Top Stories of The Week

Australian fintech Finder wins court battle over crypto yield product

FINTECH TRIUMPH: Finder.com WINS THREE-YEAR LEGAL BATTLE AGAINST ASIC. After a grueling three-year courtroom clash, the Australian Federal Court has delivered a resounding victory for fintech innovator Finder.com. The verdict clears Finder and its high-yield product, Finder Earn, from allegations brought by the Australian Securities and Investments Commission (ASIC), marking a pivotal moment for the future of decentralized finance in Australia.

Thursday’s gavel confirmed: Finder Wallet and Earn played by the consumer finance rulebook, according to Justices Stewart, Cheeseman, and Meagher, upholding a prior ruling.

Finder’s Earn product dodged a bullet, with a federal court upholding the earlier ruling that it doesn’t qualify as a financial product, the company announced in a celebratory blog post Thursday.

BitMine gobbles over $2B in ETH in 16 days amid treasury arms race

A crypto whale just made a splash! Bitcoin mining giant BitMine Immersion Technologies went on an Ether-buying spree, gobbling up over $2 billion in just 16 days. Forget tiny ripples – this is a tidal wave, putting them back at the helm of a new fleet of Ether treasury titans.

In a stunning crypto grab, BitMine revealed Thursday it has devoured a staggering 566,776 Ether in just over two weeks. The digital feeding frenzy cost a cool $2.03 billion, signaling a massive bet on Ethereum’s future.

Flush with recent acquisitions, crypto bull Tom Lee, head of FundStrat and BitMine’s chairman, declared the company is aggressively “charging towards” its ambitious target: controlling a staggering 5% of the total Ethereum supply through strategic staking. This bold move signals a major power play in the ETH ecosystem.

BitMine’s aggressive buying spree signals a growing interest from institutions in Ethereum.

XRP price drops 19% but analysts say it’s a ‘healthy correction’

XRP felt the chill of a crypto winter blast on Thursday, plummeting 12.5% as a market-wide frost shaved 3% off the total crypto capitalization, leaving a $3.79 trillion landscape in its wake.

Despite this correction, analysts are terming this a “healthy pullback,” with double-digit XRP price targets still in play.

XRP’s rollercoaster ride took a sharp dip on Thursday, plunging as much as 19% from its peak. The cryptocurrency kissed a multiyear high of $3.66 before gravity took hold, dragging it down to a $2.95 intra-day low, according to Cointelegraph Markets Pro and TradingView.

Cascading liquidations and thinning liquidity fueled XRP’s drop as over-leveraged longs got flushed across the board.

Source: Cointelegraph

Hulk Hogan, Ozzy memecoins soar as tributes roll in over icons’ deaths

This week, the crypto world witnessed a bizarre yet predictable phenomenon: memecoins dedicated to Hulk Hogan and Ozzy Osbourne exploded in value following (false) reports of their demise. Was it a ghoulish tribute or a calculated pump-and-dump? Either way, the digital currencies, riding a wave of viral misinformation, offered a stark reminder of the memecoin market’s volatility and its uneasy relationship with celebrity culture.

The wrestling world reels: Hulk Hogan, the immortal icon, is gone. Thursday saw paramedics rush to his residence following a reported cardiac arrest, but the 71-year-old powerhouse, Terry Bollea beneath the bandana, could not be revived. The legend who slammed giants and ignited arenas has taken his final count.

Just days after the music world lost a legend, the stage fell silent for Ozzy Osbourne, Black Sabbath’s notorious frontman, who passed away Tuesday at 76. The Prince of Darkness has taken his final bow.

Hulk Hogan didn’t just wrestle; hewasthe 1980s WWF. A titan in the ring, “Hulkamania” transcended wrestling, body-slamming its way into television and film for a career that defined an era.

Ozzy Osbourne. The Prince of Darkness. A name synonymous with heavy metal mayhem and a voice that defined a generation. More than just a musician, Osbourne is a cultural icon, a living legend whose influence echoes through the halls of rock history. As the frontman of Black Sabbath, he unleashed a sonic onslaught that captivated the world, selling an estimated 75 million albums and forever changing the landscape of music.

Ether will ‘knock on $4,000’ and soon outperform Bitcoin: Novogratz

Forget Bitcoin, Ethereum’s about to explode. Galaxy Digital CEO Michael Novogratz is betting big, predicting a supply shock driven by institutional FOMO could send Ether soaring past Bitcoin in the next six months.

Mike Novogratz just dropped a bombshell: he’s betting on Ethereum to eclipse Bitcoin in the next three to six months. Why? Because ETH’s scarcity gives it a serious edge. Forget silver versus gold – this could be the crypto showdown of the year.

“Ether is knocking on the door of uncharted territory. According to Nansen data, a decisive surge past $4,000 – just an 8.5% leap from its current $3,618 – could catapult ETH into a thrilling ‘price discovery’ phase.”

