HBAR’s pulse quickens! After weeks stuck in neutral, Hedera’s native token is hinting at a dramatic escape. Hidden bullish signals are flashing: an RSI divergence screaming “upswing,” funding rates hinting at renewed confidence, and a rare Chaikin Money Flow crossover suggesting money is finally flowingin. Is HBAR ready to break free?

But beneath the fleeting exuberance, the engine of development sputters, idling near its lowest point in months. Is this rally a phoenix rising from the ashes, or simply a paper tiger, destined to fold under the slightest pressure? The real test of its mettle is yet to come.

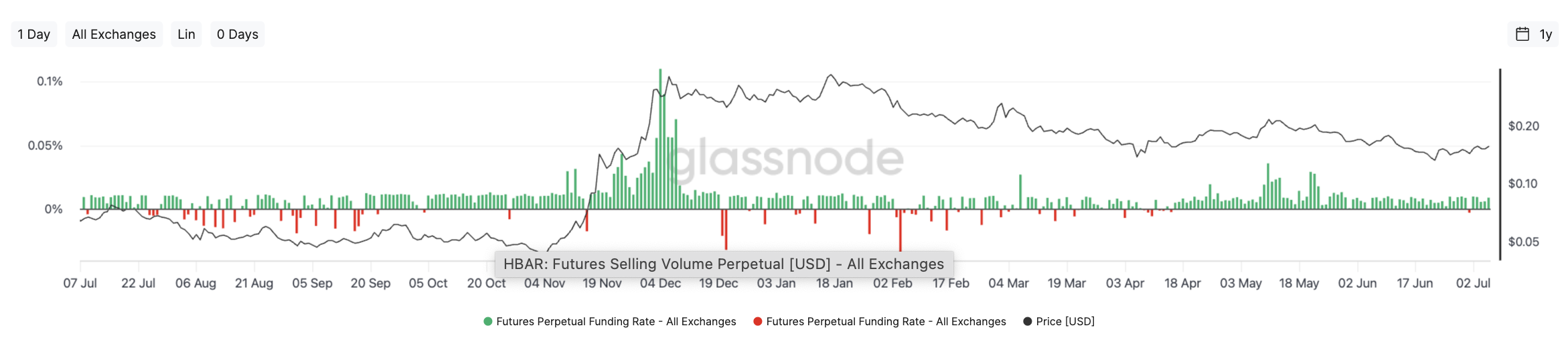

Funding Rates Show Bullish Build-Up, But No Euphoria Yet

HBAR’s future is looking bright, at least according to futures traders. Funding rates for HBAR perpetual contracts have been steadily climbing since early June, painting a picture of resurgent bullish sentiment. Green candles dominate the charts, signaling that longs are comfortably in control, extracting payments from short positions – a classic indicator of a market leaning decidedly bullish.

HBAR price and funding rates: Glassnode

HBAR’s echoing September-October 2024 dance. Last time it waltzed like this, a quick price surge followed. Is history about to repeat amid this sluggish climb?

