, transactions can be batched, and wallet recovery is a breeze. Pectra isn’t coming; rather, it is set to unleash an outright surge of options.

* Ethereum Price Forecast: ETH plunges below key technical levels, eyes $1,688 support *

Mass liquidation of $50.93 million hit the Ethereum markets within the past 24 hours, according to Coinglass, sending the day into flames for leveraged traders. With longs taking the whole brunt of the liquidation, coming up to $39.78 million of the overall destruction, shorts, too, suffered heavy losses, standing at $11.15 million in the mayhem.

It was an edge-of-a-knife kind of moment for Ethereum, suddenly losing its balance under $1,800 to witness the shattering of several vital technical lifelines like the 14-day EMA, 50-day SMA, and the symmetrical triangle support. Bears stepped in with glee at the sight of this weakness, but the bulls, bruised yet not defeated, are fighting to get some footing back. A decisive daily close beneath these crucial criteria along with the triangle’s lower boundary would set sales cascading towards the support region at $1,688. The fight for Ethereum’s fate is almost now.

ETH/USDT daily chart

The technical indicators are casting an ominous shadow: the Relative Strength Index teetering precariously on top of neutrality while the Stochastic Oscillator plunged from overbought status back below zero. The calm before the storm, or are the bears already flexing their claws?

A daily candlestick close above the symmetrical triangle will invalidate the thesis.

Share:

Cryptos feed

Thanks for reading Ethereum Price Forecast: Short sellers dominate ETH futures but spot investors remain bullish ahead of Pectra upgrade