Most Memorable Quotations

Robert Kiyosaki , author of Rich Dad Poor Dad:

“‘Pigs get fat…. hogs get slaughtered.’ I am buying one more [Bitcoin]…. and get fatter.”

Mena Theodorou , co-founder and head of product and marketing at Coinstash:

“If you’re analytical, follow the patterns, and take an emotionless approach, you’re going to do well in the crypto space.”

Michael Novogratz , CEO of Galaxy Digital:

“Ethereum’s scarcity is becoming its superpower. Forget crowded races; ETH’s limited supply gives it a real shot at sprinting past Bitcoin in the next quarter or two.”

Markus Thielen , CEO of 10x Research:

“We believe Ethereum is looking vulnerable in the near term.”

Solomon Tesfaye , chief business officer at Aptos Labs:

“The walls between Washington and Web3 are crumbling. Policymakers and digital innovators are finally speaking the same language, forging legislation that’s turning institutional curiosity into confident, long-term investment in digital assets.”

Mister Crypto , pseudonymous crypto trader:

“A massive short squeeze is inevitable!”

Winners and Losers

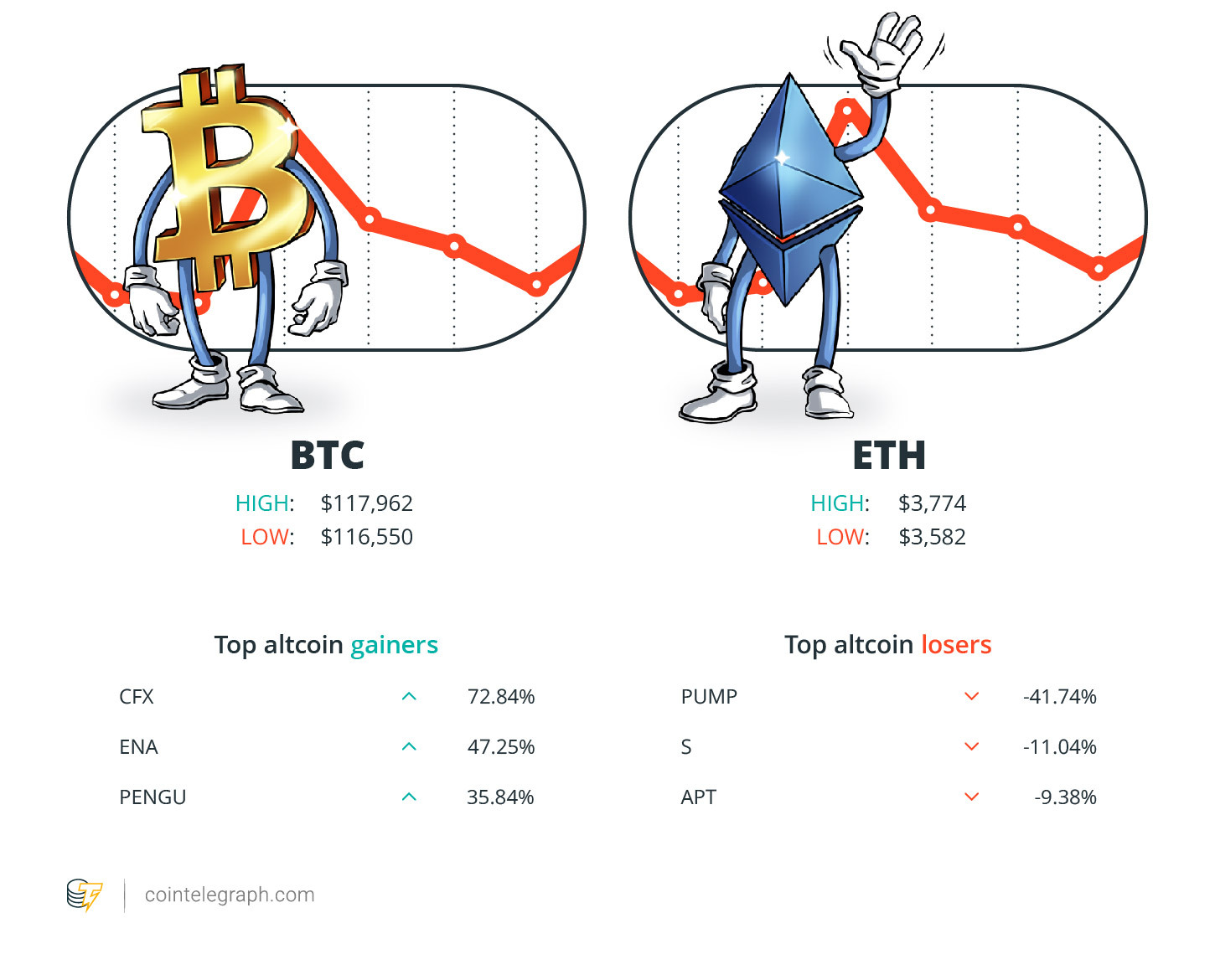

The crypto markets are closing the week with a mixed bag of fortunes. Bitcoin sits comfortably at $117,962, retaining its dominance. Ether is holding its own at $3,774, showcasing its strength. XRP, however, is priced at $3.20. CoinMarketCap reports the entire crypto ecosystem is valued at $3.88 trillion.