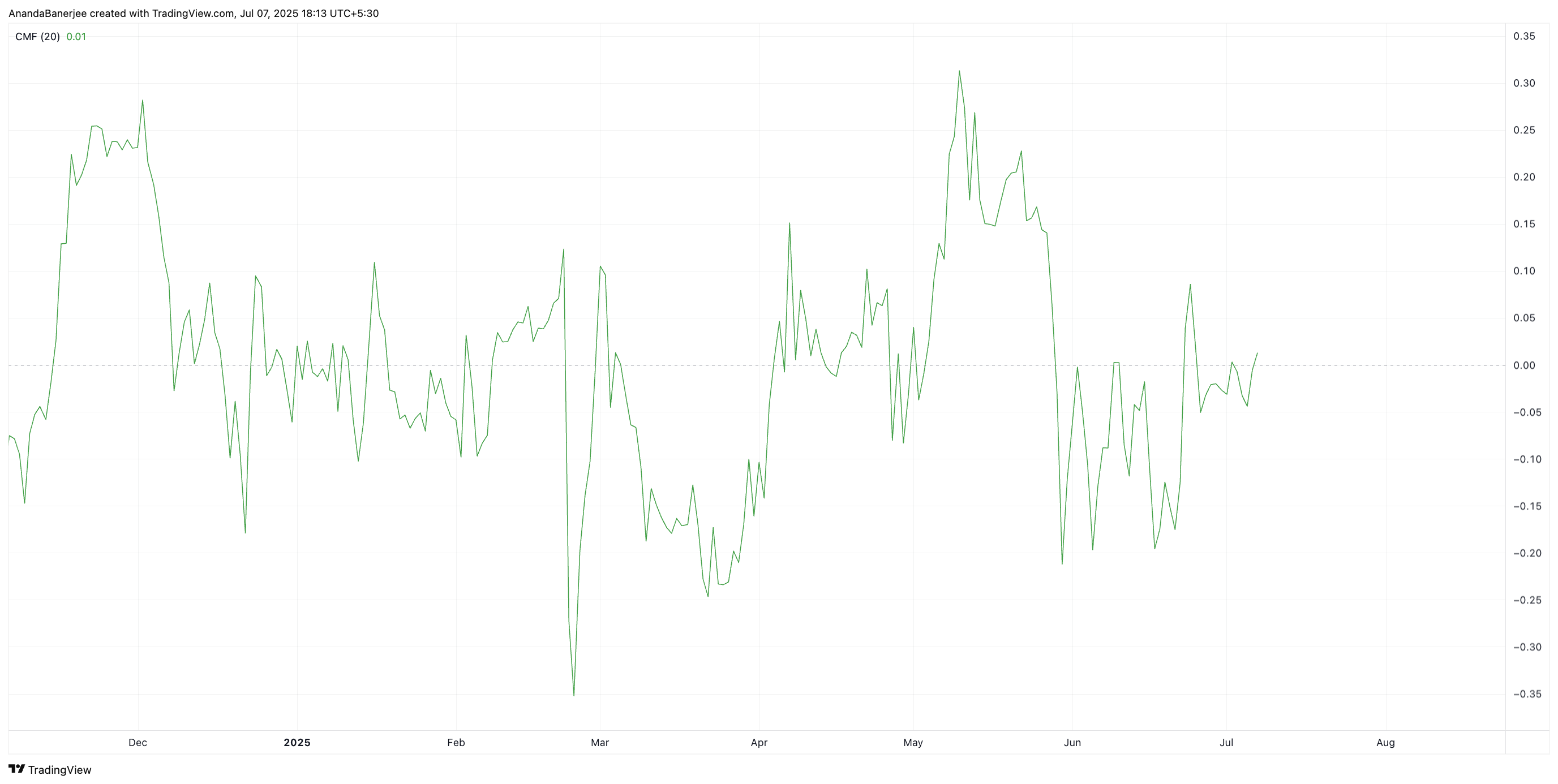

Chaikin Money Flow Crosses Into Positive Zone

“The bulls are back? After almost two months in the red, the Chaikin Money Flow (CMF) just surged past the zero line! Think of it as a volume-powered lie detector for market momentum. A positive CMF reading suggests real buying pressure, separating genuine accumulation from fleeting market fads.”

HBAR CMF: TradingView

“A hair above zero, the Chaikin Money Flow (+0.01) whispers of change, snapping a chain of persistent outflows. This solitary crossover isn’t a siren song of sustained buying pressure, but consider the ensemble: a price trend flexing its muscles, and an RSI hinting at underlying strength. Suddenly, that marginal CMF becomes a subtle, yet compelling, vote of confidence.”

Development Activity Remains Concerning

Hedera’s price and derivatives might be hinting at a comeback, but a deeper look reveals a concerning trend: developer activity is dwindling. Santiment data paints a clear picture – since March, the purple line charting development contributions has been on a steady decline, suggesting a potential slowdown in innovation and growth.

HBAR price and development activity: Santiment

It’s now sitting near its lowest level in six months, indicating fewer updates or visible work on the Hedera ecosystem.

Price Approaches Breakout With RSI Divergence

HBAR teeters on a precipice. A stubborn downtrend, tracing its lineage back to March’s peak, now clashes with the token’s upward momentum. $0.162: HBAR’s Mount Everest. Three times it’s been challenged this week, three times the summit has remained unconquered. Will HBAR finally plant its flag, or will gravity pull it back down the slope?

HBAR price Bullish divergence: TradingView

Here’s why bulls are ready to charge: a classic RSI divergence is flashing. While the price has been stuck in neutral since mid-June, or even dipped slightly, the RSI has been quietly building momentum with higher lows. This disconnect between price and momentum is a well-known precursor to a potential breakout. Watch closely.

HBAR price key levels: TradingView

HBAR Poised for a Leap?

HBAR bulls are eyeing a clear path upward, but the road hinges on conquering $0.162. A decisive break above this threshold could uncork a surge toward $0.178, with $0.217 looming as the ultimate prize. However, a stumble at this critical juncture could spell trouble, sending HBAR tumbling back to the $0.143 safety net. The key? Watch for a spark in development activity; continued stagnation could be the anchor that drags it down.

Thanks for reading HBAR Price Shows Bullish Divergence But Weak Fundamentals Still Haunt the Rally