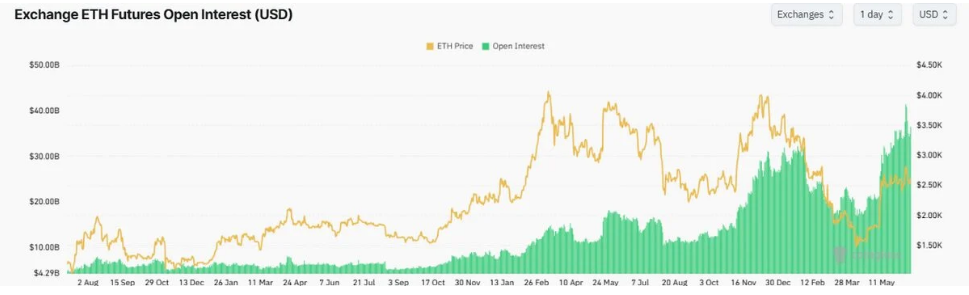

This is one roller coaster about to go! Within June 16, the futures open interest rose to an all-time yearly high of $36.56 billion, and thousands of traders obviously came in. The bulk of the price is performing above $2,600 as the resistance-level enjoys being a wall for a long, long time. As these bold traders await the breakout-boom or the bitter crash, the focus is on ETH. Stay ready for fireworks!

Futures Open Interest Hits Yearly High

Ethereum futures are very hot markets! CoinGlass shared an explosive growth in open interest over three days, reaching a gargantuan $36.56 billion on Monday, a figure left tall to be achieved last year. This tremendous surge shows that heavy-weight traders, probably with monies borrowed, are speculating on Ethereum-where the trader believes the coin will go next. Is the casino operating on a bullish premise while the other side is gearing for an alleged bear trap? There has never been so much talk around the Ethereum futures, and it has never carried larger stakes.

Price Tests Multi‑Year Resistance

Ethereum had a surge of about 4.5%, in a matter of just one thrilling session, moving towards a critical junction. Investors are glued to the charts as ETH tests a descending trendline that has prevented it from going higher over the past few months. Will it break through the trendline, or will bears claim control again? The next few hours could decide the destiny.

A tug-of-war is currently going on for Ethereum: the 50-week moving average is on top and the 200-week one is almost under its feet. Can ETH escape? Such a breakout may push it even higher, but weak volume may have the bulls requesting the cavalry to help push their cause.

ETF Flows Show Steady Support

Speed Bump for Ethereum ETFs: Following nineteen days of inflows, this marked the first outflow for US spot Ethereum funds in a small way, to the tune of $2.18 million. Do not panic! That J-curve is far overshadowed by the monumental $528.12 million that has entered this week alone. These ETFs now collectively have an AUM in excess of $10 billion, and that spells long-term interest in Ethereum from investors.

Institutional Backing Expands ETH Reach

Ethereum is no longer just a cryptocurrency playing field, Wall Street giants are moving in. Leading the way are BlackRock and Fidelity, innovating with tokenized treasuries and stablecoin funds plugging directly into the ETH ecosystem. This is not just toe-dipping; this is full immersion into the future of finance!

According to the companies themselves, these new offerings are being launched to bring the large players previously sitting on the sidelines into Ethereum. This gives more weight to the view now growing that the possibilities provided by Ethereum reach beyond some DeFi occurrences formed on it and can be the basis of real-world applications.

Ethereum Drift Remains Steady Before Potential Ripples

Ethereum Nudges $2,630 as Calm Waters Ripple with Bullish Undertones.

On the 16th of June, certain serenity conquered the Ethereum markets, price holding itself steadfast at $2,630, albeit this calmness with that 4% slight yet fine climbing during the last day. Meanwhile in the background, the heartbeat begins to pick up speed. Traders have come inclined to the future markets as trading volumes have soared. This is because major dignitaries are investing in the future of ETH. The savvy are moving.

Come, brace yourself: calm waters often mean a coming storm. When the market is seized by speculative fever and leveraged bets pile high, even the most benign ripple can become a gigantic tsunami. These enormous positions, powered by leverage, become balancing acts of sorts. A slight gazing upward or downward in price might just set the whole thing off as a cascade of liquidations rip through the other side-there go longs and shorts scurrying to the exits. Tranquility is suddenly broken, and the chart ripples through jagged peaks. Today’s placid landscape lies cloaked in the potential for tremendous upheaval tomorrow, should these colossal wagers begin to unwind.

Featured image from Unsplash, chart from TradingView

Thanks for reading Record‑High Ethereum Open Interest Signals Institutional Confidence