Disclaimer: The analyst who wrote this article owns shares in Strategy.

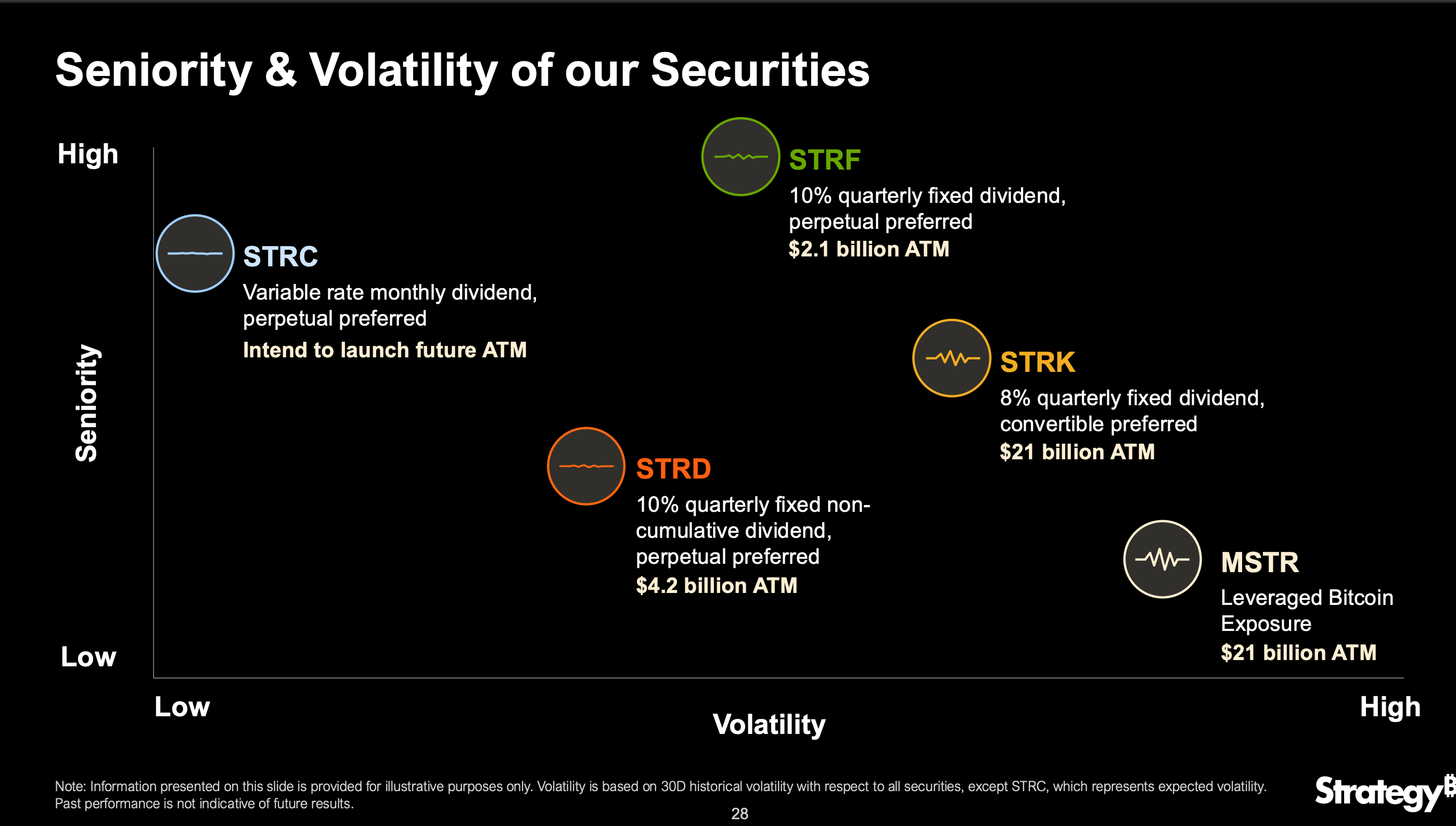

Michael Saylor’s MicroStrategy (MSTR) appears to be doubling down on its Bitcoin strategy, potentially closing its biggest preferred stock offering yet. The “STRC” shares are poised to join existing “STRD,” “STRF,” and “STRK” preferred stock, creating a complete credit yield curve and signaling Saylor’s unwavering commitment to the company’s digital asset holdings.

