With previous hinting in the past week, the fall of gold became further accentuated as it pierced its way into 3200s. The global tensions, coupled with this tariff tug-of-war, seem to be losing their charm, compelling investors to seek riskier opportunities in stocks and cryptocurrencies, leaving behind the likes of gold.

Table of Contents

- Previous week’s forecast recap of crypto.news

- Key economic events of this week

- Gold HTF Overview

- Gold Forecast for May 5th to May 9th

- Trading Strategies & Investment Recommendation

There’s a bit of pause in gold, taking its rest before the FOMC fireworks on Wednesday. Will it cause a mighty rally or send prices on a free-fall? This XAUUSD weekly forecast for the week of May 5th-9th, 2025, implies the key price levels that will determine whether you’re buying or selling.

Previous week’s forecast recap of crypto.news

Last week’s chart was an absolute gold mine for those who knew how to capitalize on it! Did you short gold between $3342 and $3353? If yes, celebrate for your timely exit on a beyond 1500-point free-fall!

XAUUSD 1h chart – Source: Tradingview

Furthermore, the buying levels forecasted in gold from $3247-$3193 have also also given a 900+ points move so far.

Are you ready to unlock the secrets of the economics of this week and see how these may push the gold prices to a higher position, or lay them to dust? Let’s roll it!

Key economic events of this week

Several significant U.S. economic reports are scheduled for release this week, all of which might significantly impact XAUUSD.

Monday, May 5, ISM Services PMI:

Is gold about to glitter or lose its gleam? Watch closely the US Services Sector Index. A faltering number may send investors running for gold as a safe haven thus pushing the price into the sky. On the other hand, a report corroborating strength tends to go unquestioned in dollarbuilding and probably will dull the sparkle of gold and push its price down. It constitutes a primary gauge of economic health in the U.S., and ripples generated from it are felt on the gold market.

Wednesday, May 7, FOMC Press Conference:

The yellow metal is living on an edge indeed. The Federal Reserves’ monetary policy announcement will be followed by another press conference where every minute word or fleeting expression informing interest rate changes or economic outlook will be analyzed. No incidence of nonaction is anticipated in the trader’s domain. The market layer shall be jostled with XAUUSD volatility as the repercussions of the Fed statement are felt across the market.

Thursday, May 8: Unemployment Claims

The recent unemployment data should be indicative of economic activity. Will the numbers sneak in whispers about a recession? The sudden rise in jobless claims foretells the dimming of the employment scenario; hence, investors might start looking at gold as a safe haven while the metal gains footing amid economic uncertainties.

You might also like:

Investors see Swiss franc, gold as safe havens outpacing Bitcoin

Gold HTF Overview

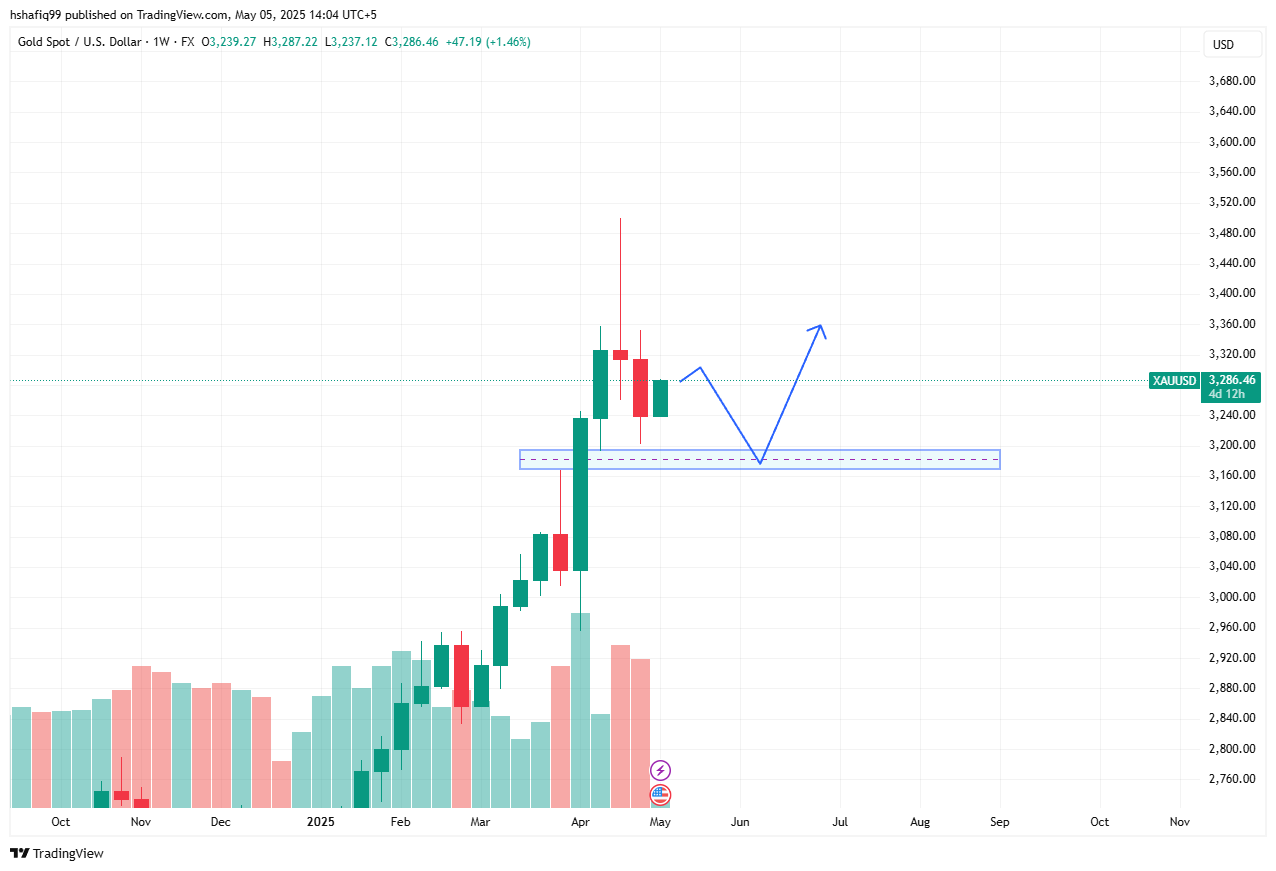

The gold market is flirting with a comeback after two weeks of sheer carnage! But hold on; that darn price gap is yet to put itself to bed: the weekly Fair Value Gap. Expect a dip as gold traces the route to fill this void, possibly in the area of $3194-$3168. This could be your golden opportunity. Look for bullish strength to return in this area. A strong bounce may just be the sign to enter and ride the wave upward. Is gold about to shine once again?

XAUUSD 1w chart – Source: Tradingview

Gold Forecast for May 5th to May 9th

Gold woke up bullish this week, but the winds are now blowing against it. Sellers could appear very strong above $3300. The bulls are fighting to hold the range on the 4-hour chart between $3259-$3239, where a nice fair value gap rests right below an important order block, and also coinciding with the lower boundary of the value area of a most recent bearish swing. This zone is a prime candidate for a bounce.

XAUUSD 4h chart – Source: Tradingview

Notice a breaking point with these names! The strategic short trade on XAUUSD is being set up in a range from $3305 to about $3313. That is right where the Point of Control (POC) lies, where immense price agreement occurs, and an established 1-hour bearish order block opens the door to bearish momentum. Let’s make money off this setup!

You might also like:

Goldman Sachs scraps recession forecast as Trump pauses tariffs

Trading Strategies & Investment Recommendation

In gold trading, luck favors patient strategists. Learn your higher timeframes because those make the very bedrock of finding great buying opportunities, and then get on your lower timeframes like a hawk ready to pounce on a fleeting shorting opportunity. This is a list of key levels you draw on your charts; with them acting as your compass through the swirling currents of the market, you will find profitable trades.

Support Levels

- $3194-3168 – weekly FVG

- $3259-3239 – 4h FVG and VAL

Resistance Levels

- $3305-3313 – 1hr OB and POC

Heads up! Consider this as a gym for you to work out your financial literacy rather than a fast way to build your wealth. We are here to strengthen your financial knowledge, not to select stocks for you. So get your mental dumbbells and get prepared for a workout!

Thanks for reading XAUUSD weekly forecast: $3200s acting as support a pump back to $3500 soon?