This week’s altcoin surge is led by three standouts defying market trends. Conflux (CFX) blazes a trail with a 72.84% jump, leaving other top 100 cryptocurrencies in the dust. Hot on its heels is Ethena (ENA), riding a 47.25% wave of momentum. And proving that memes can move markets, Pudgy Penguins (PENGU) waddles its way to a notable 35.84% gain.

This week’s altcoin bloodbath sees Pump.fun(PUMP)leading the pack of losers with a staggering 41.74% dip. Sonic(S)rings in second, shedding 11.04% of its value, followed by Aptos(APT), nursing a 9.38% wound. Want to dissect the carnage and understand the market’s mood swings? Head over to Cointelegraph’s market analysis for the full autopsy.

Source: Cointelegraph

Top Prediction of The Week

Eric Trump ‘agrees’ Ether should be over $8K as Global M2 money soars

Ether Poised for a Breakout? Analysts See $8,000+ Price Target Amidst Global Liquidity Surge.

Ether’s true value remains untapped, with projections soaring past $8,000. Fueling this bullish outlook is a torrent of global liquidity, as broad money supply (M2) smashed records, reaching a staggering $95.58 trillion last Friday. Is this the catalyst that unlocks Ether’s hidden potential?

Global liquidity, measured as the aggregate M2 money supply across economic powerhouses like the US, eurozone, Japan, the UK, and Canada, offers a critical pulse reading of the world’s financial health. This combined, dollar-adjusted figure reveals the ebb and flow of capital available to fuel (or potentially flood) global markets.

An expanding M2 money supply floods the financial landscape with readily available cash, encompassing everything from everyday checking accounts to easily accessible liquid assets. This surge in liquidity often acts as a powerful magnet, drawing capital towards higher-risk, higher-reward investments – digital currencies like crypto among them.

Is Ether poised to mirror the M2 money supply’s ascent, echoing a Wyckoff accumulation pattern, but delayed until 2025?

Top FUD of The Week

Arizona woman sentenced for helping North Korea coders get US crypto jobs

An Arizona woman’s elaborate scheme to aid North Korean agents infiltrate American cryptocurrency and tech companies has landed her behind bars for over eight years. Using stolen identities and fabricated documents, she provided the crucial gateway for these operatives to access and exploit US firms.

Christina Marie Chapman’s elaborate scheme unraveled Thursday, culminating in a hefty 8.5-year prison sentence. The US Attorney’s Office for the District of Columbia announced her conviction on charges of wire fraud conspiracy, aggravated identity theft, and money laundering conspiracy – a trifecta of financial crimes that left a trail of victims and illicitly gained wealth. Chapman’s intricate web of deceit finally collapsed, delivering a severe blow to her criminal enterprise.

A shadowy network, orchestrated by Christopher Chapman, funneled North Korean operatives into the heart of corporate America. Posing as everyday US tech workers, these agents infiltrated over 300 companies, stealing not data, but something arguably more valuable: American wages. This elaborate scheme, tied to the Democratic People’s Republic of Korea, raked in a staggering $17 million, a silent cyber heist masked by mundane IT roles.

Source: Cointelegraph

Bitcoin tumbles below $116K in bloodbath for crypto longs

Friday’s crypto bloodbath saw over half a billion dollars in long positions wiped out as Bitcoin plunged below $116,000, triggering a market-wide panic.

Bitcoin Bleeds: A $585 Million Long Squeeze

The crypto market just witnessed a brutal bloodbath. Over $585 million in long positions were wiped out as Bitcoin took a nosedive, plummeting 2.63% to $115,356. Bitcoin longs took the brunt of the impact, suffering a $140.06 million liquidation. The market is reeling, and investors are scrambling to understand the sudden downturn.

Ether followed with $104.76 million in long liquidations, falling 1.33% to $3,598 over the same period.

New York crypto torture case suspects out on $1M bail each

A million-dollar price tag now hangs over John Woeltz, 37, and William Duplessie, 33, accused of a brutal crime. New York Supreme Criminal Court Judge Gregory Carro slapped each with a staggering $1 million bail on Wednesday, according to ABC News. Woeltz and Duplessie stand accused of kidnapping, assault, and coercion, charges they vehemently deny, entering not guilty pleas.

Months before, a digital shakedown went violently wrong, setting the stage for the courtroom drama. It began on May 6th when a 28-year-old Italian crypto trader, fresh off the plane in New York, vanished. Kidnapped, they say. His arrival, a trap sprung with cold, calculated precision in the city that never sleeps.

Weeks of unspeakable torment: held captive and relentlessly tortured, the victim’s captors sought the key to his Bitcoin fortune.

Thanks for reading XRP dip was a ‘healthy correction’ Ether supply shock: Hodler’s Digest July 20 – 26