“STRC stands out for its seniority and stability. It introduces a fresh, short-term funding option, broadening the company’s approach to securing capital for BTC acquisitions.”

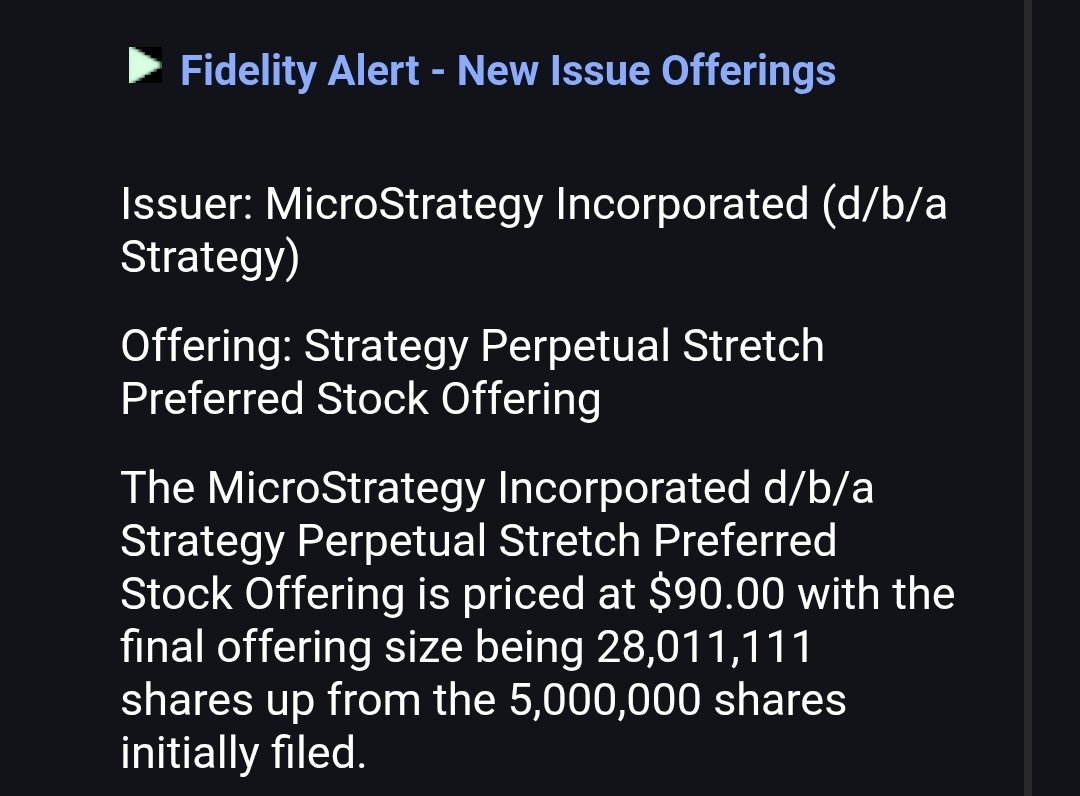

Fidelity Alert MSTR STRC (Fidelity)

A feeding frenzy just erupted around this Bitcoin player: A $2.52 BILLION deal just materialized, announced via Fidelity alert on X. That’s 28 million shares snapped up at $90 a pop. But here’s the kicker: This behemoth obliterates the initial $500 million target floatedjust days ago. Talk about a company betting big on Bitcoin’s future – this is a declaration of war in the digital gold rush.

