- SUI has broken below a key support as bearish sentiment intensifies.

- Derivatives data shows declining interest and rising short positions.

- Network activity has dropped sharply, signalling weak fundamental support.

The SUI (SUI) cannot take any beating and the price has dropped somewhat. Traders’ apprehension has given a larger number of reasons to express their views, possibly worrying about a severe downturn upon the horizon.

SUI’s brief flirtation with the $4 mark rapidly became a thing of the past, causing the token to balance dangerously on a knife edge. All eyes are now fixed on the key support level, the fate of which will most likely determine the dramatic act to be performed next by SUI.

Started on a dip, but Nasdaq: SUI hasn’t stood steady ever since it floated at $2.75. With the stock having been down 5% in the last 24 hours alone, this is indeed a drastic development from its previous high price of $3.51.

Although the token still maintains an impressive 255% gain over the past year, its short-term momentum has notably weakened.

SUI price analysis signals caution

SUI’s triangle pattern gave out and unleashed a massive selling pressure. The token retreated to $2.78, a familiar battleground, which militantly remained a floor during late-March market skirmishes.

Losing this vital zone is dangerous. Stay alerted! Closing below this line in the sand on a daily basis might mean a frightful free fall to the $2.24 mark. Here the market might encounter a super-shady kiss of a safety net from the 23.6% Fibonacci retracement-a faint recall of the road from this year’s low of $1.71 all the way up to the all-time top of $5.35. Will it hang on, or will it fall free?

Adding to the concern, momentum indicators are flashing mixed but generally negative signals.

“The RSI sings of opportunity. Nearing oversold territory at $33.64$, the price has seen the inception of a bullish divergence, calling out to the desperate buyer to see a possible trend reversal.”

However, the Moving Average Convergence Divergence (MACD) remains in bearish territory, showing no clear sign of upward momentum just yet.

SUI derivatives market shows a bearish market sentiment

Something is sizzling. This news points out that the momentum is fading, and the rally has met with a rather brutal beating. The HR Bitcoin continues to swallow billions of dollar inflows.

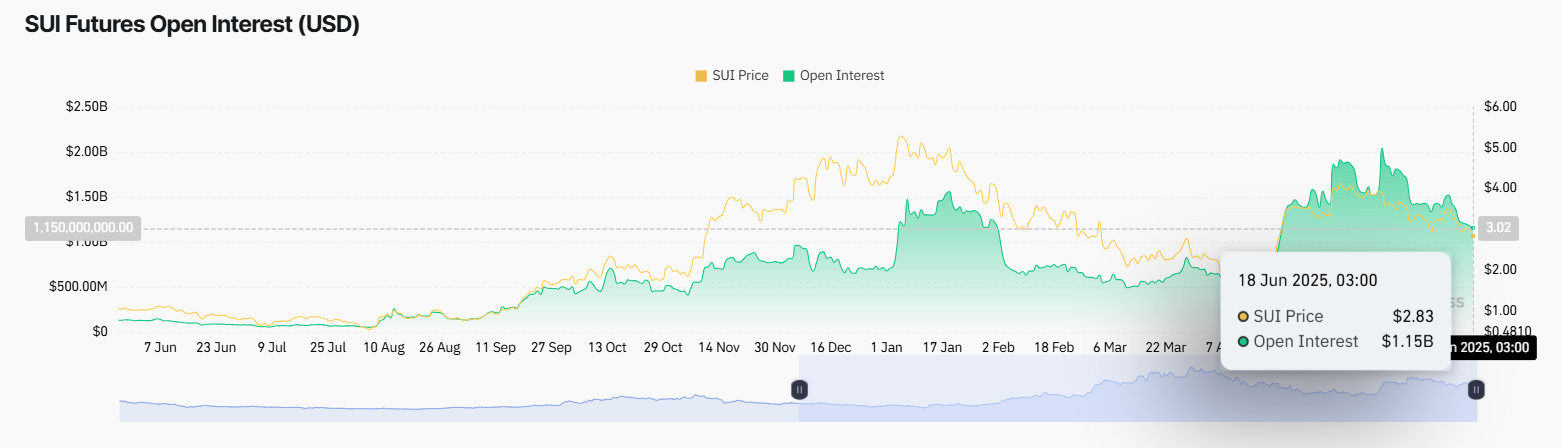

Money is leaving the derivatives market in chunks. Having hit almost $2.05 billion in May, a drop as strong as 43% reflects mass withdrawal of money.

The declining OI is accompanied by a falling OI-weighted funding rate, currently at 0.0060%, further suggesting reduced bullish enthusiasm.

The bears are in full domination. With each tick of time, the recent take buy/sell volume data presents a crystal clear picture: the shorts can flex their muscles, holding 55% of the market while the bulls shrink to 45%.

Some nervousness has taken hold of the market: the long/short ratio has now plunged to 0.8195, depicting the fact that market participants are essentially running for the hills, bidding heavily on a correction.

Unless sentiment improves, the pressure on spot prices is likely to persist.

Head-and-shoulders pattern points to a $2.20 target

Technical analysts have noted the emergence of a head-and-shoulders pattern on SUI’s daily chart, adding weight to the bearish narrative.

According to market analyst NebraskanGooner, this classic reversal setup could push SUI down to the $2.20 region by early July.

The right shoulder gave way then, when 99-day moving average drove away, reminding just how important support had been but failed.

$SUI (per request)

The $3.00–$3.10 region, which previously served as support, now acts as a significant resistance barrier.

“The window of the bulls are shrinking. If you don’t take hold of the earth quickly, you may very soon find things sharply moving south.”

Fading network activity fuels more doubt

On-chain metrics also paint a bleak picture for SUI’s near-term prospects.

Perhaps the rolling of the tide has had some harsh in-friction effects on a bubbly Sui network. Transactions have crashed going all the way down from 19 million to 9 million. The very heart of any blockchain- active users- seem to have faced some even more dramatic of an exodus- from a lively 1.66 million to a ghost town now housing some 320,000, according to SuiVision. What happened to the hype?

The pulse had now flatlined. Hisses of fading hype now accompanied the death rattle-the previous ascend had been perhaps a speculative whirl rather than a demand from true users.

The loss of momentum in both price and usage underscores the difficulty SUI may face in mounting a swift recovery.

One hopeful flicker ignites the futures, yet the general impression remains that of doubt. Open interest, still clinging to the $1.2 billion mark, signals a fragile recovery, but a definite resurgence is nowhere near happening. Caution still whispers in the air among the traders.

Market participants appear to be waiting for clearer signals before committing to new positions.

What to look out for going forward

Battle lines are drawn. Every eye watches $2.78, the last holdout for absorbing some support. Will it hold? If it does, a rebound from here would surely see a big rally toward $3 again. Bulls with serious intentions are even working toward a run at the month’s high of $3.55, but $2.78 must hold first.

However, a breakdown followed by a failed retest could pave the way for a drop to $2.20 or even lower.

Looking further ahead, analysts like CoinLore forecast a potential price range of $3.77 to $5.80 by the end of 2025.

However, while this suggests room for long-term growth, the near-term path remains clouded by technical weakness and shrinking on-chain activity.

For now, until bulls reclaim key resistance levels and network fundamentals stabilise, SUI’s short-term outlook will likely remain fragile.

Traders should closely monitor both technical support zones and broader market sentiment before making high-conviction moves.

Thanks for reading SUI price prediction amid fears of an extended correction