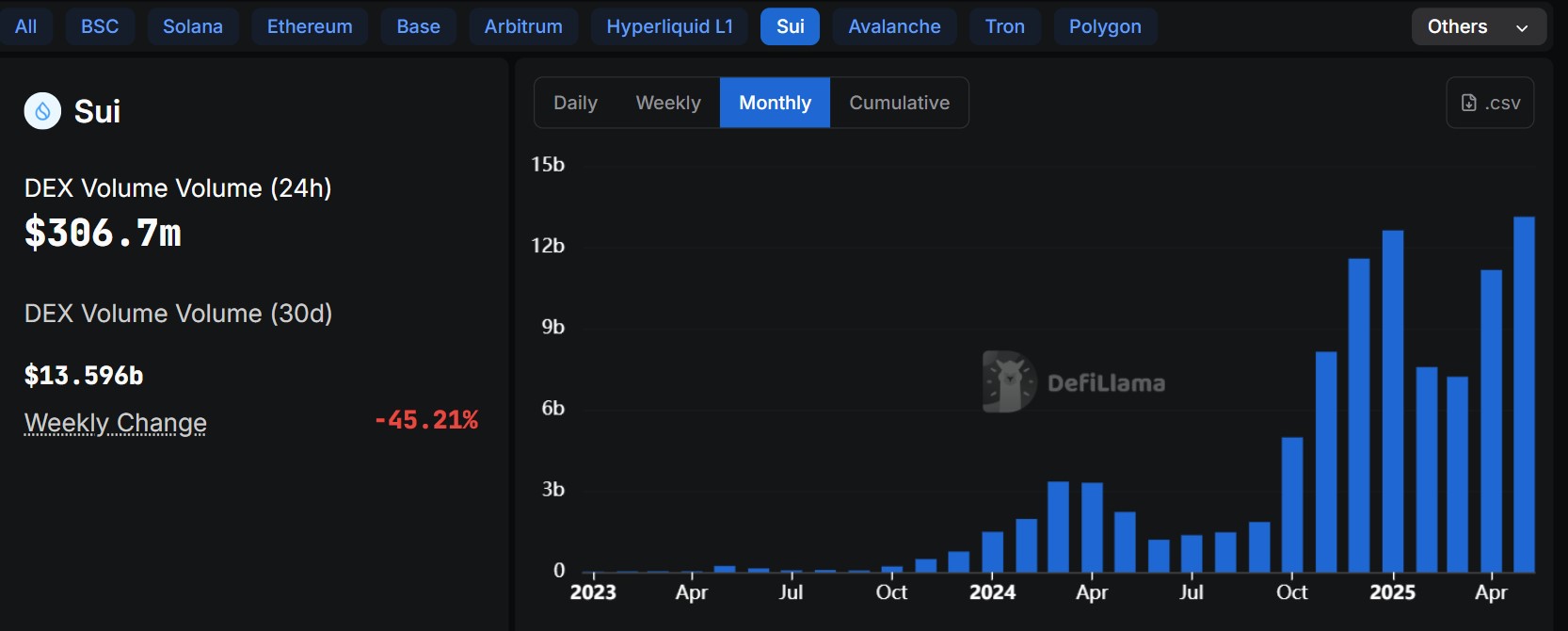

- Sui has hit a $14.8 billion monthly DEX volume despite price stagnation.

- The $223 million Cetus exploit has shaken Sui’s market confidence.

- The price of SUI is currently struggling to break past the $3.87–$4.13 resistance range.

While Cetus’ security incident threatened to put a spanner in the DeFi works, Sui just shrugged off a weekly dip of 45.21% and went on smashing records, with a magnificent $13.596 billion DEX volume for the month – an all-time best. Now that is some resilience!

Sui’s trading was 4-fold the typical $3.93 billion average monthly level in May. The explosion was not some passing streak; rather, it was the loud-and-clear evidence of investors marching into Sui’s growing ecosystem attracted by the power and possibility of its DeFi protocols.

SUI price analysis amid the Cetus hack aftermath

The SUI beat gravity; transaction speeds shot up into the stratosphere, but the price found itself anchored by the gravity below. It just couldn’t survive an assault on the $3.87 barrier and was held captive in an irritating orbit of the few cents just below it.

The on-chain indicators seem to flash green for Cetus Protocol while its price just refuses to lift up. The recent exploit’s security has lingered on everyone’s minds, clasping hopefulness in its grasp despite the excellent data.

A chill-infused exploit has hit Cetus, the uncontested DEX king of Sui. Crafty attackers would not touch the coding; rather, they bizarrely deviated reality and bent orders of magnitude toward price oracles. Their booty? Roughly a colossal $223 million from Cetus’ liquidity pools, leaving the DeFi world gasping.

Following the digital heist, the authorities intervened to bring the compromised smart contracts to a halt and, pharmaceuticals on a daring note, proceeded to rinse $162 million-a staggering fortune seized from the blockchain.

While a chunk of the stolen funds was frozen by the authorities, the rest were spirited away by the hackers, then sent through a maze of crypto bridges to convert the recovery into a digital scavenger hunt.

Keeping blood from flowing from the Cetus mishap, the Sui Foundation waxed into a secured loan. This crucial capital injection immediately allowed Cetus to start compensating its users, lastly to frame a full recovery program.

Time is running out. A lifeline for affected users is in limbo, waiting for that very crucial vote by the community. Will the frozen funds eventually be unfrozen and funneled to fully compensate those impacted? It is now the community’s call to decide the fate of this recovery effort.