BTC

$116,623.03

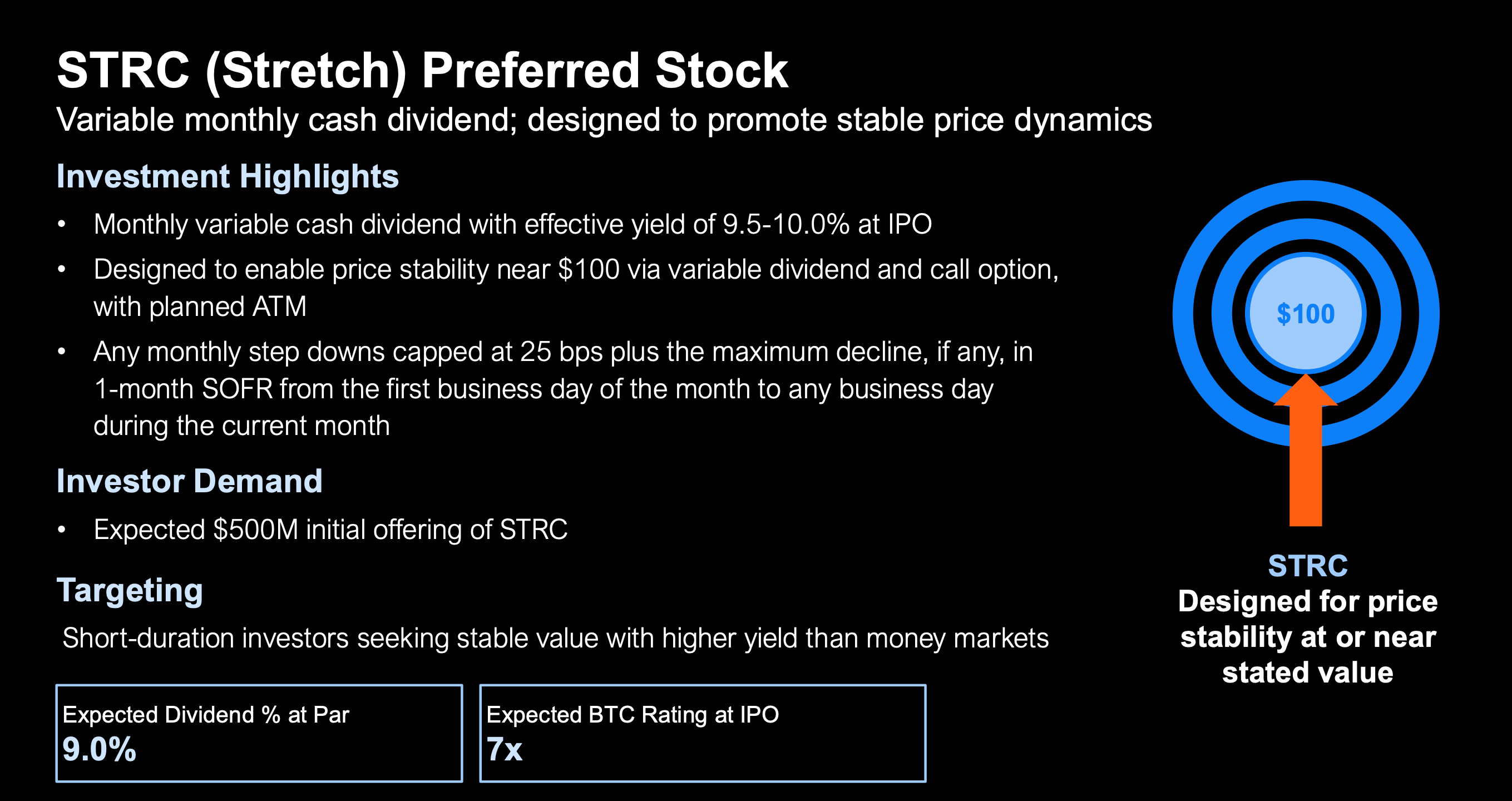

Stretch Preferred Stock (Strategy)

holdings.

Tired of market volatility? STRC offers a compelling haven: a senior, perpetual preferred stock engineered for stability and income. Imagine a reliable monthly income stream, currently yielding a robust 9.5%-10.0%, designed to keep your investment hovering near $100. STRC employs clever tools like adjustable dividends, strategic secondary offerings, and premium call options to maintain its par value, providing peace of mind while delivering consistent returns. It’s a sophisticated yet accessible solution for yield-focused investors seeking a calmer portfolio.

