Ethereum has experienced a week-long rally, pushing its price closer to the anticipated $3,000 milestone.

However, this surge faces resistance from notable investors selling, putting pressure on the crypto asset’s continued upward momentum.

Ethereum Investors Increase Selling Pressure

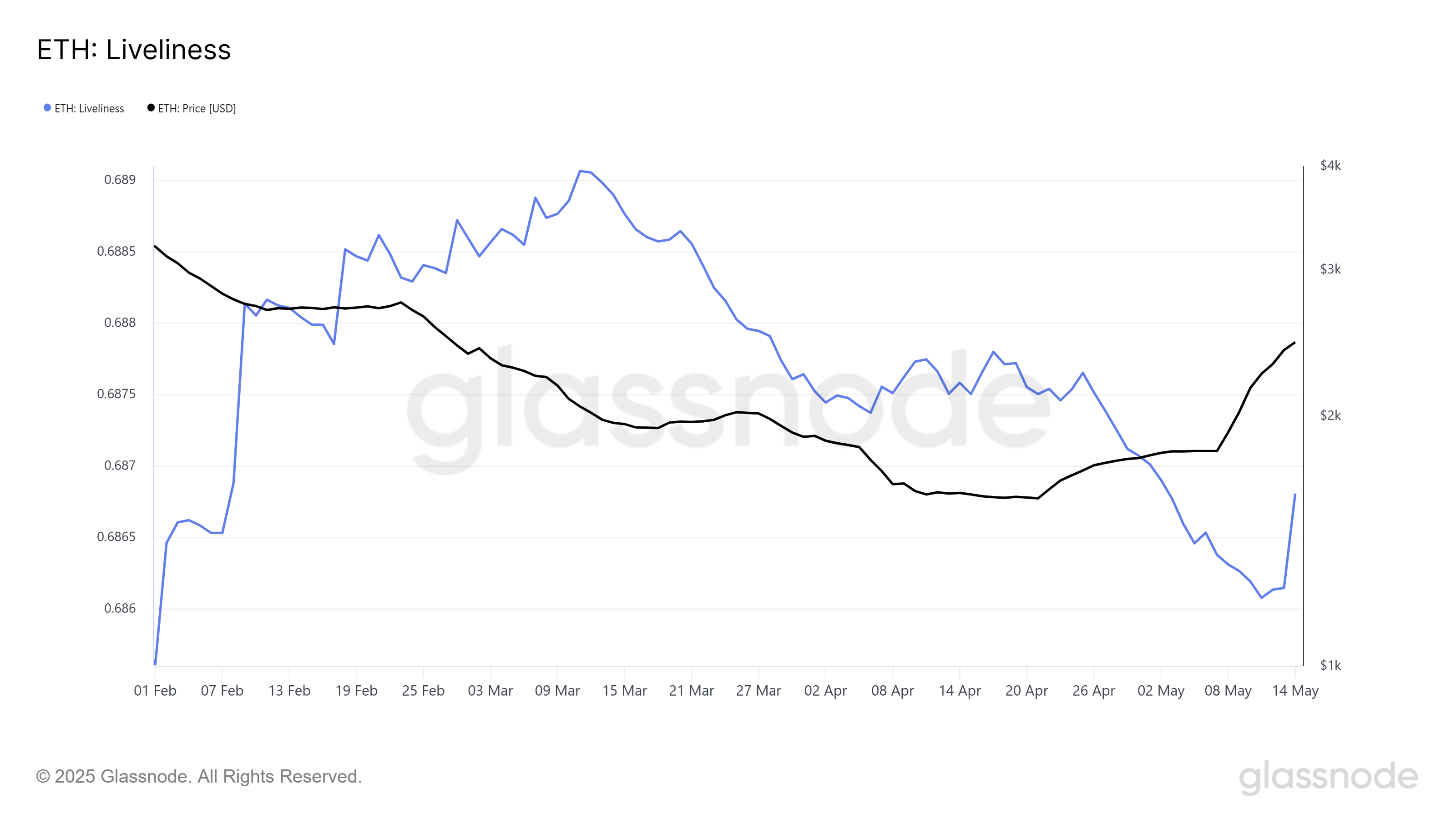

The pulse of Ethereum is accelerating. Liveliness, the classic long-term holder behavioral index, spiked up heavy for the first time in three months. It’s not just entropy; rather, it is a signal that veteran Ethereum investors are selling. These are not day traders; they are, indeed, the ecosystem’s bedrock. Their premature profit-taking can pressure ETH prices on the way down as smart money is cashing out. Is it just a blip, or is it the opening move in a larger dump? The market is keenly watching.