The community is holding its breath as it should. An exploit darker than anything in Sui’s DeFi ecosystem has just taken place, launching raging arguments over potential vulnerabilities of oracles and demanding a reckoning over auditing standards in every protocol.

Due to the exploit, investors flew the coop leaving the price of the CETUS token in a freefall of nearly 40%. Panic selling went viral in a trembling market, both the end result of shattered confidence and fostered by a feeling of malaise broadcasting all around.

Despite the headwind, Sui’s TVL just touched $2.406 billion, giving the chart a 2.51% bump in a single day. This is not a short-lived spectacle. It is a potent signal proven by the big whales investing ever more capital into Sui at an dazzling speed.

Amidst market seesaws, smart investors have been slowly but surely ramping up wagers: Spot flow data reveals a modest $1.31 million flowing in, thereby giving subtle yet unmistakable signs of confidence in an eventual rally. Out there in this chaos, someone holds a long view.

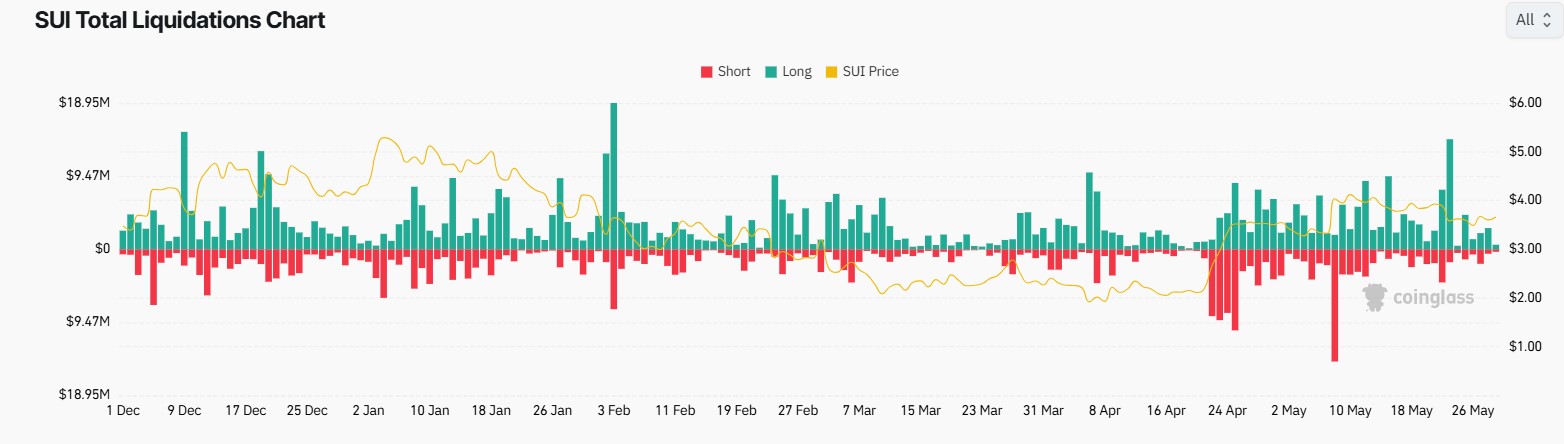

An open interest of $1.77 billion spells caution and is down 1.58%, as the speculative zeal has slightly abated. Are leveraged bets being unwound by traders, possibly to pocket gains before the impending storm? The near horizon remains blurred, with a strategic departure from high-risk bets.

SUI price forecast

SUI’s bull attack seems to be slowing down. The MACD, a fading enthusiasm, shows its shrinking histogram bars while the signal lines flirt with the neutrality of a precarious balance that could tip either way.

Gas prices have been holding a steady trend lately. At about $3.69, these prices remain trapped below an obstinate ceiling in the $3.87-$4.13 Fibonacci resistance zone. This range has proven to be a kind of Kryptonite to the bulls for several weeks.

Looking at the price action, one can see that it has re-entered the tightening wedge, foretelling a breakout possibility. Above, several EMAs in the cluster range between $3.59 and $3.62, thus capping any upwards momentum that may brew. Could it be that the bulls break this ceiling?

“Hold on tight! A smooth passage under $3.50 could fast-track a steep downfall, with $3.30 and maybe even $3.20 standing in as hard crash pads. Liquidation avalanches might actually make this liquor floor thaw very quickly!”

A danger zone marked by CoinGlass came to be: a tightrope for cryptocurrencies between $3.60 and $3.87. This price pocket was a battleground in which traders robustly defended their positions from the liquidation reaper, instead of the price dips becoming arrival points for price rebounds.

But if the bulls slide past this resistance, the short squeeze could be on. The price will rocket up, passing Fibonacci levels in a flash and could even shoot out there to $4.97 at dizzying speed.

There was a stagger in Cetus; yet, Sui soared. Come dawn, look away from Cetus’ downfall and fix your stare upon the flame. DEX volume blows with a blaze, TVL lessoned to fresh heights, and the ecosystem could prove it to be worthy of any storm. At the center of Sui’s strength lies incorruptibility.

On-chain heroics defined the SUI and now they are met by resistance. While there exists a zone with no significant fluctuations between $3.87 and $4.13, this break must only be offered by the proverbial bulls hitting buffers with all their might.

Governance debates rage on, while the market will surely continue to reel from the exploit in the immediate short run. The big question is: Will confidence resuscitate fast enough to keep the DeFi flame alive on this chain?

Thanks for reading Sui hits highest-ever monthly DEX volume despite price dip following Cetus exploit