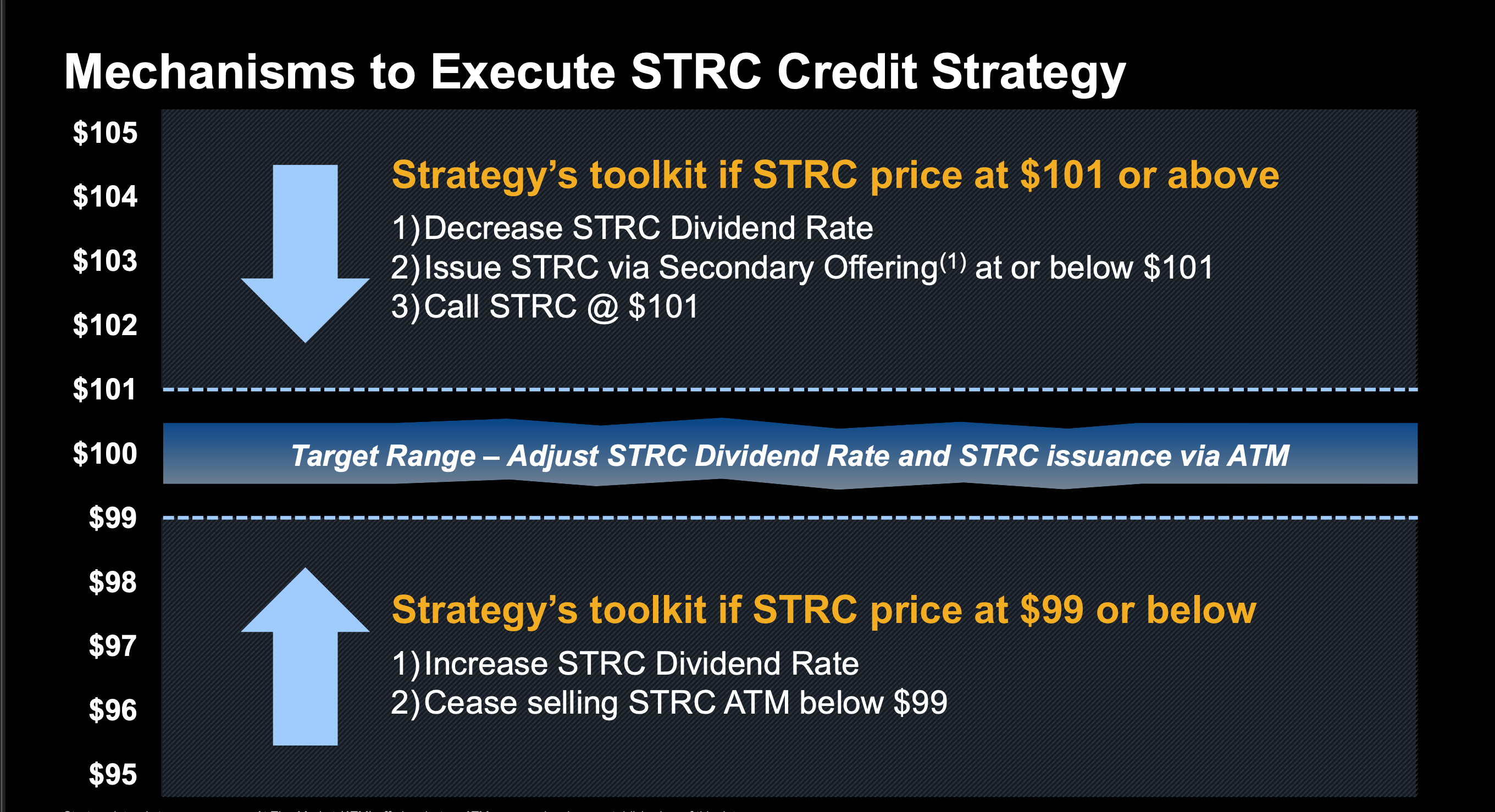

Stretch Preferred Stock (Strategy)

“This financial instrument wields a unique ‘stability toolkit.’ Imagine levers: dividends boosted to reward patience, sales suspended if the stock dips below $99 to defend its floor. Conversely, if STRC soars above $101, new shares could flood the market, or the stock could be ‘called’ to temper exuberance. These mechanisms intertwine, forging a self-regulating ecosystem. The goal? Market equilibrium, juicy returns, and a haven amidst today’s turbulent interest rates.”

Dividend cuts are cushioned: drops are limited to 0.25% plus the period’s biggest SOFR dip.