Long-term holders of Ethereum are putting up sell orders, which may cause a stall in the recent upward move. The profit-taking frenzy could obstruct Ethereum’s momentum and render it more difficult to break through resistance and achieve higher price levels.

Ethereum Liveliness. Source: Glassnode

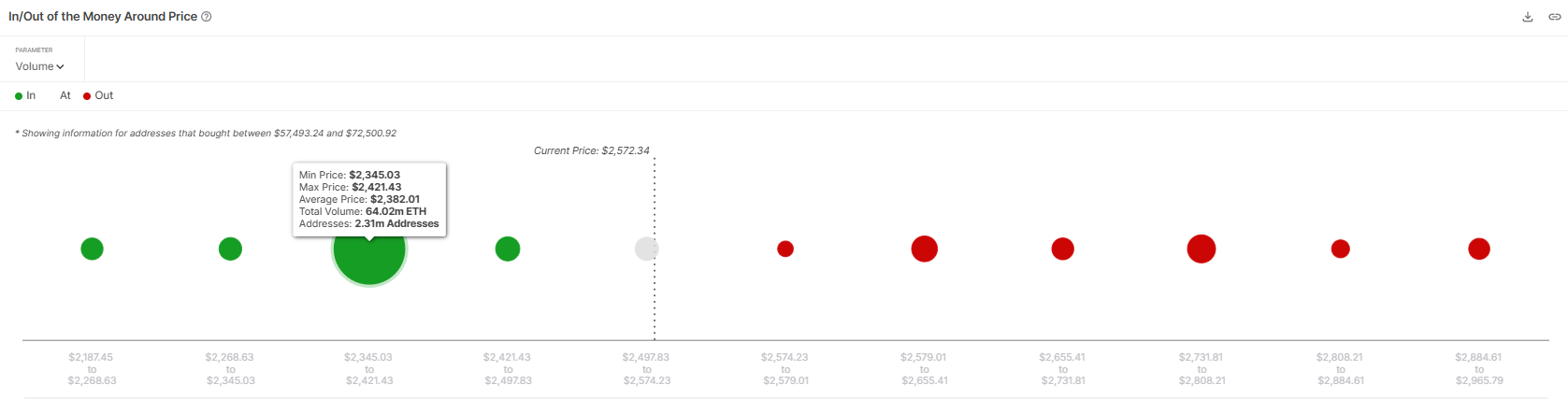

Ethereum now stands on a knife’s edge, with a huge buy wall awaiting it. On-chain analysis exhibits a gigantic support range situated between $2,345 and $2,421. This can be considered a digital fortress wherein more than 64 million ETH, worth a staggering $164 billion, had exchanged hands within this narrow range. These are no small investors; these are holders with serious skin in the game-unscrupulous to panic sell and ready to defend their positions. This implies bulls theoretically must vigorously defend the $2,345-$2,421 zone. Trading below this mark could spur a deeper correction, yet every eye remains glued to this crucial range for now.

Ethereum is poised on the knife-edge. This particular price-level constitutes the last line of defense against a free-fall. Think about it as a fortress wall, manned by resolute investors who bought at these levels. They are dug in and have little reason to sell, thus standing as an unbendable barrier, which may very well blunt even the sharpest winds of a market downturn and save Ethereum from goading into a full-blown panic.

Ethereum IOMAP. Source: IntoTheBlock

ETH Price Needs To Find Support

Ethereum is roaring ahead! Creating history in the crypto markets, ETH has nearly seen a 42% run in about a week while sitting confidently at $2,577. Having defeated the $2,500 stronghold, all attention is now towards the $2,654 resistance. Can Ethereum pass this resistance and shoot for the heavens? Bulls are surely in favor of that.

The cryptocurrency teeters on the precipice of $3,000, a scant 16% away from glory. Long-term holders are selling, giving resistance to the upside. The good part is that a very strong support zone can catch down if it falls; the selling pressure subsides, and ETH holds $2,814 as its new support; the move up should begin once again. The bulls are ready; it’s just all about holding through the storm.

Ethereum Price Analysis. Source: TradingView

Ethereum bull run is but a thread away from breaking. A market plunge could ignite a veritable selling pressure upon investors trying to cut their loses. Down we go: breaking below $2,344 will lead to a flood of sell orders toward $2,141, stopping the rally in its tracks and possibly turning it around.

Thanks for reading Ethereum Price’s Rise to $3000 Could Be Impeded By These ETH Holders