Stretch Preferred Stock (Strategy)

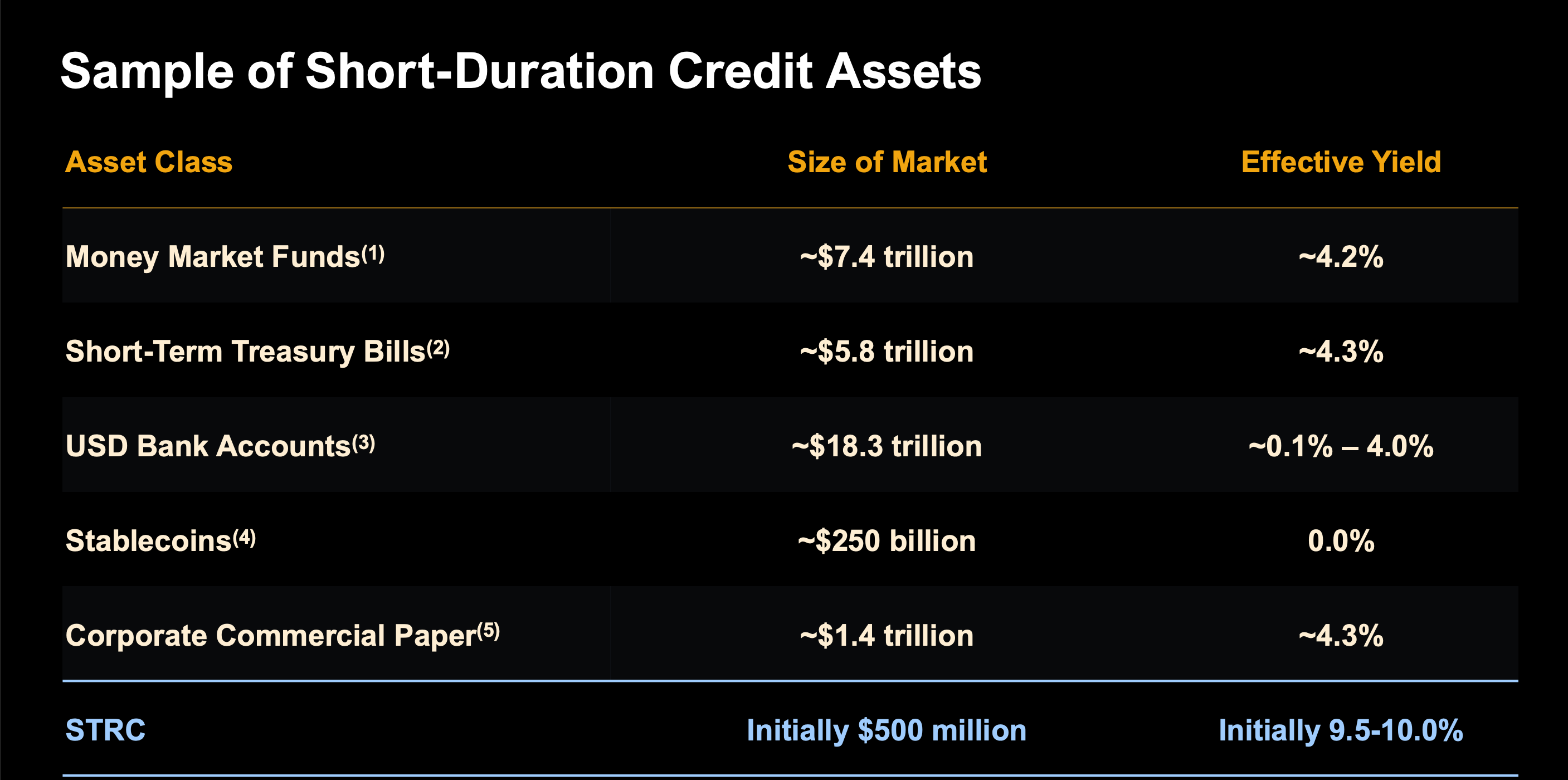

Tired of paltry returns from money markets and T-bills? STRC delivers a jolt to your portfolio, potentially more than doubling the typical 4% yield. Forget fleeting gains – STRC is engineered for investors seeking substantial income without the stomach-churning dips of riskier assets. Think of it as a souped-up alternative to humdrum commercial paper and bank deposits, offering a smoother ride to higher yields.

Stretch Preferred Stock (Strategy)

Thanks for reading Michael Saylor Continues to Build Out His Own Yield Curve